Are banks at risk of asset quality deterioration? Here is what UBS says

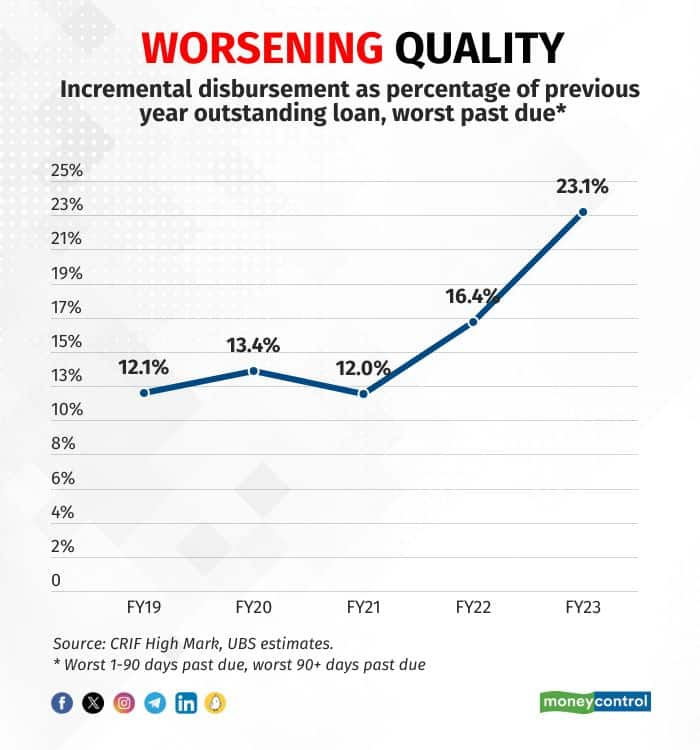

Compared to the pre-covid numbers, the report says that new PL disbursement to borrowers with weaker credit profiles could expose this segment to a potential down cycle.

While most analysts and fund managers are bullish on the banking sector, there have been concerns raised about the growing asset quality deterioration within the segment. Reserve Bank of India Governor Shaktikanta Das also flagged the rise in unsecured retail loans during the latest post Monetary Policy review press meet. According to the RBI, in the last two years, unsecured retail credit has spiked 23 percent against an overall credit growth of 12-14 percent in the system.

Also read: Banking Central | What does RBI know about unsecured loans that we don’t?

A latest report by UBS has downgraded the banking sector to neutral due to increased default risks in retail unsecured loans pushing up credit losses for banks. The retail borrower base (excluding agriculture loans), the report highlights, grew to 20.4 crore in March 2023, at a 5-year CAGR (FY2018 to FY2023) of 16.3 percent. According to the report, the credit losses could increase by 50-200 basis points. UBS analysts have raised the credit cost forecasts for the banks under their coverage (State Bank of India, Axis Bank, Kotak Bank, IndusInd Bank, HDFC Bank and Bank of Baroda) by 5-10 basis points in FY25. The report adds that the due past date (DPD) levels for lower ticket-size personal loans and credit card debt are 4-5x higher than higher ticket loans, an increase seen from FY2023-end to July 2023.

The following charts from the UBS report, explain their rationale behind the downgrade and the concern.

