Corporate bankruptcies and defaults are surging – here’s why

Federal Reserve Board Chairman Jerome Powell departs after speaking during a news conference following the Federal Open Market Committee meeting, at the Federal Reserve in Washington, DC, on June 14, 2023.

Mandel Ngan | AFP | Getty Images

The Federal Reserve plans to keep hiking interest rates to stem inflation, which means an increase in corporate default rates is likely in coming months.

The corporate default rate rose in May, a sign that U.S. companies are grappling with higher interest rates that make it more expensive to refinance debt as well as an uncertain economic outlook.

There have been 41 defaults in the U.S. and one in Canada so far this year, the most in any region globally and more than double the same period in 2022, according to Moody’s Investors Service.

Earlier this week, Fed Chairman Jerome Powell said to expect more interest rate increases this year, albeit at a slower rate, until more progress is made on lowering inflation.

Bankers and analysts say high interest rates are the biggest culprit of distress. Companies that are either in need of more liquidity or those that already have hefty debt loads in need of refinancing are faced with a high cost of new debt.

The options often include distressed exchanges, which is when a company swaps its debt for another form of debt or repurchases the debt. Or, in dire circumstances, a restructuring may take place in or out of court.

“Capital is much more expensive now,” said Mohsin Meghji, founding partner of restructuring and advisory firm M3 Partners. “Look at the cost of debt. You could reasonably get debt financing for 4% to 6% at any point on average over the last 15 years. Now that cost of debt has gone up to 9% to 13%.”

Meghji added that his firm has been particularly busy since the fourth quarter across numerous industries. While the most troubled companies have been affected recently, he expects companies with more financial stability to have issues refinancing due to high interest rates.

Through June 22, there were 324 bankruptcy filings, not far behind the total of 374 in 2022, according to S&P Global Market Intelligence. There were more than 230 bankruptcy filings through April of this year, the highest rate for that period since 2010.

