F&O Manual | Market turbulent; expect high volatility on monthly expiry as bears tighten grip

Among individual stocks, Jubliant Food works, Rec Ltd, Polycab and PEL witness short built up.

The Nifty50 is now down 1,300 points from its September 15 peak of 20,222 as the selloff intensified on October 26, the monthly expiry day. Over the last few sessions, the equity benchmark has come under heavy pressure from foreign institutional investors (FII) selling and monthly F&O expiry and it is not over.

The market may see a further fall later in the day, reacting to the bearish trends, say traders.

“The second half of the expiry day is expected to witness increased volatility with more extenuated and sharper price movements,” said trader Rajesh Shrivastava. “The market continues to signal bearish trends, and it is likely to experience further downward movement in the latter part of the month’s expiry day.”

At 12 pm, the Sensex was down 805.90 points or 1.26 percent at 63,243.16, and the Nifty was down 249.20 points or 1.30 percent at 18,873. About 502 shares advanced, 2579 shares declined, and 82 shares unchanged.

Just a month ago, the market was euphoric with the Nifty scaling new highs. Broader markets, too, were buoyant and the rally in some stocks was reaching inexplicable proportions.

Now, the benchmark has seen six straight sessions of selloff. The midcap index is down over 3,000 points from its peak, while the smallcap index has corrected over 700 points.

What’s weighing on the market

Arun Kumar Mantri, Founder of Mantri Finmart, said: “Markets have been under significant pressure due to the rising bond yields in the US, which have exceeded the psychological threshold of 5 percent. Additionally, Federal Reserve Chair Jerome Powell’s recent speech hinted at further rate hikes. The escalating conflicts in the Israel-Hamas conflict have also contributed to a decline in investor sentiment.”

On the domestic front, continuous selling by foreign institutional investors (FIIs), combined with bearish positioning in the monthly F&O expiry, has pushed down the index prices. The global markets and the increasing volatility in crude oil prices will play a significant role in determining the short-term trend.

Which stocks will gain if market rebounds?

If the market recovers from its current levels, it’s expected that banks, IT, and consumer durable sectors will rebound, and could be accumulated at this point.

“Stocks that had previously provided substantial returns have seen significant corrections, particularly in sectors like defense, railways, banking, and select mid-cap stocks, which have declined from higher levels,” Mantri added.

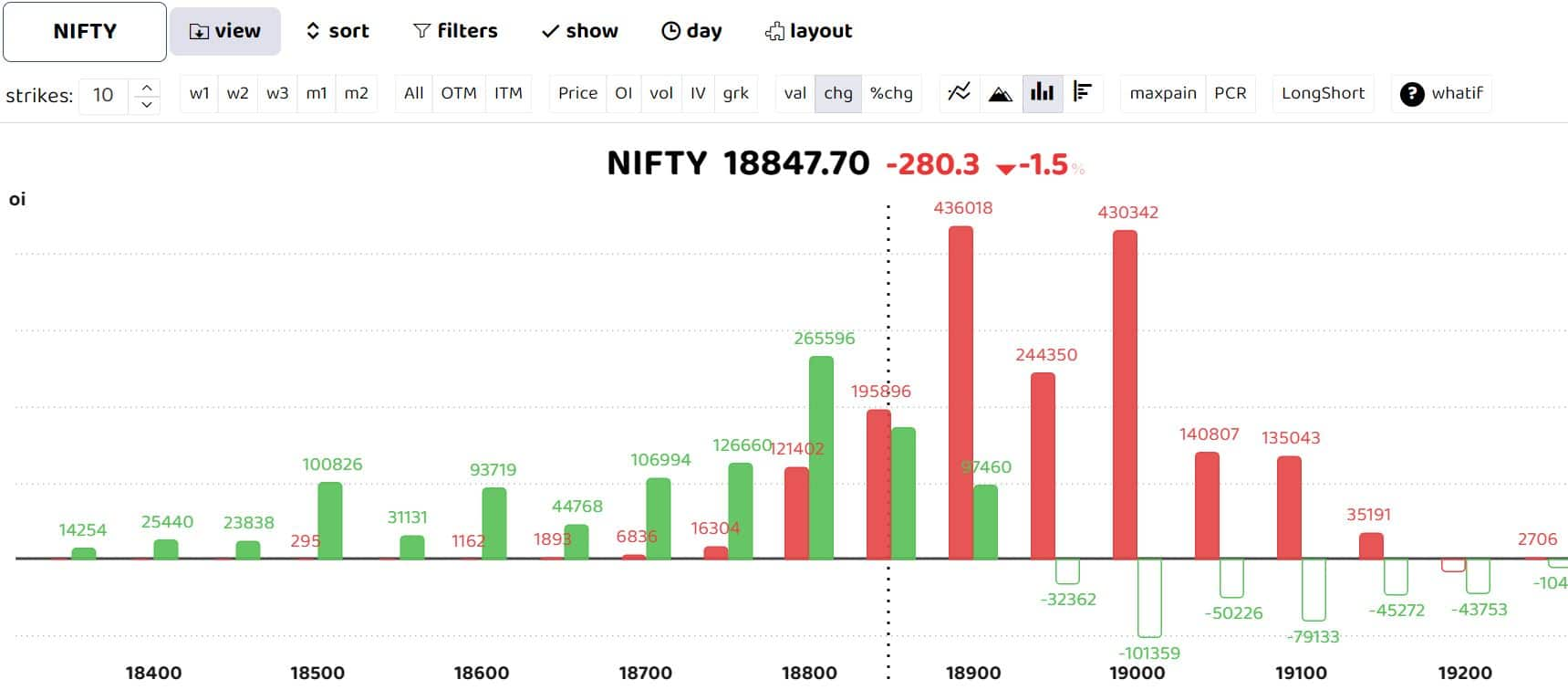

Here’s what Nifty options data shows

Options data suggests call writers dominant for the day with heavy call writing at 18950 and 19,000 strike. As per Axis Securities, “The high Open Interest concentration on Call side is seen at 19,100 strike followed by 18,950 & 18900 which may act as immediate resistance.

Open Interest concentration on Put side is seen at 18,800 strike followed by 18,700 & 18,600 which may act as immediate support.”

Among individual stocks, Jubliant Food works, Rec Ltd, Polycab and PEL witness short built up.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-80864706-af4bc38e94e34052a5106e15bf44b2a2.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-77294443-88c7023010c9410c933c8029b3931c91.jpg)