Dalal Street Week Ahead | RBI policy, PMI numbers, Fed Chair speech among 10 key factors to watch

.

After a 1 percent cut on September 28, Indian markets staged a smart recovery the day after and managed to close the week only 0.2 percent lower. The Nifty settled 0.18 percent down at 19,638 and the Sensex was down 0.27 percent at 65,828 for the week.

Within sectors, Nifty Realty (up 2.4 percent) and Nifty Pharma (up 2.3 percent) were the top gainers while IT (down 3.5 percent) and Consumer Durables (down 1.4 percent) were top losers. Meanwhile, the broader market remained buoyant with Nifty Midcap 100 and Nifty Smallcap 100 gaining 1 percent and 2.18 percent for the week, respectively.

In the coming week, the market will first react to September auto sales numbers announced in the initial days of October.

With the onset of October, market experts believe that the ‘sell on rally’ market construct is likely to change, pushing Nifty back towards the psychological 20,000 mark.

Also Read: Premiums of new boys on Dalal Street ease in September; analysts allude to rich valuations

“October is usually a favourable month, both for US and Indian markets. There are indications that this historical trend may play out this October too. The ‘triple whammy’ of up-trending dollar, US bond yields and Brent crude is showing signs of easing. If this trend continues it will facilitate a recovery in markets,” Dr. V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services said.

While the coming week is a truncated one for equity markets, with October 2 (Monday) a trading holiday on the occasion of Gandhi Jayanti, investors still have a lot of data points and events to look forward to.

Here are 10 key factors to watch out for next week:

RBI policy

The Reserve Bank is likely to maintain status quo on policy rates for the fourth time in a row as retail inflation continues to remain high and the US Federal Reserve has decided to keep a hawkish stance for some more time, according to experts.

The Reserve Bank raised the benchmark repo rate to 6.5 percent on February 8, 2023, and since then it has retained the rates at the same level. The Reserve Bank Governor-headed six-member Monetary Policy Committee (MPC) meeting is scheduled for October 4-6, 2023.

Manufacturing and services numbers

India’s manufacturing PMI for September will be released on October 3 and is expected to dip to 57 from 58.6 clocked the month ago. In addition, the services PMI, set to be released on October 5, is expected to ease as well to 59 from 60.1 in August. That would be the second consecutive month of growth slowdown after a 13-year high of 62.3 printed in July.

Also Read: Standard Chartered doesn’t see Rupee cross 84 even if dollar climbs

Fed Speak

In the coming week, the Fed members are set to make appearances at several events. On October 2, Fed Chair Jerome Powell and Patrick Harker will take part in a roundtable talk with business owners in Pennsylvania. Fed’s Williams and Mester will also speak at separate events on Monday.

On Wednesday, Bowman is set to speak at a banking conference. On Thursday, Mester will talk at the Chicago Payments event and Daly will speak at the Economic Club of NY.

This comes on the heels of Federal Reserve’s preferred inflation metric – the Personal Consumption Expenditures (PCE) index – growing at its slowest pace on a monthly basis since late 2020 during August. Month-over-month, core PCE rose 0.1 percent in August, down from 0.2 percent in July, and the lowest rate since November 2020.

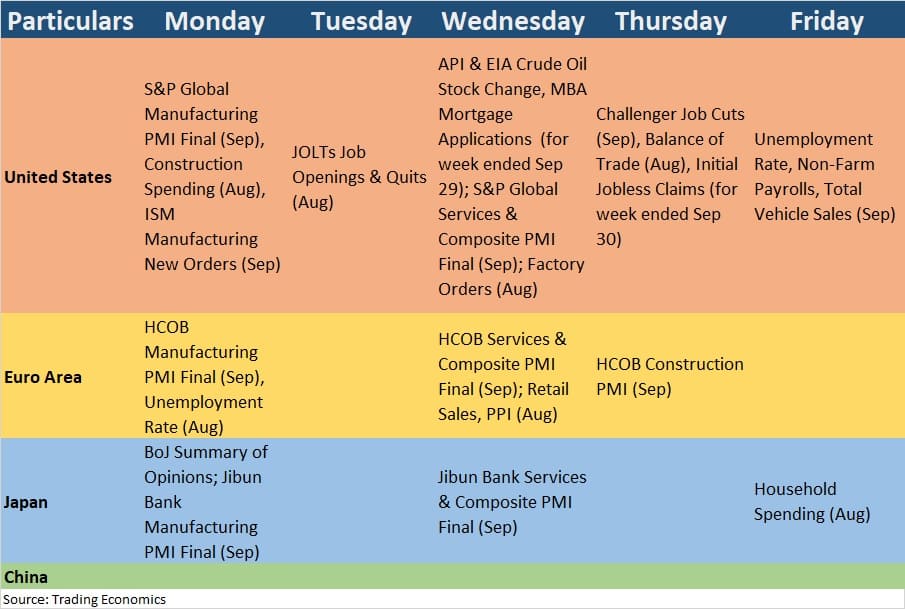

Global Economic Data Points

Here are key global economic data points to watch out for:

Oil Prices

Front-month Brent November futures gained about 2.2 percent in the week gone by to $95.31 per barrel and 27 percent in the third quarter. U.S. West Texas Intermediate crude (WTI) settled up 1 percent in the week and 29 percent in the quarter.

