F&O Manual | Global cues evoke selling pressure; Bank Nifty sees heavy call writing

Among individual stocks, Syngene, Biocon, HDFC and ICICI Bank see short built up

The Indian equity benchmark indices opened gap-down amid mixed global cues and are traded near day’s low by mid-day. Bank, power, realty and capital goods stocks saw a selling spree, while buying was noted in the pharma and auto names.

At 12 noon, the Sensex was down 436.98 points or 0.66 percent to 65,991.11, and the Nifty was down 109.30 points or 0.55 percent to 19,702.20. About 1,160 shares advanced, 1,940 declined, and 126 shares traded unchanged.

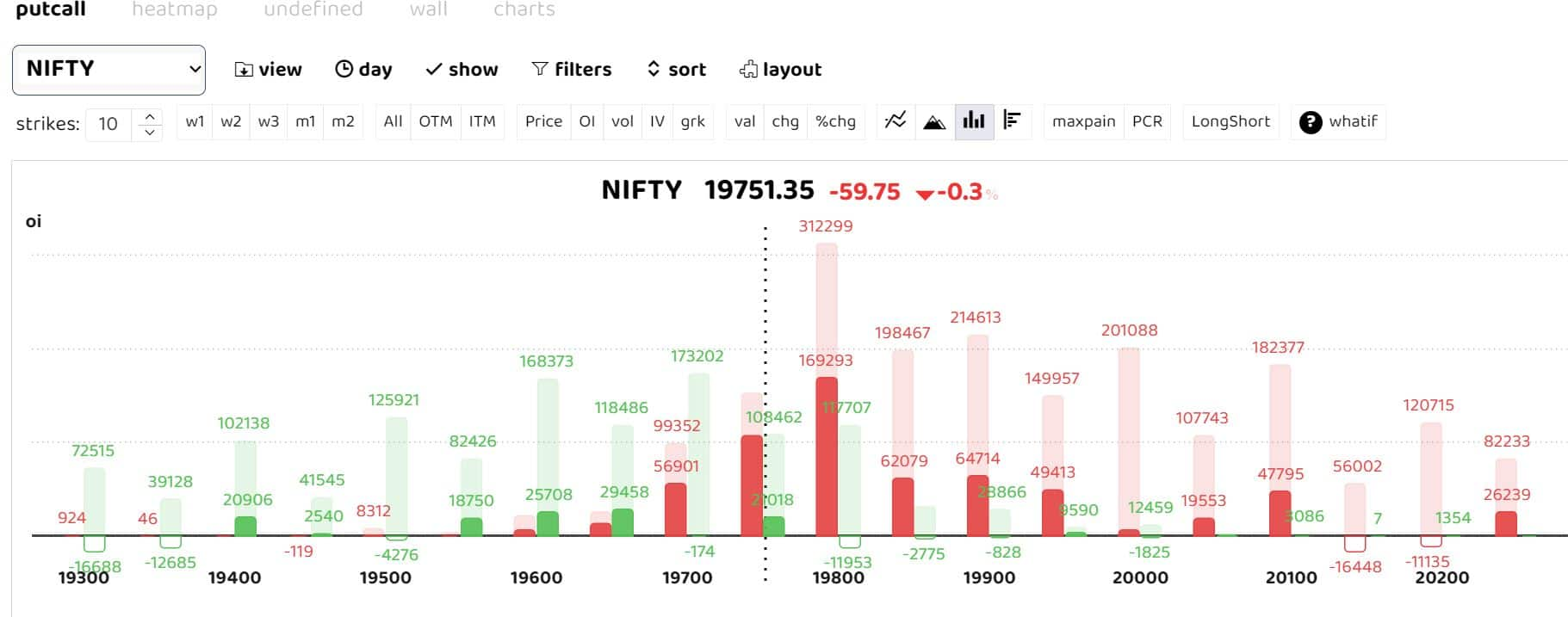

Options data suggests call writers were dominant through the day with heavy call writing at 19,800 strike forming key resistance. “Technically, the index would have the near-term support zone of 19,600 levels of the significant 50EMA zone, while the upside would need to breach decisively above the tough barrier zone of 19,850 levels. The support for the day is seen at 19550 levels while the resistance is seen at 19800 levels,” an analyst said.

