F&O Manual| Nifty slips below 19,300 mark as sectoral pressure persists

Among individual stocks, Idea, Escorts and SunTV saw a bullish setup, while Ambuja Cement, Syngene, DLF and Rec Ltd saw a short buildup.

Indices commenced the trading session on a subdued note with the Nifty maintaining a hovering stance around the 19,300 level. As the trading session unfolded, the indices exhibited a gradual decline, edging further below this level. All the sectoral indices are trading in the red with realty, capital goods and PSU Bank down 1 percent each.

At 12 pm, the Sensex was down 227.81 points or 0.35 percent at 65,024.53, and the Nifty was down 73.70 points or 0.38 percent at 19,313. About 1236 shares advanced, 1794 shares declined, and 102 shares unchanged.

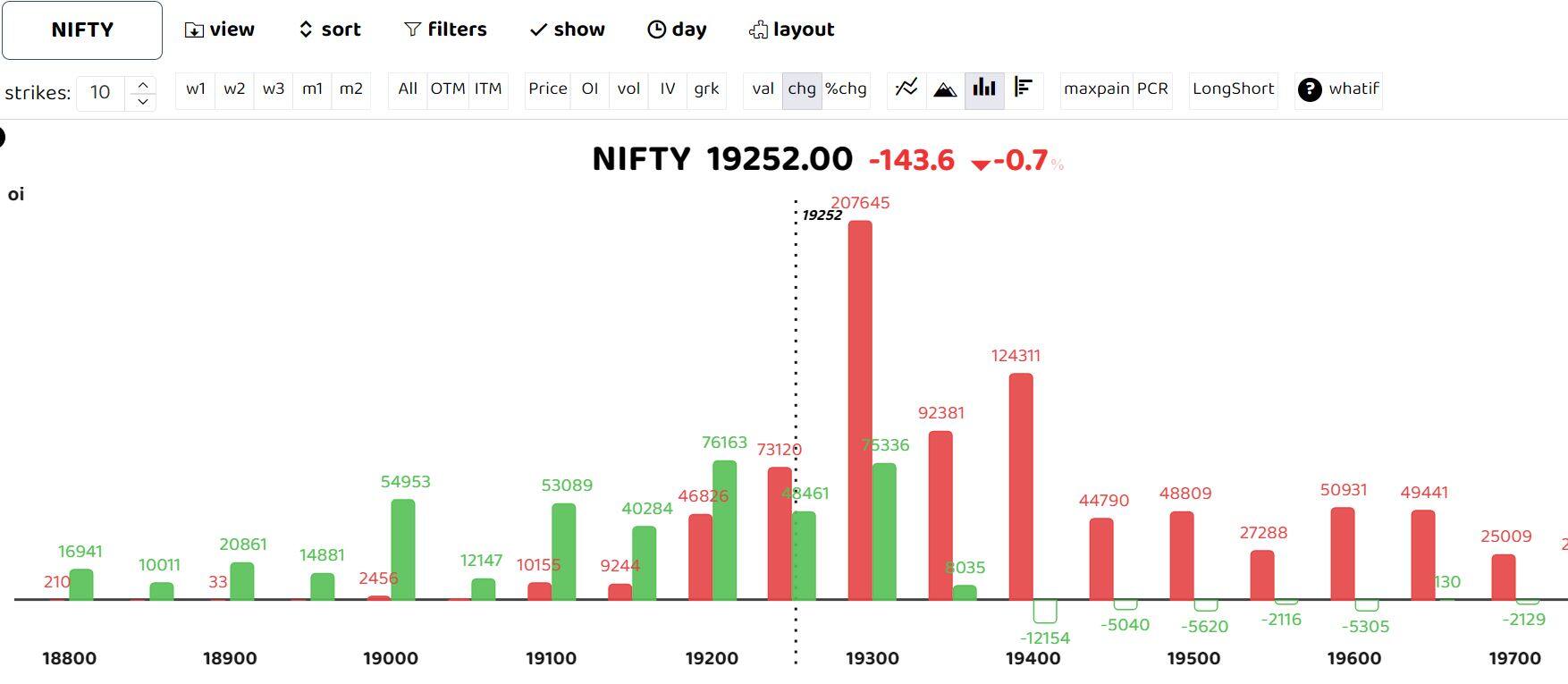

Bars reflect changes in open interest (OI) during the day. The red bars show call option OI and the green put option OI.

As per options data call writers are dominant for the day with calls written over twice of put written at 19300 levels. Key resistance for the day can be seen at 19400 strike followed by 19500 and 19600.

According to ICICI Securities, if Nifty sustains below 19300 levels than the current profit booking might extend towards 19150.

