Trade setup for Wednesday: 15 things to know before opening bell

The market ended another lacklustre session on a flat note with a negative bias on September 26. Overall, the benchmark indices traded within the previous day’s range and the trading range narrowed compared to the previous session, indicating the possibility of a sharp move on either side of the trade in the coming sessions. On the higher side, the Nifty may face resistance at 19,800, while in case of correction, it may get support at 19,600-19,500 levels, experts said.

The BSE Sensex declined 78 points to 65,945, while the Nifty50 dropped 10 points to 19,665 and formed a small-bodied bearish candlestick pattern with minor upper & lower shadows.

“A small body of negative candle was formed on the daily chart with minor upper and lower shadows. Technically, this pattern shows a squeeze type formation, where the underlying prepares to show big moves on either side eventually,” Nagaraj Shetti, technical research analyst, HDFC Securities said.

After the formation of a Doji-type candle pattern on Monday, the market was expected to show a reasonable upside bounce in the subsequent session. Hence, an inability of bulls to witness any sustainable upside bounce from here could eventually result in a decisive downside breakout of the present range movement, he feels.

The high-low areas to be watched for the short term are around 19,750-19,600 levels, he said.

The broader markets had a mixed trend, with the Nifty Midcap 100 index falling 0.2 percent and Smallcap 100 index rising 0.6 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty may be taking support at 19,643, followed by 19,629 and 19,605. On the higher side, 19,691 can be an immediate resistance, followed by 19,705 and 19,729.

On September 26, the Bank Nifty also traded within previous day’s range and the trading range narrowed to half compared to previous session, indicating the move on either side of trade in coming sessions. The index fell 142 points to 44,624.

“The Bank Nifty index has remained in a consolidation phase, marked by the bulls defending the 45,500 levels, while the bears have established a hurdle around 45,000. To establish a trending move, the index must break out of this range on either side, providing a clear direction for the market,” Kunal Shah, senior technical & derivative analyst at LKP Securities said.

Currently, the index is trading below its 20-day moving average (20DMA). “And a decisive move above this level could trigger positional buying on the long side, potentially changing the landscape of this consolidation phase,” he said.

As per the pivot point calculator, the banking index is expected to take support at 44,551, followed by 44,494 and 44,402. On the upside, the initial resistance is at 44,736 then 44,793 and 44,885.

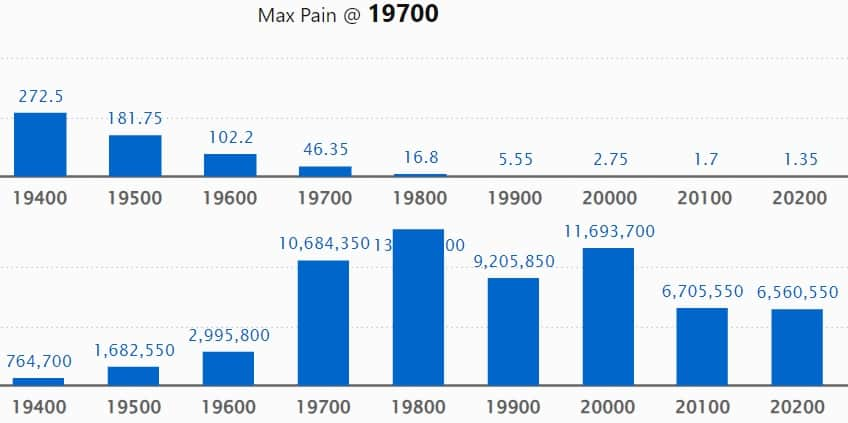

As per the options data, the maximum weekly Call open interest (OI) was seen at 19,800 strike with 1.33 crore contracts, which can act as a key resistance for the Nifty. It was followed by 20,000 strike which had 1.17 crore contracts, while 19,700 strike had 1.07 crore contracts.

The meaningful Call writing was seen at 19,700 strike, which added 29.39 lakh contracts followed by 19,800 and 20,100 strikes, which added 22.57 lakh and 15.94 lakh contracts.

The maximum Call unwinding was at 20,200 strike, which shed 7.68 lakh contracts followed by 20,300 strike and 20,600 strike, which shed 3.21 lakh contracts, and 51,950 contracts.

On the Put side, the maximum open interest remained at 19,600 strike, with 93.56 lakh contracts. This can be an important support for the Nifty in the coming sessions.

It was followed by 19,000 strike comprising 92.91 lakh contracts, and 19,500 strike with 87.73 lakh contracts.

The meaningful Put writing was at 19,600 strike, which added 25.4 lakh contracts, followed by 19,200 strike and 19,500 strike, which added 17.92 lakh and 11.44 lakh contracts.

