Coal on ‘fire’: India set to be growth engine for global coal demand, says IEA

Demand from power and industrial sectors to lift domestic coal consumption this year from 1,033 MT in 2021, which was a 14 percent rebound from a pandemic low in 2020, says International Energy Agency.

‘);

$(‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]);

//if(resData[stkKey][‘percentchange’] > 0){

// $(‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”);

// $(‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”);

//}else if(resData[stkKey][‘percentchange’] = 0){

$(‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”);

//$(‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”);

$(‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”);

}else if(resData[stkKey][‘percentchange’] 0)

{

var resStr=”;

let secglbVar = 1;

var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’;

$.get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) {

$(‘#backInner1_rhsPop’).html(data);

$.ajax({url:url,

type:”POST”,

dataType:”json”,

data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs},

success:function(d)

{

if(typparam1==’1′) // rhs

{

var appndStr=”;

//var newappndStr = makeMiddleRDivNew(d);

//appndStr = newappndStr[0];

var titStr=”;var editw=”;

var typevar=”;

var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’);

var phead =’Why add to Portfolio?’;

if(secglbVar ==1)

{

var stkdtxt=’this stock’;

var fltxt=’ it ‘;

typevar =’Stock ‘;

if(lastRsrs.length>1){

stkdtxt=’these stocks’;

typevar =’Stocks ‘;fltxt=’ them ‘;

}

}

//var popretStr =lvPOPRHS(phead,pparr);

//$(‘#poprhsAdd’).html(popretStr);

//$(‘.btmbgnwr’).show();

var tickTxt =’‘;

if(typparam1==1)

{

var modalContent = ‘Watchlist has been updated successfully.’;

var modalStatus = ‘success’; //if error, use ‘error’

$(‘.mc-modal-content’).text(modalContent);

$(‘.mc-modal-wrap’).css(‘display’,’flex’);

$(‘.mc-modal’).addClass(modalStatus);

//var existsFlag=$.inArray(‘added’,newappndStr[1]);

//$(‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’);

//if(existsFlag == -1)

//{

// if(lastRsrs.length > 1)

// $(‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’);

// else

// $(‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’);

//

//}

}

//$(‘.accdiv’).html(”);

//$(‘.accdiv’).html(appndStr);

}

},

//complete:function(d){

// if(typparam1==1)

// {

// watchlist_popup(‘open’);

// }

//}

});

});

}

else

{

var disNam =’stock’;

if($(‘#impact_option’).html()==’STOCKS’)

disNam =’stock’;

if($(‘#impact_option’).html()==’MUTUAL FUNDS’)

disNam =’mutual fund’;

if($(‘#impact_option’).html()==’COMMODITIES’)

disNam =’commodity’;

alert(‘Please select at least one ‘+disNam);

}

}

else

{

AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’;

commonPopRHS();

/*work_div = 1;

typparam = t;

typparam1 = n;

check_login_pop(1)*/

}

}

function pcSavePort(param,call_pg,dispId)

{

var adtxt=”;

if(readCookie(‘nnmc’)){

if(call_pg == “2”)

{

pass_sec = 2;

}

else

{

pass_sec = 1;

}

var postfolio_url = ‘https://www.moneycontrol.com/portfolio_new/add_stocks_multi.php?id=’+dispId;

window.open(postfolio_url, ‘_blank’);

} else

{

AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’;

commonPopRHS();

/*work_div = 1;

typparam = t;

typparam1 = n;

check_login_pop(1)*/

}

}

function commonPopRHS(e) {

/*var t = ($(window).height() – $(“#” + e).height()) / 2 + $(window).scrollTop();

var n = ($(window).width() – $(“#” + e).width()) / 2 + $(window).scrollLeft();

$(“#” + e).css({

position: “absolute”,

top: t,

left: n

});

$(“#lightbox_cb,#” + e).fadeIn(300);

$(“#lightbox_cb”).remove();

$(“body”).append(”);

$(“#lightbox_cb”).css({

filter: “alpha(opacity=80)”

}).fadeIn()*/

$(“.linkSignUp”).click();

}

function overlay(n)

{

document.getElementById(‘back’).style.width = document.body.clientWidth + “px”;

document.getElementById(‘back’).style.height = document.body.clientHeight +”px”;

document.getElementById(‘back’).style.display = ‘block’;

jQuery.fn.center = function () {

this.css(“position”,”absolute”);

var topPos = ($(window).height() – this.height() ) / 2;

this.css(“top”, -topPos).show().animate({‘top’:topPos},300);

this.css(“left”, ( $(window).width() – this.width() ) / 2);

return this;

}

setTimeout(function(){$(‘#backInner’+n).center()},100);

}

function closeoverlay(n){

document.getElementById(‘back’).style.display = ‘none’;

document.getElementById(‘backInner’+n).style.display = ‘none’;

}

stk_str=”;

stk.forEach(function (stkData,index){

if(index==0){

stk_str+=stkData.stockId.trim();

}else{

stk_str+=’,’+stkData.stockId.trim();

}

});

$.get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?sc_id=’+stk_str, function(data) {

stk.forEach(function (stkData,index){

$(‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]);

});

});

function redirectToTradeOpenDematAccountOnline(){

if (stock_isinid && stock_tradeType) {

window.open(`https://www.moneycontrol.com/open-demat-account-online?classic=true&script_id=${stock_isinid}&ex=${stock_tradeType}&site=web&asset_class=stock&utm_source=moneycontrol&utm_medium=articlepage&utm_campaign=tradenow&utm_content=webbutton`, ‘_blank’);

}

}

Amid climate concerns, coal is again living up to its reputation of ‘black gold’ as the global demand for the fossil fuel is set to hit a record high with a bulk of it coming from India.

