‘We are not decoupling’: G-7 leaders agree on approach to ‘de-risk’ from China

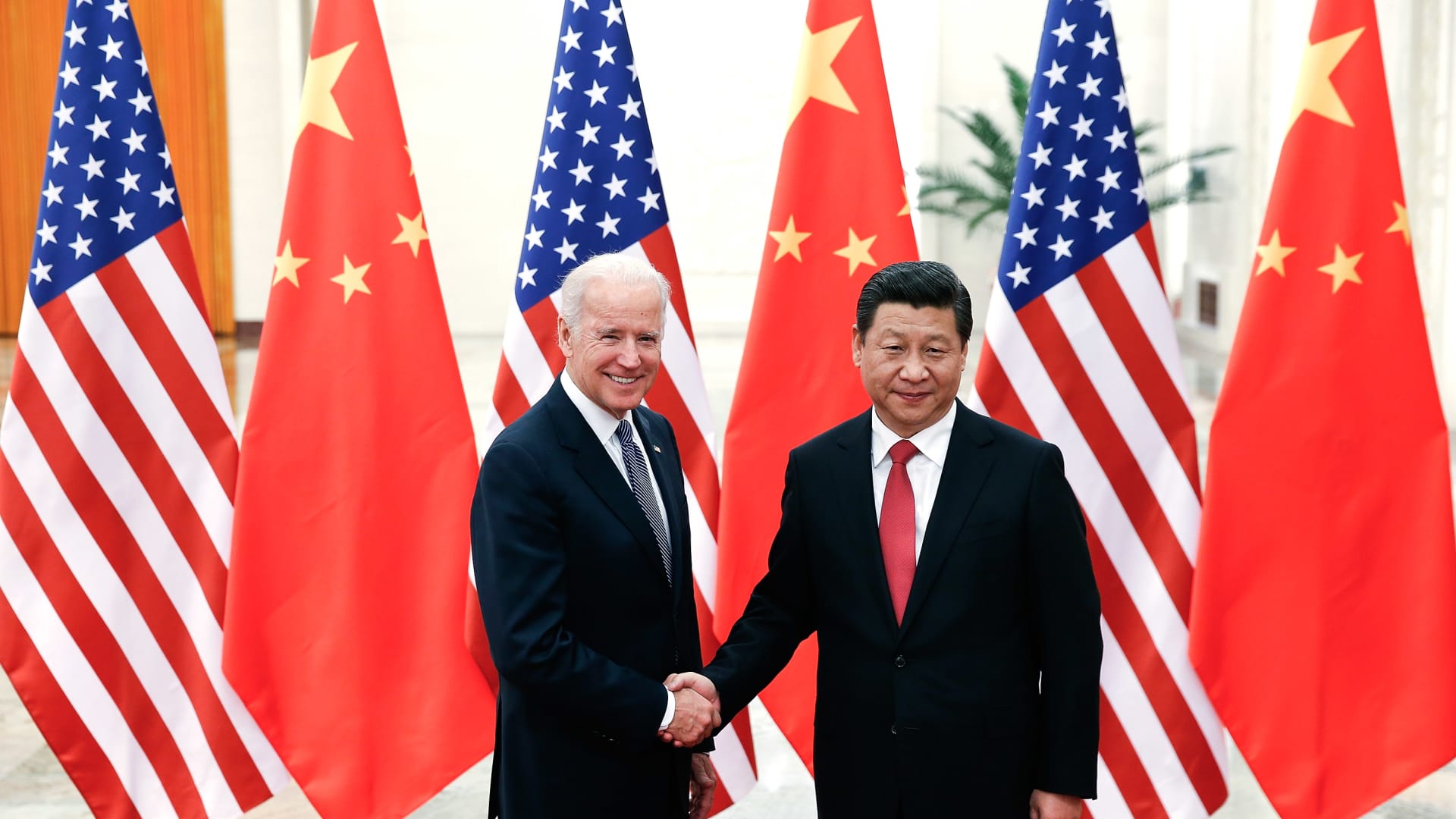

Chinese President Xi Jinping and hands with then U.S Vice President Joe Biden inside the Great Hall of the People on December 4, 2013 in Beijing, China.

Lintao Zhang | Getty Images News | Getty Images

Leaders of the Group of Seven agreed there’s a need to de-risk, not decouple from China, and acknowledged challenges posed by the mainland’s practices which “distort the global economy.”

