Stocks that remained resilient in market carnage and why

- Hot Stocks

admin

- October 29, 2023

- 0

- 47

- 30 minutes read

Over the past six sessions, Indian markets saw a steep 7% drop in both the Sensex and Nifty indices

Over the past few sessions, there was a steep fall in both Sensex and Nifty. This decline followed a strong rally since April, driven by improving economic conditions and foreign investments. However, in October, high valuations, foreign investor sell-offs, rising crude oil prices and geopolitical tensions contributed to significant selling pressure. Nonetheless, a few stocks managed to remain resilient during this period. (Data as of October 26 closing price)

BSE Ltd: The stock has surged by nearly 22 percent in the past six sessions even as equity markets saw selling pressure. The gains in the stock are driven by strong expectations of earnings growth as the company enters the index options market. The stock saw impressive gains of over 30 percent in July and August, a 22 percent rise in September and a nearly 39 percent jump in October. Several factors are contributing to this rally, including increased volumes in equity and index derivatives, broader participation in the cash segment, higher charges on equity derivatives and growing transaction fees for index options. BSE is gaining market share in derivatives, especially with the introduction of weekly index options in May, dominating BSE derivatives trading and providing more options for investors.

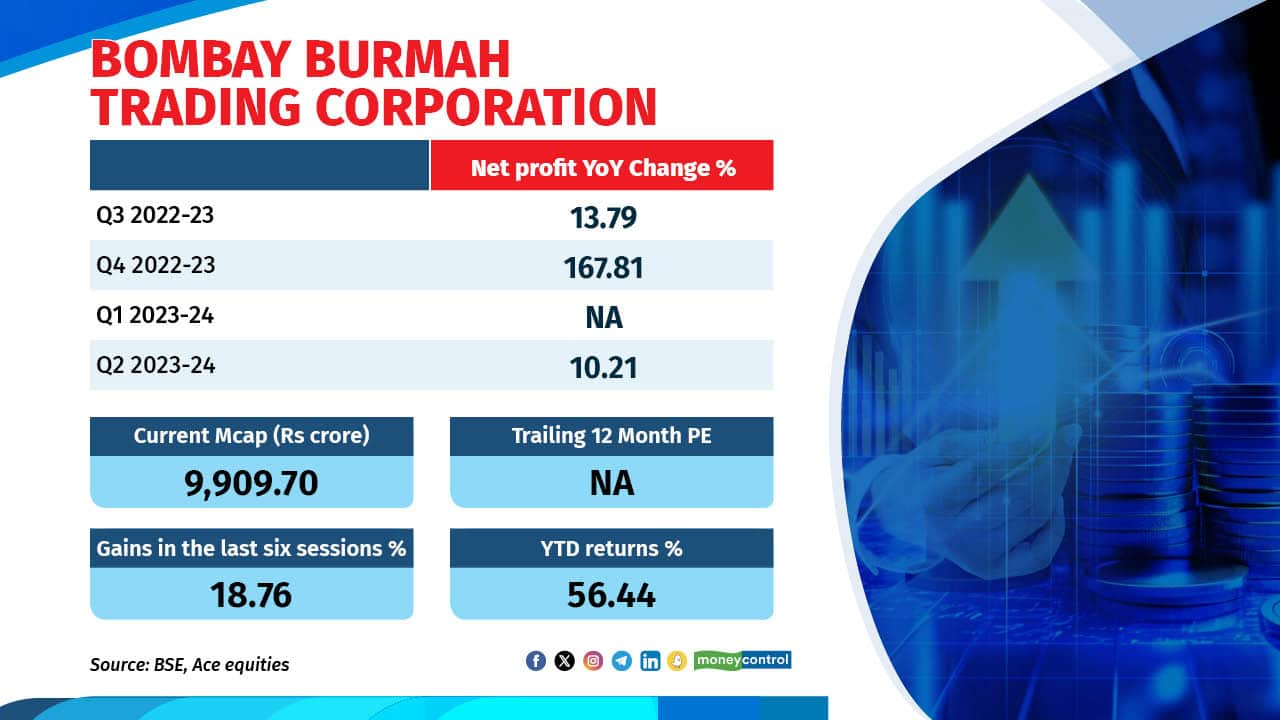

Bombay Burmah Trading Ltd: The stock has surged by nearly 19 percent amid the recent six-session decline in India’s Sensex and Nifty indices. The stock has delivered impressive returns of almost 90 percent since the beginning of 2023. This firm is an investment company within the Wadia Group. The stock’s recent rally was driven by the news that a Wadia Group subsidiary, Bombay Dyeing and Manufacturing Company Limited (BDMC), is selling 22 acres in Worli to Goisu Realty Pvt, a subsidiary of Sumitomo Realty & Development Company Limited, for Rs5,200 crore in one of Mumbai’s most prominent land deals, aimed at debt repayment and future project funding.

Angle One Ltd: It has surged by nearly 15 percent in the past six sessions. The stock jumped over 84 percent so far this year. The stock broking services provider recently reported a robust performance in Q2-FY24, with a 40.7 percent YoY increase in gross revenue to Rs 1,049 crore driven by client growth and order volume. Profit after tax also rose by 37.9 percent QoQ to Rs 304.5 crore. The company added a record 2.1 million clients in the quarter marking a 59.8 percent QoQ growth and bringing the total client base to nearly 17.1 million, a 13.3 percent QoQ increase. Additionally, the total number of orders surged by 36.1 percent QoQ to 338 million from 249 million in Q1-FY24.

