These smallcaps gain up to 37% despite 2.5% hit on markets from India-Canada crisis

The BSE MidCap index shed 1.7 percent, SmallCap index 2 percent and LargeCap index fell 2.5 percent.

The Indian benchmarks snapped a three-week gaining momentum and closed weaker in a truncated week ended September 22 amid rising diplomatic tension between India and Canada, concern over the Fed keeping the interest rates higher for a longer period, surging crude prices, and sustained selling by foreign investors.

Inclusion of Indian bonds in JP Morgan’s Government Bond Index has provided some support.

The BSE Sensex fell 2.69 percent or 1,829.48 points to close at 66,009.15 during the week and Nifty50 shed 2.56 percent or 518.1 points to end at 19,674.25. Both the indices added 2 percent each so far in September.

The BSE MidCap index shed 1.7 percent, SmallCap index 2 percent and LargeCap index fell 2.5 percent.

“The equity markets traded lower since the beginning of the week, mostly swayed by developments around the US monetary policy and the US markets. Though the Fed announced a hold on the Fed Funds Rate, the guidance on future rates left a strong probability of hikes, at least one before the end of this year. The thought that there may be further hikes rattled the markets with the US markets losing altitude first, followed by Europe and Asian markets,” said Joseph Thomas, Head of Research, Emkay Wealth Management.

“There is also an element of profit-booking that is at work, though this may be a passing one, as also some selling by FPIs. The factors that have influenced the markets may continue to exert some pressure in the coming week too,” he said.

Among sectors, the Nifty Realty index shed 4.3 percent, Nifty Metal index 3.9 percent, Nifty Bank index 3.5 percent, and the Nifty Pharma index 3.3 percent. The Nifty PSU Bank index, however, added 3.3 percent.

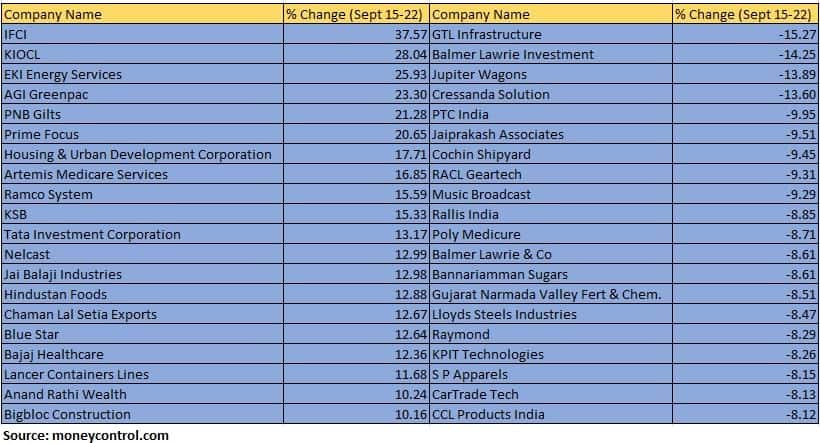

The BSE Small-cap index fell 2 percent, dragged by GTL Infrastructure, Balmer Lawrie Investment, Jupiter Wagons, Cressanda Solution, PTC India, Jaiprakash Associates, Cochin Shipyard, RACL Geartech and Music Broadcast.

IFCI, KIOCL, EKI Energy Services, AGI Greenpac, PNB Gilts and Prime Focus added 20-37 percent.

“Throughout the week, the investor sentiment was plagued by concerns of impending rate hikes driven by inflationary pressure. Rising crude oil prices, attributed to expectations of increased demand in China, coupled with supply cuts, contributed to these inflation concerns. Although the Fed chair opted to maintain the existing interest rates, the suggestion of potential future rate hikes in response to inflationary pressures led to rising US bond yields and a stronger US dollar, prompting investors to seek refuge in safe-haven investments. This cast a shadow over the domestic market and displayed a bearish trend,” said Vinod Nair, Head of Research at Geojit Financial Services.

“Amid these conditions, PSU bank stocks saw gains, partially due to India’s inclusion in JP Morgan’s Government Bond Index, which resulted in a decline in bond yields. However, overall, risk-averse sentiment prevailed, driven by the ongoing ascent of US bond yields and concerns regarding the possibility of higher rates persisting for an extended period,” he said.

Foreign institutional investors (FIIs) continued to sell off Indian equities nine weeks on with the exits this week amounting to worth Rs 8,681.30 crore. Domestic institutional investors (DIIs), on their part, bought equities worth Rs 1,938.94 crore during the week.

Where is Nifty50 headed?

Let’s hear from experts on the market dynamics expected over the next few weeks.

Amol Athawale, Vice President – Technical Research, Kotak Securities

Due to temporary oversold conditions, we could expect a quick pullback rally in the near future. For the short-term traders, the 50-day SMA (Simple Moving Average) of 19,600 and 19,500 would be the key support zones, while 19,800 and 19,900 could be the key resistance areas.

For Bank Nifty, the 50-day SMA or 45,000 would be the sacrosanct support level. As long as it’s trading below the same, the weak sentiment is likely to continue. Below which, the index may slip till 44300-44000. On the flip side, a fresh uptrend is possible only after the dismissal of a 50-day SMA or 45,000, above which it could move up till 45,400-45,500.

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas

The Nifty is trading at a crucial support zone of 19,720-19,620, where parameters in the form of 40 moving average and key Fibonacci retracement level is placed. The speed of the fall has slowed down as the hourly momentum indicator has a positive crossover which indicates that a pullback is likely before the next leg of the fall resumes.

The pullback can be till 19,850 – 19,880 where key hourly moving averages and the gap area formed on September 21 is placed. In terms of levels, 19,620–19,604 is the crucial support zone, while 19,850–19,880 shall act as an immediate hurdle zone.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.