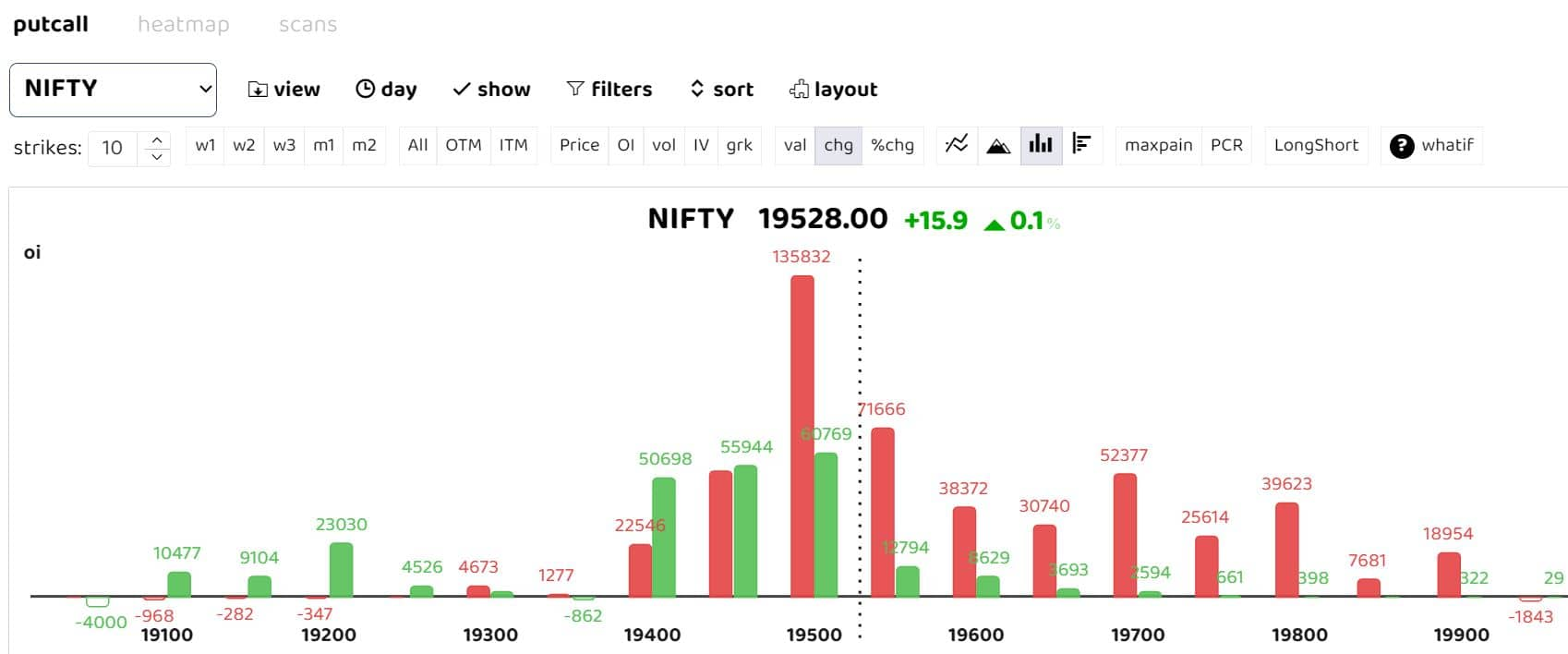

F&O Manual | Market sees tepid trading, Nifty stays flat with resistance at 19,550

Among individual stocks, NationAlum, NMDC and SAIL saw a bullish setup, while Escorts, IndusTower and BergerPaint saw a bearish build-up.

Indian indices opened higher on September 4, tracking neutral global cues. As the day progressed, the indices failed to hold on to the gains and stayed flat amid volatile trading. All sectoral indices traded in the green with the metal index up nearly 3 percent and the realty index up 1 percent.

Options data suggests that call writers were dominant, with heavy call writing at 19,450, 19,550 and 19,700 strikes. Analysts said that despite a positive initial start, the prices struggled to maintain the upward trajectory and are expected to return within the recent trading range and continue with the choppy phase.

After experiencing five consecutive weekly losses, the Nifty index ended the last week in the green. It has formed a morning star pattern on the daily chart with a higher close, which is considered to be a bullish reversal signal.

