Market extends losses, but these 85 small-caps give double-digit returns

In this week, BSE Sensex fell 0.66 percent or 438.95 points to finish at 65,721.25, and Nifty50 lost 0.65 percent or 129.05 points to end at 19,517.

For the second consecutive week ending on August 4, the market experienced prolonged selling due to subdued global indicators, including the downgrade of the US credit rating by rating agency Fitch, lacklustre factory activity data from China, another interest rate hike by the Bank of England, and continued selling by foreign institutional investors (FIIs). However, better service data, buying by domestic institutional investors (DIIs), and a surplus monsoon helped boost investor sentiments, leading to some recovery at the end of the week.

This week, the BSE Sensex fell 0.66 percent or 438.95 points, to close at 65,721.25, and the Nifty50 lost 0.65 percent or 129.05 points, to end at 19,517.

Among the broader indices, the BSE SmallCap Index rose 1.5 percent, MidCap Index ended flat, and the BSE LargeCap Index fell 0.6 percent.

“The week began on a positive note, with hopes of an end to the policy-tightening era due to cooling inflation worldwide. However, negative news about the US rating downgrade, weak factory activity data from the Eurozone and China, and prolonged FII selling triggered by rising US bond yields caused widespread worries across the globe,” said Vinod Nair, Head of Research at Geojit Financial Services.

“Increased concerns over the US economy forced investors to flee in search of safe haven investments, leading to a surge in the dollar index. Nonetheless, the domestic market recovered from the impact of weak global cues, gaining support from positive domestic earnings led by IT and pharma stocks.”

“India’s manufacturing activity remained robust, although it marginally moderated for the second consecutive month in July. On the other hand, the domestic service PMI exceeded market expectations, reaching a 13-year high, driven by a rise in new orders, particularly in international sales. Investors are awaiting the upcoming MPC meeting, where the RBI is expected to maintain its policy rate at 6.5 percent,” Nair added.

On the sectoral front, the Nifty Realty index shed 4.2 percent, Nifty PSU Bank index declined 4 percent, Nifty FMCG index fell 1.7 percent, the Nifty IT index rose 3 percent, and the Nifty Pharma index climbed nearly 2 percent.

