F&O Manual |Indian benchmark indices open higher after Fed’s rate hike; Trade flat amid expiry volatility

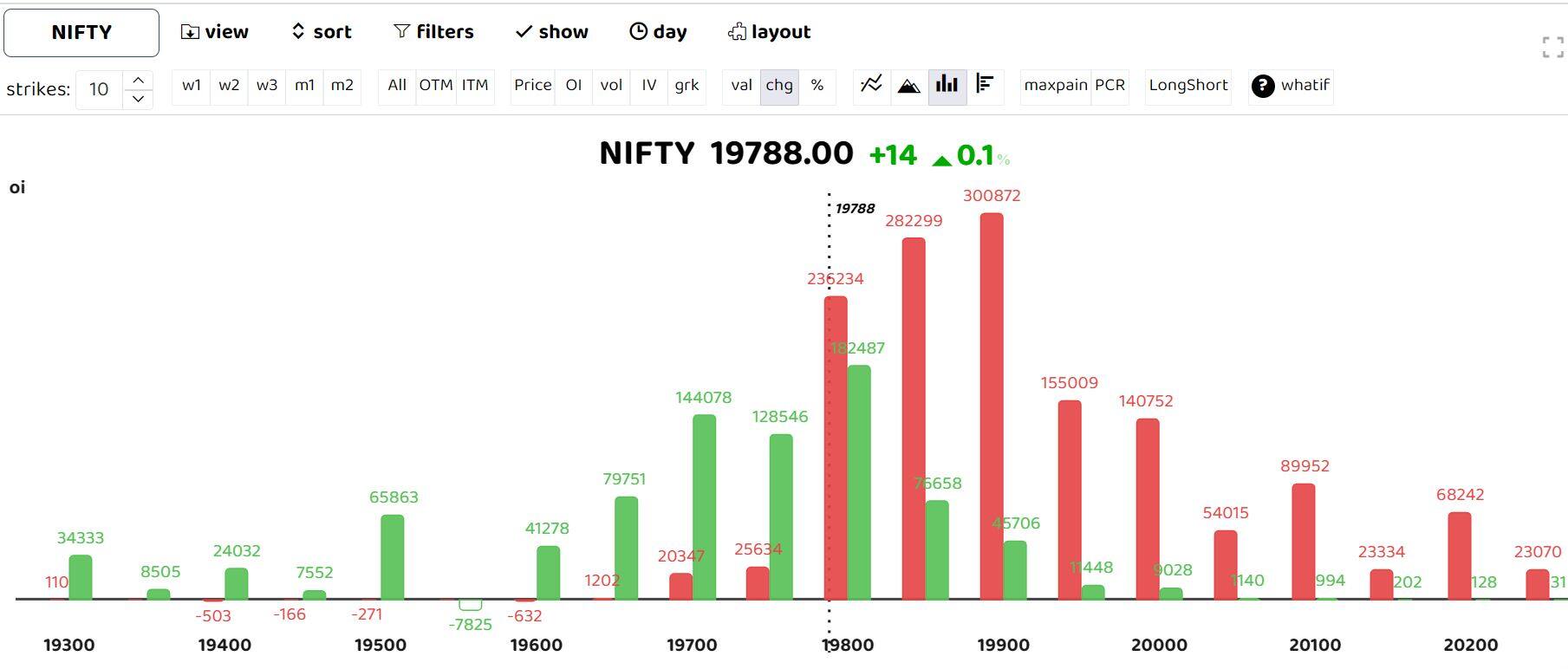

The Nifty is likely to open higher on back of positive global news. Nifty has sizable Call OI at 19800 strike and if Nifty manages to sustain above 19800 levels after the opening, then a move towards 19950 can be seen on back of short covering, as per ICICI securities.

The benchmark indices for India opened higher as Asian equities futures were up following the Federal Reserve’s increase in interest rates to a 22-year high. However, by mid morning indices erase gains and trade flat. Among sectors, auto index down 1 percent, pharma index up 2 percent and PSU Bank index up 1 percent. BSE Midcap and Smallcap indices up 0.5 percent each.

The Nifty benchmark index had a positive start, opening above the previous session’s high and witnessing extended buying in the initial hour. Prices traded within a range with a positive undertone, but some profit booking occurred mid-morning. Analysts anticipate the market to consolidate further before the next significant upward trend.