“We are not decoupling or turning inwards,” the G-7 said in a joint statement released over the weekend as leaders met in Hiroshima, Japan. “At the same time, we recognize that economic resilience requires de-risking and diversifying.”

Leaders added, “We will seek to address the challenges posed by China’s non-market policies and practices, which distort the global economy. We will counter malign practices, such as illegitimate technology transfer or data disclosure.”

Reiterating the stance, President Joe Biden said at a press conference on Sunday: “We’re not looking to decouple from China, we’re looking to de-risk and diversify our relationship with China.

He explained that means taking steps to diversify supply chains, “so we’re not dependent on any one country for necessary product. It means resisting economic coercion together and countering harmful practices that hurt our workers. It means protecting a narrow set of advanced technologies critical for our national security.”

Speaking after the G-7 finance ministers and central bank governors’ meeting earlier this month, U.S. Treasury Secretary Janet Yellen said China’s behavior is “a matter that should be of concern to all of us.”

“There have been examples of China using economic coercion on countries that take actions that China’s not happy with from a geopolitical perspective,” she said, citing China’s trade disputes with Australia and Lithuania as examples.

In their statement the G-7 leaders said, “We will foster resilience to economic coercion. We also recognize the necessity of protecting certain advanced technologies that could be used to threaten our national security without unduly limiting trade and investment.”

The world’s leading democracies said the group will “reduce excessive dependencies in our critical supply chains” while emphasizing the need to cooperate with China, citing its role in the international community and the size of its economy.

“We stand prepared to build constructive and stable relations with China, recognizing the importance of engaging candidly with and expressing our concerns directly to China. We act in our national interest,” the statement said.

President Joe Biden’s administration previously briefed industry groups such as the Chamber of Commerce on measures seeking to curb American investments into China, according to media reports.

Such rules would mean stricter guidelines for U.S. companies that will be required to inform the government of new investments in Chinese technology companies, according to Politico. Deals in critical sectors such as microchips will also be banned, according to the publication.

U.K. Prime Minister Rishi Sunak also told journalists that London was open to following the U.S. lead over curbs on Chinese investment, the Financial Times reported.

Decoupling risks ahead?

Ahead of the weekend’s G-7 summit, Goldman Sachs economists Hui Shan and Andrew Tilton said they expected steps to be taken by the Committee on Foreign Investment in the United States, or CFIUS — a U.S. government agency that reviews deals involving foreign investment in the U.S. to see if the transaction infringe on the country’s national security.

In a note previewing the set of measures earlier this month, they said there may be “more focus on refining the existing tariff, export control, and investment regimes once basic frameworks are in place.”

“We expect them to be fairly narrowly-focused on advanced semiconductors and related technologies, paralleling last autumn’s export controls, and do not anticipate significant restrictions on secondary market portfolio investments.”

‘Far-reaching’ damages

The impact of a widening rift between the U.S. and China may lead to further damage, economists at Allianz said in a note las Wednesday.

“The economic implications of a further decoupling between the West and China could be far-reaching,” they wrote, adding the damage to the Chinese economy could be “far from negligible.”

“China could retaliate by curtailing the supply of critical raw materials in which it has a dominant position, which could severely disrupt global supply chains,” they said.

“But this is unlikely as it already applies some forms of outbound investment restrictions and is still looking towards economic pragmatism.”

The Taiwan factor

Further escalations could potentially lie ahead for U.S.-China relations after Washington concluded negotiations with Taiwan on a number of trade items on Friday, marking a potential deal on the first part of the bilateral “21st Century Trade” initiative.

The first agreement under the initiative includes: customs administration and trade facilitation, good regulatory practices, services domestic regulation, anticorruption, and small and medium-sized enterprises, the office of the United States Trade Representative said in a release.

U.S. trade representative Katherine Tai said of the agreement, “This accomplishment represents an important step forward in strengthening the U.S.-Taiwan economic relationship.”

China has repeatedly warned against deepening bilateral engagement between the U.S. and Taiwan.

Goldman Sachs argued that with the Taiwan factor, the focus of U.S.-China tensions may shift from trade to military.

“The more immediate focus has been on building Taiwan’s military capabilities to deter a conflict,” U.S. political economists Alec Phillips and Tim Krupa wrote earlier this month, adding that they see “good odds” that the U.S. Congress passes additional support to currently existing schemes.