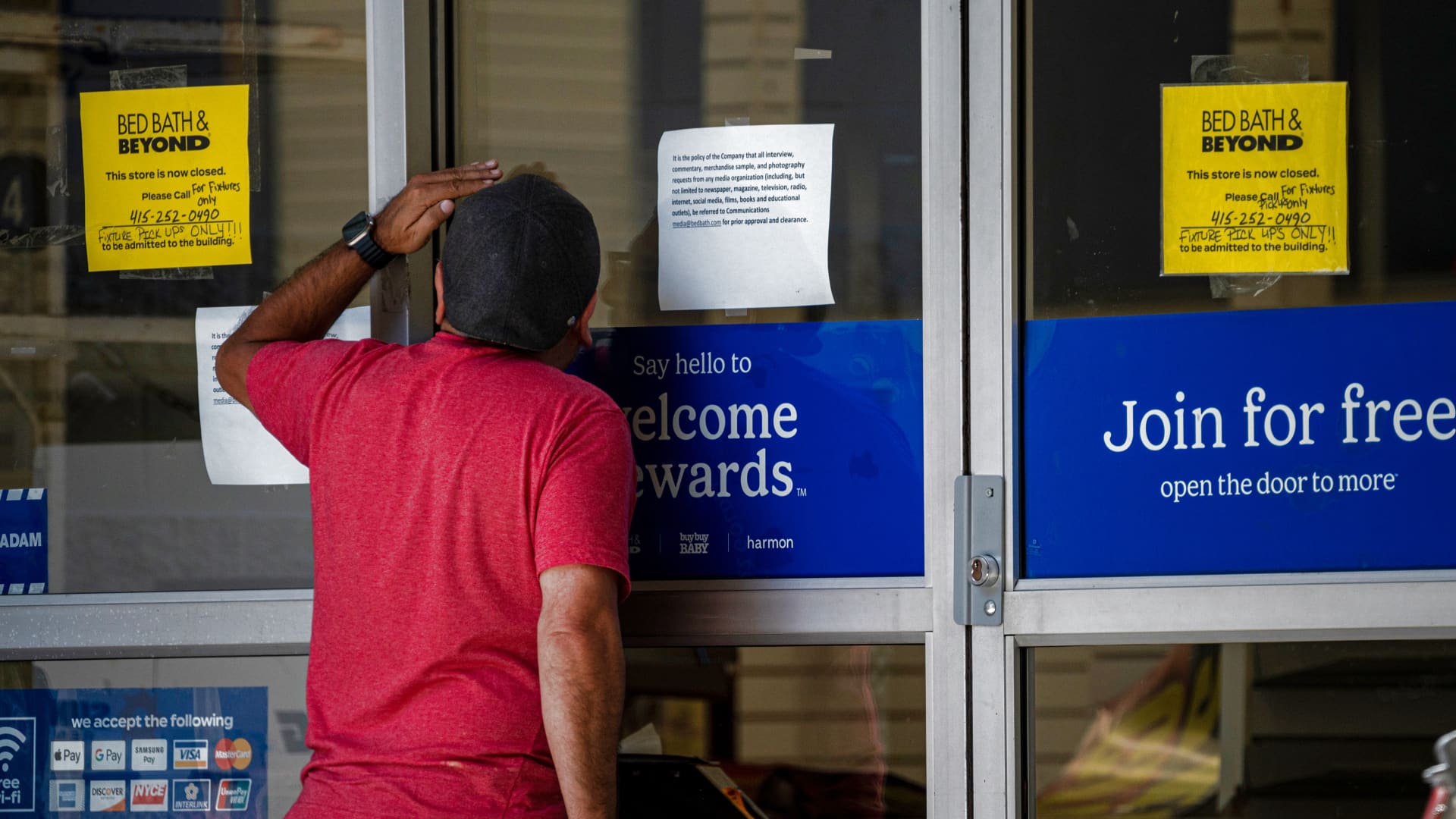

A closed Bed Bath & Beyond store in San Francisco, California, US, on Monday, April 24, 2023.

David Paul Morris | Bloomberg | Getty Images

Envision Healthcare, a provider of emergency medical services, was the biggest default in May. It had more than $7 billion in debt when it filed for bankruptcy, according to Moody’s.

Home security and alarm company Monitronics International, regional financial institution Silicon Valley Bank, retail chain Bed Bath & Beyond and regional sports network owner Diamond Sports are also among the largest bankruptcy filings so far this year, according to S&P Global Market Intelligence.

In many cases, these defaults are months, if not quarters, in the making, said Tero Jänne, co-head of capital transformation and debt advisory at investment bank Solomon Partners.

“The default rate is a lagging indicator of distress,” Jänne said. “A lot of times those defaults don’t occur until well past a number of initiatives to address the balance sheet, and it’s not until a bankruptcy you see that capital D default come into play.”

Moody’s expects the global default rate to rise to 4.6% by the end of the year, higher than the long-term average of 4.1%. That rate is projected to rise to 5% by April 2024 before beginning to ease.

It’s safe to bet there will be more defaults, said Mark Hootnick, also co-head of capital transformation and debt advisory at Solomon Partners. Until now, “we’ve been in an environment of incredibly lax credit, where, frankly, companies that shouldn’t be tapping the debt markets have been able to do so without limitations.”

This is likely why defaults have occurred across various industries. There were some industry-specific reasons, too.

“It’s not like one particular sector has had a lot of defaults,” said Sharon Ou, vice president and senior credit officer at Moody’s. “Instead it’s quite a number of defaults in different industries. It depends on leverage and liquidity.”

In addition to big debt loads, Envision was toppled by health-care issues stemming from the pandemic, Bed Bath & Beyond suffered from having a large store footprint while many customers opted for shopping online, and Diamond Sports was hurt by the rise of consumers dropping cable TV packages.

“We all know the risks facing companies right now, such as weakening economic growth, high interest rates and high inflation,” Ou said. “Cyclical sectors will be affected, such as durable consumers goods, if people cut back on spending.”