Rewind 2022: HDFC, Adani Enterprises and other memed stocks of the year

India Pakistan T20 World Cup match, Argentina versus France in FIFA’s final showdown and Indian equity markets in 2022 ? all three had something in common ? they set hearts racing with nail biting twists and turns. If you look at the Nifty’s move this year, from 17,600 to 15,300 to 18,800 and back to 17,900 ? investors bled money, made money and again lost some before closing the year. It was nothing short of a roller-coaster ride.

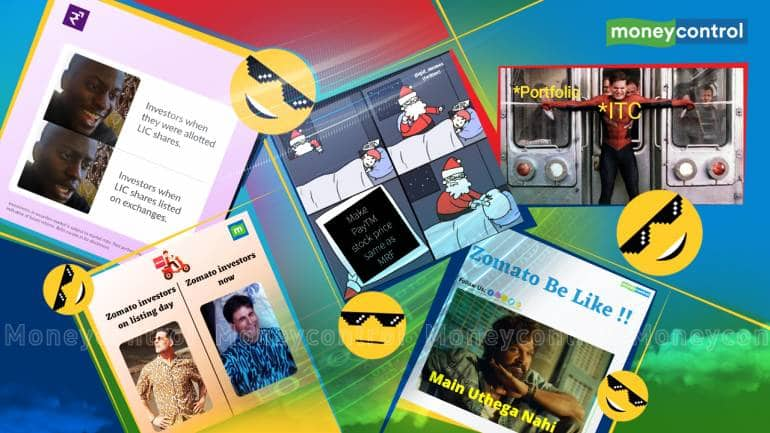

Many stocks made headlines but the ones that really left a mark were those that were picked up by the meme community. Be it a stunning rally or a disappointing decline, memes made some stocks eternal this year. Reddit, Twitter, and WhatsApp were all flooded by them and investors had a good laugh in a year marred by market volatility. Let’s take a look at some.

HDFC twins

On April 4, before the market opened, an announcement took everyone by surprise. A transformational merger between HDFC and HDFC Bank sent newsrooms into a scurry. It was not anticipated. There were hardly any whispers on such a deal brewing. “I am disappointed with media intelligence,” said Deepak Parekh as he addressed reporters in a press conference.

Nevertheless, the announcement gave enough fodder to memers who unleashed their creativity. As the merger is all set to create a $160-billion financial services behemoth, investors were quick to liken it to Nawazuddin Siddiqui’s popular dialogue from Gangs of Wasseypur – Kabhi kabhi lagta hai apun hi bhagwan hai.

Adani Enterprises

Akshay Kumar sported an eccentric polka dot shirt in Hera Pheri and claimed he can double your money in 25 days. That was a lie, but Adani Enterprises has certainly managed to do so in the span of one year. The stock began its 2022 climb at Rs 1,700 and is all set to end above Rs 3,700. A big trigger was its entry into the Nifty 50 index in September.

The flagship entity of Adani Group and its Chairperson Gautam Adani were in the limelight for many other reasons, as well. A cement deal which makes it the second-largest player in the space, a media deal which made heads turn, a blockbuster debut by the group’s FMCG arm, and a relentless rally that has propelled its promoter to Asia’s richest man ? it was certainly an eventful year for Adani Enterprises. Not to forget, a mind boggling 345x P/E valuation has also left many investors scratching their heads.

LIC

The public insurer’s listing on May 17 was the event of a lifetime. The government’s 3.5 percent stake sale in the 65-year-old institution made it India’s biggest ever initial public offering (IPO). It fetched close to Rs 21,000 crore. The issue price was set at Rs 949 apiece. Retail investors lapped up the shares, with their allotted quota subscribed 1.99 times. It was the perfect recipe for a grand success, but then… the dreadful happened!

The stock listed 8 percent below its issue price at Rs 872. Fingers were pointed at the Reserve Bank of India. Investors said RBI’s sudden interest rate hike soured the mood and caused the listing to be at a discount. For the meme world, LIC was Baahubali, RBI was Katappa.

Since its listing, the stock has gone only downwards. It is set to end the year near Rs 690 level.

ITC

No list is complete without the OG meme stock – ITC. Since May 2019, investors had been waiting patiently to see the stock touch the Rs 300 mark again. And it finally happened in July 2022. Just like its many businesses ? cigarettes, FMCG, hotels, paper, agri ? the variety of memes was a sight to behold. From a turtle on a treadmill to a galloping bull, ITC was likened to several animals.

It is the second-best-performing Nifty stock of the year, with a 52 percent gain. If we go by what brokerages say, the stock is all set to puff more gains in 2023. For instance, Antique Stock Broking has a Rs 419 target on the stock. One can only imagine the hysteria that will follow once ITC crosses the Rs 400 mark!

#itc touched Rs.300/-

ITC stock to ITC investors: pic.twitter.com/w6N7QGcLGu

— Ahmad Sadat Nawfal (@sadat_nawfal) July 21, 2022

Zomato

Zomato’s lock-in period ended on July 25 and the stock crashed to a record low, triggering a meme fest on social media. The most iconic meme was one comparing Zomato’s share price to the price of one kg of tomato. Currently, it is trading way below its issue price of Rs 76.

Zomato sure has an edge as it operates in a duopolistic market, believe analysts. But, its $570-million acquisition of Blinkit resulting in greater cash burn has not gone down well with investors. The company still has some way to go before it can dish out profits. Till then, social media will serve you some great memes. Keep watching the space!

Do share your favourite stock memes of the year with us! And here’s to hoping that 2023 has another laugh riot in store for us.