The International Energy Agency (IEA), in its latest report, has forecast the global coal demand to grow by 1.2 percent in 2022 and surpass 8 billion tonne for the first time.

This augurs well for Indian coal producers like Coal India Ltd (CIL) as well as for the companies like Tata Power and Adani Power, which have access to captive coal.

Demand surge

“Russia’s invasion of Ukraine has sharply altered the dynamics of the coal trade, price levels, and supply and demand patterns in 2022,” IEA said in its report.

Due to the bans imposed by the western nations, Russia, the world’s third-largest exporter of coal, is not able to divert its supplies earlier meant for Europe to the East or the South. This has tightened the market and bumped up prices.

Following the war, all fossil fuel prices have risen substantially, with natural gas rising the most. This has resulted in a shift away from gas in favour of more price-competitive options, including coal, in many regions.

China, which is also the world’s largest consumer of coal with a 53 percent share of global consumption, was reeling under the strict and prolonged Covid lockdowns, which adversely impacted economic activity and undermined the demand for coal. However, at the same time, it faced droughts and heat waves during summer that resulted in a surge in coal demand for powering air-conditioning and covering the shortfall in hydropower generation.

Europe, which has a heavy reliance on Russian gas, had to switch to coal to meet its heating needs.

Coal production

China and India are not only the world’s largest consumers but are also the biggest producers. They are also the world’s largest importers of this fossil fuel.

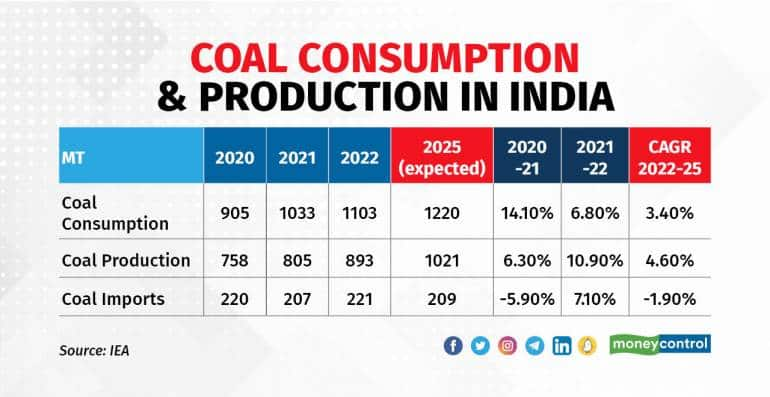

The Indian government has been pushing to increase domestic production to reduce reliance on imports amid increased global prices. In 2021, coal production in India reached 800 million tonne (MT) for the first time, and as per IEA’s forecast, India’s production will likely surpass one billion tonne by 2025.

India to lift global coal demand

India as a country is still predominantly dependent on thermal power, and the renewable power supply still has to go a long way to go.

“India’s coal consumption surged to 1,033 MT in 2021, a 14 percent rebound from a pandemic low in 2020 and has doubled since 2007 at an annual growth rate of 6 percent”, IEA said in its report, adding that “India is set to continue to be the growth engine of global coal demand”.

About 93 percent (959 MT) of the country’s coal demand was thermal coal (including lignite), mainly for electricity generation (757 MT). The rest was met coal, which is primarily used for steel production (75 MT). Demand for both types of coal increased strongly by 14 percent for thermal coal and 13 percent for met coal.

The Indian economy continues to witness healthy growth amid a slowdown in other major global economies. India’s GDP is forecast to expand by close to 7 percent this year.

The demand for coal is largely driven by electricity consumption, and as per IEA, India will meet 73 percent of its power requirement from coal-fired thermal power plants in 2022.

“We expect electricity demand to grow by 7 percent due to robust economic growth and demand was also supported by the severe heatwave from March to early May,” said IEA.

What does it mean for stocks?

The strong demand and elevated prices are set to benefit producers like CIL and GMDC Ltd and put thermal power producers like Tata Power and Adani Power in good stead on account of their captive coal mines.

In the foreseeable future, experts expect CIL’s production and dispatches to keep rising with increased plant load factors at coal-based power plants in India.

“CIL’s capital expenditure has soared 33 percent on-year in the first half of the current fiscal, with the company spending Rs 7,027 crore to expand its coal evacuation infrastructure, up Rs 1,727 crore compared to the corresponding period last year,” said an analyst at JM Financial Services.

There is also a likelihood of a shortage of high-grade thermal coal for the non-power sector. This is because a large chunk of high-grade coal from South Africa is now getting diverted to Europe. This would benefit CIL as “it will lead to sustained electronic auction premiums for Coal India”, an analyst at JM Financial told Moneycontrol.

Analysts at Centrum Institutional Research concurred, saying CIL would continue to benefit from higher e?auction prices and volumes in H2FY23.

Analysts have a positive stance on CIL and expect it will continue to perform well in the coming quarters, too, aided by robust thermal power demand, high international coal prices and the subsequent increase in demand for domestic coal. The dividend payout would also remain healthy (around 10 percent yield), which is an added positive.

Centrum has a target price of Rs 301 per share for CIL.

Apart from CIL, Neerav Karkera, Head of Research at FISDOM, is also positive on private power players like Tata Power and Adani Power, which have the benefit of their captive coal mines as well as moving towards increasing the share of renewable energy in their portfolio.

Elara Capital has a ‘Buy’ rating on Tata Power with a target price of Rs 258 per share valuing the company at 27.7x FY23 earnings and 24.3x FY24.

Disclaimer: The views and investment tips of investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.