F&O Manual | Sensex and Nifty slip, consolidation phase persists

Among individual stocks, Alkem, Apollo Tyres, Concor and Sun TV saw bearish set up while IRCTC, BEL and HCL Tech saw a long build-up.

The indian equity markets started the session on a flat note and gradually drifted downward on August 11. Selling was seen in the bank, FMCG, healthcare, and metals, while power, realty, and capital goods witnessed buying.

At 11 am, the Sensex was down 316.42 points or 0.48 percent at 65,371.76, and the Nifty was down 97.60 points or 0.50 percent at 19,445.50. About 1,503 shares advanced, 1,455 shares declined, and 114 shares remained unchanged.

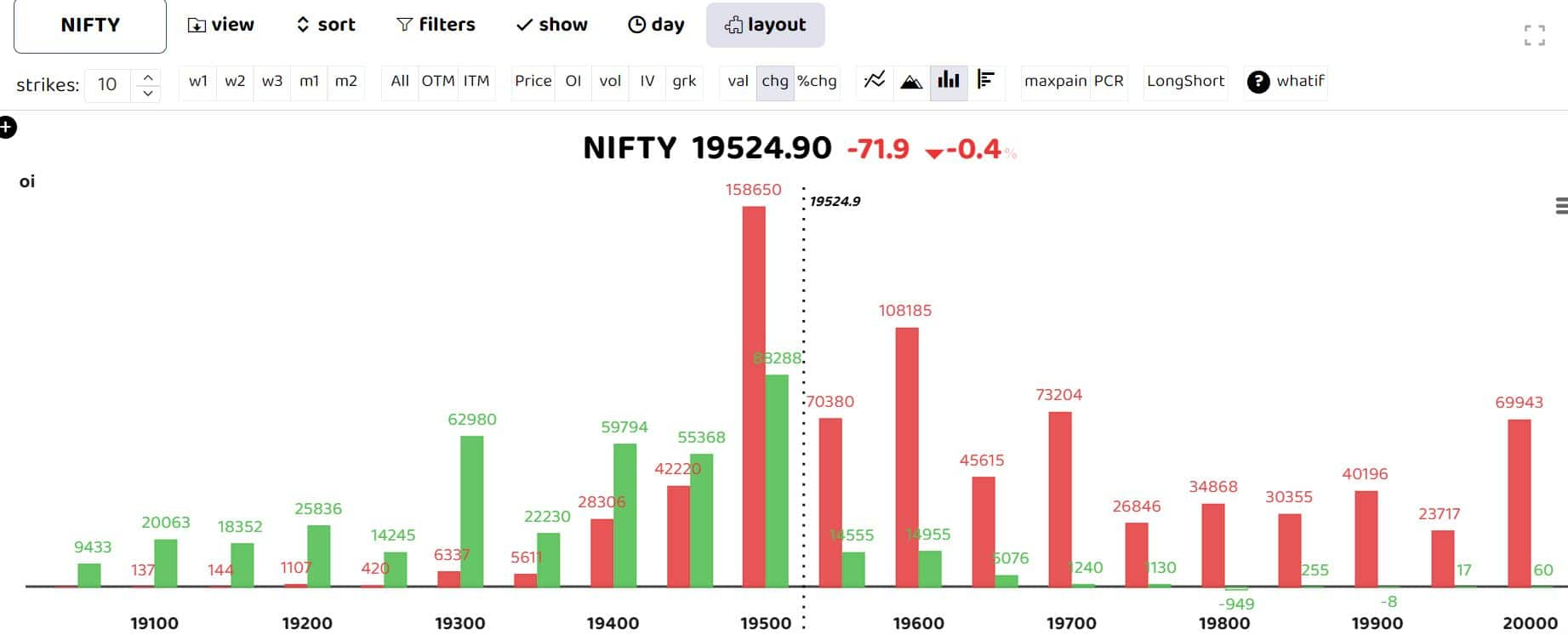

Technically, the index continues to hover near the 20-day SMA with no significant change in the chart structure, portraying a lack of conviction by both counterparties. Structurally the setup remains unchanged, suggesting further consolidation in the index and a continuation of the time-wise corrective phase. On the levels front, the bearish gap of 19,600-19,705 withheld the sturdy hurdle and on the lower end, 19,440-19,200 held the pivotal support for Nifty in the comparable period.