According to Ravindra Rao of Kotak Securities, crude oil price trajectory will now be dictated by the OPEC meeting due on October 4. While supply increases by Russia and Saudi Arabia can come as a relief, sources have told Reuters that OPEC+ is unlikely to tweak its current oil output policy.

“Investors need to be on alert given the rise of oil prices. If crude continues to stay above the 90 USD level, it will be a threat to inflation and boil the operational margins,” Vinod Nair, Head of Research at Geojit Financial Services said.

Also Read: Crude Oil Prices Rising, But Won’t Cross $100/Barrel In 2023 | Moneycontrol Experts’ Poll

FII Flows

In the week gone by, foreign institutional investors net sold equities worth Rs 8430.77 crore, while domestic institutional investors net bought equities worth Rs 8143.28 crore.

Cumulatively, FIIs net sold Rs 26,692.16 crore worth of equities in the month of September while DIIs net bought equities worth Rs 20,312.65 crore. Going ahead, it will be key to monitor this trend in the backdrop of easing the dollar index.

The dollar index eased below 106 on September 29, after data showed that the core PCE price index rose by less than expected. A weaker dollar index has usually coincided with an increase in foreign inflows within emerging markets like India.

Primary Market Action

On the mainboard, Plaza Wires will close for subscription on October 5 and Valiant Laboratories will close on Oct 3. JSW Infrastructure and jewellery retailer Vaibhav Jewellers will be making their debuts on the bourses on Oct 3, much before their scheduled listing dates. Given the T+3 listing timeline, it is likely that Valiant Laboratories will also make its debut in the coming week.

On the SME board, a slew of IPOs will close for subscription over the week including Karnika Industries, Plada Infotech Services, Sharp Chucks And Machines, Vishnusurya Projects and Infra, Vivaa Tradecom, Oneclick Logistics India, Canarys Automations, Vinyas Innovative Technologies, Kontor Space, and E Factor Experiences.

Also Read: JSW Infrastructure, Vaibhav Jewellers advance listing date, to debut on October 3

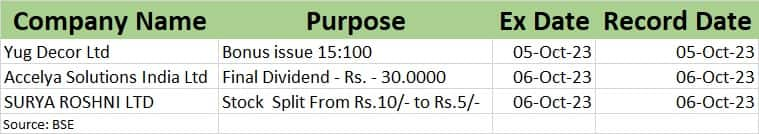

Corporate Action

Here are key corporate actions taking place in the coming week:

Technical levels

As Nifty has taken support from the 50-Day Exponential Moving Average (DEMA) of 19,562, experts believe the 19,500 level on the downside and the 19,800 level on the upside are the two key levels to watch now. “A decisive break on either side, will provide cues about the future direction in the index,” Ashwin Ramani, Derivatives & Technical Analyst, SAMCO Securities said.

On the Bank Nifty, the bulls have successfully defended the key support level at 44,200. “However, challenges persist as the 20-day moving average (20DMA) at 45,000 continues to act as a strong resistance. The index appears to be consolidating within a range, with levels of 44,200 on the downside and 45,000 on the upside defining this range,” Kunal Shah, Senior Technical & Derivative analyst at LKP Securities said, adding that a decisive break on either side will trigger fresh trending moves.

F&O Cues

The Options data suggested that the 19,800 mark on the Nifty50 is expected to be crucial for the higher side, whereas 19,600-19,500 is likely to remain critical for further downside if any.

On the weekly Options front, the maximum Call open interest was seen at 19,800 strike, followed by 19,700 & 20,200 strikes, with meaningful Call writing at 19,800 strike, then 20,200 & 20,100 strikes, while the maximum Put open interest was visible at 19,600 strike, followed by 19,500 strike, with Put writing at similar strike in the same sequence.

“Strong Put writing was observed at 19,500 & 19,600 strikes which led to the up move in Nifty on Friday. The 19,500 level on the downside and the 19,800 level on the upside are the two key levels to track in Nifty. A decisive break on either side, will provide cues about the future direction in the index,” Ashwin Ramani, derivatives & technical analyst at SAMCO Securities said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.