Downgrades outpace upgrades over the past month as Q1 earnings throw up nasty surprises

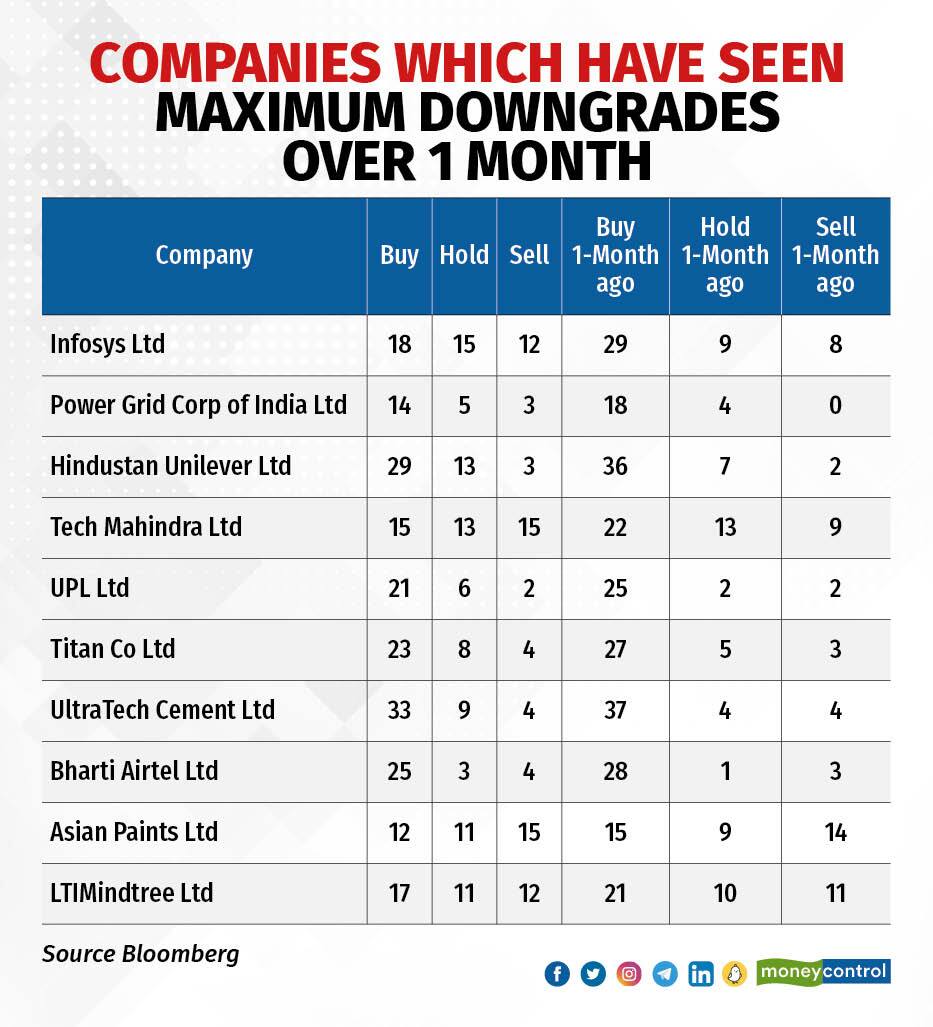

According to the data from Moneycontrol’s July analyst call tracker, several companies have seen significant downgrades by brokerages over the past month.

Representative image.

‘);

$(‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]);

//if(resData[stkKey][‘percentchange’] > 0){

// $(‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”);

// $(‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”);

//}else if(resData[stkKey][‘percentchange’] < 0){

// $(‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”);

// $(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

//}

if(resData[stkKey][‘percentchange’] >= 0){

$(‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”);

//$(‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”);

$(‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”);

}else if(resData[stkKey][‘percentchange’] < 0){

$(‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”);

//$(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

$(‘#gainlosstxt_’+articleId).find(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

}

$(‘#volumetxt_’+articleId).show();

$(‘#vlmtxt_’+articleId).show();

$(‘#stkvol_’+articleId).text(resData[stkKey][‘volume’]);

$(‘#td-low_’+articleId).text(resData[stkKey][‘daylow’]);

$(‘#td-high_’+articleId).text(resData[stkKey][‘dayhigh’]);