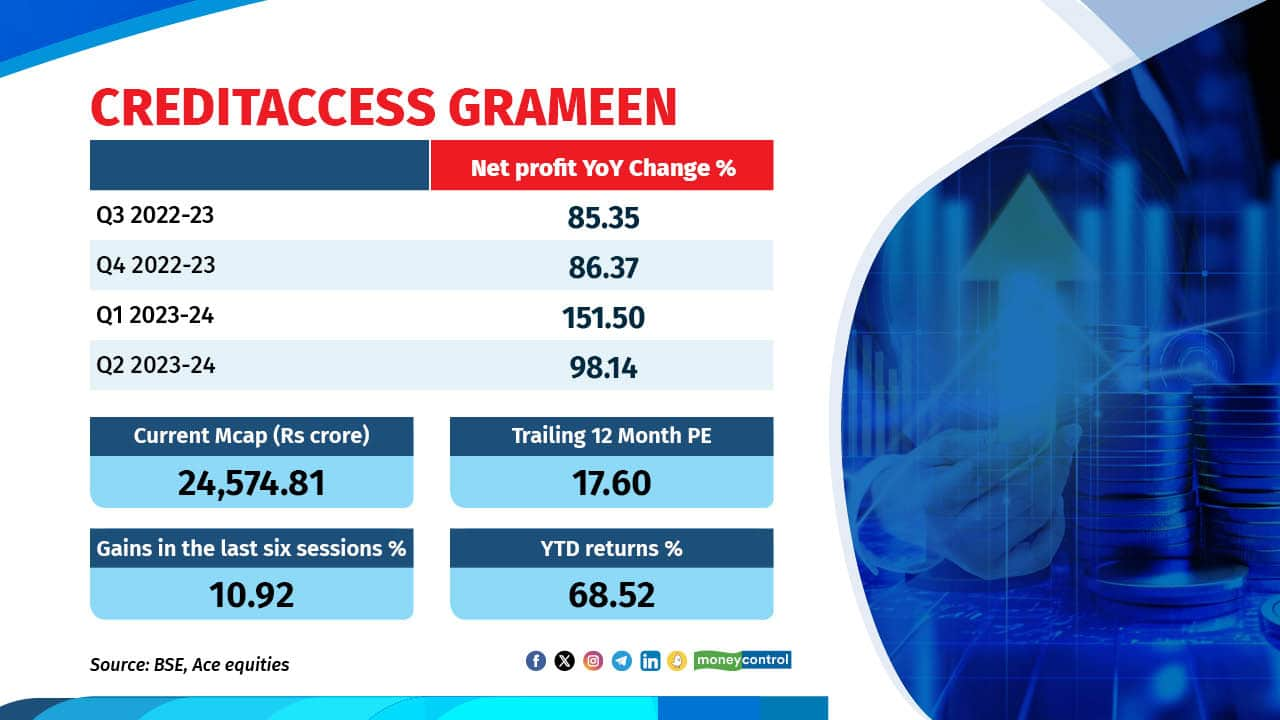

CreditAccess Grameen: The stock rose by 11 percent in the last six sessions and is up by 68 percent this year. This performance is notable despite selling pressure in local equities. In Q2, the company’s net profit nearly doubled to Rs 347 crore, driven by higher loan sales and a 53 percent YoY increase in total income, mainly due to greater net interest income (NII). Analysts at Motilal Oswal foresee CreditAccess Grameen as a segment leader due to low-cost organized financing, improved operational efficiency through technology, and integrated risk management for enhanced asset quality and reduced credit costs. They anticipate strong return ratios and value the stock as inexpensive.

