More than 150 smallcaps surge 10-68% in September

In this month, FIIs sold equities worth Rs 26,692.16, while DIIs purchased equities worth Rs 20,312.65 crore.

The weak global cues including likely rate hikes, dollar strength, higher US bond yields, rising crude oil prices and FII selling, keep the domestic benchmark indices volatile in the last week of September.

In this week, BSE Sensex was down 0.27 percent or 180.74 points to end at 65,828.41, and Nifty50 fell 0.18 percent or 35.95 points to close at 19,638.30.

BSE Large-cap Index ended flat, while the BSE Mid-cap Index gained 1.2 percent and BSE Small-cap index added 1.3 percent, this week.

“Amidst mounting concerns stemming from escalating crude oil prices and inflationary pressures, which were compounded by fears of another rate hike by the Fed, the domestic market grappled with volatility throughout the week. The increase in US bond yields and volatility in the INR further diminished the attractiveness of domestic indices for foreign investors. Further, due to low liquidity and a lack of catalysts to stimulate buying, the market is encountering strong resistance at higher levels,” said Vinod Nair, Head of Research at Geojit Financial Services.

“Throughout the week, IT stocks underperformed due to adverse global cues, while the pharma sector witnessed strong buying interest as investors adopted a defensive strategy in response to global uncertainties. Yet the market concluded the week on a positive note, boosted by healthy momentum in industrial growth, up by 12% YoY.”

“Volatility is expected to remain elevated in the short term, given the upside risk of domestic inflation on account of higher crude prices. Investors will closely monitor upcoming releases of domestic, US, and Chinese PMI data, among other indicators, as they are expected to shape future market trends,” he added.

Among sectors, the BSE Telecom index rose 2.7 percent, the BSE healthcare index added 2.6 percent, the BSE realty index gained 2.5 percent, and the BSE Metal and Capital Goods indices rose 2 percent each. On the other hand, the BSE Information Technology index shed 3 percent and the BSE Auto index slipped 0.5 percent.

The selling was continued by Foreign institutional investors (FIIs) on tenth consecutive week as they offloaded equities worth Rs 8,430.77 crore, while domestic institutional investors (DIIs) bought equities worth Rs 8,143.28 crore in this week.

For the Month

BSE Sensex and Nifty50 indices added 1.5 percent and 2 percent respectively. BSE Midcap, Smallcap and Largecap indices rose 3.6 percent, 1 percent and 2 percent.

In this month, FIIs sold equities worth Rs 26,692.16, while DIIs purchased equities worth Rs 20,312.65 crore.

