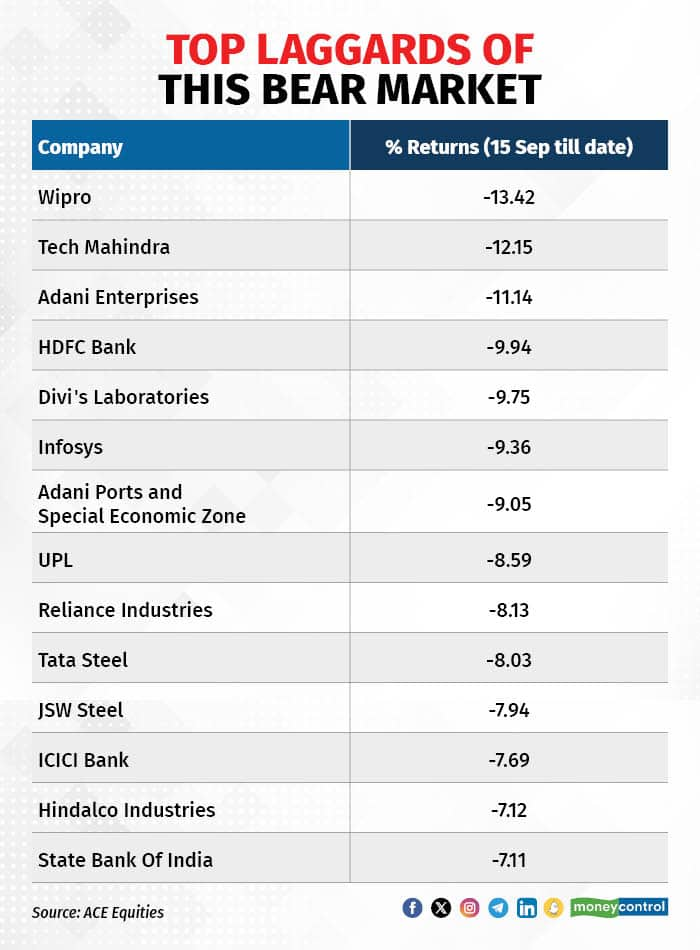

Wipro, TechM, Adani Enterprises, HDFC Bank biggest losers as Nifty sinks below 19,000

The slide has been sharp and quick. After hitting an all-time high of 20,222 on September 15, the Nifty has lost more than 1,000 points in a little over a month, with IT, banking and pharma stocks hit the hardest

Equity benchmark Nifty tumbled for the sixth straight session on October 26 to crash below 19,000

‘);

$(‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]);

//if(resData[stkKey][‘percentchange’] > 0){

// $(‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”);

// $(‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”);

//}else if(resData[stkKey][‘percentchange’] < 0){

// $(‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”);

// $(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

//}

if(resData[stkKey][‘percentchange’] >= 0){

$(‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”);

//$(‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”);

$(‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”);

}else if(resData[stkKey][‘percentchange’] < 0){

$(‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”);

//$(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

$(‘#gainlosstxt_’+articleId).find(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

}

$(‘#volumetxt_’+articleId).show();

$(‘#vlmtxt_’+articleId).show();

$(‘#stkvol_’+articleId).text(resData[stkKey][‘volume’]);

$(‘#td-low_’+articleId).text(resData[stkKey][‘daylow’]);

$(‘#td-high_’+articleId).text(resData[stkKey][‘dayhigh’]);

$(‘#rightcol_’+articleId).show();

}else{

$(‘#volumetxt_’+articleId).hide();

$(‘#vlmtxt_’+articleId).hide();

$(‘#stkvol_’+articleId).text(”);

$(‘#td-low_’+articleId).text(”);

$(‘#td-high_’+articleId).text(”);

$(‘#rightcol_’+articleId).hide();

}

$(‘#stk-graph_’+articleId).attr(‘src’,’//appfeeds.moneycontrol.com/jsonapi/stocks/graph&format=json&watch_app=true&range=1d&type=area&ex=’+stockType+’&sc_id=’+stockId+’&width=157&height=100&source=web’);

}

}

}

});

}

$(‘.bseliveselectbox’).click(function(){

$(‘.bselivelist’).show();

});

function bindClicksForDropdown(articleId){

$(‘ul#stockwidgettabs_’+articleId+’ li’).click(function(){

stkId = jQuery.trim($(this).find(‘a’).attr(‘stkid’));

$(‘ul#stockwidgettabs_’+articleId+’ li’).find(‘a’).removeClass(‘active’);

$(this).find(‘a’).addClass(‘active’);

stockWidget(‘N’,stkId,articleId);

});

