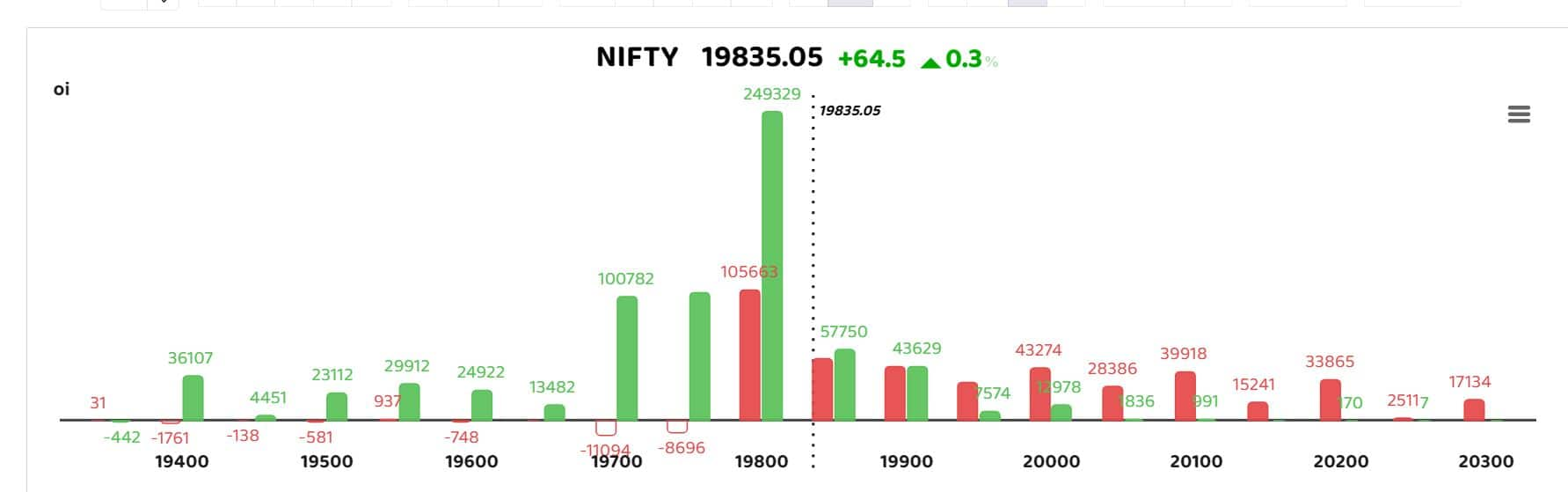

F&O Manual | Bullish momentum continues; Nifty Index Inches Towards 20,000 Amid Strong Option Activity at 19,800 Strike

Among individual stocks, ICICI PruLi, Coforge and Tatapower were those that saw short buildup while MFSL, Polycab and NTPC saw long buildup.

The market trades in green with BSE midcap and smallcap indices up 0.5 percent each. Among sectors, power index up 1 percent, while oil & gas, pharma and realty indices up 0.5 percent each.

As of 11.25 am, the Nifty index was down 0.014 percent or 2.75 points at 19,746.50. The Nifty Bank was up 0.19 percent or 84.70 points at 45,495.55

Bars reflect the change in OI during the day. Red bars show call option OI, and green bars show put option OI.

Bars reflect the change in OI during the day. Red bars show call option OI, and green bars show put option OI.

There is 2 times more put writing than call writing at 19,800 Strike in Nifty. Hence, option activity at 19,800 Strike will provide cues that market is expected to maintain bullish position. Crucial key support can be seen at 19700 followed by 19750, while upside resistance is observed at 19950 and 20000 levels.

ICICI Securities stated, “The elongation of rallies followed by shallow retracement signifies inherent strength that makes us confident to reiterate our positive stance and expect index to gradually head towards psychological mark of 20000. In the process, bouts of volatility can not be ruled out tracking global development amid overbought conditions.” They believe the buy on dips would be the prudent strategy to adopt as they do not expect index to breach key support threshold of 19300.

