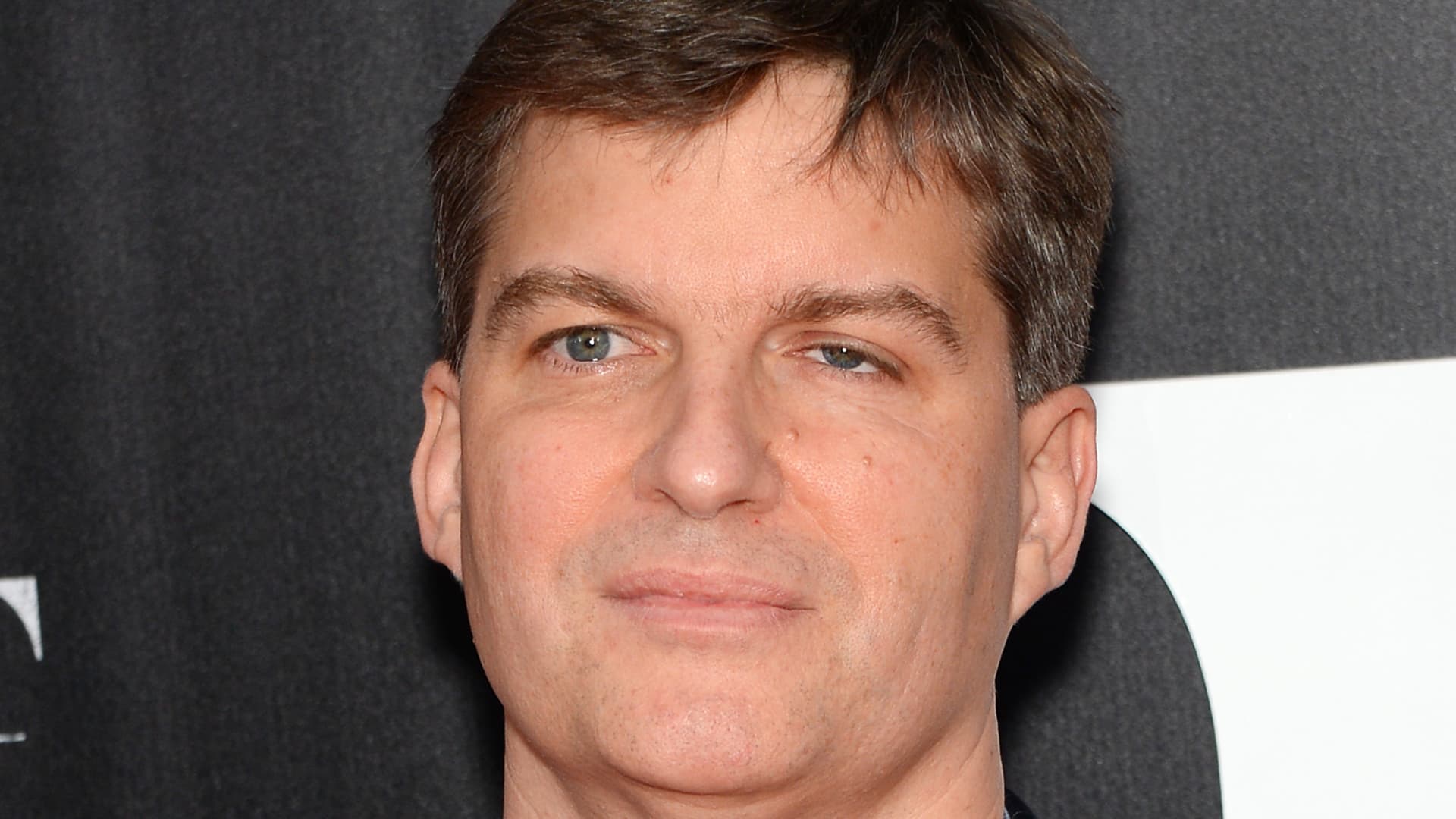

‘Big Short’ Michael Burry on his current positioning: ‘You have no idea how short I am’

“The Big Short” investor Michael Burry, known for calling the subprime mortgage crisis, hinted that he currently has a sizable short position after being bearish throughout 2022. “You have no idea how short I am,” Burry said in a Tuesday evening tweet. It’s unclear what kind of bet Burry is making, if he’s shorting any specific sectors or stocks or just the whole market. It’s also not clear if Burry is implying he is betting against the market at all. The investor is known for his cryptic tweets and he routinely deletes them after posting. Burry, who runs hedge fund Scion Asset Management, has been correctly warning investors about a severe market downturn on Twitter all year. He drew parallels between today’s market environment and that of 2008, saying it’s like “watching a plane crash.” Burry also sounded alarms on massive earnings compressions as well as “addictive” consumer spending amid soaring inflation. The famed investor previously highlighted crashes in cryptocurrencies, meme stocks and SPACs this year. The crypto industry has been upended as fallout from crypto exchange FTX’s shocking Chapter 11 bankruptcy filing continued to drag digital currencies lower. Burry said the stage might be set for gold to rally amid the turmoil in crypto. “Long thought that the time for gold would be when crypto scandals merge into contagion,” Burry said in a tweet earlier this week. The S & P 500 has rebounded in the past one month after falling into a bear market. The benchmark is still down more than 17% on the year. A new regulatory filing showed at the end of the third quarter, Burry held relatively small positions in just six names. He picked up $10 million worth of Qurate Retail , owner of home shopping channels QVC and HSN, making it his second-biggest holding. In the second quarter, he had dumped nearly all of his holdings including Big Tech names Meta and Alphabet . Short positions are not disclosed in quarterly reports. Burry didn’t immediately respond to CNBC’s emailed request for comment.