Top 10 bets for August series as Nifty takes a breather but holds pivotal support

The 19,600-19,500 zone may be crucial for Nifty and, if this is breached, then correction can be seen towards 19,300. On the higher side, 19,700-19,800 is important to watch out for as a decisive close above 19,800 may take it towards its fresh all-time high

Sunil Shankar Matkar

July 31, 2023 / 06:53 AM IST

The broader market looks dazzling with immense opportunity to outperform the indices.

‘);

$(‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]);

//if(resData[stkKey][‘percentchange’] > 0){

// $(‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”);

// $(‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”);

//}else if(resData[stkKey][‘percentchange’] < 0){

// $(‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”);

// $(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

//}

if(resData[stkKey][‘percentchange’] >= 0){

$(‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”);

//$(‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”);

$(‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”);

}else if(resData[stkKey][‘percentchange’] < 0){

$(‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”);

//$(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

$(‘#gainlosstxt_’+articleId).find(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

}

$(‘#volumetxt_’+articleId).show();

$(‘#vlmtxt_’+articleId).show();

$(‘#stkvol_’+articleId).text(resData[stkKey][‘volume’]);

$(‘#td-low_’+articleId).text(resData[stkKey][‘daylow’]);

$(‘#td-high_’+articleId).text(resData[stkKey][‘dayhigh’]);

$(‘#rightcol_’+articleId).show();

}else{

$(‘#volumetxt_’+articleId).hide();

$(‘#vlmtxt_’+articleId).hide();

$(‘#stkvol_’+articleId).text(”);

$(‘#td-low_’+articleId).text(”);

$(‘#td-high_’+articleId).text(”);

$(‘#rightcol_’+articleId).hide();

}

$(‘#stk-graph_’+articleId).attr(‘src’,’//appfeeds.moneycontrol.com/jsonapi/stocks/graph&format=json&watch_app=true&range=1d&type=area&ex=’+stockType+’&sc_id=’+stockId+’&width=157&height=100&source=web’);

}

}

}

});

}

$(‘.bseliveselectbox’).click(function(){

$(‘.bselivelist’).show();

});

function bindClicksForDropdown(articleId){

$(‘ul#stockwidgettabs_’+articleId+’ li’).click(function(){

stkId = jQuery.trim($(this).find(‘a’).attr(‘stkid’));

$(‘ul#stockwidgettabs_’+articleId+’ li’).find(‘a’).removeClass(‘active’);

$(this).find(‘a’).addClass(‘active’);

stockWidget(‘N’,stkId,articleId);

});

$(‘#stk-b-‘+articleId).click(function(){

stkId = jQuery.trim($(this).attr(‘stkId’));

stockWidget(‘B’,stkId,articleId);

$(‘.bselivelist’).hide();

});

$(‘#stk-n-‘+articleId).click(function(){

stkId = jQuery.trim($(this).attr(‘stkId’));

stockWidget(‘N’,stkId,articleId);

$(‘.bselivelist’).hide();

});

}

$(“.bselivelist”).focusout(function(){

$(“.bselivelist”).hide(); //hide the results

});

function bindMenuClicks(articleId){

$(‘#watchlist-‘+articleId).click(function(){

var stkId = $(this).attr(‘stkId’);

overlayPopupWatchlist(0,2,1,stkId);

});

$(‘#portfolio-‘+articleId).click(function(){

var dispId = $(this).attr(‘dispId’);

pcSavePort(0,1,dispId);

});

}

$(‘.mc-modal-close’).on(‘click’,function(){

$(‘.mc-modal-wrap’).css(‘display’,’none’);

$(‘.mc-modal’).removeClass(‘success’);

$(‘.mc-modal’).removeClass(‘error’);

});

function overlayPopupWatchlist(e, t, n,stkId) {

$(‘.srch_bx’).css(‘z-index’,’999′);

typparam1 = n;

if(readCookie(‘nnmc’))

{

var lastRsrs =new Array();

lastRsrs[e]= stkId;

if(lastRsrs.length > 0)

{

var resStr=”;

let secglbVar = 1;

var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’;