As per ICICI Securities, “The index is undergoing slower pace of retracement as over the past three weeks Nifty retraced less than 50 percent of the preceding four week’s rally (18646-19991). The lack of faster retracement on either side signifies prolongation of ongoing consolidation in the broader range of 19,900-19,200 that would make market healthy. In a secular bull market, secondary correction in a common phenomenon. Thus, buying dips would be rewarding at current juncture as we believe key support is placed at 19,300.”

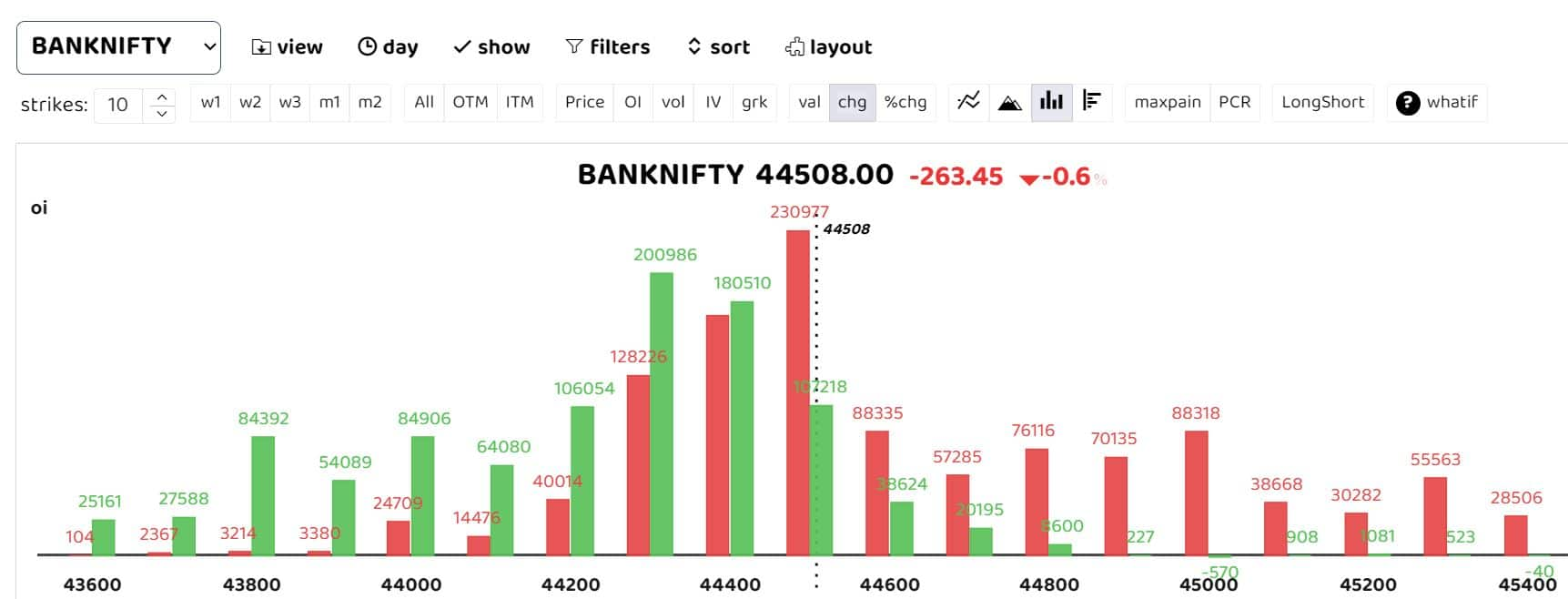

As per Ashwin Ramani, Derivatives & Technical Analyst, SAMCO Securities, “Bank Nifty came under intense selling pressure after the RBI introduced incremental cash reserve ratio (ICRR) of 10 percent on a temporary basis to drain excess liquidity from the banking system, which will leave the banks with lesser funds to lend.” The downside support for Bank Nifty is placed at 44,200. A break below 44,200 could take Bank Nifty until 43,500 levels. For the uptrend to resume, Bank Nifty needs to give a strong close above 45,100 levels.

Among individual stocks, Alkem, Apollo Tyres, Concor, and Sun TV saw a bearish set up while IRCTC, BEL, and HCL Tech saw a long build-up.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.