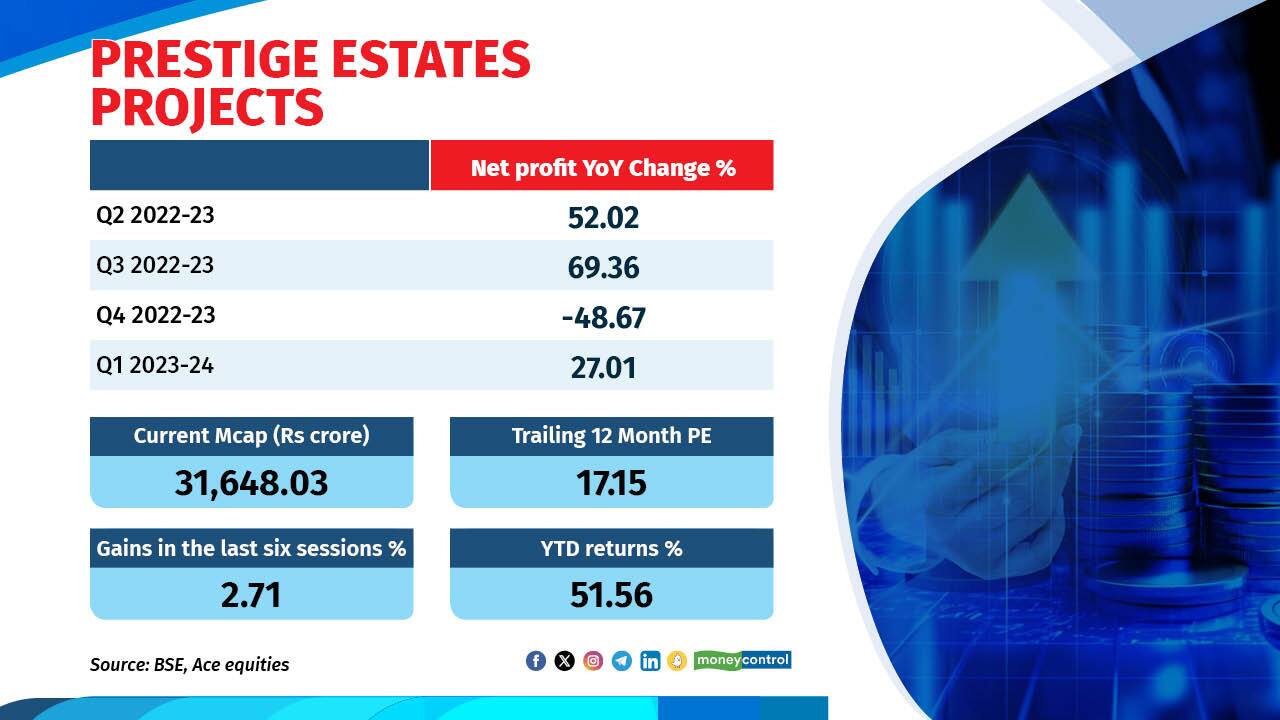

Prestige Estates Projects Ltd: The stock surged 10 percent in the last six sessions and over 69 percent this year. Their Q2 performance update revealed record-breaking sales of Rs 11,007.3 crore in the first half of FY24, a 69 percent YoY increase, driven by a sales volume of 10.7 million square feet. In Q2 FY24, they reported sales of Rs7,092.6 crore, a massive 102 percent YoY growth, with sales volume at 6.84 million square feet. In H1 FY24, they launched new projects covering 16.20 million square feet, with 8.11 million square feet completed. Analysts anticipate a 4x growth in its annuity revenue from FY24–28E. While the residential segment will generate strong cash flows, substantial annuity capital expenditure and business development requirements (Rs 3,000 crore-plus annually) are expected to increase PEPL’s leverage with net debt-to-equity reaching 0.9x, analysts added.