$.get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) {

$(‘#backInner1_rhsPop’).html(data);

$.ajax({url:url,

type:”POST”,

dataType:”json”,

data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs},

success:function(d)

{

if(typparam1==’1′) // rhs

{

var appndStr=”;

//var newappndStr = makeMiddleRDivNew(d);

//appndStr = newappndStr[0];

var titStr=”;var editw=”;

var typevar=”;

var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’);

var phead =’Why add to Portfolio?’;

if(secglbVar ==1)

{

var stkdtxt=’this stock’;

var fltxt=’ it ‘;

typevar =’Stock ‘;

if(lastRsrs.length>1){

stkdtxt=’these stocks’;

typevar =’Stocks ‘;fltxt=’ them ‘;

}

}

//var popretStr =lvPOPRHS(phead,pparr);

//$(‘#poprhsAdd’).html(popretStr);

//$(‘.btmbgnwr’).show();

var tickTxt =’‘;

if(typparam1==1)

{

var modalContent = ‘Watchlist has been updated successfully.’;

var modalStatus = ‘success’; //if error, use ‘error’

$(‘.mc-modal-content’).text(modalContent);

$(‘.mc-modal-wrap’).css(‘display’,’flex’);

$(‘.mc-modal’).addClass(modalStatus);

//var existsFlag=$.inArray(‘added’,newappndStr[1]);

//$(‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’);

//if(existsFlag == -1)

//{

// if(lastRsrs.length > 1)

// $(‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’);

// else

// $(‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’);

//

//}

}

//$(‘.accdiv’).html(”);

//$(‘.accdiv’).html(appndStr);

}

},

//complete:function(d){

// if(typparam1==1)

// {

// watchlist_popup(‘open’);

// }

//}

});

});

}

else

{

var disNam =’stock’;

if($(‘#impact_option’).html()==’STOCKS’)

disNam =’stock’;

if($(‘#impact_option’).html()==’MUTUAL FUNDS’)

disNam =’mutual fund’;

if($(‘#impact_option’).html()==’COMMODITIES’)

disNam =’commodity’;

alert(‘Please select at least one ‘+disNam);

}

}

else

{

AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’;

commonPopRHS();

/*work_div = 1;

typparam = t;

typparam1 = n;

check_login_pop(1)*/

}

}

function pcSavePort(param,call_pg,dispId)

{

var adtxt=”;

if(readCookie(‘nnmc’)){

if(call_pg == “2”)

{

pass_sec = 2;

}

else

{

pass_sec = 1;

}

var postfolio_url = ‘https://www.moneycontrol.com/portfolio_new/add_stocks_multi.php?id=’+dispId;

window.open(postfolio_url, ‘_blank’);

} else

{

AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’;

commonPopRHS();

/*work_div = 1;

typparam = t;

typparam1 = n;

check_login_pop(1)*/

}

}

function commonPopRHS(e) {

/*var t = ($(window).height() – $(“#” + e).height()) / 2 + $(window).scrollTop();

var n = ($(window).width() – $(“#” + e).width()) / 2 + $(window).scrollLeft();

$(“#” + e).css({

position: “absolute”,

top: t,

left: n

});

$(“#lightbox_cb,#” + e).fadeIn(300);

$(“#lightbox_cb”).remove();

$(“body”).append(”);

$(“#lightbox_cb”).css({

filter: “alpha(opacity=80)”

}).fadeIn()*/

$(“.linkSignUp”).click();

}

function overlay(n)

{

document.getElementById(‘back’).style.width = document.body.clientWidth + “px”;

document.getElementById(‘back’).style.height = document.body.clientHeight +”px”;

document.getElementById(‘back’).style.display = ‘block’;

jQuery.fn.center = function () {

this.css(“position”,”absolute”);

var topPos = ($(window).height() – this.height() ) / 2;

this.css(“top”, -topPos).show().animate({‘top’:topPos},300);

this.css(“left”, ( $(window).width() – this.width() ) / 2);

return this;

}

setTimeout(function(){$(‘#backInner’+n).center()},100);

}

function closeoverlay(n){

document.getElementById(‘back’).style.display = ‘none’;

document.getElementById(‘backInner’+n).style.display = ‘none’;

