Government policies to play big role in improving fortunes of shares of city gas distribution companies

A committee is expected to propose a formula that helps reduce prices for the priority sector by about $2/mmBtu or so, bringing the price down to $7/mmBtu from more than $9.2/mmBtu now.

‘);

$(‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]);

//if(resData[stkKey][‘percentchange’] > 0){

// $(‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”);

// $(‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”);

//}else if(resData[stkKey][‘percentchange’] = 0){

$(‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”);

//$(‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”);

$(‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”);

}else if(resData[stkKey][‘percentchange’] 0)

{

var resStr=”;

var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’;

$.get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) {

$(‘#backInner1_rhsPop’).html(data);

$.ajax({url:url,

type:”POST”,

dataType:”json”,

data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs},

success:function(d)

{

if(typparam1==’1′) // rhs

{

var appndStr=”;

var newappndStr = makeMiddleRDivNew(d);

appndStr = newappndStr[0];

var titStr=”;var editw=”;

var typevar=”;

var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’);

var phead =’Why add to Portfolio?’;

if(secglbVar ==1)

{

var stkdtxt=’this stock’;

var fltxt=’ it ‘;

typevar =’Stock ‘;

if(lastRsrs.length>1){

stkdtxt=’these stocks’;

typevar =’Stocks ‘;fltxt=’ them ‘;

}

}

//var popretStr =lvPOPRHS(phead,pparr);

//$(‘#poprhsAdd’).html(popretStr);

//$(‘.btmbgnwr’).show();

var tickTxt =’‘;

if(typparam1==1)

{

var modalContent = ‘Watchlist has been updated successfully.’;

var modalStatus = ‘success’; //if error, use ‘error’

$(‘.mc-modal-content’).text(modalContent);

$(‘.mc-modal-wrap’).css(‘display’,’flex’);

$(‘.mc-modal’).addClass(modalStatus);

//var existsFlag=$.inArray(‘added’,newappndStr[1]);

//$(‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’);

//if(existsFlag == -1)

//{

// if(lastRsrs.length > 1)

// $(‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’);

// else

// $(‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’);

//

//}

}

//$(‘.accdiv’).html(”);

//$(‘.accdiv’).html(appndStr);

}

},

//complete:function(d){

// if(typparam1==1)

// {

// watchlist_popup(‘open’);

// }

//}

});

});

}

else

{

var disNam =’stock’;

if($(‘#impact_option’).html()==’STOCKS’)

disNam =’stock’;

if($(‘#impact_option’).html()==’MUTUAL FUNDS’)

disNam =’mutual fund’;

if($(‘#impact_option’).html()==’COMMODITIES’)

disNam =’commodity’;

alert(‘Please select at least one ‘+disNam);

}

}

else

{

AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’;

commonPopRHS();

/*work_div = 1;

typparam = t;

typparam1 = n;

check_login_pop(1)*/

}

}

function pcSavePort(param,call_pg,dispId)

{

var adtxt=”;

if(readCookie(‘nnmc’)){

if(call_pg == “2”)

{

pass_sec = 2;

}

else

{

pass_sec = 1;

}

var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’;

$.ajax({url:url,

type:”POST”,

//data:{q_f:3,wSec:1,dispid:$(‘input[name=sc_dispid_port]’).val()},

data:{q_f:3,wSec:pass_sec,dispid:dispId},

dataType:”json”,

success:function(d)

{

//var accStr= ”;

//$.each(d.ac,function(i,v)

//{

// accStr+=’‘;

//});

$.each(d.data,function(i,v)

{

if(v.flg == ‘0’)

{

var modalContent = ‘Scheme added to your portfolio.’;

var modalStatus = ‘success’; //if error, use ‘error’

$(‘.mc-modal-content’).text(modalContent);

$(‘.mc-modal-wrap’).css(‘display’,’flex’);

$(‘.mc-modal’).addClass(modalStatus);

//$(‘#acc_sel_port’).html(accStr);

//$(‘#mcpcp_addportfolio .form_field, .form_btn’).removeClass(‘disabled’);

//$(‘#mcpcp_addportfolio .form_field input, .form_field select, .form_btn input’).attr(‘disabled’, false);

//

//if(call_pg == “2”)

//{

// adtxt =’ Scheme added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘;

//}

//else

//{

// adtxt =’ Stock added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘;

//}

//$(‘#mcpcp_addprof_info’).css(‘background-color’,’#eeffc8′);

//$(‘#mcpcp_addprof_info’).html(adtxt);

//$(‘#mcpcp_addprof_info’).show();

glbbid=v.id;

}

});

}

});

} else

{

AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’;

commonPopRHS();