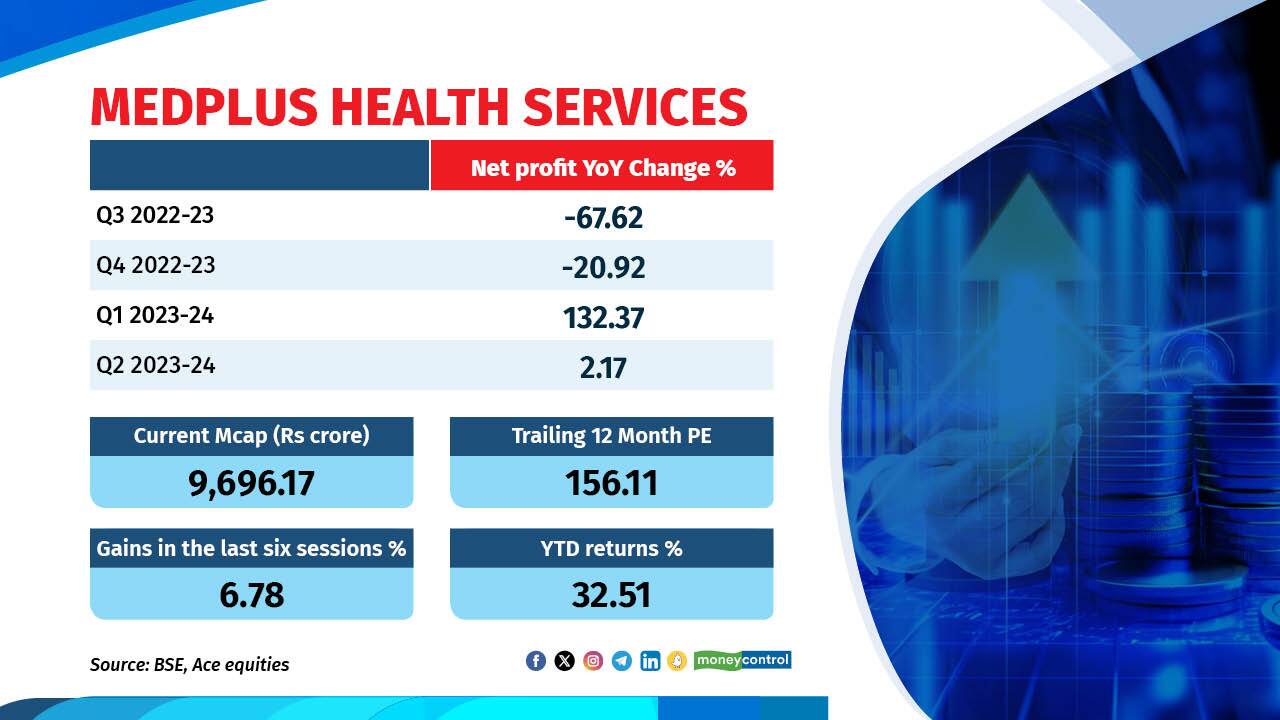

Medplus Health Services Ltd: The counter witnessed nearly 7 percent gains in the last six sessions and is up 33 percent year-to-date. After a 20 percent correction in August and September due to weak Q1 earnings, the company plans to announce its Q2 earnings on November 8. Medplus is focusing on expanding with 1000 new stores in FY2023, aiming to sustain this momentum. However, aggressive store additions may pressure margins due to increased employee costs. The competitive market, with new players offering discounts, could impact profitability for existing companies, according to analysts. Analysts expect as a result, OPM is forecasted to decline by 120 bps from FY2022 to FY2023. The current market price (CMP) reflects a trading multiple of 120.4x/62.4x for FY2023E/FY2024E EPS and 29.1x/22.2x for FY2023E/FY2024E EV/EBITDA.

