Street awaits Ashok Vaswani’s ‘tech touch’, overhang on Kotak Bank remains

While the stock has been a consistent compounder in the past two decades, the overhang of Uday Kotak’s exit has been weighing for two years. The stock has been trading the Rs 1,700-Rs 2,100 range since the beginning of 2021

Kotak Mahindra Bank has named Ashok Vaswani as the new MD and CEO.

‘);

$(‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]);

//if(resData[stkKey][‘percentchange’] > 0){

// $(‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”);

// $(‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”);

//}else if(resData[stkKey][‘percentchange’] < 0){

// $(‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”);

// $(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

//}

if(resData[stkKey][‘percentchange’] >= 0){

$(‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”);

//$(‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”);

$(‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”);

}else if(resData[stkKey][‘percentchange’] < 0){

$(‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”);

//$(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

$(‘#gainlosstxt_’+articleId).find(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

}

$(‘#volumetxt_’+articleId).show();

$(‘#vlmtxt_’+articleId).show();

$(‘#stkvol_’+articleId).text(resData[stkKey][‘volume’]);

$(‘#td-low_’+articleId).text(resData[stkKey][‘daylow’]);

$(‘#td-high_’+articleId).text(resData[stkKey][‘dayhigh’]);

$(‘#rightcol_’+articleId).show();

}else{

$(‘#volumetxt_’+articleId).hide();

$(‘#vlmtxt_’+articleId).hide();

$(‘#stkvol_’+articleId).text(”);

$(‘#td-low_’+articleId).text(”);

$(‘#td-high_’+articleId).text(”);

$(‘#rightcol_’+articleId).hide();

}

$(‘#stk-graph_’+articleId).attr(‘src’,’//appfeeds.moneycontrol.com/jsonapi/stocks/graph&format=json&watch_app=true&range=1d&type=area&ex=’+stockType+’&sc_id=’+stockId+’&width=157&height=100&source=web’);

}

}

}

});

}

$(‘.bseliveselectbox’).click(function(){

$(‘.bselivelist’).show();

});

function bindClicksForDropdown(articleId){

$(‘ul#stockwidgettabs_’+articleId+’ li’).click(function(){

stkId = jQuery.trim($(this).find(‘a’).attr(‘stkid’));

$(‘ul#stockwidgettabs_’+articleId+’ li’).find(‘a’).removeClass(‘active’);

$(this).find(‘a’).addClass(‘active’);

stockWidget(‘N’,stkId,articleId);

});

$(‘#stk-b-‘+articleId).click(function(){

stkId = jQuery.trim($(this).attr(‘stkId’));

stockWidget(‘B’,stkId,articleId);

$(‘.bselivelist’).hide();

});

$(‘#stk-n-‘+articleId).click(function(){

stkId = jQuery.trim($(this).attr(‘stkId’));

stockWidget(‘N’,stkId,articleId);

$(‘.bselivelist’).hide();

});

}

$(“.bselivelist”).focusout(function(){

$(“.bselivelist”).hide(); //hide the results

});

function bindMenuClicks(articleId){

$(‘#watchlist-‘+articleId).click(function(){

var stkId = $(this).attr(‘stkId’);

overlayPopupWatchlist(0,2,1,stkId);

});

$(‘#portfolio-‘+articleId).click(function(){

var dispId = $(this).attr(‘dispId’);

pcSavePort(0,1,dispId);

});

}

$(‘.mc-modal-close’).on(‘click’,function(){

$(‘.mc-modal-wrap’).css(‘display’,’none’);

$(‘.mc-modal’).removeClass(‘success’);

$(‘.mc-modal’).removeClass(‘error’);

});

function overlayPopupWatchlist(e, t, n,stkId) {

$(‘.srch_bx’).css(‘z-index’,’999′);

typparam1 = n;

if(readCookie(‘nnmc’))

{

var lastRsrs =new Array();

lastRsrs[e]= stkId;

if(lastRsrs.length > 0)

{

var resStr=”;

let secglbVar = 1;

var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’;

$.get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) {

$(‘#backInner1_rhsPop’).html(data);

$.ajax({url:url,

type:”POST”,

dataType:”json”,

data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs},

success:function(d)

{

if(typparam1==’1′) // rhs

{

var appndStr=”;

//var newappndStr = makeMiddleRDivNew(d);

//appndStr = newappndStr[0];

var titStr=”;var editw=”;

var typevar=”;

var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’);

var phead =’Why add to Portfolio?’;

if(secglbVar ==1)

