F&O Manual | Nifty hints at sideways-to-positive momentum, critical support at 19,250

Among individual stocks, BHEL, GNFC and BHEL saw a bullish setup, while COLPAL, Dabar, Adani Ports and Naukri saw a short buildup.

Indian markets opened higher, tracking supportive global cues. Among sectors, except for FMCG, information technology, all other indices were trading in the green by the noon on August 28.

At 12pm, the Sensex was up 149.47 points or 0.23 percent at 65,035.98, and the Nifty was up 47.70 points or 0.25 percent at 19,313.50. About 1,895 shares advanced, 1,254 shares declined, and 144 shares unchanged.

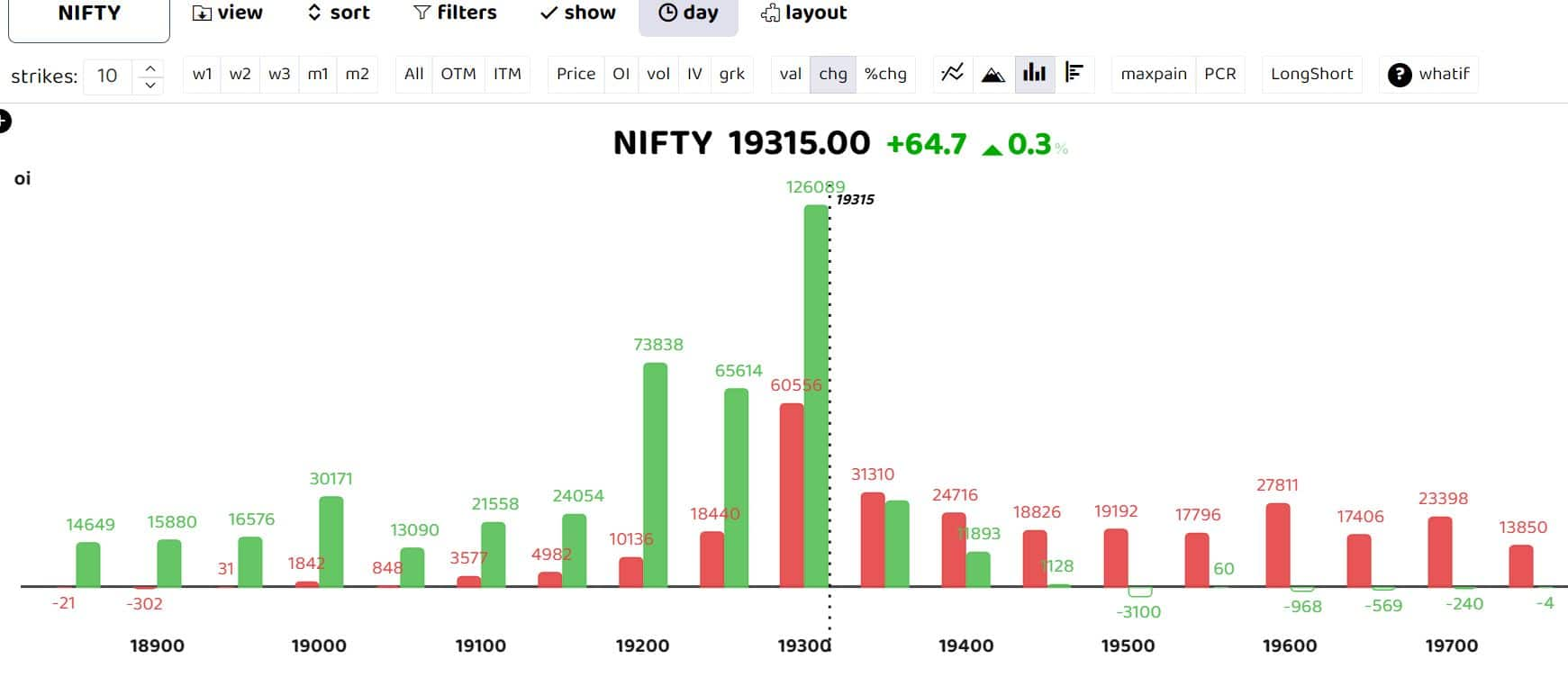

Bars reflect changes in open interest (OI) during the day. The red bars show call option OI and the green put option OI.

The options data suggests a sideways-to-positive momentum. Put options written were almost twice the open interest level of call options at the 19,300 strike. Analysts believe that a decisive breach below the 19,250-19,270 zone would weaken the overall bias and could trigger a further slide, with the next major support zone visible near 18,800-18,900 level and 19,000 points serving as the psychological landmark in between. Support for the day is seen at 19,200 levels, while resistance is likely at 19,450.

“We remain optimistic about the market and expect dips to benefit the bulls. Additionally, the Nifty Midcap and Small-cap indices continue to attract the attention of traders due to their robust setup. Therefore, we recommend focusing on thematic movers to assess momentum and outperformance,” brokerage firm Angel One said. “It’s important to closely monitor global and domestic developments, as they might act as catalysts influencing the immediate trend.”

Follow our live blog for all market action

Among individual stocks, BHEL, GNFC and BHEL saw a bullish setup, while COLPAL, Dabar, Adani Ports and Naukri saw a short build-up.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.