“The maximum call open interest is placed at 19,500 strike. Short-covering at 19,500 strike in the coming days is likely to push the index even higher,” Samco Securities said.

Bars reflect changes in open interest (OI) during the day. The red bars show call option OI and the green put option OI

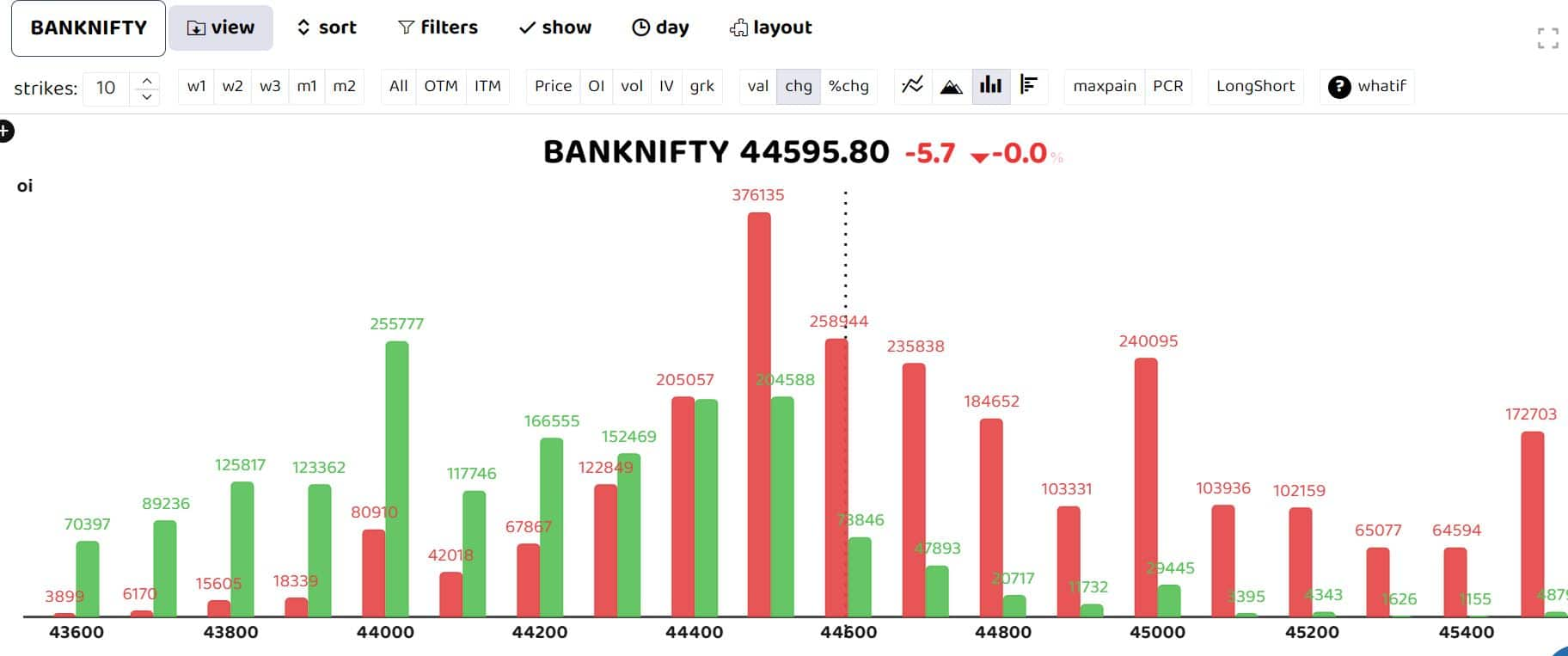

Bars reflect changes in open interest (OI) during the day. The red bars show call option OI and the green put option OI

The Bank Nifty sees lacklustre momentum trading within a range to negative. The index rebounded from the 100-day Exponential Moving Average (EMA) of 43,930 for the second consecutive day and closed at 44,436, up 447 points. As per analysts, the level of 44,000 on the downside will act as a strong support for Bank Nifty. A close above Friday’s high of 44,569 will result in the resumption of an uptrend.

Follow our live blog for all market action

Among individual stocks, NationAlum, NMDC and SAIL saw a bullish setup, while Escorts, IndusTower and BergerPaint saw a bearish build-up.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.