Banking stocks dragged the markets down into the red, on the projections of the US Federal Reserve maintaining the current federal funds rate and rising Treasury yields.

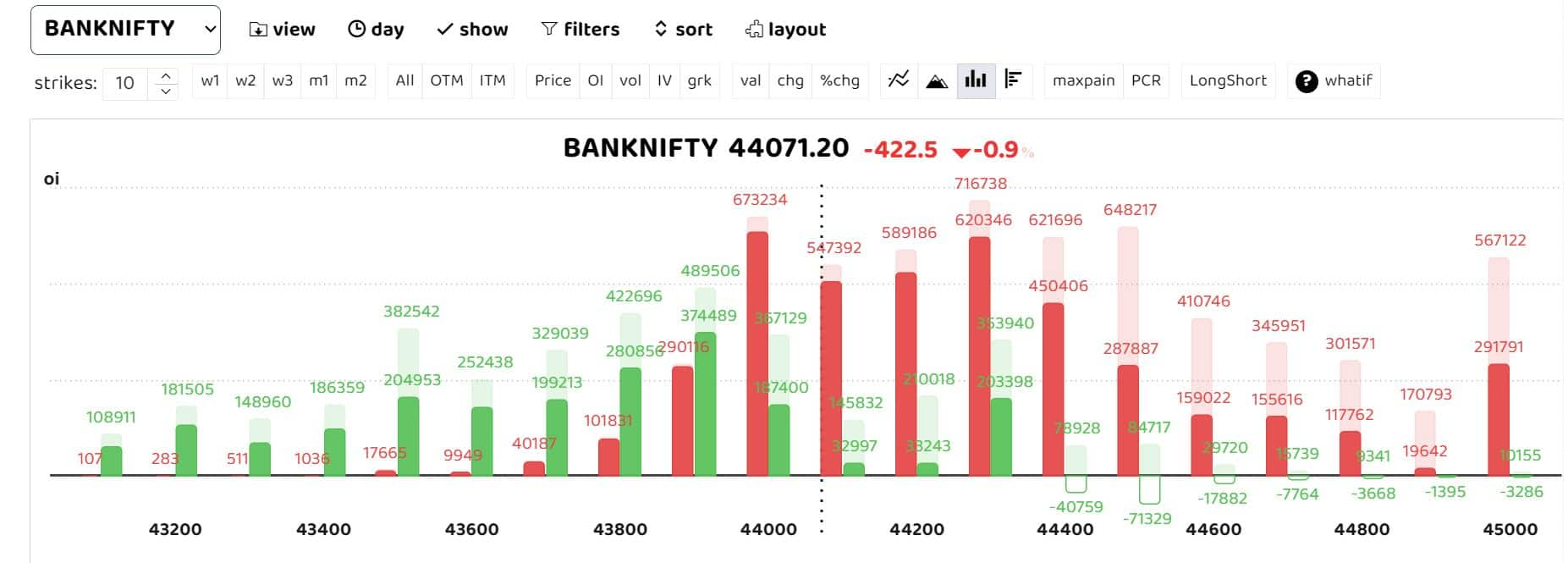

“The Bank Nifty has seen decrease in Open Interest of -2.88 percent with a decrease in price of -0.43 percent indicating Long Unwinding,” Axis Securities said. Axis views on Bank Nifty continues to be moderately bearish, with a put spread strategy recommended for the October expiry.

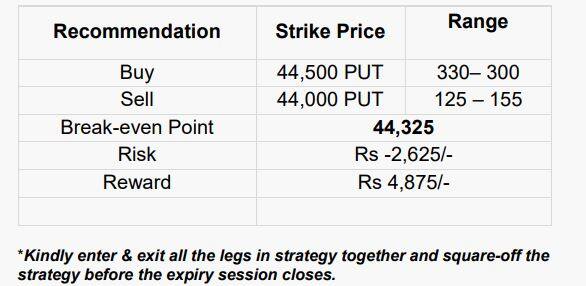

Strategy recommendation for Oct 26 expiry from Axis Securities

Traders could initiate this spread strategy to make modest returns with limited risk and reward. The spread suggested consists of buying one lot of 44,500 strike put option and simultaneously selling one lot of 44,000 strike put option.

Follow our live blog for all action

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.