F&O manual |Fitch fallout shakes up markets from overbought zone, Nifty below 19,550

Among individual stocks GAIL, GNFC, Bosch saw short buildup while Mphasis and ACC witnessed long unwinding.

India’s benchmark indices declined nearly 1 percent through midday on August 2 on subdued global sentiment after Fitch downgraded the sovereign rating of the US from top rating of AAA to AA+ due to its finances and debt burden.

“The impact on the stock markets is likely to be negative but not large since the US economy is now headed for a soft landing and not a recession, as markets feared earlier,” Dr V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services, wrote on Twitter.

At 11 am, the Sensex was down 693.73 points or 1.04 percent at 65,765.58, and the Nifty was down 205.30 points or 1.04 percent at 19,528.20. About 1331 shares advanced, 1699 shares declined, and 114 shares unchanged.

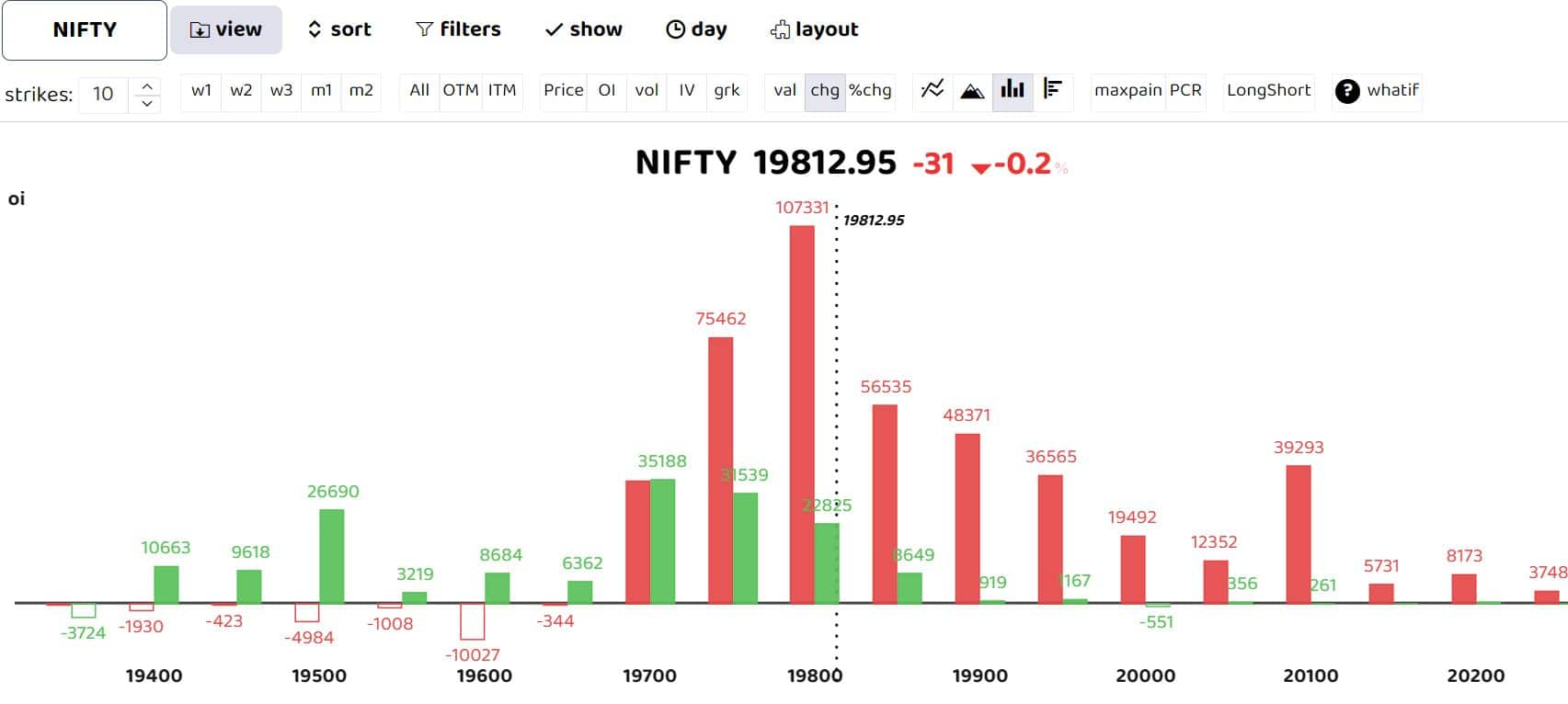

Put writers dominated the day with strong action at 19,800 levels. According to Geojit Financial Services, “the inability to stay above 19,745 might facilitate yet another attack on the 19,720-695 band. A break of this range could let the bears dominate and make intraday recovery difficult.” Key resistance is seen at 19,850, followed by 19,900 and 20,000 levels. Analysts believe that the ongoing consolidation between 19,200-19,800 will make the market healthy by cooling off overbought conditions, wherein stock-specific actions would prevail amid the progression of the earning season. However, if the market sustains the weakness below 19,562, it could catalyze a deep shakeout.

