Tick, tock, one more block: Can markets stay on top?

Apart from general profit-booking, some promoters have been paring stake because the second generation is not too interested in the business

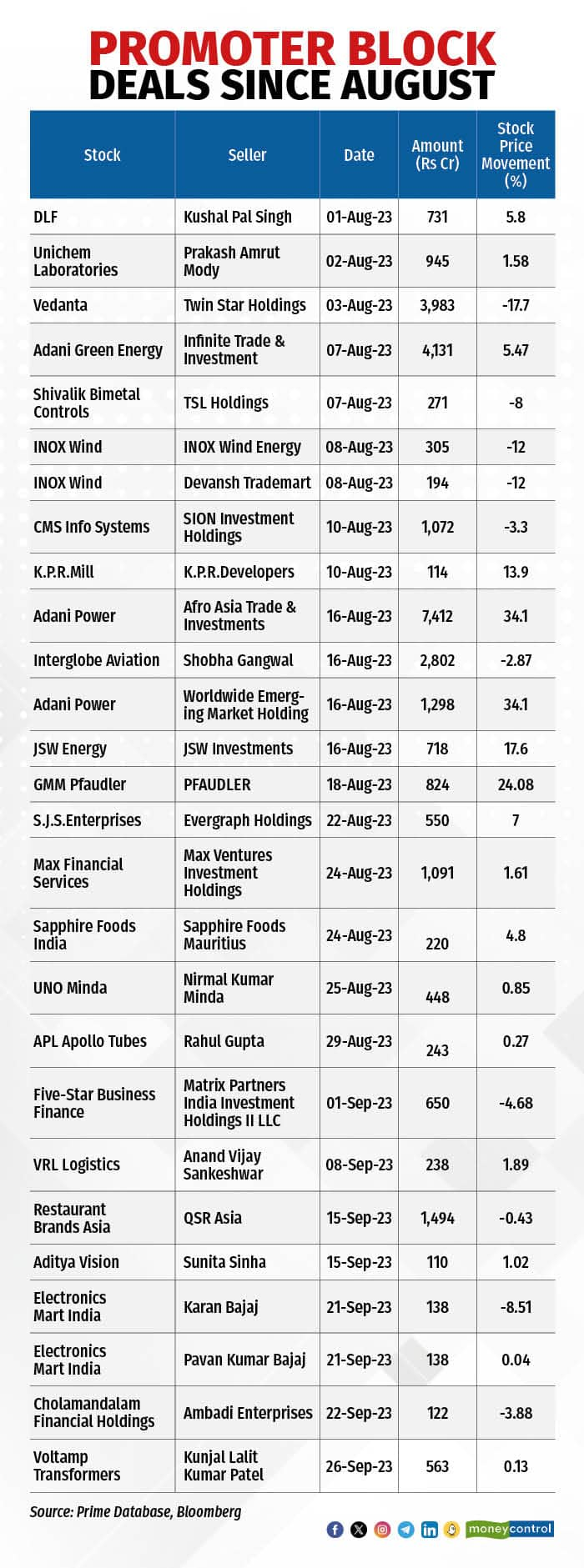

Indian equity markets have seen back-to-back block deals over the past two months, with several private equity funds or promoters paring their stake. While this could be viewed negatively by the market, indicating a likely top, this time around things are different, say experts.

As per data compiled by Prime Database, promoter blocks worth Rs 94,902 crore have changed hands in 2023 so far compared to Rs 40,669 crore in the whole of calendar year 2022. Furthermore, analysts say that figure could be much higher than Rs 94,902 crore as the data does not include PE block sales from the public shareholding part.

Some notable share sales in the recent past were those of Baring PE in Coforge, Everstone in SJS Enterprises, Warburg Pincus in IDFC First Bank and promoter sales in Max Financial, Uno Minda, Solara Active Pharma and APL Apollo.

Why the frequent block deals?

Apart from general profit-booking, some promoters have been paring stake because the second generation is not too interested in the business, said two fund managers who did not wish to be named.

“Many mid and smallcap companies operating in the old economy, machinery and manufacturing segments are facing this problem. The promoters’ children would rather look at different investing avenues via the family office than getting into day-to-day operations,” said one fund manager.

The other section of block deals is a function of PE funds closing down after running out of their time horizon, according to Ashutosh Tiwari, head – institutional equities, Equirus Capital. A private equity fund invested in a listed entity typically has a lifespan of five to seven years, although timeline extensions are up to the manager’s discretion and consent from two-thirds of investors.

“Once the fund’s timespan runs out, they have to liquidate and distribute the profits to the holders. Even if the fund’s term is extended for a few years, they start liquidating earlier,” Tiwari said.

Also Read: Extended trading hours: Pain for traditional brokers, gain for digital brokers?

For instance, Ascent India Fund III, which sold a stake in Radiant Cash Management, had closed its corpus back in 2010. PI Opportunities Fund-I, a seller in Medplus, is a 2008 vintage private equity growth expansion fund managed by Premji Invest.

Adding to this, Vikas Khattar, co-head of Investment Banking and Head of ECM at Ambit, said, “Over the last decade, several unlisted companies have secured investments from private equity firms. With these companies now entering Dalal Street during a bustling primary market, it’s evident that significant block sales will play a pivotal role in the Indian equity markets.”

A long wait for good days

New-age stocks such as Zomato and Paytm, which were battered after listing in 2021, finally saw the tide turn in 2023 as they increasingly focused on profitability.

PE/VC funds were waiting for these good days to finally book profits as lock-in periods ended. For instance, SoftBank’s 3.35 percent stake in Zomato, which it was issued during Zomato’s acquisition of quick grocery-delivery startup Blinkit, was freed up in the last week of August. Soon after, Softbank sold 10 crore shares at an average floor price of Rs 94.70 apiece against an average cost price of Rs 83-85, netting a profit of Rs 10-12 a share.

According to Nuvama Alternative Research, between August 22 and December 31, a total of 37 companies are slated to have their pre-listing shareholder lock-ins, both for promoters and non-promoters, lifted. This only means that block deals are here to stay.

Liquidity aplenty

Historically, insiders are comfortable offloading stake when liquidity and demand is strong, said Sahil Kapoor, head – products, DSP Mutual Fund. “We are not in a situation where markets or stocks will fall 20 percent because of block deals. Promoters and owners can sell now as appetite and liquidity is good.”

Also Read: Delta Corp: Game over or will the house win as always?

In all the recent blocks, reputed long funds stood on the buying side. Morgan Stanley, BNP Paribas Arbitrarge, Societe Generale and Citigroup were some of the buyers in the Zomato block deal. Meanwhile, domestic mutual funds like ICICI Prudential Mutual Fund, HDFC Mutual Fund, SBI Mutual Fund, and Aditya Birla Sun Life Fund were the big names in midcaps such as Coforge, SJS Enterprises and Amber Enterprises.

“Low volumes with high price is an indication of markets topping out. By no means do Indian markets have low volumes today. On a secular basis, foreign investors as well as promoters have full faith in the India story, which has brought the Sensex from 3,000 in 2003 to 66,000 currently,” said Khattar.

To be sure, during the block deal bonanza, the Nifty managed to scale the momentous 20,000 mark, while the Nifty Midcap and Smallcap, too, reached new peaks.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.