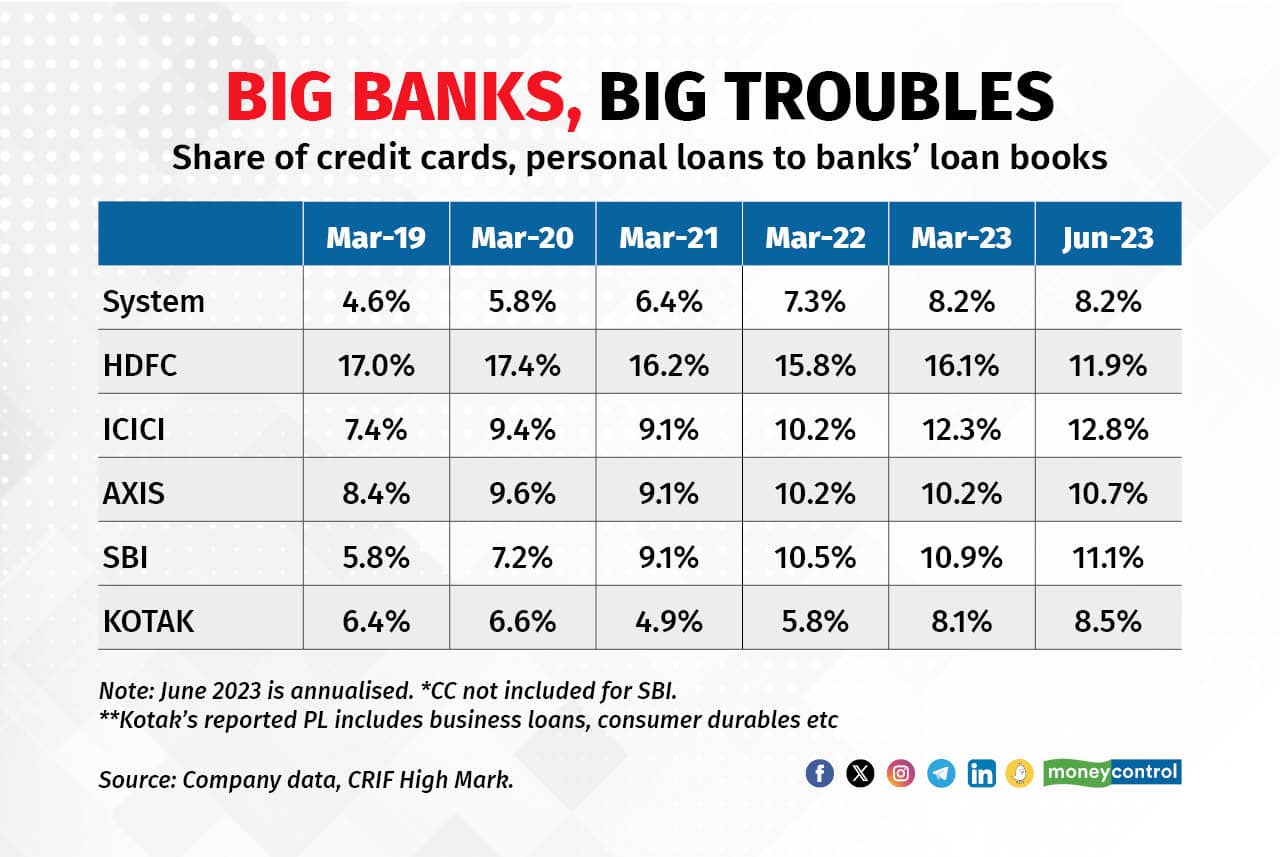

1. According to the report, the share of credit cards and personal loans in big banks’ loan books has seen a sustained and major increase over the years. The only exception was FY21, when there was an impact of the pandemic.

