More than 50 smallcaps give double digit return despite market fall

19400 would act as a key resistance level for the bulls and above the same, the index could rise till 19450-19500, says Amol Athawale, Vice President – Technical Research, Kotak Securities.

In the truncated week, Indian benchmark indices extended the fall in the fourth consecutive week as poor monsoon, rupee depreciation and elevated Indian inflation figures dampened the investors sentiment. However, on global front, spiking US bond, rising dollar, fears of a Fed rate hike and slowing demand in China weighed on investors.

In this week, BSE Sensex shed 0.57 percent or 373.99 points to end at 64,948.66, and Nifty50 fell 0.60 percent or 118.1 points to close at 19,310.20.

Among broader indices, BSE Small-cap index ended on a flat note, while BSE Large-cap Index fell 0.7 percent and Mid-cap Index shed 0.5 percent.

“Sensex and Nifty declined this week following the weakness in most global equity markets. BSE Mid-cap and BSE Small-cap indices saw some correction. Sectorally, most of the indices posted negative returns. Amongst them, the sectoral indices that underperformed the broader markets includes BSE Metals, BSE Energy and BSE Oil & Gas,” said Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities.

“Weak monsoon conditions has prevailed over most parts of India resulting into deficient monsoon in August. India’s CPI inflation in July 2023 surged to 7.4% (from 4.8% in June 2023), led by high vegetable prices. Brent crude oil price corrected this week, but remains above the price range witnessed a few months back. Q1FY24 results showed weakness in consumption demand; however, investment demand continues to be strong. Further, Q1FY24 results also showed further improvement in profitability,” he added.

On the sectoral front, BSE Metal index shed 4 percent, BSE Telecom index fell 2 percent, BSE Oil & Gas index fell 1.2 percent, while BSE Power index added 0.5 percent.

