F&O Manual: Indian market rebounds, Nifty witnesses short covering

Among individual stocks, Canara Bank, RBL Bank, and Shriram Finance are witnessing long build-up.

The Indian equity benchmark indices are showing signs of recovery, opening with a gap up after yesterday’s session’s rout. All the sectoral indices are trading in the green, with the auto, capital goods, IT, power, and realty sectors up by 1 percent each. Infosys, Apollo Hospitals, Wipro, HCL Technologies, and SBI are among the major gainers on the Nifty.

According to Chandan Taparia, Senior VP and Head of Derivatives at Motilal Oswal Financial Services, “India VIX decreased by 8.50%, from 12.82 to 11.73 levels in the October series. Volatility remained comparatively lower for most of the series, rising to 12.8 zones towards the end, paving the way for the bears. Despite a sharp selloff, there wasn’t a spike in the Greed and Fear Index, which indicates no panic and a resiliently stronger market compared to our global counterparts.”

Catch all the market action here

At 10 AM, the Sensex was up 502.37 points or 0.80 percent at 63,650.52, and the Nifty was up 147.80 points or 0.78 percent at 19,005.10. About 2461 shares advanced, 365 shares declined, and 87 shares unchanged.

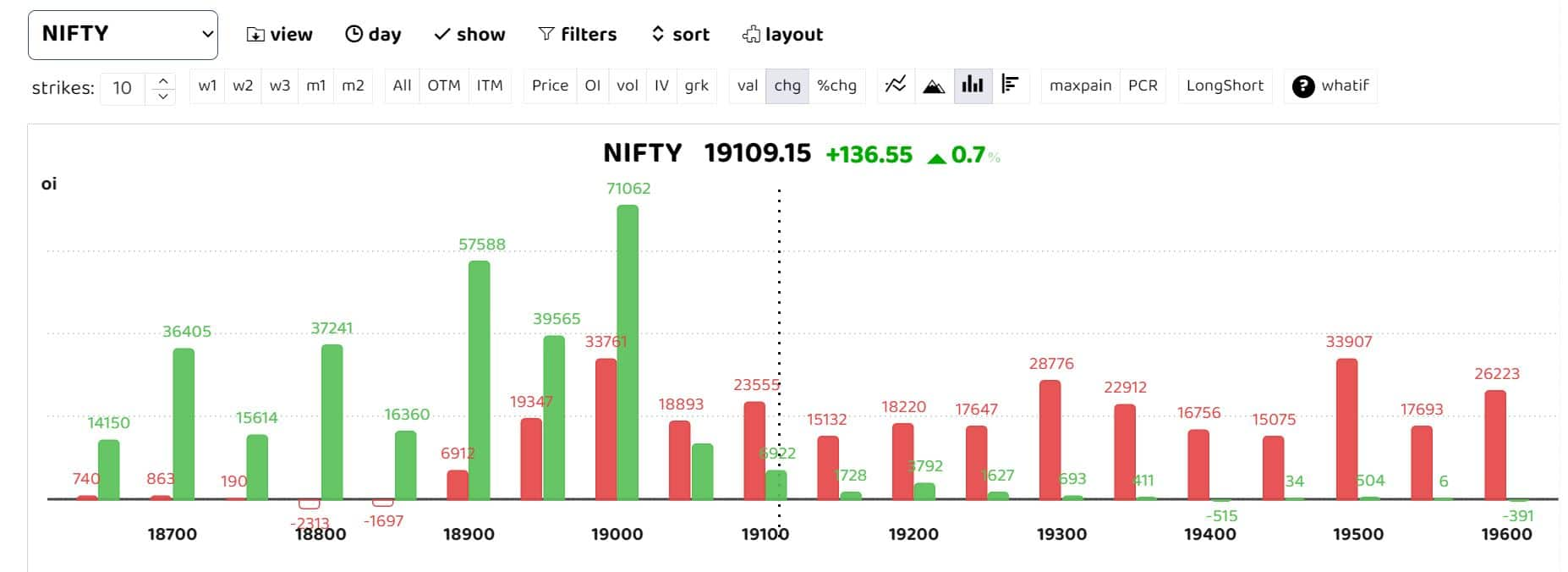

The bar in green shows the change in put open interest, while red shows the change in call open interest levels.

Option data suggests that put writers are dominant for the day, with straddle positions built up at the strike of 19,000 and 18,950.

Since it is the beginning of a new expiry, option data is scattered at various far strike prices. On the weekly front, the Maximum Call Open Interest is at 19,100 and then at the 19,400 strike, while the Maximum Put Open Interest is at 18,000, 18,500, and 18,800 strikes. According to Chandan Taparia, “Nifty closed near the last session’s 18,850 zones, and the At The Money Straddle (November Monthly 18,850 Call and 18,850 Put) is trading at a net premium of around 575 points, giving a broader range of 18,275 to 19,425 levels. Considering overall Derivatives activity, we expect dampness to continue in Nifty as we head into the November series. We expect Nifty to be in a broader range between 18,500 and 19,500 zones at the start of the November series with stock-specific action and capped upside in the market.”

Among individual stocks, Canara Bank, RBL Bank, and Shriram Finance are witnessing long build-up.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-80864706-af4bc38e94e34052a5106e15bf44b2a2.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-77294443-88c7023010c9410c933c8029b3931c91.jpg)