F&O Manual | Nifty in red as call writers active, FIIs hold shorts

Nifty’s open interest has decreased to nearly 9 million shares

Indian equity benchmarks traded marginally lower during the October 23 morning session on weak global cues amid heavy call writing in out-of-money options and FIIs mostly holding short positions.

The Nifty had shed more than a percent the previous week, mainly due to escalating geopolitical tensions in West Asia.

Rising bond yields and crude oil prices have dampened risk-on sentiments worldwide. Despite these challenges, Indian indices have significantly outperformed global counterparts, thanks to robust Q2 FY24 earnings.

At 11 am, the Sensex was down 161.13 points, or 0.25 percent, at 65,236.49, and the Nifty declined 59.30 points, or 0.30 percent, to 19,483.40. Out of the total, 682 shares advanced, 2,468 declined and 136 remained unchanged.

According to ICICI Securities, “Broader markets have also come under pressure, with the midcap segment underperforming the headline indices. Looking ahead, we anticipate that the Nifty may face challenges in surpassing the October series VWAP of 19,650. Therefore, one should consider a resumption of the uptrend only above these levels.”

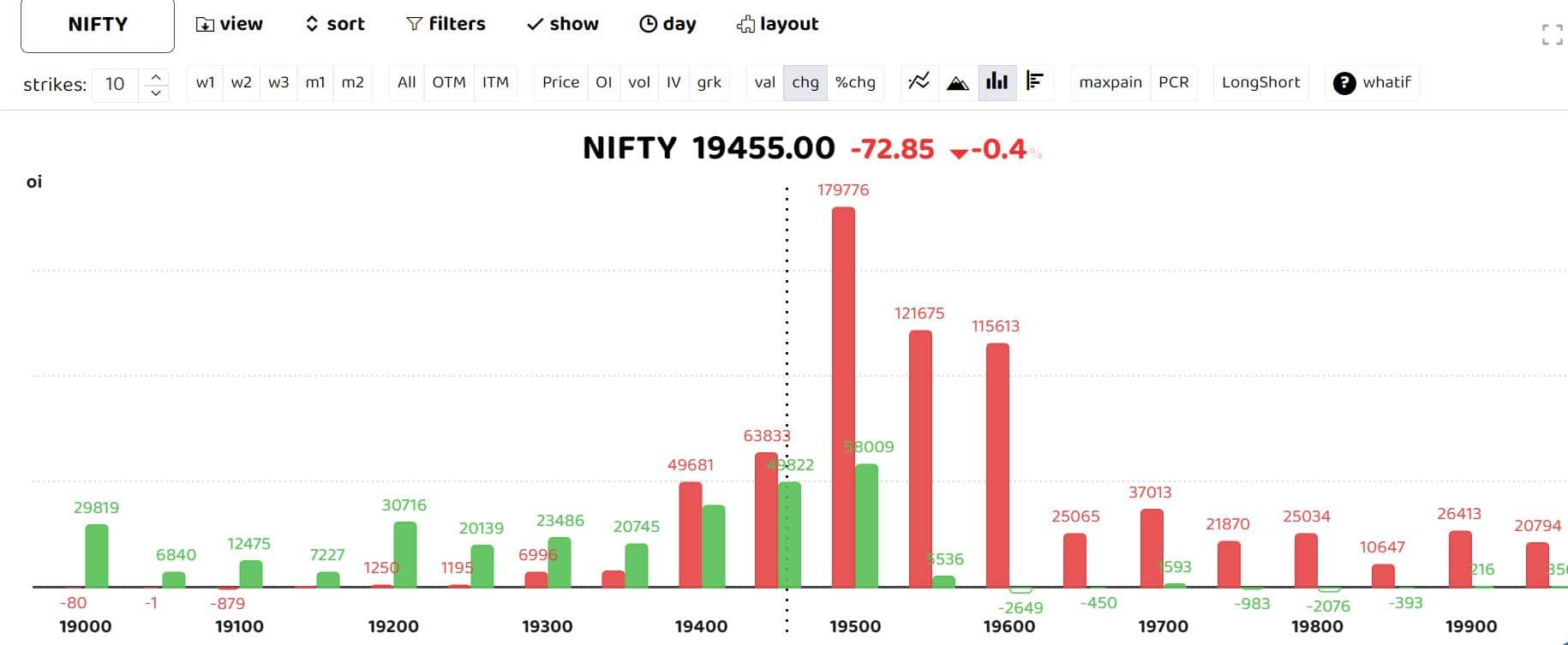

Raj Deepak Singh, Derivatives Research Head at ICICI Securities, said from a data perspective, FIIs short positions remained largely intact, with the majority of short positions observed in the banking index, as the Nifty’s open interest continued to decline throughout the week.

“The Nifty’s open interest has decreased to nearly 9 million shares. Overall, FIIs still hold net shorts in excess of 80,000 going into the settlement week, with aggressive writing among out-of-the-money Call strikes. We believe that any short-covering move should be expected from the lower support level of 19,300 or a move above 19,650,” ICICI Securities said.

The volatility index India VIX has stayed below 11 despite weakness in the market and global jitters. Thus, a move below 19,500 may

extend weakness in the shortened expiry week. “Moreover, considering ongoing results season, we expect stock- specific actions likely to

be in focus, ICICI Securities said.

The Bank Nifty continued its underperformance, marking its fifth consecutive week of negative closings, Singh said. The pressure was primarily driven by PSU stocks, which, along with private sector heavyweights, weighed on the index.

“Only a select few stocks managed to close the week in positive territory amidst broader weakness. Looking ahead, we anticipate that a move above the 44,000 level may propel Bank Nifty towards its series VWAP, positioned near 44,500 during the shortened expiry week,” Singh said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.