{

var stkdtxt=’this stock’;

var fltxt=’ it ‘;

typevar =’Stock ‘;

if(lastRsrs.length>1){

stkdtxt=’these stocks’;

typevar =’Stocks ‘;fltxt=’ them ‘;

}

}

//var popretStr =lvPOPRHS(phead,pparr);

//$(‘#poprhsAdd’).html(popretStr);

//$(‘.btmbgnwr’).show();

var tickTxt =’‘;

if(typparam1==1)

{

var modalContent = ‘Watchlist has been updated successfully.’;

var modalStatus = ‘success’; //if error, use ‘error’

$(‘.mc-modal-content’).text(modalContent);

$(‘.mc-modal-wrap’).css(‘display’,’flex’);

$(‘.mc-modal’).addClass(modalStatus);

//var existsFlag=$.inArray(‘added’,newappndStr[1]);

//$(‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’);

//if(existsFlag == -1)

//{

// if(lastRsrs.length > 1)

// $(‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’);

// else

// $(‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’);

//

//}

}

//$(‘.accdiv’).html(”);

//$(‘.accdiv’).html(appndStr);

}

},

//complete:function(d){

// if(typparam1==1)

// {

// watchlist_popup(‘open’);

// }

//}

});

});

}

else

{

var disNam =’stock’;

if($(‘#impact_option’).html()==’STOCKS’)

disNam =’stock’;

if($(‘#impact_option’).html()==’MUTUAL FUNDS’)

disNam =’mutual fund’;

if($(‘#impact_option’).html()==’COMMODITIES’)

disNam =’commodity’;

alert(‘Please select at least one ‘+disNam);

}

}

else

{

AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’;

commonPopRHS();

/*work_div = 1;

typparam = t;

typparam1 = n;

check_login_pop(1)*/

}

}

function pcSavePort(param,call_pg,dispId)

{

var adtxt=”;

if(readCookie(‘nnmc’)){

if(call_pg == “2”)

{

pass_sec = 2;

}

else

{

pass_sec = 1;

}

var postfolio_url = ‘https://www.moneycontrol.com/portfolio_new/add_stocks_multi.php?id=’+dispId;

window.open(postfolio_url, ‘_blank’);

} else

{

AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’;

commonPopRHS();

/*work_div = 1;

typparam = t;

typparam1 = n;

check_login_pop(1)*/

}

}

function commonPopRHS(e) {

/*var t = ($(window).height() – $(“#” + e).height()) / 2 + $(window).scrollTop();

var n = ($(window).width() – $(“#” + e).width()) / 2 + $(window).scrollLeft();

$(“#” + e).css({

position: “absolute”,

top: t,

left: n

});

$(“#lightbox_cb,#” + e).fadeIn(300);

$(“#lightbox_cb”).remove();

$(“body”).append(”);

$(“#lightbox_cb”).css({

filter: “alpha(opacity=80)”

}).fadeIn()*/

$(“.linkSignUp”).click();

}

function overlay(n)

{

document.getElementById(‘back’).style.width = document.body.clientWidth + “px”;

document.getElementById(‘back’).style.height = document.body.clientHeight +”px”;

document.getElementById(‘back’).style.display = ‘block’;

jQuery.fn.center = function () {

this.css(“position”,”absolute”);

var topPos = ($(window).height() – this.height() ) / 2;

this.css(“top”, -topPos).show().animate({‘top’:topPos},300);

this.css(“left”, ( $(window).width() – this.width() ) / 2);

return this;

}

setTimeout(function(){$(‘#backInner’+n).center()},100);

}

function closeoverlay(n){

document.getElementById(‘back’).style.display = ‘none’;

document.getElementById(‘backInner’+n).style.display = ‘none’;

}

stk_str=”;

stk.forEach(function (stkData,index){

if(index==0){

stk_str+=stkData.stockId.trim();

}else{

stk_str+=’,’+stkData.stockId.trim();

}

});

$.get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?classic=true&sc_id=’+stk_str, function(data) {

stk.forEach(function (stkData,index){

$(‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]);

});

});

function redirectToTradeOpenDematAccountOnline(){

if (stock_isinid && stock_tradeType) {

window.open(`https://www.moneycontrol.com/open-demat-account-online?classic=true&script_id=${stock_isinid}&ex=${stock_tradeType}&site=web&asset_class=stock&utm_source=moneycontrol&utm_medium=articlepage&utm_campaign=tradenow&utm_content=webbutton`, ‘_blank’);

}

}

Kotak Mahindra Bank’s new MD and CEO Ashok Vaswani could bring in ‘much-needed aggression’ in the conservative bank, accelerating growth at a time when the Indian economy is on the cusp of a breakout and technology is at the left, right and centre of banking evolution, analysts said.