Put unwinding was at 19,800 strike, which shed 3.42 lakh contracts followed by 20,000 strike and 19,900 strike, which shed 1.63 lakh and 1.14 lakh contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. SBI Card, Crompton Greaves Consumer Electricals, Britannia Industries, Hindustan Unilever, and Sun Pharmaceutical Industries have seen the highest delivery among the F&O stocks.

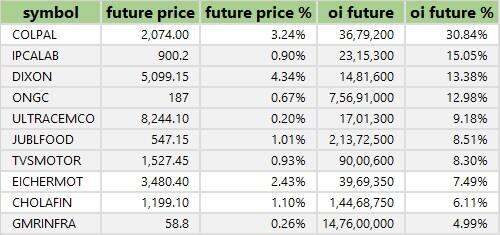

A long build-up was seen in 31 stocks, including Colgate Palmolive, Ipca Laboratories, Dixon Technologies, ONGC, and UltraTech Cement. An increase in open interest (OI) and price indicates a build-up of long positions.

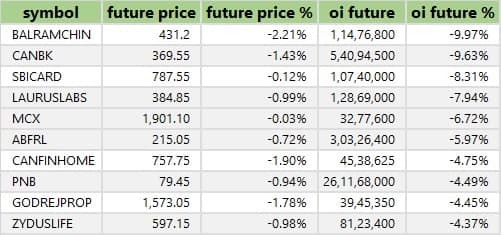

Based on the OI percentage, a total of 58 stocks including Balrampur Chini Mills, Canara Bank, SBI Card, Laurus Labs, and MCX India, saw long unwinding. A decline in OI and price indicates long unwinding.

42 stocks see a short build-up

A short build-up was seen in 60 stocks, including Delta Corp, Navin Fluorine International, Coforge, Muthoot Finance, and Bata India. An increase in OI along with a fall in price points to a build-up of short positions.

Based on the OI percentage, 37 stocks were on the short-covering list. These included Mahanagar Gas, Astral, Container Corporation of India, Granules India, and Bharat Electronics. A decrease in OI along with a price increase is an indication of short-covering.

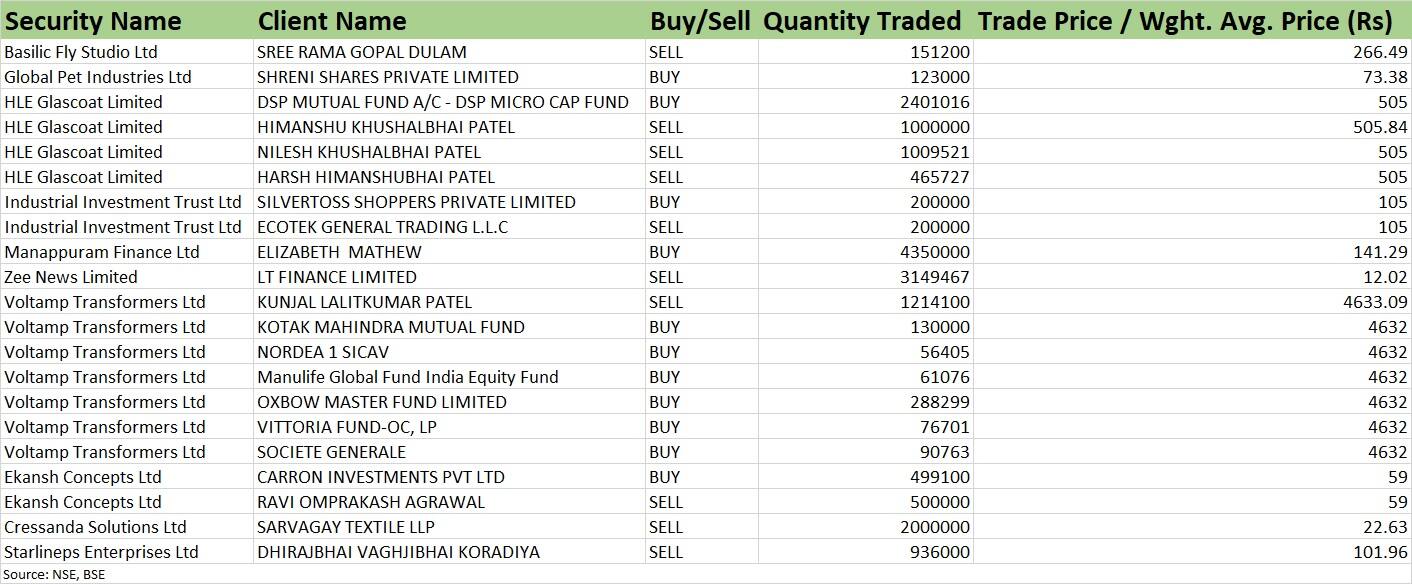

Voltamp Transformers: Promoter Kunjal Lalitkumar Patel has sold 12.14 lakh equity shares, which is equivalent to 12 percent of paid-up equity, via open market transactions, at an average price of Rs 4,633.09 per share. The stake sale by the promoter amounted to Rs 562.5 crore. However, Kotak Mahindra Mutual Fund, Nordea 1 Sicav, Manulife Global Fund India Equity Fund, Oxbow Master Fund, Vittoria Fund-OC LP, and Societe Generale have bought 7.03 lakh shares (6.95 percent stake) at an average price of Rs 4,632 per share, amounting to Rs 325.7 crore.

