F&O Manual: Bank Nifty struggles at 45,000 strike

Among individual stocks, short covering was seen in IDFC, Siemens and BirlaSoft.

The markets opened positively today ahead of the Q1 earnings results from IT giants. As of 9:50 am, the Nifty traded 121 points or 0.63 percent higher at 19,477.30, while the Bank Nifty also traded 150.25 points or 0.33 percent higher at 45,011.10.

Since March, the “buy on dips” strategy has worked well as the Nifty has not corrected by more than 400 points while sustaining above the 20-day EMA. ICICI Securities believes that any decline from this point should not be seen as negative but rather capitalized on as an incremental buying opportunity, as they do not expect the index to breach the key support threshold of 19,100.

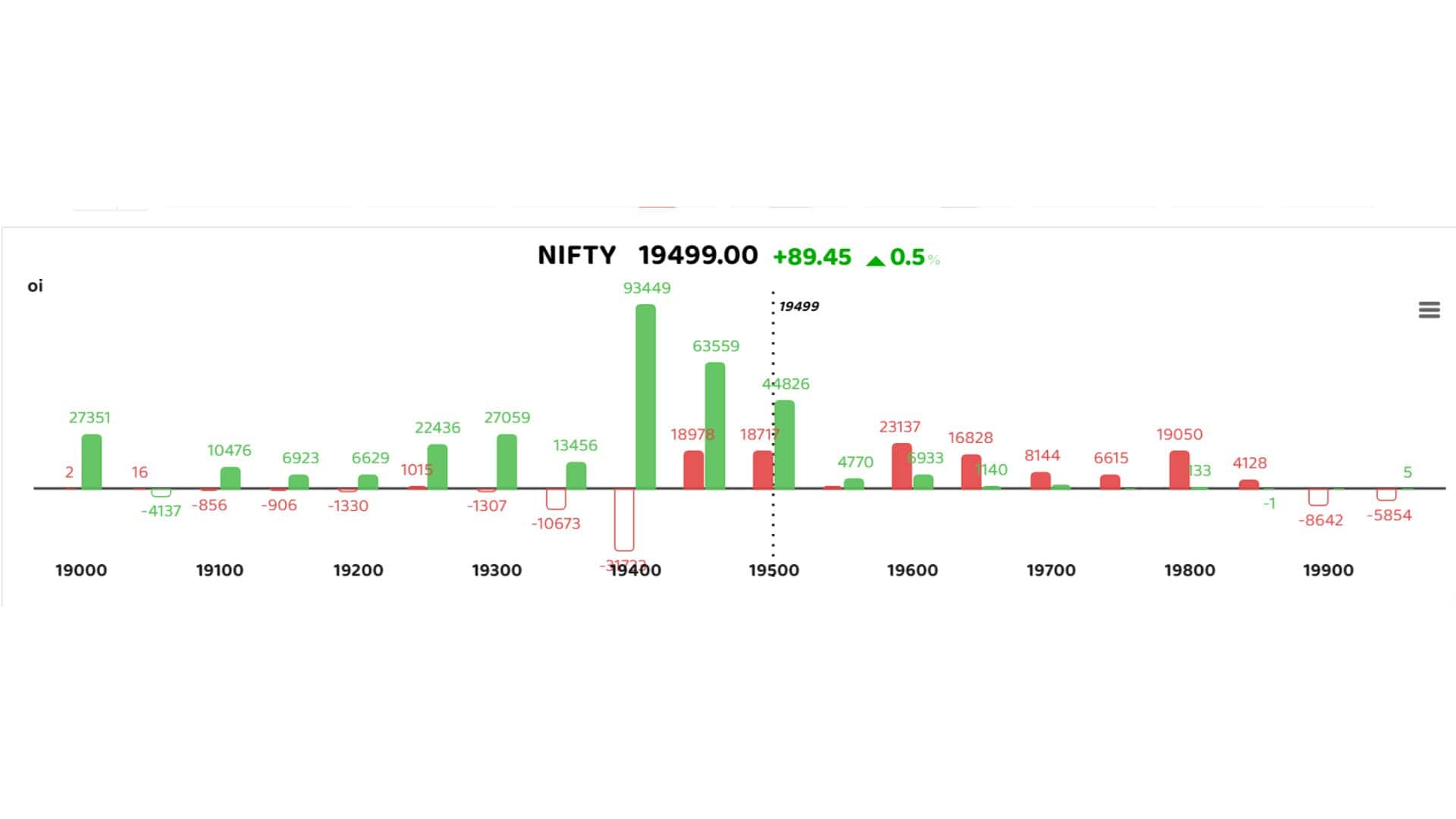

The bar graph reflects the change in OI (Open Interest) during the day. Red bars represent call option OI, while green bars represent put option OI.

The bar graph reflects the change in OI (Open Interest) during the day. Red bars represent call option OI, while green bars represent put option OI.

The options data shows that put option writers are dominant for the day, with 19,400 being the key support level. On the upside, 19,600-19,700 will act as an immediate hurdle.

The bar graph reflects the change in OI (Open Interest) during the day. Red bars represent call option OI, while green bars represent put option OI.

The bar graph reflects the change in OI (Open Interest) during the day. Red bars represent call option OI, while green bars represent put option OI.

Bank Nifty:

The Bank Nifty has been relatively underperforming compared to the Nifty. Both call and put writers are battling it out at the 45,000 strike in Bank Nifty to gain the upper hand, making key Straddle positions dominant at the 45,000 level. On the upside, 45,300 is likely to act as a strong resistance, while the downside support is placed at 44,800. Rahul K Ghose, Founder & CEO of Hedged, an algorithm-powered advisory platform, stated, “Bank Nifty, on the other hand, has a broader range pegged between 44,000 and 45,500. This range should hold true even for the July monthly expiry, unless we see a sharp rise in put writers at the 45,000 PE strike.” Playing a directional view might not be prudent at this point, traders are recommended to initiate short straddles with offsets, he suggests.

Among individual stocks, there was a long buildup seen in TataComm, HDFC, Polycab, and RBL Bank. Meanwhile, a short buildup was seen in Deepak Nitrate, UPL, and PI Industries.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.