Yet, they feel in the near term, the overhang on the stock that has persisted over the past two years because of the leadership transition is unlikely to vanish in a hurry.

Vaswani was appointed to the top position at India’s third-largest private lender by market cap on October 21 after founder Uday Kotak resigned in September.

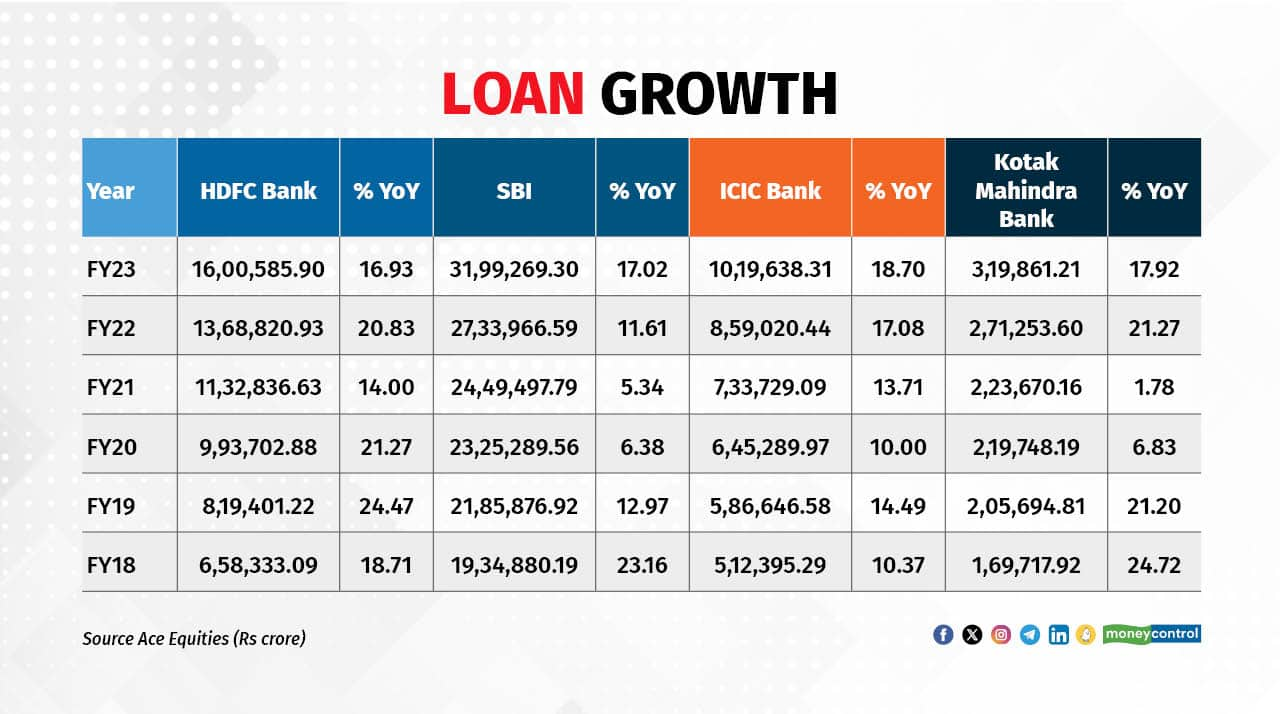

“Kotak Bank‘s loan growth has been consistent, but it is rather conservative and comes on a low base. With Vaswani’s appointment, the bank is most likely to go for aggressive digital growth,” said Sudip Bandyopadhyay of Inditrade Capital.

Vaswani’s appointment will be for three years from the date of taking charge, which shall not be later than January 1, 2024, Kotak Mahindra Bank has said. The appointment has to be approved by shareholders.

The international banker has over three decades of experience, initially at Citigroup and more recently, at Barclays as the Chief Executive Officer of Barclays Bank, UK, and subsequently CEO of their global consumer, private, corporate and payments businesses.

Another analyst, who did not wish to be named said, “We will now see the digital side of Kotak Bank becoming a bigger force to reckon with, as the bank is now likely thinking about payment products, unsecured retail lending and more.”

The bank is already on a tech transformation journey. Last August, Kotak made two important appointments. Milind Nagnur, who came from Early Warning, a fintech owned by seven of the leading banks in the United States, as president and CTO to lead technology transformation. Bhavish Lathia, an Amazon veteran, was hired as its chief of customer experience.

Vaswani’s appointment appears to be in line with the bank’s ambition to take the tech route to growth. This comes at a time when fintechs like Paytm, PhonePe are going big on digital lending and ahead of the impending entry of Jio Financial Services, the analyst added.