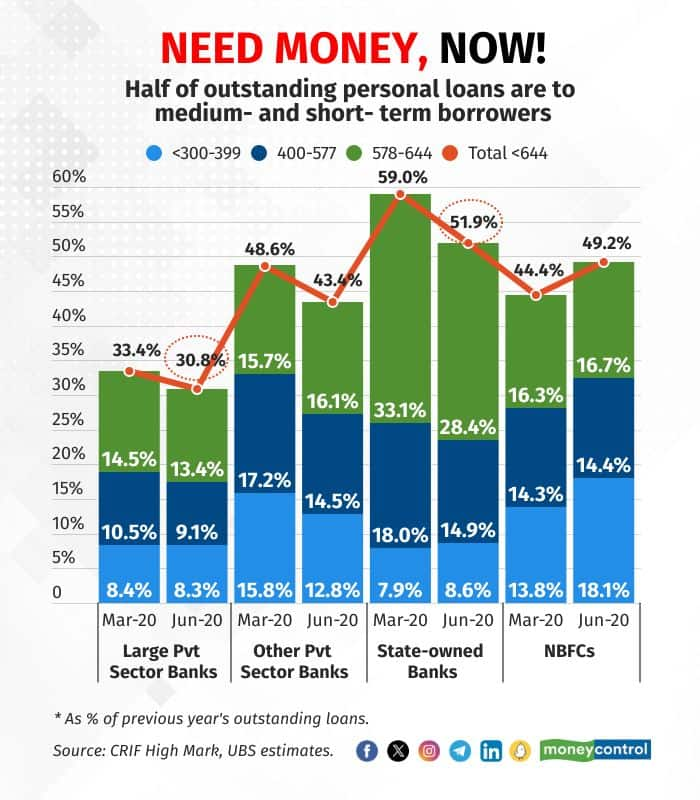

2. Analysts at UBS say that 52 percent of state-owned enterprise (SOE), or public sector banks’ outstanding personal loans in June 2023 were to borrowers with a credit score below 644 (medium to high risk) versus about 31 percent for large private sector banks. The report says that SOE banks generally have a higher market share of unsecured loans than private sector banks and also a greater proportion of higher-risk borrowers. Due to this, the analysts expect the build-up of credit losses in FY2025 to be greater for SOE banks than large private sector banks.

Also read: UBS Securities red flags retail loans, sees credit cost soaring by up to 200 bps

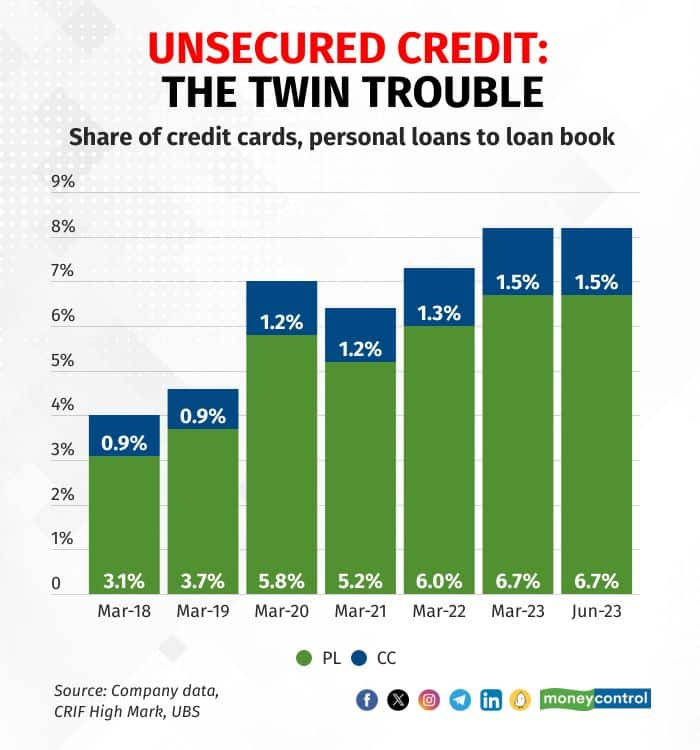

3. Unsecured retail loans’ share of banks and NBFCs’ total outstanding loans, according to the report, has more than doubled in the past five years to 8.2 percent currently. Additionally, personal loans and credit cards as a percentage of total loans increased by 360 and 60 basis points, respectively versus FY2018 to 6.7 percent and 1.5 percent in June 2023.

.

.

4. Compared to the pre-Covid numbers, the report says the new PL disbursement to borrowers with weaker credit profiles could expose this segment to a potential down cycle. Compared to larger banks, the report says NBFCs and SOE banks have a higher share of weak PL borrowers. The report identifies customers with a credit score of less than 577 as weak credit profiles. Between January 2022 and June 2023, the share of PL disbursements to customers with weaker credit profiles, according to the report, was 22.6 percent for SOE banks, 28.8 percent for NBFCs, and 13.1 percent for large private banks

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1347125073-1a34b3e4c1924d6cafc4ef488d33d39f.jpg)