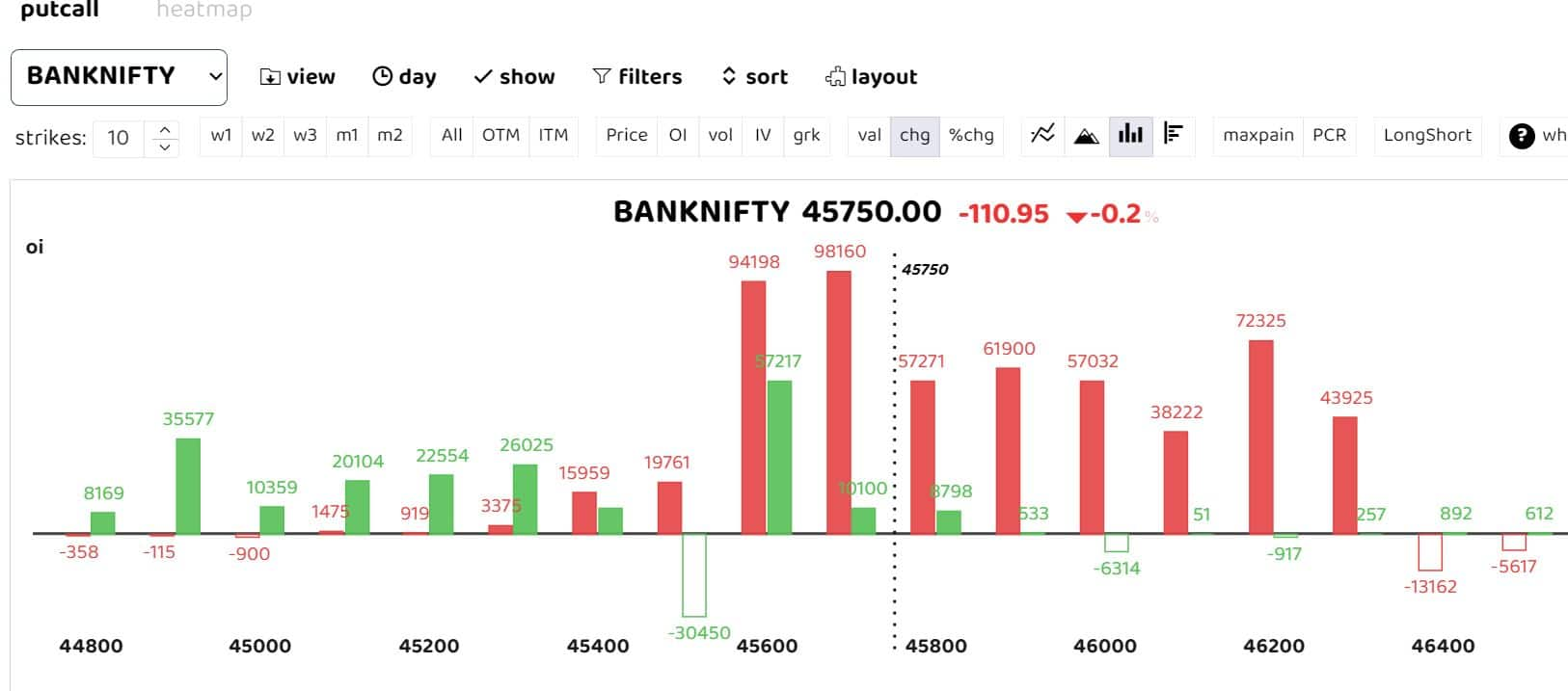

Major selling pressure can be seen in the Bank Nifty counters, down 500 points. Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities, stated that “a significant support level is visible at 45,300 levels. If the index breaks below this support level, it could signify the bears gaining full control, leading to potential downside movements towards 45,000-44,700 levels.”

Among individual stocks GAIL, GNFC, Bosch saw short buildup while Mphasis and ACC witnessed long unwinding.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.