/*work_div = 1;

typparam = t;

typparam1 = n;

check_login_pop(1)*/

}

}

function commonPopRHS(e) {

/*var t = ($(window).height() – $(“#” + e).height()) / 2 + $(window).scrollTop();

var n = ($(window).width() – $(“#” + e).width()) / 2 + $(window).scrollLeft();

$(“#” + e).css({

position: “absolute”,

top: t,

left: n

});

$(“#lightbox_cb,#” + e).fadeIn(300);

$(“#lightbox_cb”).remove();

$(“body”).append(”);

$(“#lightbox_cb”).css({

filter: “alpha(opacity=80)”

}).fadeIn()*/

$(“#myframe”).attr(‘src’,’https://accounts.moneycontrol.com/mclogin/?d=2′);

$(“#LoginModal”).modal();

}

function overlay(n)

{

document.getElementById(‘back’).style.width = document.body.clientWidth + “px”;

document.getElementById(‘back’).style.height = document.body.clientHeight +”px”;

document.getElementById(‘back’).style.display = ‘block’;

jQuery.fn.center = function () {

this.css(“position”,”absolute”);

var topPos = ($(window).height() – this.height() ) / 2;

this.css(“top”, -topPos).show().animate({‘top’:topPos},300);

this.css(“left”, ( $(window).width() – this.width() ) / 2);

return this;

}

setTimeout(function(){$(‘#backInner’+n).center()},100);

}

function closeoverlay(n){

document.getElementById(‘back’).style.display = ‘none’;

document.getElementById(‘backInner’+n).style.display = ‘none’;

}

stk_str=”;

stk.forEach(function (stkData,index){

if(index==0){

stk_str+=stkData.stockId.trim();

}else{

stk_str+=’,’+stkData.stockId.trim();

}

});

$.get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?sc_id=’+stk_str, function(data) {

stk.forEach(function (stkData,index){

$(‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]);

});

});

function redirectToTradeOpenDematAccountOnline(){

if (stock_isinid && stock_tradeType) {

window.open(`https://www.moneycontrol.com/open-demat-account-online?classic=true&script_id=${stock_isinid}&ex=${stock_tradeType}&site=web&asset_class=stock&utm_source=moneycontrol&utm_medium=articlepage&utm_campaign=tradenow&utm_content=webbutton`, ‘_blank’);

}

}

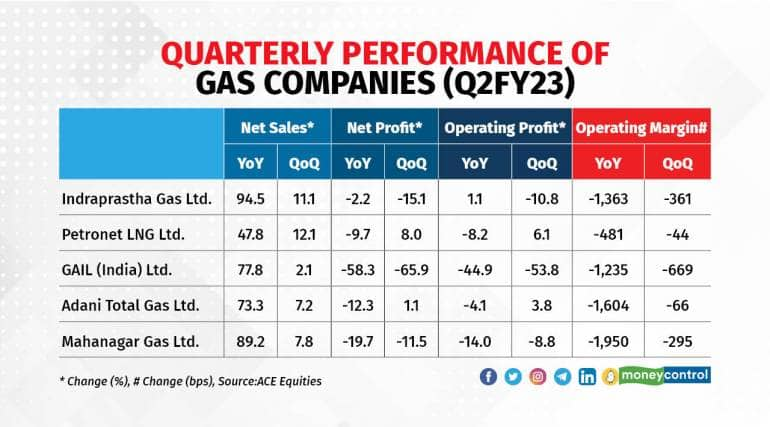

Gas/gas distribution companies reported a muted performance over the quarter ended September 2022. Though most of them witnessed a robust year-on-year growth in their top line aided by growth in volumes, sequential growth was more or less flat with marginal increases for most players.

However, margins came under severe pressure due to a sharp spike in global gas prices while the increase in realisations lagged.

Experts say that near-term outlook for gas companies look bleak as they cannot go for more price hikes now without it having an effect on volumes.

Movement in gas prices

Gas pricing in India has always been revised every six months based on a formula derived from the weighted average prices of four global benchmarks: the US-based Henry Hub, Canada-based Alberta gas, the UK-based NBP and Russian gas.

In the last revision effective April 2022 to September 2022, the price of natural gas from old and regulated fields was doubled to $6.1 per million British thermal unit (mmBtu). Price of gas produced from difficult fields like the KG-D6 block operated by the Reliance Industries-bp combine was hiked from $6.13 earlier to 9.92 per mmBtu for the April-September 2022 period.

“Local gas prices are at a record high and are expected to rise further due to a sharp increase in global gas prices triggered by the Ukraine-Russia conflict,” said Deepak Jasani, head of retail research, HDFC Securities.

With the likelihood of gas prices remaining elevated in the foreseeable future, the government is finalising a plan to make things easier for priority sectors such as city gas distribution (CGD, where companies supply piped natural gas or PNG to homes as an alternative to liquefied natural gas or LNG for cooking purposes), and fertiliser plants that use natural gas as feedstock, etc.