As per Angel One, “On the levels front, 19300 is expected to cushion any further blip, while the sheet anchor lies around the 19250-19200 zone. On the flip side, 19500 remains a daunting task and a decisive breakthrough could only re-strengthen the undertone”

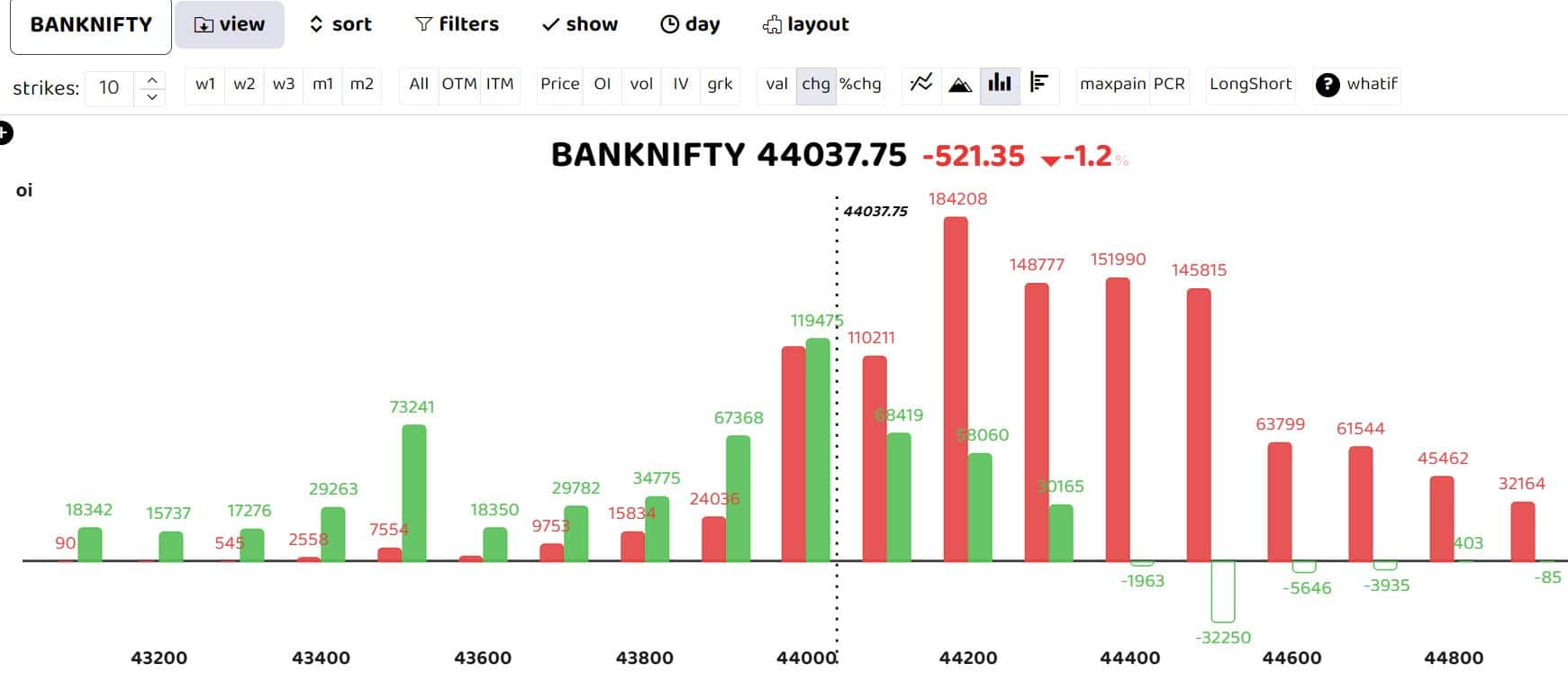

Bank Nifty

The Bank Nifty tested 45000 levels, however selling pressure in HDFC bank capped upside in yesterday’s trading session. For the day, options data shows heavy call writing with analysts expecting Bank Nifty to consolidate around current levels, as both 44000 Call and Put strike holds noteworthy OI.

As per Rajesh Bhosale, Technical Analyst at Angel One Ltd, if weakness persists, the market may continue to experience the recent range-bound behavior.

“Considering the RSI smoothened buy signal within the oversold zone, a strategic approach would involve considering long positions during price dips. In this scenario, the support levels at 44200, followed by the 89EMA around 44000, are expected to hold firm. On the contrary, the resistance at 45000 has proven to be a significant hurdle throughout the month of August, and any substantial momentum movement will only occur when prices achieve a sustained breakout above this level”, added Bhosale.

Further he suggests that stock-specific actions within this sector are displaying strength, and it would be wise to focus on such trades for potential outperformance.

Follow our live blog for all market action

Among individual stocks, Idea, Escorts and SunTV saw a bullish setup, while Ambuja Cement, Syngene, DLF and Rec Ltd saw a short buildup.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.