$(‘#rightcol_’+articleId).show();

}else{

$(‘#volumetxt_’+articleId).hide();

$(‘#vlmtxt_’+articleId).hide();

$(‘#stkvol_’+articleId).text(”);

$(‘#td-low_’+articleId).text(”);

$(‘#td-high_’+articleId).text(”);

$(‘#rightcol_’+articleId).hide();

}

$(‘#stk-graph_’+articleId).attr(‘src’,’//appfeeds.moneycontrol.com/jsonapi/stocks/graph&format=json&watch_app=true&range=1d&type=area&ex=’+stockType+’&sc_id=’+stockId+’&width=157&height=100&source=web’);

}

}

}

});

}

$(‘.bseliveselectbox’).click(function(){

$(‘.bselivelist’).show();

});

function bindClicksForDropdown(articleId){

$(‘ul#stockwidgettabs_’+articleId+’ li’).click(function(){

stkId = jQuery.trim($(this).find(‘a’).attr(‘stkid’));

$(‘ul#stockwidgettabs_’+articleId+’ li’).find(‘a’).removeClass(‘active’);

$(this).find(‘a’).addClass(‘active’);

stockWidget(‘N’,stkId,articleId);

});

$(‘#stk-b-‘+articleId).click(function(){

stkId = jQuery.trim($(this).attr(‘stkId’));

stockWidget(‘B’,stkId,articleId);

$(‘.bselivelist’).hide();

});

$(‘#stk-n-‘+articleId).click(function(){

stkId = jQuery.trim($(this).attr(‘stkId’));

stockWidget(‘N’,stkId,articleId);

$(‘.bselivelist’).hide();

});

}

$(“.bselivelist”).focusout(function(){

$(“.bselivelist”).hide(); //hide the results

});

function bindMenuClicks(articleId){

$(‘#watchlist-‘+articleId).click(function(){

var stkId = $(this).attr(‘stkId’);

overlayPopupWatchlist(0,2,1,stkId);

});

$(‘#portfolio-‘+articleId).click(function(){

var dispId = $(this).attr(‘dispId’);

pcSavePort(0,1,dispId);

});

}

$(‘.mc-modal-close’).on(‘click’,function(){

$(‘.mc-modal-wrap’).css(‘display’,’none’);

$(‘.mc-modal’).removeClass(‘success’);

$(‘.mc-modal’).removeClass(‘error’);

});

function overlayPopupWatchlist(e, t, n,stkId) {

$(‘.srch_bx’).css(‘z-index’,’999′);

typparam1 = n;

if(readCookie(‘nnmc’))

{

var lastRsrs =new Array();

lastRsrs[e]= stkId;

if(lastRsrs.length > 0)

{

var resStr=”;

let secglbVar = 1;

var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’;

$.get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) {

$(‘#backInner1_rhsPop’).html(data);

$.ajax({url:url,

type:”POST”,

dataType:”json”,

data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs},

success:function(d)

{

if(typparam1==’1′) // rhs

{

var appndStr=”;

//var newappndStr = makeMiddleRDivNew(d);

//appndStr = newappndStr[0];

var titStr=”;var editw=”;

var typevar=”;

var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’);

var phead =’Why add to Portfolio?’;

if(secglbVar ==1)

{

var stkdtxt=’this stock’;

var fltxt=’ it ‘;

typevar =’Stock ‘;

if(lastRsrs.length>1){

stkdtxt=’these stocks’;

typevar =’Stocks ‘;fltxt=’ them ‘;

}

}

//var popretStr =lvPOPRHS(phead,pparr);

//$(‘#poprhsAdd’).html(popretStr);

//$(‘.btmbgnwr’).show();

var tickTxt =’‘;

if(typparam1==1)

{

var modalContent = ‘Watchlist has been updated successfully.’;

var modalStatus = ‘success’; //if error, use ‘error’

$(‘.mc-modal-content’).text(modalContent);

$(‘.mc-modal-wrap’).css(‘display’,’flex’);

$(‘.mc-modal’).addClass(modalStatus);

//var existsFlag=$.inArray(‘added’,newappndStr[1]);

//$(‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’);

//if(existsFlag == -1)