The plan

The Ministry of Petroleum and Natural Gas has set up a committee under energy expert and former Planning Commission (since renamed NITI Aayog) member Kirit Parekh to review the current gas pricing formula for domestically produced gas to ensure a fair price to the end consumers for boosting the use of cleaner fuel and controlling imported inflation caused by having to ship in petroleum products.

The committee includes representatives of the gas producers’ association, a member from private the city gas operators’ body, state gas utility GAIL, ONGC & OIL, a representative of Indian Oil Corporation (IOC) and a member from the fertiliser ministry.

The Parekh panel is evaluating the option of keeping two sets of prices, one for the fertiliser and power industries and another one for PNG and LPG.

“The government’s accommodative policies would benefit CGDs given their exposure to CNG (compressed natural gas, used mainly as an auto fuel)/D-PNG //please expand D-PNG and a line on what it is// as it would reduce gas cost, retain pricing power in CNG and help in margin recovery for CGDs,” said Abhijeet Bora, deputy vice-president, research, Sharekhan by BNP Paribas.

Expectations from Parekh committee

Experts are of the opinion that some capping of the administered pricing mechanism (APM) gas price supplied to CGD companies may come into force, with the government required to subsidise the difference to the oil exploration companies.

“The capping of APM gas price may be by way of moving average of the last three years or capping at a fixed amount which may be subject to inflation adjustment every year,” said Jasani.

Also, there is a likelihood that translation from dollars to rupees may be made at an average exchange rate rather than the latest rate.

“The committee is expected to propose a formula which helps reduce gas prices for the priority sector by ~$2/mmBtu or so, thereby bringing the gas price down to $7/mmBtu from current price of > $9.2/mmBtu,” Probal Sen, analyst, oil and gas, ICICI Securities, said in a note.

Experts are of the opinion that setting up the Parekh committee is a step in the right direction in order to relook into the pricing of domestic APM gas.

“We continue to believe that for APM gas (allocated to priority CGDs, fertilizer and power segments), there is a case to have a ceiling and floor pricing, while, on the contrary, for High Pressure High Temperature (HPHT) gas (marketing freedom, price decided by e-auctions), the ceiling needs to be done away with”, said a note from Sumit Pokharna, research analyst and vice-president, Kotak Securities.

“In our view, pending the expected relief on APM gas price soon, CGDs have taken lower-than-required hikes,” added Pokharna.

At the same time, capping of gas prices will be negative for upstream gas producers because, according to Swarnendu Bhushan, institutional research analyst, oil, gas, aviation and specialty chemicals at Motilal Oswal Financial Services, “A cap without a floor may adversely impact upstream companies like ONGC and OIL India but the other way to look at it is that a cap may reduce realisations but also offer respite, shall there be a drop in gas prices beyond a certain limit.”

Suggestions for gas companies and the government

In order to address the current situation, gas companies also need to step up and take steps that can aid their cause.

“The companies need to improve distribution which would decrease the crowd at CNG retail outlets, thereby encouraging more private consumers to shift to CNG while at the same time automobile manufacturers also need to strengthen the ecosystem in order to raise adoption of CNG variants,” said Bhushan.

Experts suggest that the government has more scope to address the situation. Sen of ICICI Securities suggests, “The government should bring gas under the ambit of GST (goods and services tax); there should be clarity on the gas supply basket for all players (old and new) over the next five to seven years; aggressive regulatory support to mandate compulsory conversion of all state transport to CNG and EV (electric vehicles); and discouraging, if not outright banning, usage of more polluting liquid fuels for industrial usage.”

Stock picks

Experts prefer names like Indraprastha Gas Ltd IGL), Mahanagar Gas Ltd (MGL), GAIL and Gujarat Gas from this space owing to resilience of their business models to volatile supply and price environments, dominant market positions and improving prospects.

According to Bora, “IGL and MGL are trading at attractive valuation of 18.5x and 11x FY24E EPS (earnings per share) respectively, which is at a 23 percent and 27 percent discount to historical average P/E (price-earnings) multiple and favourable gas pricing would improve volume growth/margin visibility especially for IGL and MGL while will drive re-rating for CGDs.”

However, Bhushan of Motilal Oswal has Gujarat Gas as his top pick among CGDs. “Although a cap would decrease the sourcing cost for CNG/PNG domestic, and IGL and MGL have a higher proportion of these segments in their sales. Our thesis is that Mumbai and Delhi being much more polluted, the threat of EVs would be much stronger in these cities, thereby challenging the long-term growth prospects.”

Gujarat Gas, on the other hand, has much larger industrial prospects and would continue to see high volume growth trajectory for much longer time to come, Bhushan added.

Disclaimer: The views and investment tips of investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.