$(‘#stk-b-‘+articleId).click(function(){

stkId = jQuery.trim($(this).attr(‘stkId’));

stockWidget(‘B’,stkId,articleId);

$(‘.bselivelist’).hide();

});

$(‘#stk-n-‘+articleId).click(function(){

stkId = jQuery.trim($(this).attr(‘stkId’));

stockWidget(‘N’,stkId,articleId);

$(‘.bselivelist’).hide();

});

}

$(“.bselivelist”).focusout(function(){

$(“.bselivelist”).hide(); //hide the results

});

function bindMenuClicks(articleId){

$(‘#watchlist-‘+articleId).click(function(){

var stkId = $(this).attr(‘stkId’);

overlayPopupWatchlist(0,2,1,stkId);

});

$(‘#portfolio-‘+articleId).click(function(){

var dispId = $(this).attr(‘dispId’);

pcSavePort(0,1,dispId);

});

}

$(‘.mc-modal-close’).on(‘click’,function(){

$(‘.mc-modal-wrap’).css(‘display’,’none’);

$(‘.mc-modal’).removeClass(‘success’);

$(‘.mc-modal’).removeClass(‘error’);

});

function overlayPopupWatchlist(e, t, n,stkId) {

$(‘.srch_bx’).css(‘z-index’,’999′);

typparam1 = n;

if(readCookie(‘nnmc’))

{

var lastRsrs =new Array();

lastRsrs[e]= stkId;

if(lastRsrs.length > 0)

{

var resStr=”;

let secglbVar = 1;

var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’;

$.get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) {

$(‘#backInner1_rhsPop’).html(data);

$.ajax({url:url,

type:”POST”,

dataType:”json”,

data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs},

success:function(d)

{

if(typparam1==’1′) // rhs

{

var appndStr=”;

//var newappndStr = makeMiddleRDivNew(d);

//appndStr = newappndStr[0];

var titStr=”;var editw=”;

var typevar=”;

var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’);

var phead =’Why add to Portfolio?’;

if(secglbVar ==1)

{

var stkdtxt=’this stock’;

var fltxt=’ it ‘;

typevar =’Stock ‘;

if(lastRsrs.length>1){

stkdtxt=’these stocks’;

typevar =’Stocks ‘;fltxt=’ them ‘;

}

}

//var popretStr =lvPOPRHS(phead,pparr);

//$(‘#poprhsAdd’).html(popretStr);

//$(‘.btmbgnwr’).show();

var tickTxt =’‘;

if(typparam1==1)

{

var modalContent = ‘Watchlist has been updated successfully.’;

var modalStatus = ‘success’; //if error, use ‘error’

$(‘.mc-modal-content’).text(modalContent);

$(‘.mc-modal-wrap’).css(‘display’,’flex’);

$(‘.mc-modal’).addClass(modalStatus);

//var existsFlag=$.inArray(‘added’,newappndStr[1]);

//$(‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’);

//if(existsFlag == -1)

//{

// if(lastRsrs.length > 1)

// $(‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’);

// else

// $(‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’);

//

//}

}

//$(‘.accdiv’).html(”);

//$(‘.accdiv’).html(appndStr);

}

},

//complete:function(d){

// if(typparam1==1)

// {

// watchlist_popup(‘open’);

// }

//}

});

});

}

else

{

var disNam =’stock’;

if($(‘#impact_option’).html()==’STOCKS’)

disNam =’stock’;

if($(‘#impact_option’).html()==’MUTUAL FUNDS’)

disNam =’mutual fund’;

if($(‘#impact_option’).html()==’COMMODITIES’)

disNam =’commodity’;

alert(‘Please select at least one ‘+disNam);

}

}

else

{

AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’;

commonPopRHS();

/*work_div = 1;

typparam = t;

typparam1 = n;

check_login_pop(1)*/

}

}

function pcSavePort(param,call_pg,dispId)

{

var adtxt=”;

if(readCookie(‘nnmc’)){

if(call_pg == “2”)

{

pass_sec = 2;

}

else

{

pass_sec = 1;

}

var postfolio_url = ‘https://www.moneycontrol.com/portfolio_new/add_stocks_multi.php?id=’+dispId;

window.open(postfolio_url, ‘_blank’);

} else

{

AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’;

commonPopRHS();

/*work_div = 1;

typparam = t;

typparam1 = n;

check_login_pop(1)*/

}

}

function commonPopRHS(e) {

/*var t = ($(window).height() – $(“#” + e).height()) / 2 + $(window).scrollTop();

var n = ($(window).width() – $(“#” + e).width()) / 2 + $(window).scrollLeft();

$(“#” + e).css({

position: “absolute”,

top: t,

left: n

});

