F&O Manual | Nifty trades positive, crucial support at 19,250

Among individual stocks, Idea, BHEL and ONGC saw a bullish setup, while TorrentPharma, LaurusLabs and Siemens saw a short build-up.

Indian shares shrugged off a slow start amid mixed global cues to trade higher in the afternoon session on September 1, with the metal index up 3 percent, auto 0.5 percent and the oil & gas index up 0.8 percent from the previous day.

At 12.20 pm, the Sensex was trading 176.71 points, or 0.27 percent, higher at 65,008.12, while the Nifty gained 73.20 points, or 0.38 percent, at 19,327.00. About 1,842 shares advanced, 1,179 declined and 127 shares remained unchanged.

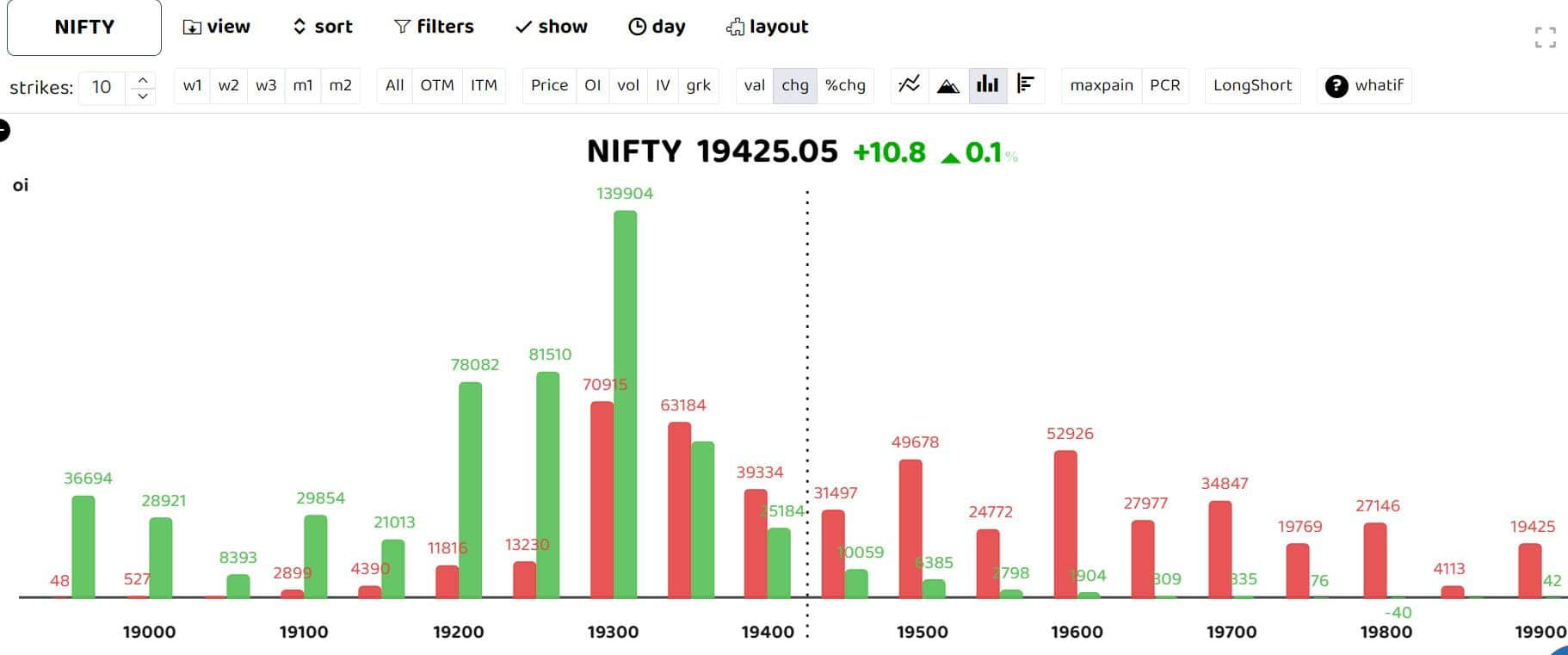

The bars reflect changes in open interest (OI) during the day. The red show call option OI and the green put option OI

The options data suggests that crucial support for Nifty is at 19,250, which was seeing with heavy put writing.

Analysing the daily chart, prices throughout August exhibited a corrective phase characterised by time-wise consolidation within a very narrow range.

“This consolidation is depicted on the hourly chart as a ‘Falling Channel’ pattern, with prices now ending slightly above the lower boundary of this pattern,” Sameet Chavan, Head of Research, Technical and Derivatives at Angel One, said.

“An intriguing observation is the presence of a ‘Three Point Positive Divergence’ in the RSI Smoothened oscillator on the hourly chart, potentially signalling a bullish turnaround.”

So, the support level of 19,170–19,200 will remain crucial. A breach can lead to further weakness and the Nifty can fall to 19,050–19,000 in the near term.

Conversely, if the index manages to hold above the support level, it can re-test of the upper boundary of the channel pattern at around 19,500. But before that, 19,380–19,400 will be the immediate resistance. A broad-based rally will only be possible once 19,500 is broken with authority.

Rupak De, Senior Technical Analyst, LKP Securities, said, “The overall sentiment remains pessimistic, with the likelihood of any upward rallies being met with selling activity.”

On the downside, the initial support is at 19,200. If the index falls below 19,200, it can slide to 19,000 mark. The “sell-on- rise” strategy is expected to favour the traders until the Nifty convincingly surpasses the 19,500 level, he said.

Follow our live blog for all market action

Among individual stocks, Idea, BHEL and ONGC saw a bullish setup, while Torrent Pharma, Laurus Labs and Siemens saw a short buildup.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.