}

stk_str=”;

stk.forEach(function (stkData,index){

if(index==0){

stk_str+=stkData.stockId.trim();

}else{

stk_str+=’,’+stkData.stockId.trim();

}

});

$.get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?classic=true&sc_id=’+stk_str, function(data) {

stk.forEach(function (stkData,index){

$(‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]);

});

});

function redirectToTradeOpenDematAccountOnline(){

if (stock_isinid && stock_tradeType) {

window.open(`https://www.moneycontrol.com/open-demat-account-online?classic=true&script_id=${stock_isinid}&ex=${stock_tradeType}&site=web&asset_class=stock&utm_source=moneycontrol&utm_medium=articlepage&utm_campaign=tradenow&utm_content=webbutton`, ‘_blank’);

}

}

The market negated higher highs of the last 17 weeks and closed down half a percent on the Nifty50 in the week ended July 28, but took a good support at the previous week’s low of 19,563 and formed a bearish candlestick pattern with lower and upper shadows on the weekly charts. The index closed at 19,646.

The 19,600-19,500 zone is expected to be crucial for the index and, if this is breached, then correction can be seen towards 19,300 points. On the higher side, 19,700-19,800 is important to watch out for as a decisive close above 19,800 may take the Nifty50 towards its fresh all-time high, experts said.

Given the stable breadth and volatility falling to fresh historic lows, experts are not worried about the recent fall as it was on the expected lines and could be considered as profit-booking after the recent rally to uncharted territory.

“Amid the ongoing breather in the market, the chart structure construes optimism, and it is likely to continue a cheerful run in the comparable period. Till the index firmly withholds the pivotal support of 19,500, there is no sign of caution in the market,” Osho Krishan, Senior Analyst for Technical and Derivative Research at Angel One, said.

On the higher end, he feels 19,800-20,000 holds stiff resistance and a decisive move beyond which could trigger the next leg of the rally.

He remains confident in the market but advises participants to avoid undue risk as the market lacks buying conviction in the current scenario.

The broader market looks dazzling with immense opportunity to outperform the indices. “I would advocate traders to focus on stock-specific action,” he said.

Rohit Srivastava, who founded Indiacharts.com and charts out investment strategies, too, sees more room for rally in the market and it is likely to head towards 20,600 and eventually 21,000 in the coming months.

“Valuations are high at a stock-specific or sector level but not at a market-wide level and cannot be a reason for concern yet for the general stock market,” he said.

Let’s take a look at the top 10 trading ideas by experts for the next three-four weeks. Returns are based on the July 28 closing prices:

Expert: Subash Gangadharan, senior technical & derivative analyst at HDFC Securities

Tata Power: Buy | LTP: Rs 234.65 | Stop-Loss: Rs 214 | Target: Rs 265 | Return: 13 percent

Tata Power has shown relative strength last week. While the Nifty has lost 0.55 percent last week, Tata Power has gained a healthy 8 percent. In the process, the stock has closed above its recent trading range on the back of above average volumes, which augurs well for the uptrend to continue.

Technical indicators are giving positive signals as the stock is trading above the 20 and 50-day SMA (simple moving average). Momentum readings like the 14-week RSI (relative strength index), too, are in rising mode and not overbought, which implies potential for further upsides.

With the intermediate technical setup too looking attractive, we expect the stock to move up towards its previous intermediate highs in the coming weeks. One can buy between Rs 233-237 levels, with a stop-loss of Rs 214 and target of Rs 265.

Hindalco Industries: Buy | LTP: Rs 451.50 | Stop-Loss: Rs 426 | Target: Rs 485 | Return: 7.4 percent

After correcting from an intermediate high of Rs 504 tested in January 2023, Hindalco found support around Rs 381 levels in March 2023. These are strong supports as they also roughly coincide with previous intermediate lows.

The stock has since then been climbing higher and making higher bottoms in the process. Last week, the stock has also seen breakout of its recent trading range on the back of healthy volumes, indicating it is set to move higher in the coming weeks.