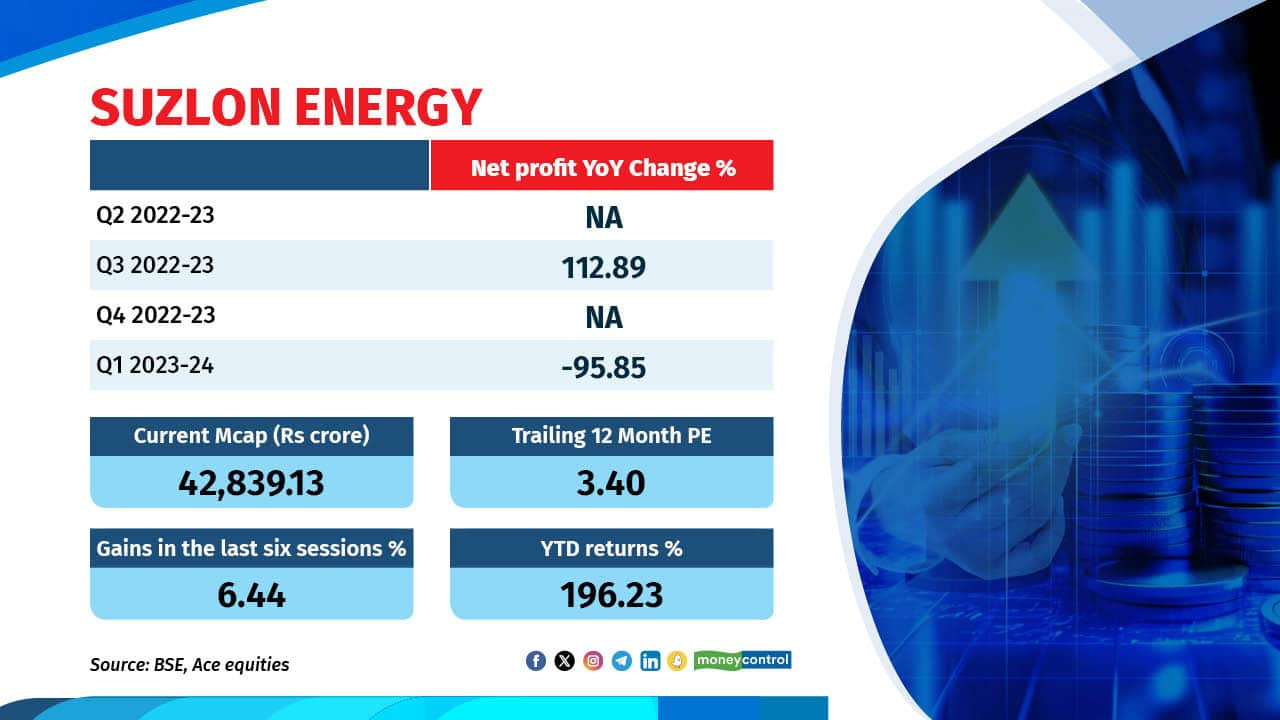

Suzlon Energy: The stock was up 7 percent in the last six trading sessions even as local equities saw huge selling pressure. In 2023 so far, Suzlon saw a remarkable 196 percent gain and in the past six months it surged by 286 percent, outperforming the Nifty. This boosted its market capitalisation above Rs 42,000 crore. Despite a 471 percent increase over the last five years, it remains 92 percent below its all-time high. Analysts credit this growth to debt reduction, lower interest costs and an improved financial risk profile. In the past year, the company refinanced its debt and raised Rs 2,000 crore in a QIP with Rs 1,500 crore allocated for debt repayment and the rest for working capital and capex needs. Suzlon’s order book expanded from 652 MW in Q4 FY23 to 1,582 MW in Q1 FY24, ensuring revenue visibility for the next two years, according to JM Financial analysts.