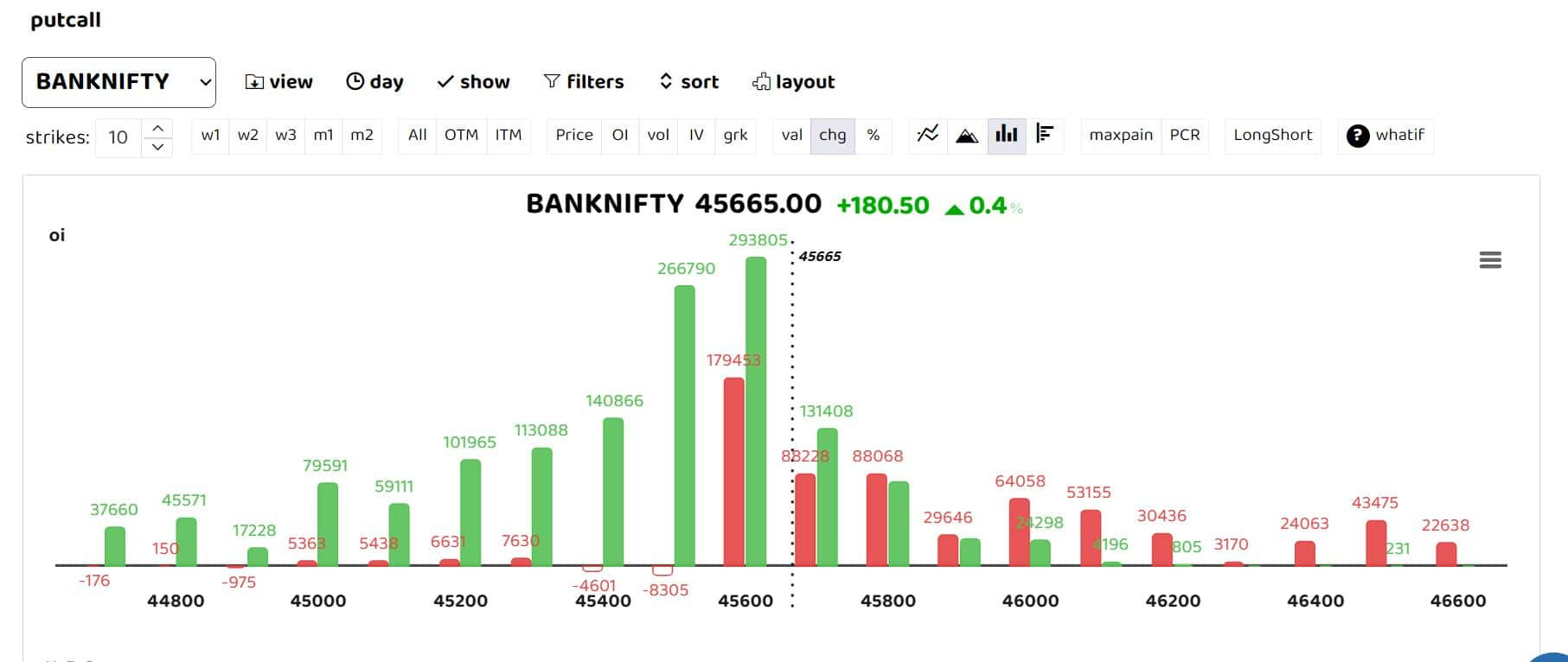

Bank Nifty

Bank Nifty, meanwhile, saw Straddle trades at 45,600 with put accumulation at 45,500 levels. For the day, support for Bank Nifty exists at 45400 levels, whereas resistance for Bank Nifty stands at 46000 levels.

Ashwin Ramani, Derivatives & Technical Analyst, SAMCO Securities stated, “Until 44,500 is taken out on the downside, Bank Nifty is likely to be bullish. The maximum call open interest (OI) is placed at 46,000, which will act as an immediate resistance.”

Bars reflect the change in OI during the day. Red bars show call option OI, and green bars show put option OI.

Bars reflect the change in OI during the day. Red bars show call option OI, and green bars show put option OI.

Among individual stocks, ICICI PruLi, Coforge and Tatapower were those that saw short buildup while MFSL, Polycab and NTPC saw long buildup.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.