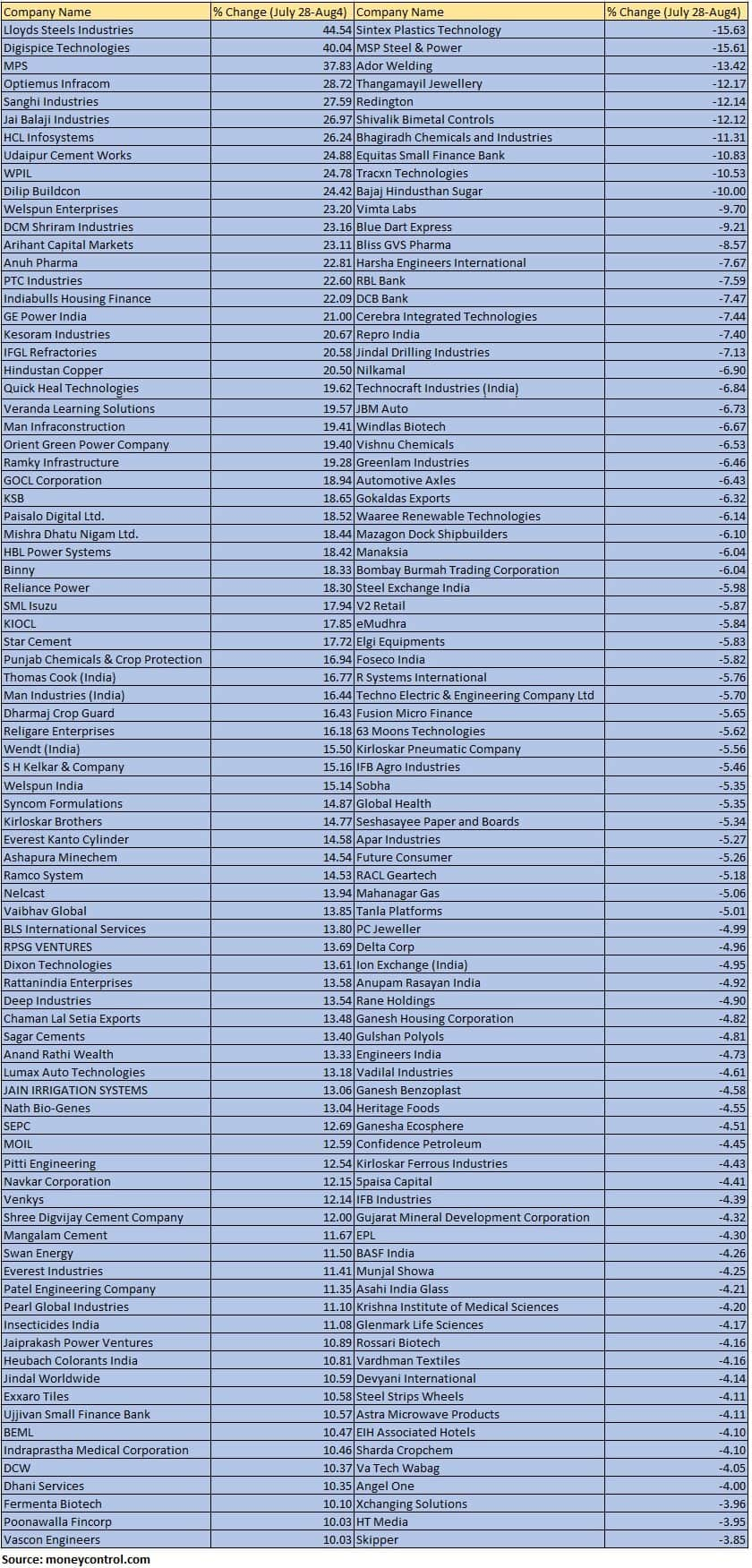

The BSE SmallCap index rose 1.5 percent supported by Lloyds Steels Industries, Digispice Technologies, MPS, Optiemus Infracom, Sanghi Industries, Jai Balaji Industries, HCL Infosystems, Udaipur Cement Works, WPIL, and Dilip Buildcon.

On the other hand, Sintex Plastics Technology, MSP Steel & Power, Ador Welding, Thangamayil Jewellery, Redington, Shivalik Bimetal Controls, Bhagiradha Chemicals and Industries, Equitas Small Finance Bank, Tracxn Technologies, and Bajaj Hindusthan Sugar fell 10-15 percent.

“The action-packed week ended with some respite as Nifty managed to reclaim the 19,500 mark. The recovery was initially led by IT counters, but later, the most affected space, BFSI, took it forward to bring some smiles back among the market participants. Mind you, we are still not completely out of the woods. Technically speaking, the Nifty slipped and closed below the 20-day EMA (exponential moving average) for the first time since March 31, 2023, and we are placed slightly below this level. So, till the time the Nifty does not surpass 19,550–19,600 on a closing basis, one should avoid being complacent. Ideally, it’s best to avoid aggressive trades,” said Sameet Chavan, Head Research, Technical and Derivatives, Angel One.

“In case of further global aberrations, the Nifty may go back to challenge the 19,400–19,300 levels. A move below this would reinforce the selling pressure to slide towards the next important cluster of 19,000–18,800.”

“As far as the optimistic scenario is concerned, a move beyond 19,600 is crucial, with global developments needing to subside completely. At the end of the week, the market has left us with some ambiguity, and hence, it’s advisable to take one step at a time. Hopefully, the current correction is not extended further, and we go back to reach the magical figure of 20,000 in the near term,” Chavan added.

Foreign institutional investors (FIIs) offloaded equities worth Rs 3,545.64 crore, while domestic institutional investors (DIIs) bought equities worth Rs 5,617.33 crore this week.

Where is Nifty50 headed?

According to Rupak De, Senior Technical Analyst at LKP Securities, the Nifty fell sharply following the downgrading of the US credit rating from AAA to AA+, leading to a breakdown from the recent consolidation on the daily timeframe. The recent fall has pulled the index below the 21-day EMA for the first time since March 29. On an immediate basis, 19,300 acted as support. However, on the higher end, 19,566 is likely to act as a crucial resistance level.

The sentiment is likely to remain weak as long as the Nifty remains below 19,566. However, a decisive move above 19,566 could take the index towards 19,700–19,750. On the other hand, a failure to move above 19,566 could trigger selling pressure.

Jatin Gedia, Technical Research Analyst at Sharekhan by BNP Paribas, said that following the sharp selling during the week, the Nifty did manage to reverse some of the losses in the last trading session of the week. However, on a weekly basis, it has closed in the red for the second consecutive week. The pullback is likely to fizzle out in the 19,560–19,600 zone, where resistance in the form of the 40-hour moving average and the hourly upper Bollinger band is placed. Thus, this bounce-back should be sold into.

The hourly momentum indicator has also reached the equilibrium line, indicating that the pullback has matured and can begin a new cycle on the downside. Overall, the trend is still negative, and we expect levels of 19,100 from a short-term perspective, he added.

The Bank Nifty has also witnessed a pullback. However, it is unlikely to result in a larger trend reversal. The pullback is likely to fizzle out in the 45,100–45,200 range, where resistance in the form of the 40-hour moving average and the hourly upper Bollinger band is placed. The hourly momentum indicator has witnessed a pullback to the equilibrium line, indicating that the pullback has matured and can start a new cycle. Overall, the trend is still negative, and we expect it to drift lower to 44,000 in the short term.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.