//{

// if(lastRsrs.length > 1)

// $(‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’);

// else

// $(‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’);

//

//}

}

//$(‘.accdiv’).html(”);

//$(‘.accdiv’).html(appndStr);

}

},

//complete:function(d){

// if(typparam1==1)

// {

// watchlist_popup(‘open’);

// }

//}

});

});

}

else

{

var disNam =’stock’;

if($(‘#impact_option’).html()==’STOCKS’)

disNam =’stock’;

if($(‘#impact_option’).html()==’MUTUAL FUNDS’)

disNam =’mutual fund’;

if($(‘#impact_option’).html()==’COMMODITIES’)

disNam =’commodity’;

alert(‘Please select at least one ‘+disNam);

}

}

else

{

AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’;

commonPopRHS();

/*work_div = 1;

typparam = t;

typparam1 = n;

check_login_pop(1)*/

}

}

function pcSavePort(param,call_pg,dispId)

{

var adtxt=”;

if(readCookie(‘nnmc’)){

if(call_pg == “2”)

{

pass_sec = 2;

}

else

{

pass_sec = 1;

}

var postfolio_url = ‘https://www.moneycontrol.com/portfolio_new/add_stocks_multi.php?id=’+dispId;

window.open(postfolio_url, ‘_blank’);

} else

{

AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’;

commonPopRHS();

/*work_div = 1;

typparam = t;

typparam1 = n;

check_login_pop(1)*/

}

}

function commonPopRHS(e) {

/*var t = ($(window).height() – $(“#” + e).height()) / 2 + $(window).scrollTop();

var n = ($(window).width() – $(“#” + e).width()) / 2 + $(window).scrollLeft();

$(“#” + e).css({

position: “absolute”,

top: t,

left: n

});

$(“#lightbox_cb,#” + e).fadeIn(300);

$(“#lightbox_cb”).remove();

$(“body”).append(”);

$(“#lightbox_cb”).css({

filter: “alpha(opacity=80)”

}).fadeIn()*/

$(“.linkSignUp”).click();

}

function overlay(n)

{

document.getElementById(‘back’).style.width = document.body.clientWidth + “px”;

document.getElementById(‘back’).style.height = document.body.clientHeight +”px”;

document.getElementById(‘back’).style.display = ‘block’;

jQuery.fn.center = function () {

this.css(“position”,”absolute”);

var topPos = ($(window).height() – this.height() ) / 2;

this.css(“top”, -topPos).show().animate({‘top’:topPos},300);

this.css(“left”, ( $(window).width() – this.width() ) / 2);

return this;

}

setTimeout(function(){$(‘#backInner’+n).center()},100);

}

function closeoverlay(n){

document.getElementById(‘back’).style.display = ‘none’;

document.getElementById(‘backInner’+n).style.display = ‘none’;

}

stk_str=”;

stk.forEach(function (stkData,index){

if(index==0){

stk_str+=stkData.stockId.trim();

}else{

stk_str+=’,’+stkData.stockId.trim();

}

});

$.get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?classic=true&sc_id=’+stk_str, function(data) {

stk.forEach(function (stkData,index){

$(‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]);

});

});

function redirectToTradeOpenDematAccountOnline(){

if (stock_isinid && stock_tradeType) {

window.open(`https://www.moneycontrol.com/open-demat-account-online?classic=true&script_id=${stock_isinid}&ex=${stock_tradeType}&site=web&asset_class=stock&utm_source=moneycontrol&utm_medium=articlepage&utm_campaign=tradenow&utm_content=webbutton`, ‘_blank’);

}

}

On the face of it, first quarter earnings have given the street more cause for cheer than for lament, but a closer reading shows a different picture.

According to the data from Moneycontrol’s July analyst call tracker, several companies have seen significant downgrades by brokerages over the past month following the release of their first-quarter earnings.

Infosys has secured the top position with 18 buy calls, 15 holds, and 12 sells, reflecting a shift from the previous month’s figures of 29 buy calls, 9 holds, and 8 sells. Following suit, Power Grid Corp Of India and Hindustan Unilever Ltd received ratings of 14 buy, 5 hold, and 3 sells, and 29 buy, 13 hold, and 3 sells, respectively. A month ago, these two companies had 18 buy, 4 holds, and zero sells, and 36 buys, 7 holds, and 2 sells, respectively. All these three stocks have fallen over 5-6 percent each in the last one month.