Technical indicators are giving positive signals as the stock is trading above the 20 and 50-day SMA. Momentum readings like the 14-week RSI too are in rising mode and not overbought, which implies potential for further upsides.

With the intermediate technical setup too looking attractive, we expect the stock to move up towards its previous intermediate highs in the coming weeks. Buy between Rs 449-453 levels, with a stop-loss at Rs 426 and target of Rs 485.

Laxmi Organic Industries: Buy | LTP: Rs 263.65 | Stop-Loss: Rs 250 | Target: Rs 290 | Return: 10 percent

After touching a low of Rs 220 in March 2023, Laxmi Organic has gradually climbed higher and made higher tops and higher bottoms. On Friday, the stock has broken out of its recent trading range on the back of above average volumes.

Momentum readings like the 14-day RSI too are in rising mode and not overbought. This augurs well for the uptrend to continue.

With the intermediate technical setup too looking positive, we believe the stock has the potential to move higher in the coming weeks. We recommend a buy between Rs 263-266 levels, with a stop-loss at Rs 250, and target of Rs 290.

Expert: Shrikant Chouhan, head of research (retail) at Kotak Securities

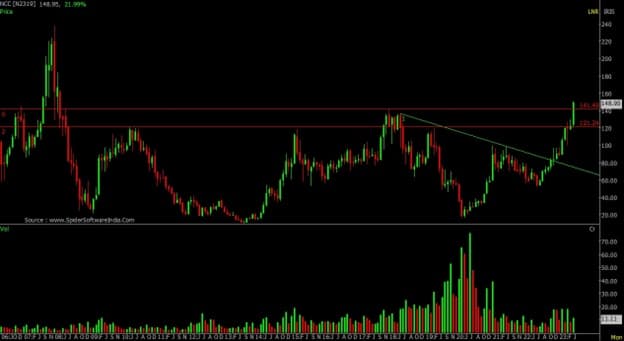

NCC: Buy | LTP: Rs 148.95 | Stop-Loss: Rs 125 | Target: Rs 190 | Return: 27 percent

Last Friday, the stock successfully surpassed the multi-year resistance point of Rs 142, which it had not done in the past 15 years. This is a significant milestone and may lead to the stock reaching the next resistance levels of Rs 190 and Rs 237.

The breakout is based on the stock’s trading volume, which suggests a more extensive trend. To take advantage of this opportunity, investors should consider buying at the current levels and during dips from the 20-day SMA, currently at Rs 135. It is important to place a stop-loss at Rs 125 or 50-day SMA to minimize potential losses.

Cipla: Buy | LTP: Rs 1,177.80 | Stop-Loss: Rs 1,100 | Targets: Rs 1,300-1,450 | Return: 23 percent

The stock has unexpectedly reached its all-time high at Rs 1,185 in a short amount of time. It is a significant breakout in terms of volume and price, which could potentially lead to a rally in the next few weeks.

Additionally, the formation is a swing high crossing, prompting long traders to consider buying. If the stock surpasses Rs 1,190, it may continue to rise towards Rs 1,300 and Rs 1,450 in the upcoming weeks or months.

It is a recommended for medium to long term-term investment, with two tranches. It is advised to purchase 50 percent at current levels and the remaining 50 percent at Rs 1,150. To mitigate potential losses, it is recommended to set a stop-loss at Rs 1,100.

Macrotech Developers: Buy | LTP: Rs 746.90 | Stop-Loss: Rs 700 | Target: Rs 799-850 | Return: 14 percent

Based on its recent performance, the stock has been following a rising corrective pattern and has found support from the 20-day SMA whenever it has experienced a decline in the past 15 days.

Looking at its weekly performance, the stock has broken out of a narrow trading range of Rs 720 and is currently rallying towards Rs 750 levels. With the stock holding above Rs 660 and subsequently Rs 720 levels, we anticipate it will continue to rise and reach its all-time high at Rs 799.

This is a positive formation on both a weekly and monthly basis, and our recommended strategy is to buy 50 percent of the stock at its current levels and the remaining 50 percent at Rs 720. We suggest setting a stop-loss at Rs 700 and aiming for a target of Rs 799 and Rs 850.

