Derivative Outlook | What should be the options strategy for ACC ahead of the Q1 results?

ACC Ltd is set to announce Q1FY24 results on July 27

ACC, part of the Adani group of cement companies, is all set to announce its first quarterly financial results on July 27. The cement sector is currently in focus ahead of the earnings results of both ACC and JK Lakshmi Cement, scheduled to be announced tomorrow.

The broader trend in the cement sector remains positive, price action riding along the overall bullish sentiment. Selective cement companies have seen remarkable upside in the past four months. While the key benchmark indices underwent tremendous volatility during this phase, shares of UltraTech Cement, ACC, and Orient Cement were formulating accumulation and laying a significant base for the upward rallies.

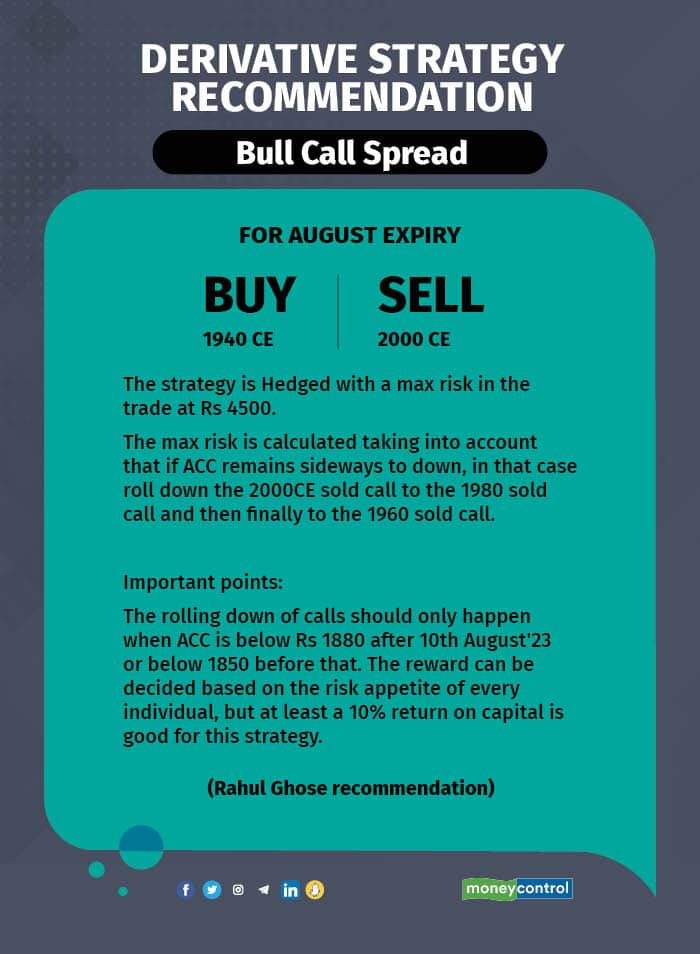

As per Rahul Ghose, Founder & CEO – Hedged, an algorithm-powered advisory platform ACC stock has broken out of a long consolidation which started in Feb’23 and an ascending triangle pattern as well. This denotes the possibility of continued upside with a potential target of the stock at 2,250. He states that the bias before the results is therefore bullish. “While planning a strategy in ACC we need to take into account the bullish bias but we need to also take into account the consolidation currently happening in Nifty”, added Ghose. He recommends a Bull Call spread in the stock using the August Expiry.

Derivatives Strategy recommended

Bull Call Spread

For August expiry: Buy 1940 CE

Sell 2000 CE

Jyoti Budhia, a trader and derivatives analyst, notes that ACC has already witnessed its first breakout near the 1900 level. She anticipates another breakout around the 2000 level based on the option chart, as volume buying has been observed. For the August expiry, if ACC closes above the 2,000 level after the earnings result, Bhudia also recommends a bull call strategy with a spread of Rs 100

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-80864706-af4bc38e94e34052a5106e15bf44b2a2.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-77294443-88c7023010c9410c933c8029b3931c91.jpg)