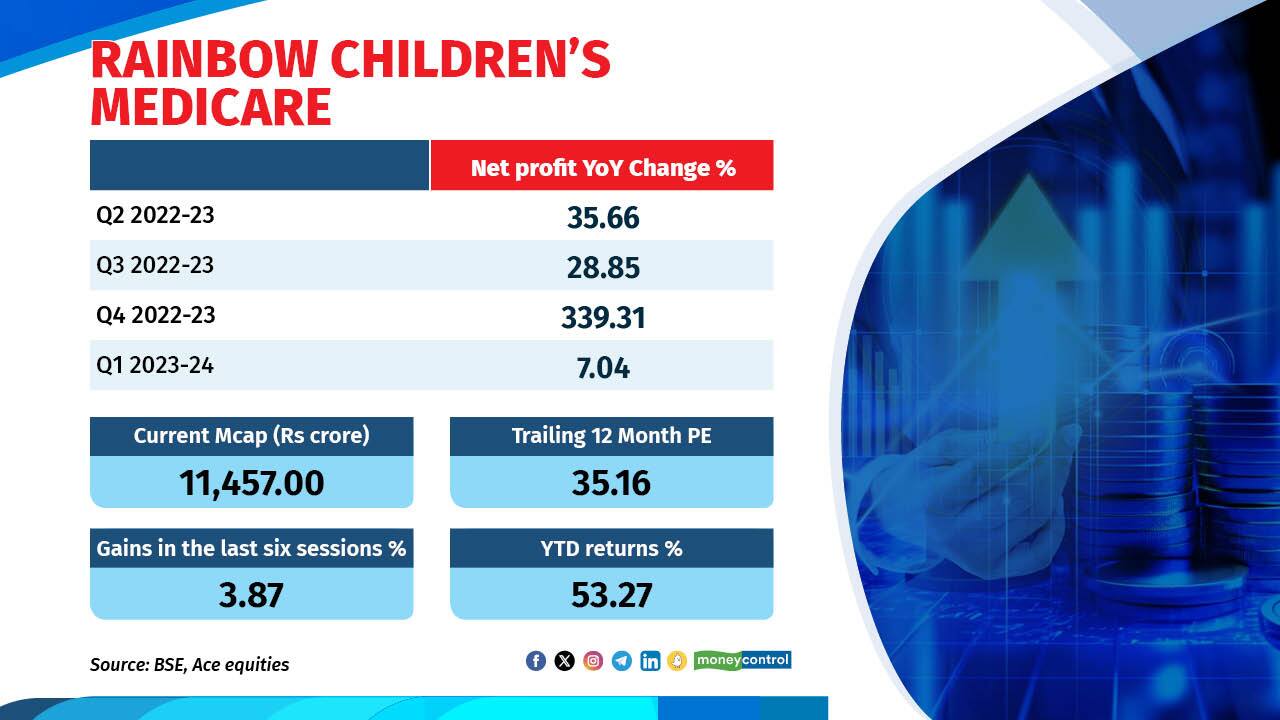

Rainbow Children’s Medicare Ltd: The counter saw gains of nearly 4 percent in the last six sessions and over 53 percent year-to-date. Since its IPO, the company has consistently reported 12-16 percent YoY revenue and PAT growth, attributed to increased bed capacity, better realisations, and occupancy rates. The stock, currently trading at 31 times one-year forward valuations, stands to benefit from