Tata MF, Plutus Wealth, others pick shares worth Rs 1,349 crore in Restaurant Brand Asia

Big block deals were seen in Restaurant Brand Asia.

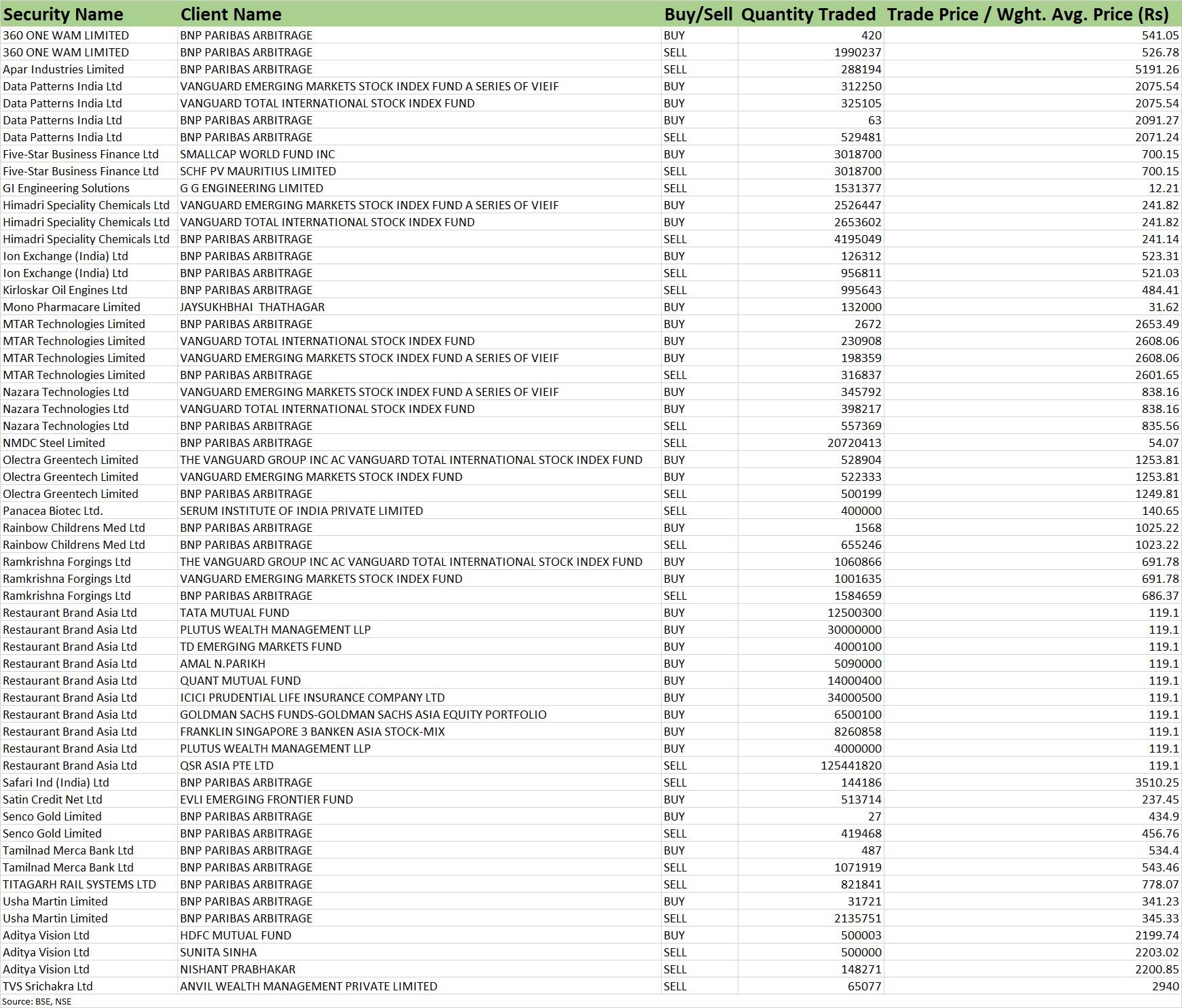

Restaurant Brands Asia, erstwhile Burger King India, saw a lot of action on September 15 as eight investors picked nearly 24 percent equity stake in the company after the promoter QSR Asia offloaded more than 25 percent shareholding via open market transactions.

The stock price climbed 6.7 percent to close at Rs 128.35 on the NSE.

Tata Mutual Fund, Plutus Wealth Management LLP, TD Emerging Markets Fund, Amal N Parikh, Quant Mutual Fund, ICICI Prudential Life Insurance Company, Goldman Sachs Funds-Goldman Sachs Asia Equity Portfolio, and Franklin Singapore 3 Banken Asia Stock-Mix have cumulatively bought 23.92 percent stake or 11.83 crore equity shares in the quick-service restaurant chain, as per bulk deals data available with the exchanges.