According to analysts, Infosys is projected to face continued stock pressure for the next two quarters. The company has revised its revenue guidance twice in a span of three months due to weakened demand. The recent wave of high-level managerial resignations has further complicated the situation. In a soft-demand environment, Infosys might be losing market share, as indicated by its subdued growth guidance for 2023-24. The series of senior-level departures in recent quarters raises concerns about the company’s stability and its effectiveness in managing key verticals, contributing to the stock’s ongoing underperformance, according to a recent Jefferies report.

Power Grid has recently disclosed its financial results for the quarter ending June 2023, indicating a modest 1 percent uptick in revenue. This growth was hindered by factors such as the adverse influence of tariff differentials, sluggish expansion in asset capitalisation, and a significant 46 percent YoY decline in revenue from the consultancy segment. Nonetheless, the consolidated EBITDA (earnings before interest, tax, depreciation, and amortization) demonstrated enhancement due to improved efficiencies. On a consolidated basis, there was a slight 5 percent decline in net profit compared to the previous year, primarily attributed to a notable decrease in the profit of the consultancy segment and a nearly 20 percent reduction in other income.

HUL’s earnings for the June quarter were weaker than expected. Although there has been some improvement in gross margin buildup compared to analysts’ expectations, the acceleration in volume is taking longer than anticipated due to the gradual normalisation of consumer habits, JM Financial said in its recent note. The management foresees this adjustment lasting for a span of two to three quarters. Despite the company’s optimism regarding rural demand recovery, increased weather-related risks have become more prominent. Notably, heightened competitive pressures have emerged, fuelled by the assertiveness of smaller players in specific categories and an elevated intensity in media competition, the JM Financial report added.

“In FY24E, the projected outlook entails single-digit sales growth centered on volume expansion. Although the company targets substantial gross margin enhancement, this progress could be counterbalanced by the need to raise Advertising & Promotion (A&P) spending, which has declined by over 350 basis points over the last three years. While the potential for a double-digit return from the stock is recognized for the upcoming year, the valuation multiples might be constrained due to the tougher operational landscape,” according to the JM Financial report.

UPL Ltd, Tinan Co Ltd, and Ultratech Cement Ltd saw huge downgrades as well. As per Moneycontrol’s analyst call tracker, UPL received 21 buy calls, 6 holds, and 2 sell calls, compared to the previous 25 buy calls and 2 each of hold and sell calls a month ago. Titan garnered 23 buy calls, 8 holds, and 4 sells, whereas it had previously secured 27 buy calls, 5 holds, and 3 sell ratings. Similarly, Ultratech Cement received 33 buy calls, 9 holds, and 4 sells, versus the earlier 37 buy calls and 4 each of hold and sell calls.

In the June quarter, UPL Ltd encountered substantial setbacks in both its profits and revenue, mainly due to a nearly double-digit decrease in sales volume. The company responded to aggressive pricing from Chinese sellers by implementing significant price reductions in international markets, according to a Motilal Oswal report. Amid the industry’s slowdown, UPL expressed its intent to prioritise profitability and cash conservation. It also anticipates a reduction in working capital days in the future. Confronting formidable global challenges during April-June, UPL has revised its revenue and operating profit guidance for the fiscal year 2023-24 (April-March). The adjustment is notable, with projected revenue growth now ranging from 1 percent to 5 percent, compared to the earlier estimate of 6 percent-10 percent. Furthermore, EBITDA is forecasted to increase by 3 percent to 7 percent, in contrast to the previously expected rise of 8 percent-12 percent.

Ultratech Cement’s earnings slightly missed estimates. As per a UBS report, there are concerns among industry observers about an anticipated demand slowdown post the upcoming general elections in May 2024. This is compounded by a swift surge in new capacity that could surpass medium-term demand. The industry is expected to witness around 110 million metric tons per annum (mtpa) of new capacity entering the market within the next 2.5 years, in contrast to an incremental demand of 70mtpa. UBS forecasts that cement players might adopt aggressive pricing strategies to safeguard their market share, especially with the intensifying competition due to Adani group’s entry into the sector.