Also Read: Kotak Bank minus Uday Kotak: Can the bank continue its winning streak?

At present, Vaswani is the president of Pagaya Technologies Ltd, a US-Israeli AI Fintech. He is also on the board of the London Stock Exchange Group and the SP Jain Institute of Global Management, UK and supports various philanthropic organisations, including Pratham, and Lend-AHand.

International over domestic; external over internal

While Bandyopadhyay believes Vaswani’s international banking experience will bring in best global practices at Kotak Bank coupled with the in-house team’s domestic banking experience, analysts at Nuvama Institutional Equities are skeptical about any immediate change in perception.

“So far, Kotak has been run largely by a core team headed by a promoter-CEO that has not changed since inception. While the new CEO brings with him rich experience in digital and consumer banking, going by the experiences at other banks, we believe it would take the new CEO at least 18–24 months to implement his perspectives,” Nuvama’s Mahrukh Adajania and Madhukar Ladha wrote in a note.

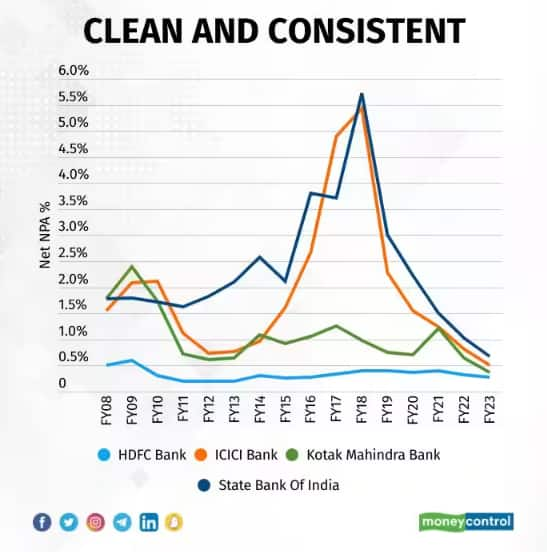

An aggressive loan growth approach is fine if it does not impact the bank’s superior asset quality. HDFC Bank has been the best of the lot, having maintained pristine asset quality — under 1 percent net non-performing assets (NPA) at all times, without exception. Kotak Bank has had periods of mildly higher NPAs but nowhere near that of any other bank.

According to analysts at Bernstein, while a change in CEO was expected, an external candidate would raise questions on any potential changes in strategy and may delay major new initiatives such as the IDBI deal.

Overhang on the stock gone?

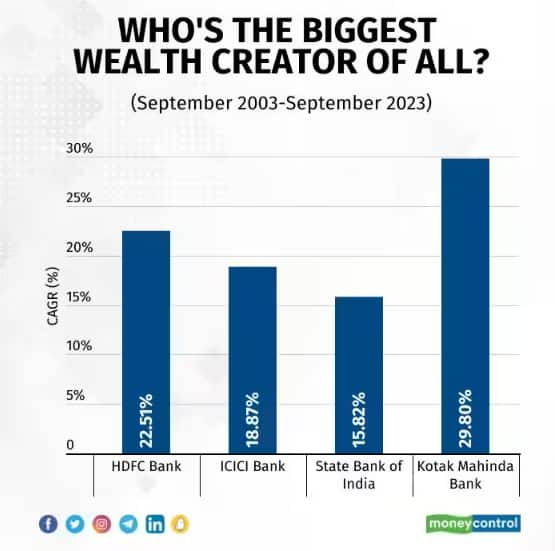

While the stock has been a consistent compounder in the past two decades, Uday Kotak’s exit has been weighing on the scrip for over two years. It has been trading in the Rs 1,7o0-Rs 2,100 range since the beginning of 2021.

Jignesh Shial of Incred Capital believes that the Street will await clear signs on changes in strategy before the overhang goes. Nuvama analysts, too, said Vaswani’s appointment would likely be a near-term overhang on the stock.

“Given the sharp correction in stock price, we believe the downside is rather limited. That said, upside triggers are not visible either. On balance, we maintain Hold, with a target of Rs 1,900,” Nuvama said.

Foreign broking firm Jefferies, too, has downgraded the stock to “hold” from “buy” and lowered the price target to Rs 1,940 from Rs 2,400. The stock continues to trade at higher valuations than HDFC Bank and ICICI Bank, though the “quality premium” has diminished over the years.

At 10:30 am, the stock was quoting at Rs 1,745.15 on the NSE, lower by 1.4 percent from previous close.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.