Core sector performance: Sequential growth to pick up even as YoY score may hit a bump

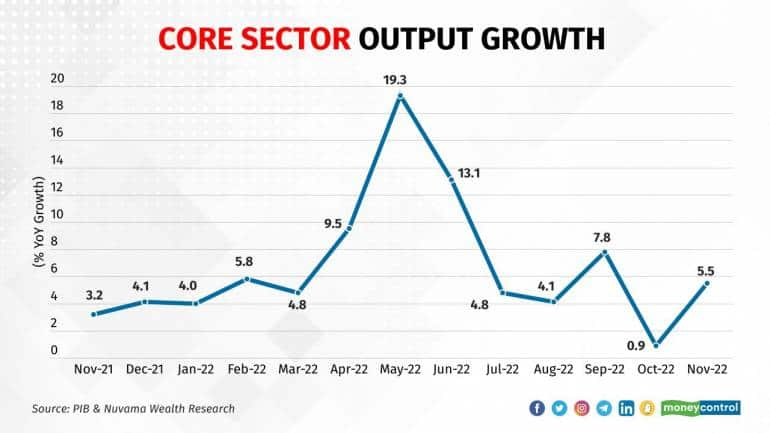

India’s core sector output came back strongly in November with a year on year growth of 5.5 per cent after a dismal performance in October when the annualized growth stooped to a 20-month low of 0.9 per cent.

The growth in core sector, which comprises eight infrastructure sectors of coal, crude oil, refinery products, natural gas, electricity, cement, steel and fertilizer, was aided by an on-year expansion in five sectors. Out of these five sectors, double-digit growth was seen in cement, coal, electricity and steel while the growth in fertilizer sector was limited to mid-single digits.

At the same time, output of crude oil, natural gas and refinery products continue to slip lower.

“This robust show is surprising not just because it’s a major pick-up in growth trajectory but also because growth is largely broad-based, with 5 out of 8 sectors recording a double-digit growth on YoY basis”, Manish Jain, Fund Manager, Coffee Can PMS, Ambit Asset Management, told Moneycontrol.

On a sequential basis, however, the growth in November remained flat.

Aditi Nayar, Chief Economist, ICRA Ltd attributes the YoY growth to fewer holidays in November this year compared to last year period. “With fewer holidays relative to November 2021, the growth of the core sector output expectedly improved to 5.5 per cent in November 2022 from the marginal 0.9 per cent in October 2022, as the base effect reversed”, she said.

Kavita Chacko, Chief Economist – Nuvama Wealth Research (Part of Nuvama Wealth Management Limited) concurred with Aditi and said, “The strong YoY growth reading for the core sector output for Nov’22 was in part aided by the low base (of Nov’21 index)”.

The data showed that in the first eight months of FY23, the core sector’s output expanded by 9.2 percent, as compared to the corresponding pre-pandemic period of FY20 and was led by sectors such as coal, fertilizers, steel cement, and electricity. However, production of crude oil and refinery products has contracted in April-November 2022 compared to the corresponding period of FY20.

Outlook for December to March

As far as the outlook for the remaining four months from December to March is concerned, experts are cautiously optimistic about the growth in core sectors. Even though the domestic activity is expected to remain resilient and help the growth, the global factors can have a negative impact (to a certain extent) on the growth of these sectors.

“We believe these sectors will continue to drive growth in the core sector for the remaining part of FY23 as well, along with lower drag from the Oil, Gas, and Refinery sectors”, said Nishit Master, Portfolio Manager, Axis Securities PMS. He is of the opinion that in spite of the recent softening in growth across the economy, there is a high possibility that the core sector growth for the next four months would still clock 5-6 per cent growth.

The outlook for government capex remains strong before the election year which is expected to push strong numbers from sectors such as cement, metals and other cyclical industries.

“The only two things to keep in mind are the base effect and the slowing consumption demand, however, capex-related sectors should continue to witness strong demand, and this should keep the growth momentum strong”, added Jain of Ambit Asset Management.

Continuing on the impact base effect, Chacko of Nuvama Wealth Research added that, “The benefit of favourable statistical base would wane for the remainder of FY23 (except in Feb’22) and core sector output could tend to show lower growth on a YoY basis even as output on a sequential basis improves aided by likely higher levels of domestic activity”.

She added a word of caution that global economic slowdown and the resultant lower demand for India’s exports could weigh down on the output for core sectors viz steel and petroleum products.

Sectoral performance in November

Electricity

The increase in economic activity in the country resulted in a surge in power demand which was met by increased generation. Electricity generation in Nov’22 rose by 12.1 per cent YoY from a year ago and it is higher by 15.5 per cent for the period from April-November 2022 as compared to the corresponding (pre-pandemic) period of FY20.

However, sequentially the electricity generation contracted for the third month in a row and was down 2 percent compared to the month of October 2022.

Coal

The growth in coal production was driven by the government’s push to reduce dependence on costly imports as well as the higher contribution from new coal mines which started contributing to coal production from Q1FY23.

India’s coal production was up 12.3 per cent in November year on year and 27.4 percent higher in the first eight months of FY22 compared to the same period of FY20.

The provisional data released by the Ministry of Coal indicates that the coal production during November 2022 stood at 75.9 million tonnes (MT) compared to 67.9 MT in the same period a year ago.

Steel

Steel production during November was the highest in the last six months and was up 10.8 per cent on year. At the same time, the demand for finished steel during the month was up 12.3 per cent on year and was fuelled by demand from construction, automobile, real estate and construction sector.

Cement

Increase in construction activity post the monsoon season contributed to the growth in demand for cement which in turn led to the increase in cement production which was up 28.6 per cent in November compared to the year ago period. On a sequential basis, the production rose 5.7 per cent in November compared to a sequential decline of 2.4 per cent in October.

Fertilizer

The growth in the sector was primarily driven by the seasonal demand at the start of the Rabi sowing season and the overall production in November expanded by 6.4 per cent on year.

Crude Oil, Refinery products and Natural Gas

These segments continue to witness contraction in their production and their production levels were down one percent on year for crude, 0.6 per cent for refinery products and 9.2 per cent for natural gas. The higher prices of natural gas led to the shift to LPG in many applications which is hampering its demand and production for the past five months since July 2022.