Nasdaq and S&P 500 close at highest levels since August on optimism over debt ceiling bill: Live updates

Stocks advanced on Thursday after the U.S. House passed a debt ceiling bill in a crucial step to avoid a default, with the measure moving to the Senate.

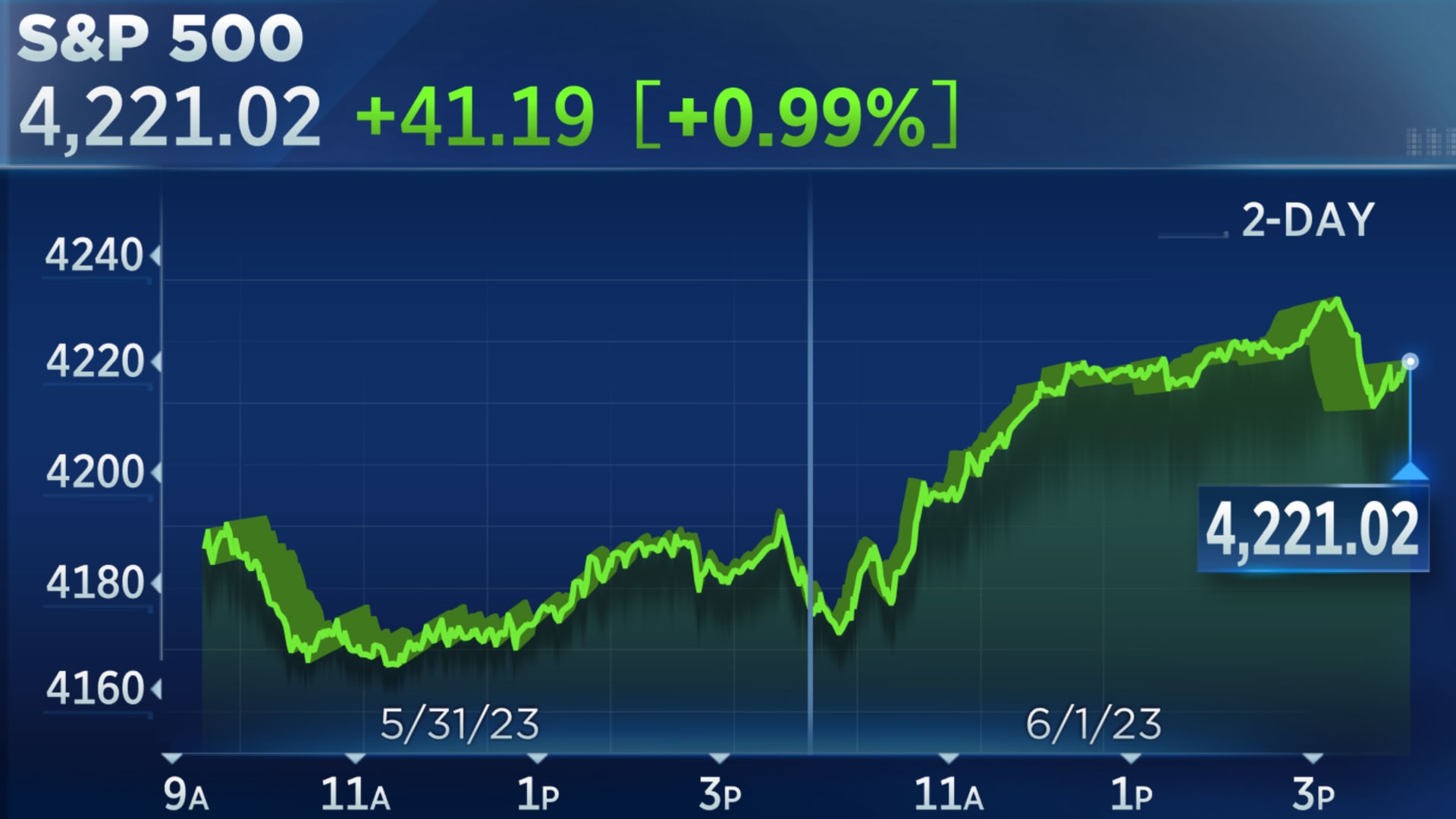

The Dow Jones Industrial Average traded up 153.3 points, or 0.47%, to end at 33,061.57 despite a 4.7% tumble in Salesforce shares a day after its earnings report. The S&P 500 gained 0.99% to finish at 4,221.02, while the Nasdaq Composite added 1.28% to end at 13,100.98. Both the S&P 500 and Nasdaq closed at their highest levels since August 2022.

The Fiscal Responsibility Act passed by a vote of 314-117 with bipartisan support on Wednesday night. Senate Majority Leader Chuck Schumer, D-N.Y., said the Senate will stay in session until a bill is sent to President Biden’s desk.

“Anytime a big negative or a big potential negative catalyst is removed, it helps remove some uncertainty from the market,” said Ross Mayfield, investment strategy analyst at Baird. “But at the same time, the equity market, at least, had really looked through this story.”

Beyond the debt ceiling battle, investors are looking ahead to the Federal Reserve’s June 13-14 policy meeting as another possible market catalyst. Philadelphia Fed President Patrick Harker said Thursday that he thinks the central bank is near the point of being able to stop interest rate hikes. But he said earlier in the week that Friday’s payrolls report could change impact how he’ll vote at the upcoming gathering.

Data from ADP showed private payrolls grew more than economists expected in May, while the number of jobless claims filed last week was smaller than economists forecasted. The labor market has been a closely watched area of the economy given concerns that sustained strength could prompt the Fed to once again raise interest rates at its policy meeting later this month.

“A lot of the market focus is shifting from whether the government is going to default on its debts, which was never going to happen, to the more pressing issue of how much further interest rates are going to rise,” said Jamie Cox, managing partner of Harris Financial.

The Nasdaq is up nearly 1% week to date, putting the technology-heavy index on pace for six straight weekly wins — a streak length not seen since January 2020. The S&P 500 is on track to end around 0.4% higher, while the Dow is poised to lose 0.1% on the week.

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1296348323-44c7aca2cbb14d2f84b65b393fec649a.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-171349083-062edb8f4c13435797d038746c27422f.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-21669937071-728bfabe684b4c8aa17fc9c47255a740.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1338457868-a84a285627f64532a38b290e15fc48ea.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1440361960-8ba9445e90a74d6d9177d1c88bd6608b.jpg)