$(“#lightbox_cb,#” + e).fadeIn(300);

$(“#lightbox_cb”).remove();

$(“body”).append(”);

$(“#lightbox_cb”).css({

filter: “alpha(opacity=80)”

}).fadeIn()*/

$(“.linkSignUp”).click();

}

function overlay(n)

{

document.getElementById(‘back’).style.width = document.body.clientWidth + “px”;

document.getElementById(‘back’).style.height = document.body.clientHeight +”px”;

document.getElementById(‘back’).style.display = ‘block’;

jQuery.fn.center = function () {

this.css(“position”,”absolute”);

var topPos = ($(window).height() – this.height() ) / 2;

this.css(“top”, -topPos).show().animate({‘top’:topPos},300);

this.css(“left”, ( $(window).width() – this.width() ) / 2);

return this;

}

setTimeout(function(){$(‘#backInner’+n).center()},100);

}

function closeoverlay(n){

document.getElementById(‘back’).style.display = ‘none’;

document.getElementById(‘backInner’+n).style.display = ‘none’;

}

stk_str=”;

stk.forEach(function (stkData,index){

if(index==0){

stk_str+=stkData.stockId.trim();

}else{

stk_str+=’,’+stkData.stockId.trim();

}

});

$.get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?classic=true&sc_id=’+stk_str, function(data) {

stk.forEach(function (stkData,index){

$(‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]);

});

});

function redirectToTradeOpenDematAccountOnline(){

if (stock_isinid && stock_tradeType) {

window.open(`https://www.moneycontrol.com/open-demat-account-online?classic=true&script_id=${stock_isinid}&ex=${stock_tradeType}&site=web&asset_class=stock&utm_source=moneycontrol&utm_medium=articlepage&utm_campaign=tradenow&utm_content=webbutton`, ‘_blank’);

}

}

There is nothing festive about the festival season for equity investors, with Dalal Street joining the global market selloff triggered by rising US bond yields and ratcheting up of geopolitical tensions.

The equity benchmarks the Sensex and the Nifty tumbled for the sixth straight session on October 26. The Nifty crashed below 19,000, the first time the blue-chip index breached the psychologically vital level since June 28. After touching a lifetime high of 20,222 on September 15, the Nifty has succumbed to selling pressure amid mixed second quarter earnings.

Also Read: Nifty slips below 18,900; US bond yield surge, inflation concerns loom large

The big losers

Wipro has been the biggest loser during the period after disappointing Q2 numbers. The Bengaluru-headquartered IT services player’s revenue declined for the third straight quarter due to a broad-based decline in its key verticals, including BFSI, communication, and manufacturing.

Wipro clocked the weakest growth among peers. With the company’s weak Q3 guidance in the range of -1.5 to -3.5 percent, analysts expect Wipro’s FY24 topline growth to be one of the lowest among Tier-1 IT firms.

“Wipro is stuck between an undemanding valuation and weak business traction,” analysts at HSBC said while maintaining a “hold” rating on the stock with a lower target price of Rs 350 a share.

Tech Mahindra is second on the list after it reported a whopping 61.6 percent fall in net profit at Rs 494 crore year-on-year in September quarter, signalling a washout second quarter driven by slowing demand in telecom and communications segment and delays in deal cycles.

Also read: Adani auditor EY faces accounting regulator inquiry

In fact, the entire domestic IT sector is on the backfoot as elevated interest rates and weak consumer sentiment in Western economies have led to a continued slowdown in discretionary spends, leading to delays in decision-making as well as deal conversions.

Adani Group flagship Adani Enterprises, too, was on the list. still reeling from the effects of the Hindenburg report. So was Adani Ports.

Also Read: FIIs raise stakes in major IT firms in Q2 despite weak earnings outlook

HDFC Bank, which reported its first quarterly results after it merged with the parent Housing Development Finance Corporation (HDFC), too, has continued to underperform.

While the Q2 numbers are not comparable to the pre-merger period, HDFC Bank’s management had provided proforma numbers for the first quarter to give a sense of how the merged entity would look.

As per an analysis by Jefferies, adjusted for the merger, HDFC Bank’s net profit declined by 2 percent sequentially against the reported 33 percent jump.

The biggest impact was on the net interest margin (NIM), which tumbled a whopping 70 basis points sequentially to 3.4 percent, as against the 4 percent-level HDFC Bank has traditionally maintained.

One basis point is one-hundredth of a percentage point.

The winning PSU

In contrast, a PSU stock has been the top performer during Nifty’s 1,000-point slide.

Shares of Coal India hit their 52-week high of Rs 319.55 on October 18 amid positive analyst commentary and sustained buying interest.