They bought shares of Restaurant Brands Asia at a price of Rs 119.1 per share, amounting to Rs 1,349 crore.

However, promoter entity QSR Asia Pte Ltd was the seller in the deal, offloading 12.54 crore shares, equivalent to 25.36 percent of paid-up equity, at the same average price. As of June 2023, it held 40.8 percent shares in the company.

Five-Star Business Finance was also in focus, falling 1.8 percent to Rs 687.55. Foreign company SCHF PV Mauritius sold 30.19 lakh shares or 1.03 percent stake in the non-banking finance company at an average price of Rs 700.15 per share, amounting to Rs 211.35 crore. It held 1.2 percent shares in the company as of June 2023.

However, foreign portfolio investor Smallcap World Fund Inc was the buyer for entire Five-Star shares in this deal, in addition to its current holding of 1.64 percent or 47.78 lakh shares as of June 2023.

Meanwhile, US-registered global investment adviser Vanguard Group has picked a stake in six stocks namely Data Patterns India, Himadri Speciality Chemicals, MTAR Technologies, Nazara Technologies, Olectra Greentech, and Ramkrishna Forgings on Friday, investing a total of Rs 706.34 crore in these stocks.

Vanguard Emerging Markets Stock Index Fund A Series of VIEIF has bought 3.12 lakh shares and Vanguard Total International Stock Index Fund 3.25 lakh shares in Data Patterns India, the defence and aerospace electronics solutions provider, at an average price of Rs 2,075.54 per share, while both these funds purchased 4.29 lakh shares in precision engineering company MTAR Technologies at an average price of Rs 2,608.06 per share.

However, Data Patterns corrected 1.23 percent to Rs 2,072.75, and MTAR fell 2.58 percent to Rs 2,602.45 on Friday.

Further, Vanguard Emerging Markets Stock Index Fund A Series of VIEIF and Vanguard Total International Stock Index Fund bought 51.8 lakh shares in chemicals company Himadri Speciality Chemicals at an average price of Rs 241.82 per share.

Both these funds also picked 7.44 lakh shares in Nazara Technologies, the gaming & sports media platform, at an average price of Rs 838.16 per share, and 10.51 lakh shares in composite polymer insulators and electrical buses maker Olectra Greentech at Rs 1,253.81 per share. More than 20.62 lakh shares of Ramkrishna Forgings were also bought by these funds, at an average price of Rs 691.78 per share.

Himadri Speciality Chemicals shares declined 0.88 percent to Rs 241.7 and Ramkrishna Forgings slipped 3.4 percent to Rs 689.4, but Nazara Technologies gained 1.01 percent at Rs 836.8 and Olectra Greentech jumped nearly 5 percent to Rs 1,254.55.

However, Paris-based private investment firm BNP Paribas Arbitrage was the seller of nine stocks namely Himadri Speciality Chemicals, Nazara Technologies, Olectra Greentech, Ramkrishna Forgings, Apar Industries, Kirloskar Oil Engines, NMDC Steel, Safari Industries (India), and Titagarh Rail Systems, offloading Rs 743.4 crore worth shares of these companies.

Dr Cyrus Poonawalla’s Serum Institute of India sold 4 lakh shares in pharma company Panacea Biotec at an average price of Rs 140.65 per share, but the stock ended with 4 percent gains at Rs 145.90. Earlier in the current quarter, Serum had sold 5 lakh shares in the company, while its shareholding at the end of June 2023 was 6.97 percent or 42.7 lakh shares.

EVLI Emerging Frontier Fund, an open-ended fund incorporated in Finland has bought 5.14 lakh shares or 0.51 percent stake in microfinance company Satin Creditcare Network at an average price of Rs 237.45 per share. The stock surged 13 percent to Rs 241.2 on the NSE.

Investor GG Engineering has been selling shares in GI Engineering Solutions since mid-August, offloading 15.3 lakh shares on last Friday at an average price of Rs 12.21 per share. With this, since last month, it has sold 1.57 crore shares or 18.31 percent stake in the company against its shareholding of 24.47 percent as of June 2023.

Aditya Vision, wherein ace investor Ashish Kacholia has a 2 percent stake as of June 2023, was also in action, falling 5.7 percent to Rs 2,231.1. Promoters sold 5.39 percent shareholding in the electronic retail chain, with Sunita Sinha offloading 5 lakh shares at an average price of Rs 2,203.02 per share and Nishant Prabhakar 1.48 lakh shares at an average price of Rs 2,200.85 per share. However, HDFC Mutual Fund was the buyer for some of those shares, purchasing 5 lakh shares at an average price of Rs 2,199.74 per share.

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-873053862-a7038639628d4f429d1cbbd25f73bad9.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1456116350-d0e3eae0adb44c35a6ee5bcdb7fb1725.jpg)