Call writers are dominant amid volatility on the monthly expiry day. Traders can opt for stock-specific actions, but it is essential to be highly selective due to the expected higher volatility, as per analysts’ predictions.

HDFC Securities stated that, “Nifty managed to reclaim its level above its 5-day EMA, placed at 19,736. The recent swing lows of 19,615 should be the stop-loss in trading long positions. On the upside, the 19,900-20,000 range could act as an immediate resistance.”

“During the monthly expiry session, strong support is observed around 19,680 – 19,600, and only sustained trading below this level may trigger a cascading sell-off towards the 20EMA positioned around 19,500 on the expiry day. On the flip side, 19,880 – 19,950 remains a stiff resistance, and traders should consider booking profits if these levels are immediately met,” stated Sameet Chavan, Head of Research, Technical, and Derivatives at Angel One.

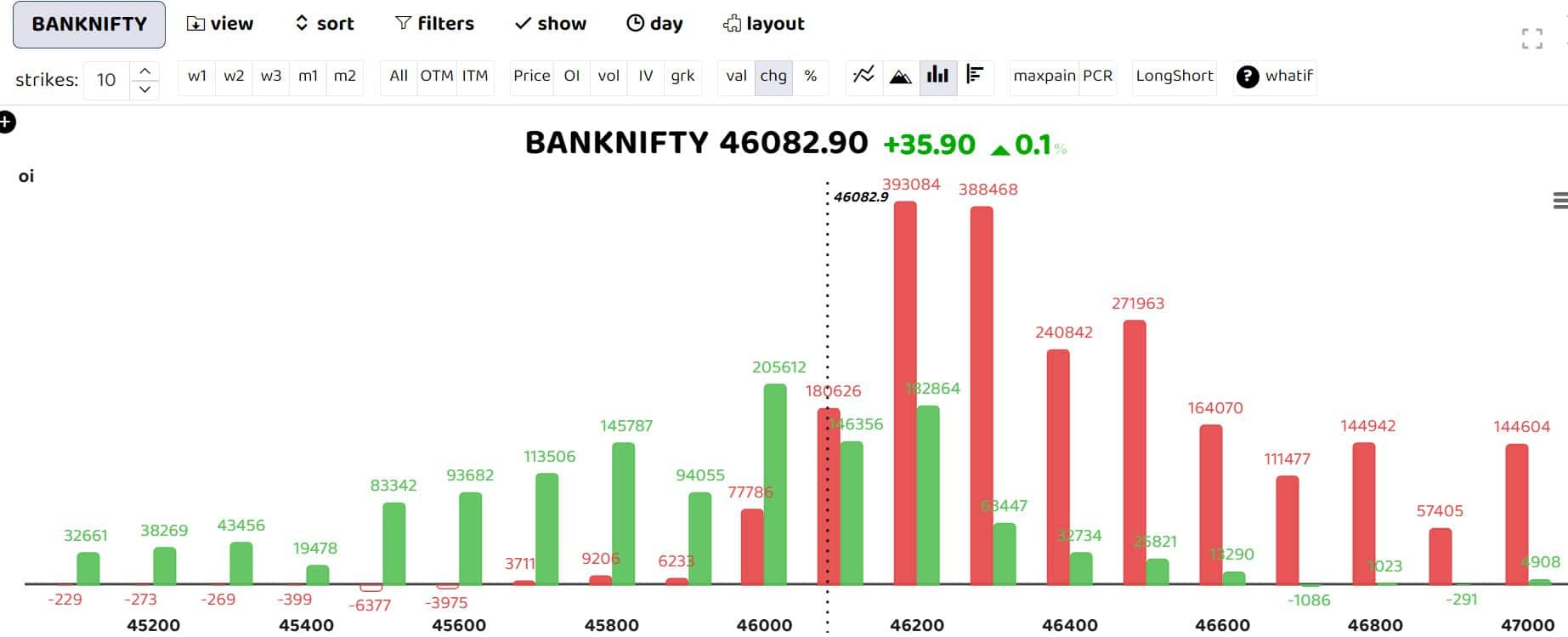

Bank Nifty

Bank Nifty trades with volatility on the monthly expiry day. Analysts at Prabhudhas Liladher stated that “support is maintained at the 45,500 zone, whereas the 46,300 level is acting as an important hurdle. Bank Nifty would have the daily range of 45,600-46,600 levels.”

Among individual Among individual stocks Cipla, Syngene and REC saw long buildup, while M&M and Britannia saw short buildup.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.