In a report earlier this month, brokerage house Nuvama Institutional Equities said that the coal player offered the triple benefits of volume growth, improved e-auction prices, and possible all-time high dividend in H2FY24.

“Despite the stock rallying ~25 percent since Sep-23, we expect further upside potential of 35 percent within a year, excluding the dividend of Rs 30 in H2FY24E and Rs 25 in FY25E,” said the brokerage.

As the monsoon recedes and hydro/wind generation falls, Nuvama said demand for thermal power is set to rise further in H2FY24. The rise in global coal prices, coupled with an uptick in industrial activity, pushed up the e-auction premium to 106 percent in the second quarter, up from 54 percent in the first fiscal quarter.

FMCG steady

Nestle India, Hindustan Unilever and Britannia have burnished the reputation of the FMCG space as a bulwark of safety during turbulent times.

Several brokerages have raised the target price of Nestle India and retained its ratings after the company reported an operating profit of more than 20 percent for the third straight quarter.

Auto companies, too, have performed well in a falling market, aided by robust demand and lower commodity prices.

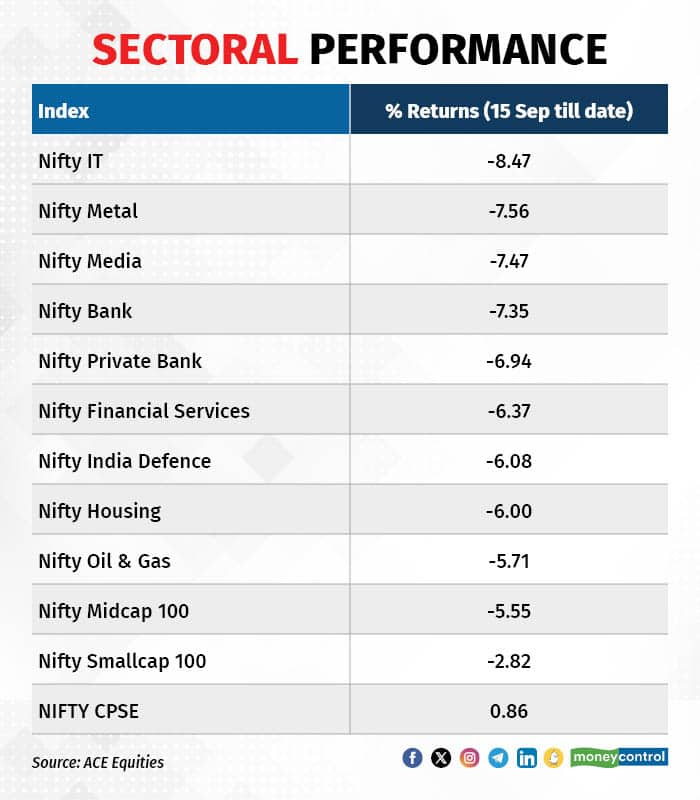

Sector-wise, IT, metal and media have been the worst performers. Only one index has managed to remain in the green – Nifty CPSE.

In the broader markets, a majority of midcap and smallcap stocks have succumbed to profit booking after a great run in recent times.

However, select realty, cement, and finance counters continued their outperformance.

The star performer during this period has been BSE.

Shares of BSE have been rising since October 21 when the stock exchange revised transaction charges in the equity derivatives segment, with effect from November 1. These changes will primarily be levied on S&P BSE Sensex Options, particularly the nearest or immediate expiry contracts.

With the increase in transaction costs, margins for BSE in the coming quarters are bound to improve, as more traders join the options trading bandwagon and hence the phenomenal rally in the BSE stock price, according to AR Ramachandran of Tips2trades. Additionally, the rising demand for the stock is also driven by the robust growth in derivatives volumes and the rising traction in its mutual fund platform Star MF.

However, looking at the overall picture, we are not out of the woods yet, according to market experts.

“There is risk-off in global equity markets triggered by a combination of economics and geopolitics. The Israel-Hamas conflict continues to be a major headwind for markets,” said V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

If the conflict lingers, it has the potential to impact global growth too, when the global economy is already in the midst of a slowdown, he said.

“In the near-term, however, the strongest headwind for the market is the stubbornly high US bond yields. With the 10-year bond yield at near 5 percenrt, FPIs are likely to be in the sell mode. Sectors like banking and IT which constitute the largest segments of the AUM of FPIs are likely to be under pressure. This will provide opportunities for long-term investors to buy quality stocks, particularly in banking, at attractive rates,” he added.

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-80864706-af4bc38e94e34052a5106e15bf44b2a2.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-77294443-88c7023010c9410c933c8029b3931c91.jpg)