Goldman Sachs says Asia tech is about to rebound — and reveals a chip stock to play it

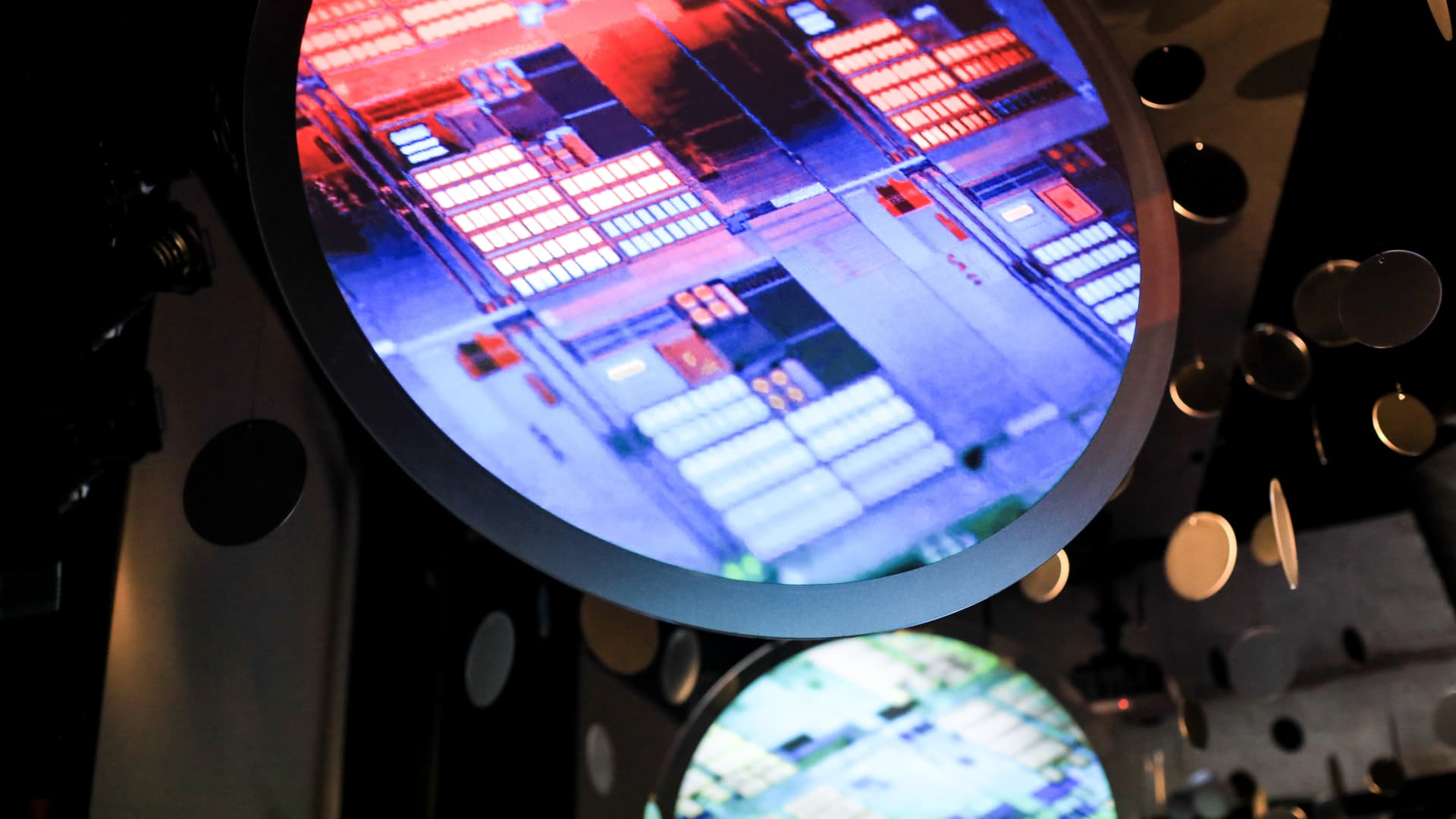

Tech stocks in Asia endured a difficult year in 2022, much like their peers in the U.S. and beyond, as they struggled with an inventory correction, supply chain disruptions and a global economic slowdown. But Goldman Sachs believes the region’s tech sector is headed for a “major bottom” — and subsequent upturn — in the first half of 2023, which could open the door for investors to jump back into Asia tech stocks. “We believe that … major bottom and stock bottom-fishing will likely occur in 1H2023,” Goldman’s analysts, led by Daiki Takayama, wrote in a note on Jan 8. “In addition to monitoring the timing of the recovery, if near-term earnings and share prices correct quickly, signs of an earnings bottom may be confirmed as early as the earnings reporting season at the end of January and first half of February, which could reinforce bottom-fishing sentiment. This is a positive scenario in our view,” he added. Investors seeking to cash in should act early, according to Takayama, who said stock prices will “rebound rapidly.” TSMC among top picks One of Goldman’s top picks is chip behemoth Taiwan Semiconductor Manufacturing Company . “We like TSMC as we believe its solid technology leadership and execution make it better positioned vs. peers to capture the industry’s long-term structural growth, particularly in areas such as 5G, artificial intelligence, high performance computing, electric vehicles,” the bank said. TSMC — a key Apple supplier — is arguably the world’s most important semiconductor manufacturer . It has also been caught up in the middle of the U.S.-China tech battle over semiconductors, with the U.S seeking to cut China off from critical chips and tools while trying to re-shore semiconductor production. In December, TSMC announced the opening of a second chip plant in Arizona , upping its investment in the state from $12 billion to $40 billion. President Joe Biden and Apple CEO Tim Cook were both at the event where the investment was announced, underscoring the critical role TSMC plays in the American semiconductor sector. Goldman has a price target of 600 Taiwan dollars ($19.70) on the buy-rated stock, which represents potential upside of 23.7% to its Jan. 11 closing price. On Tuesday, the company recorded its first quarterly revenue miss in two years . Fourth-quarter revenue at TSMC rose 43% to 625.5 billion Taiwan dollars, which fell short of estimates, according to FactSet data. Nevertheless, TSMC remains an analyst favorite, with 90% of analysts covering the stock giving it a buy rating, according to FactSet. They give it average potential upside of 25%. — CNBC’s Michael Bloom and Arjun Kharpal contributed to reporting