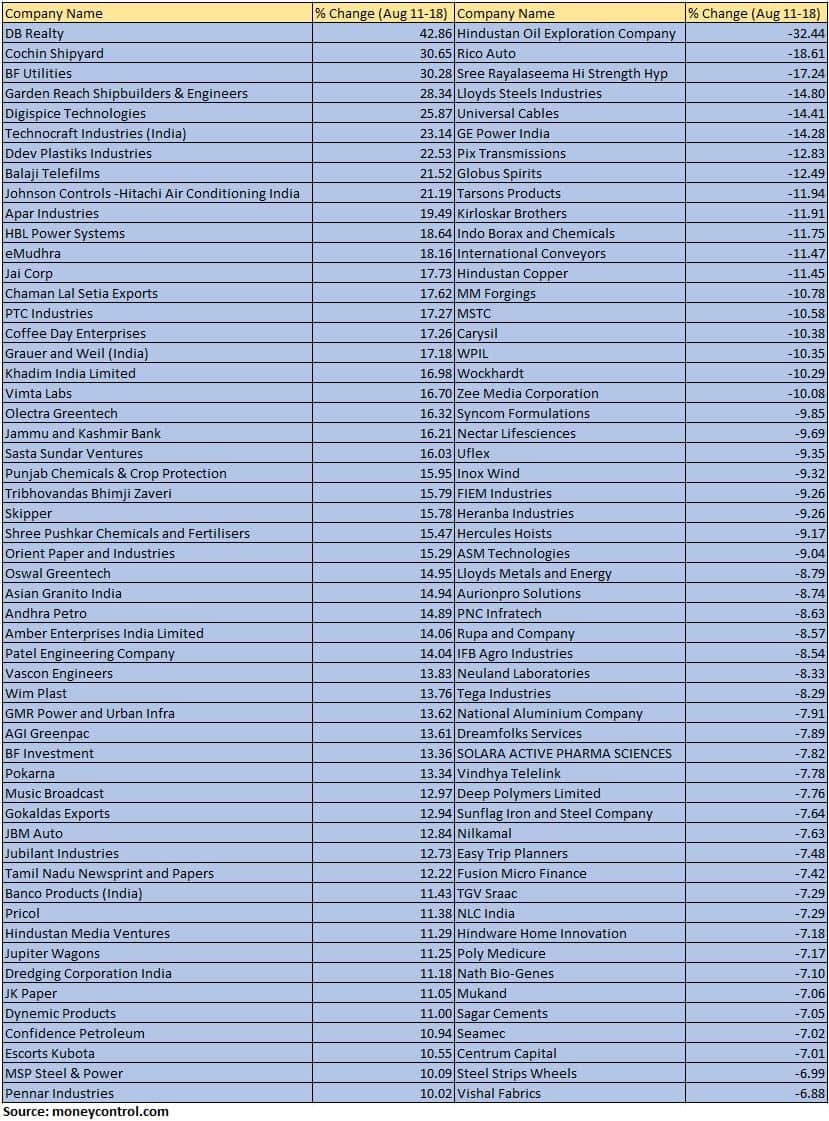

The BSE Small-cap index ended on a flat note. Hindustan Oil Exploration Company, Rico Auto, Sree Rayalaseema Hi Strength, Lloyds Steels Industries, Universal Cables, GE Power India, Pix Transmissions and Globus Spirits lost 12-32 percent.

However, DB Realty, Cochin Shipyard, BF Utilities, Garden Reach Shipbuilders & Engineers, Digispice Technologies, Technocraft Industries (India), Ddev Plastiks Industries, Balaji Telefilms, Johnson Controls -Hitachi Air Conditioning India added 21-42 percent.

“Indian indices encountered a week of vulnerability due to adverse global and domestic cues, accompanied by a shift towards safer assets by investors like the USD. Discouraging domestic industrial production, negative wholesale inflation, and elevated CPI inflation contributed to market volatility. Additional strains emerged from stronger-than-expected US retail sales data; adding to Fed rate hike fears, concerns about US bank rating downgrades, and a sudden Chinese central bank rate cut hindered recovery and sustained selling pressure,” said Vinod Nair, Head of Research at Geojit Financial Services.

“Escalating US bond yields are predicted to restrict foreign investments in India, further impacting market dynamics. With moderate core inflation & transitory July retail CPI data, the market did not foresee a rate hike. The metal sector bore the brunt this week due to sluggish industrial data and concerns about Chinese demand. Investor sentiment remains subdued due to the high volatility of the global currency market, leading to a high depreciation of EM currencies, which affects the performance of equities,” he added.

Foreign institutional investors (FIIs) remained seller in the fourth consecutive week as they offloaded equities worth Rs 3,379.31 crore, while domestic institutional investors (DIIs) compensate as they bought equities worth Rs 3892.3 crore in this week. In this month so far, FII sold equities worth Rs 10,925.84 crore and DII bought equities worth Rs 9,245.86 crore.

Where is Nifty50 headed?

Amol Athawale, Vice President – Technical Research, Kotak Securities:

On daily and intraday charts, the Nifty is holding a lower top formation and on weekly charts it has formed a small bearish candle, which is largely negative. However, on the lower side it is consistently taking support near the 50-day SMA or 19250/64750 (Simple Moving Average). A fresh sell off could be seen only after the dismissal of the 50 day SMA or 19250 level, below which the index could slip till 19200-19100.

On the flip side, 19400 would act as a key resistance level for the bulls and above the same, the index could rise till 19450-19500. In the case of Bank Nifty, weak sentiment is likely to continue till the time the index is trading below 44100. Below which, it could slip till 43500 – 43200. On the flip side, above 44100 it could move up till 44400-44600.

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas:

On the daily charts, we can observe that the Nifty has closed decisively below the 40-day moving average (19358) which is a sign of weakness. Because of the fall in the last couple of trading sessions, the Nifty has also closed in the negative for the fourth consecutive week and the weekly momentum indicator has also triggered a negative crossover which indicates that weakness is setting in on a higher time frame. The lower top lower-bottom formation is still intact and hence the downtrend is intact. On the downside we expect the Nifty to target levels of 19100.

Bank Nifty has continued with its losing streak and closed in the negative for the seventh consecutive trading session. It has reached the 20-week moving average (43800) and hence the fall may not be severe from current levels. The trend is still negative however, oversold and we can observe divergence on the hourly charts however it needs to be confirmed by the price. Until the Bank Nifty trades below 44000, we can expect the weakness to continue. On the downside, it can slip towards 43500.

Siddhartha Khemka, Head – Retail Research, Motilal Oswal Financial Services:

Markets have been consolidating in the absence of any positive trigger and consistent selling by FIIs. With Fed Chair Powell’s speech and more macro data lined up globally next week, we expect domestic as well as global markets to remain under pressure. Also, RBI would release its meeting minutes on Thursday. However, action is likely to continue in the broader market along with sectorial rotation. Index heavyweight Reliance would be in focus as Jio financial services is set to be listed on Monday.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.