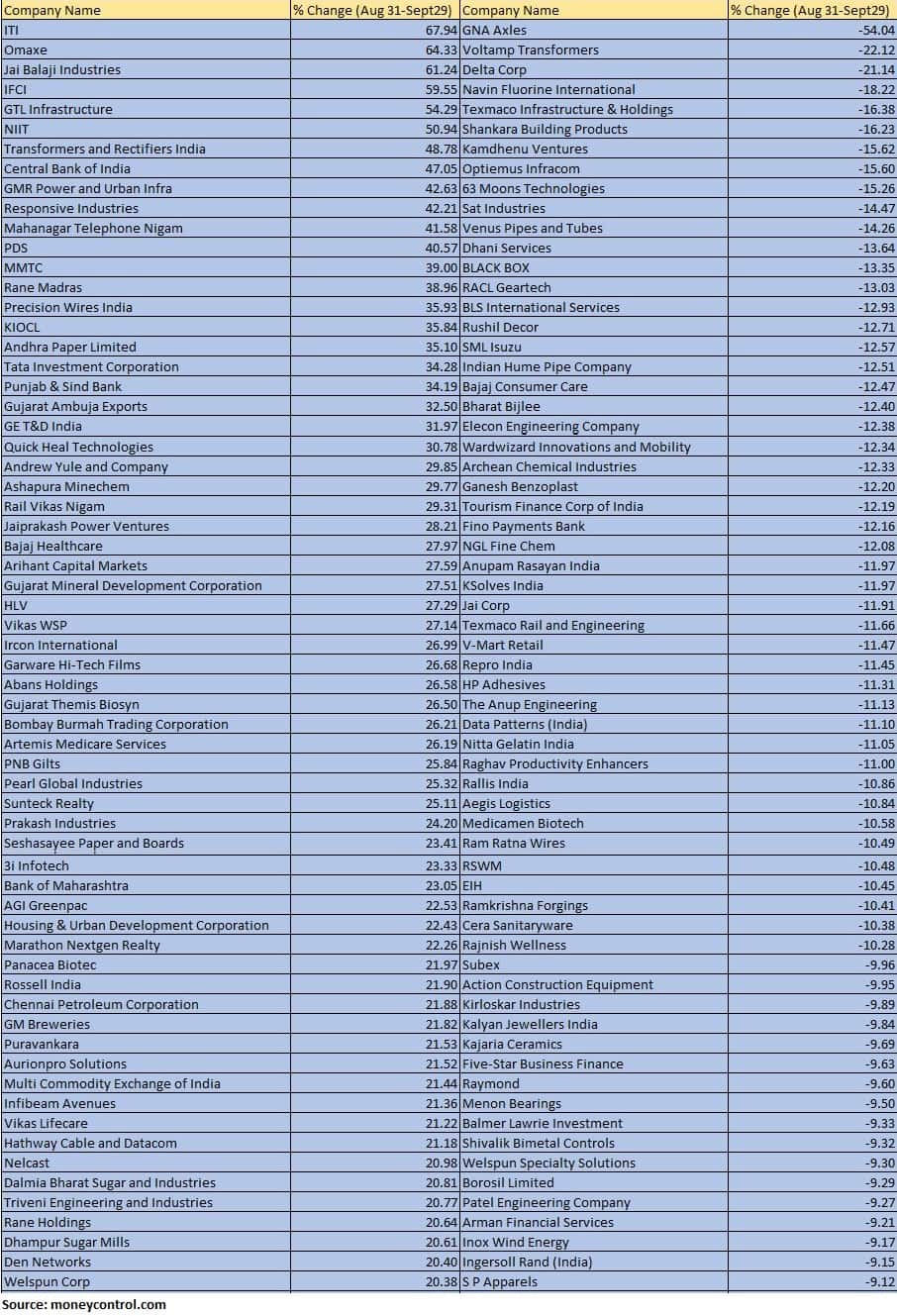

The BSE Small-cap index rose 1 percent with ITI, Omaxe, Jai Balaji Industries, IFCI, GTL Infrastructure, NIIT, Transformers and Rectifiers India, Central Bank of India, GMR Power and Urban Infra, Responsive Industries, Mahanagar Telephone Nigam, PDS adding 40-67 percent.

On the other hand, GNA Axles, Voltamp Transformers, Delta Corp, Navin Fluorine International, Texmaco Infrastructure & Holdings, Shankara Building Products, Kamdhenu Ventures, Optiemus Infracom, 63 Moons Technologies fell between 15-54 percent.

Where is Nifty50 headed?

Siddhartha Khemka, Head – Retail Research, Motilal Oswal Financial Services:

Expect the market to trade in a broader range as the higher oil price has rekindled the worry over inflation and might result in a prolonged high interest rate environment. Auto stocks will remain in focus as companies will announce monthly sales numbers. Interest rate sensitive sector would also be in focus, as RBI policy meeting is scheduled next week. Investors will also take cues from macro data to be released globally.

Amol Athawale, Vice President – Technical Research, Kotak Securities

Based on the technical formation, we believe that the market is due for a short term upward pull back in the near term. It has formed a long legged doji formation, which may see trending activity on either side. Below 19490, the Nifty could fall to 19400 or 19200 levels.

On the other hand, above 19750, it would move to 19900-20000 levels. The real trend will emerge only if the index manages to cross the level of 20250.

Regarding Bank Nifty, 44750 would be the crucial resistance level. As long as it trades below it, weak sentiment is likely to continue, and it may slip to 44100-43800 levels. Conversely, a new uptrend is possible only after the break of 44750, and it may rise to 45000-45200.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.