(For more bulk deals, click here)

Investors meeting on September 27

Quess Corp: The company’s representatives will meet analysts and institutional investors in the JP Morgan India TMT tour.

Uniparts India: Representatives of the company will be meeting with Ratnatraya Capital.

Global Health: The company’s senior officials will interact with Vontobel Asset Management.

Hindustan Foods: Officials of the company will be attending the Investors Conference hosted by JP Morgan.

SBFC Finance: The company’s officials will meet Kotak Mutual Fund, Nippon Mutual Fund, Axis Mutual Fund, ICICI Prudential Mutual Fund, ICICI Prudential Life Insurance Company, Birla Mutual Fund, and Neuberger Berman.

3i Infotech: Senior officials of the company will meet Securities Investment Management, Prasad Capital Advisors, Jeet Capital Advisors, PiSquare Investments, Bonanza Portfolio, and Aadi Investments.

BEML: The company’s officials will meet Sundaram MF.

Crompton Greaves Consumer Electricals: Senior officials of the company will interact with Marshall Wace.

Tilaknagar Industries: The company’s senior officials will be participating in the Arihant Rising Stars Summit 2023 conference.

Glenmark Pharmaceuticals: Senior representatives of the company will participate in Kotak Healthcare Forum 2023.

Stocks in the news

Signature Global India: The Delhi NCR-based affordable housing company will debut on the BSE and NSE, in the T+3 timeline, on September 27. The issue price has been fixed at Rs 385 per share.

Infosys: The country’s second-largest IT services provider has announced a collaboration with Microsoft to jointly develop industry-leading solutions that leverage Infosys’ Topaz, and American tech giant’s Azure OpenAI Service and Azure Cognitive Services. Both organisations are bringing together their artificial intelligence (AI) capabilities to enhance enterprise functions with AI-enabled solutions across multiple industries.

Sai Silks Kalamandir: The Andhra Pradesh-based ethnic apparel and value-fashion products retailer will list shares in T+3 timeline on September 27. The final issue price is Rs 222 per share.

3i Infotech: The IT company has received a contract from Ujjivan Small Finance Bank, for end-user support service (workplace services). The total contract value is Rs 39.55 crore plus one-time transition charges of Rs 35 lakh. The contract is for a period of 5 years starting from October 1, 2023 to September 30, 2028, with the option to extend the contract with mutual agreement.

Shyam Metalics and Energy: The Kolkata-headquartered integrated metal producer has made an entry into the energy storage sector to make battery-grade aluminium foil for Lithium-ion cell manufacturing. The battery-grade aluminium foil is a critical component in Lithium-ion cells.

Suzlon Energy: Dilip Shanghvi and Associates has decided to terminate the agreement with Suzlon in accordance with the terms of the agreement. Dilip Shanghvi and Associates is the investor group of the company, that had entered into an amended and restated shareholders’ agreement on February 28, 2020 with the company and promoters. Hiten Timbadia, the investor group’s nominee director on the board of the company, has resigned as director of the company with effect from September 26.

Century Textiles and Industries: Subsidiary Birla Estates has sold out phase 1 of Birla Trimaya within 36 hours of its launch. The booking value is Rs 500 crore for 556 units booked. Birla Trimaya, the 52-acre land parcel in North Bangalore is in joint partnership with M S Ramaiah Realty LLP.

Fund Flow (Rs Crore)

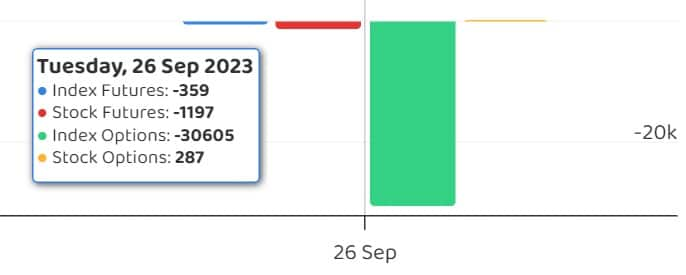

Foreign institutional investors (FII) sold shares worth Rs 693.47 crore, while domestic institutional investors (DII) bought Rs 714.75 crore worth of stocks on September 26, provisional data from the National Stock Exchange (NSE) showed.

Stocks under F&O ban on NSE

The NSE has added Delta Corp and India Cements to its F&O ban list for September 27, while retaining Balrampur Chini Mills, Canara Bank, Hindustan Copper, and Indiabulls Housing Finance to the list. Granules India was removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.