Expert: Ruchi Jain, lead research at 5paisa.com

Apollo Hospitals Enterprises: Buy | LTP: Rs 5,347 | Stop-Loss: Rs 5,170 | Targets: Rs 5,500-5,640 | Return: 5.5 percent

The stock started moving higher from the start of April month and rallied upto Rs 5,300 during mid-June. The prices then consolidated within a range in last one month which just seemed to be a time wise correction.

The momentum readings cooled-off from the overbought zone in this time and are now indicating a resumption of the trend. The stock has given a breakout from the consolidation and has hence, the stock could rally higher in the short term.

Traders can look to buy the stock in the range of Rs 5,340-5,320 for potential near term targets of Rs 5,500 and Rs 5,640. The stop-loss on long positions should be placed below Rs 5,170.

V-Guard Industries: Buy | LTP: Rs 286 | Stop-Loss: Rs 268 | Targets: Rs 300-315 | Return: 10 percent

The stock had recently given a breakout from a long consolidation phase. Post the breakout, the prices rallied higher upto Rs 297 and has seen some pullback move in last few days.

The volumes were good during the breakout while the corrections have not seen higher volumes. Traders should use this dip as a buying opportunity as the broader trend seems positive on short to medium term charts.

Traders can buy the stock in the range of Rs 285-282 for potential near term targets of Rs 300 and Rs 315. The stop-loss on long positions should be placed below Rs 268.

Expert: Mitesh Karwa, research analyst at Bonanza Portfolio

Fino Payments Bank: Buy | LTP: Rs 342 | Stop-Loss: Rs 255 | Target: Rs 490 | Return: 43 percent

The stock has seen breaking out of a rounding bottom like formation on the weekly timeframe and closing above previous swing high with a bullish candlestick pattern after almost 16 months. It is also sustaining above all its important EMA’s (exponential moving averages) which indicates bullish strength.

On the indicator front, the Supertrend indicator is indicating a bullish continuation trend; the Ichimoku Cloud is also suggesting a bullish move as the price is trading above the conversion line, base line and cloud.

Momentum oscillator RSI (21) is at around 68 on the weekly time frame indicating strength by sustaining above 50.

Observation of the above factors indicates that a bullish move in Fino Payments is possible for target upto Rs 490 in 3-4 weeks. One can initiate a buy trade in between the range of Rs 327-333, with a stop-loss of Rs 255 on daily closing basis.

Advanced Enzyme Technologies: Buy | LTP: Rs 327 | Stop-Loss: Rs 285 | Target: Rs 423 | Return: 29 percent

Advanced Enzyme has seen breaking out of a Eve & Adam pattern on the weekly timeframe with a bullish candlestick and closing above the highs of last seven months with above average volumes which indicates bullish strength.

On the indicator front, the momentum oscillator RSI (21) is at around 63 on the weekly time frame indicating strength by sustaining above 50, while the Ichimoku Cloud is also suggesting a bullish move as the price is trading above the conversion line, base line and cloud on the daily timeframe.

Observation of the above factors indicates that a bullish move in Advanced Enzyme is possible for target upto Rs 423 in 3-4 weeks. One can initiate a buy trade in the range of Rs 322-328, with a stop-loss of Rs 285 on daily closing basis.

Jagsonpal Pharmaceuticals: Buy | LTP: Rs 452 | Stop-Loss: Rs 348 | Target: Rs 552 | Return: 22 percent

Jagsonpal has seen giving a Rectangle Triangle Pattern breakout on the upside at the weekly timeframe and closing with a bullish candlestick above the highs of last eleven months and also closing above all its important EMAs which indicate bullish strength.

On the indicator front, the momentum oscillator RSI (21) is at around 69.78 showing strength by sustaining above 50. The Supertrend indicator is indicating a bullish continuation, while the Ichimoku Cloud is also indicating strength as the price is trading above the conversion line and base line.

Observation of the above factors indicates that a bullish move in Jagsonpal is possible for target upto Rs 552. One can initiate a buy trade in between the range of Rs 447-452, with a stop-loss of Rs 348 on daily closing basis.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.