F&O Manual | Global cues, FII exits dampen markets; Nifty faces resistance at 19,700

Among individual stocks, Astral, Bandhan Bank and IGL are seeing bearish set up.

The Indian benchmark indices opened gap-down on October 19, influenced by negative global cues. All the sectoral indices were trading in the red, with the metal index down by 1 percent by late morning trade.

According to analysts, the market sentiment has been negatively affected by the escalating conflict in the Middle East between Israel and Palestine militant force Hamas, unabated outflow of the foreign institutional investors (FII), and a weak Q2 performance of some big companies.

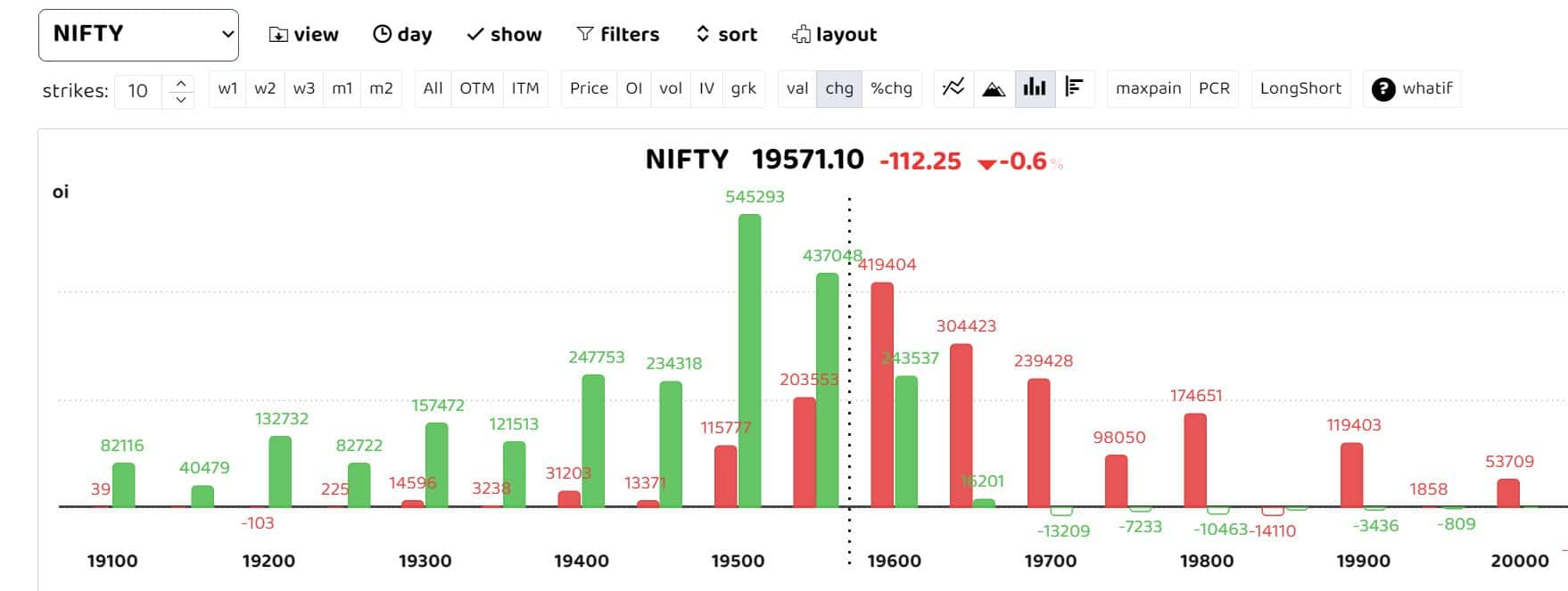

Options data suggests key straddle positions at 19,550 and 19,600 strikes. As per brokerage firm Prabhudas Lilladher, the Nifty once again failed to move past the resistance levels of 19,700 and has finally slipped in with heavy profit-booking seen to slide below the 19,600 zone with bias turning weak and sentiment maintained with a cautious approach.

“Technically, the index would have the near-term support zone at the 19,600 levels of the significant 50EMA zone, breaching which one can anticipate intensified selling pressure with next major support visible near the 19,200 zone. The support for the day is seen at the 19,500 levels while the resistance is seen at 19700 levels,” the brokerage said.

“The Nifty closed on a positive note with an increase of 0.45 percent, ending at 19,523 for the September series. In the middle of the October series, the Nifty encountered resistance around the 19,850 levels and is now trading at 19,550. The highest call option (CE) concentration for the October expiry is at 19,800, followed by 20,000 and 19,900, which might act as strong resistance. On the put option (PE) side, the highest open interest (OI) is at 19,500 PE, followed by 19,300 and 19,200, which are likely to act as immediate supports during this expiry,” Axis Securities said.

The Axis report also added that the Volatility Index (IndiaVIX), a measure of market expectations for near-term volatility, has witnessed fluctuations between 10 and 13. These fluctuations are primarily due to the influence of international news, such as the Gaza attack, and to some extent, domestic economic data numbers, rising crude oil prices, a lacklustre movement in the rupee, interest rate hikes, rainfall patterns, Federal Open Market Committee (FOMC) decisions, and inflation.

However, in the coming future, as we approach the end of the October expiry, it is expected that India VIX will remain subdued, mostly within the range of 10 to 14 for the October expiry.

Among individual stocks, Astral, Bandhan Bank and IGL are seeing bearish set up.

Follow our live blog for all market action

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-2007594509-ba97533a0736449eb4661aa3324f7d5b.jpg)