its maturing hospital profile, unique healthcare model and expansion of its proven hub-and-spoke system, analysts said.

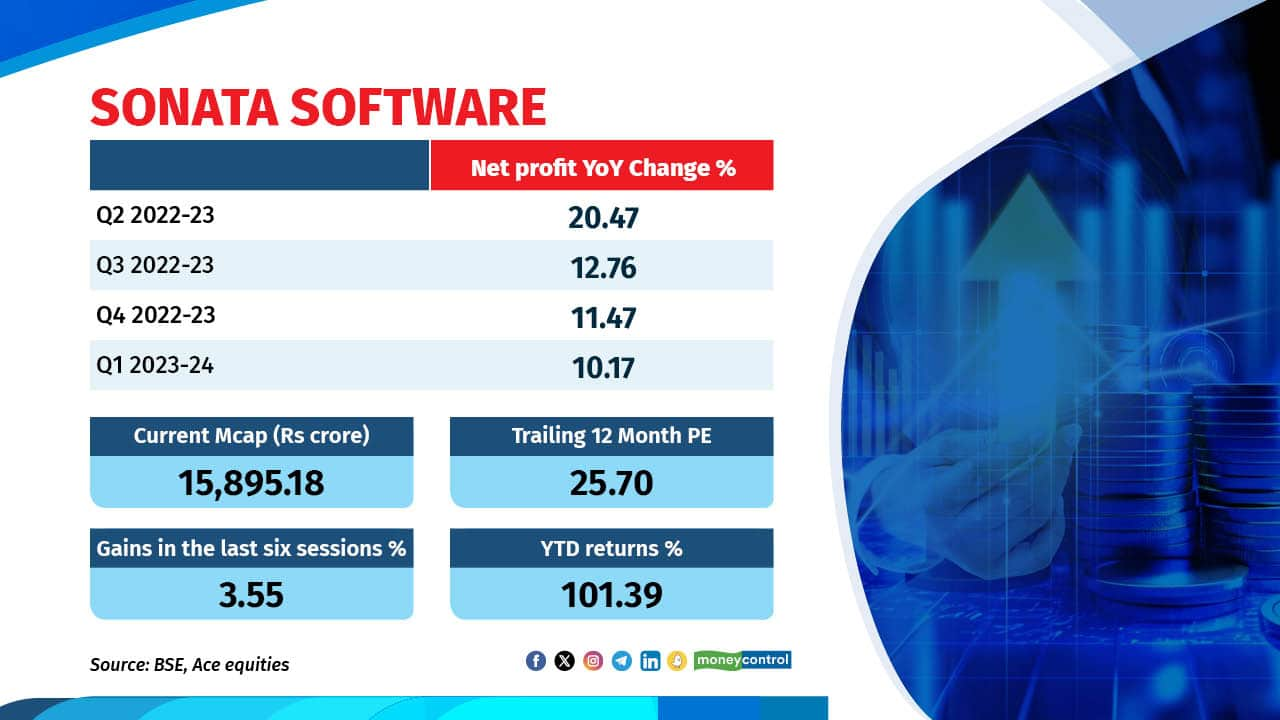

Sonata Software Ltd: It has surged 3.5 percent in the last six trading sessions and 100 percent year-to-date. In the July-September period, the company reported a consolidated profit of Rs 124.2 crore, a 3.4 percent increase from a quarter ago, while revenue from operations dipped 5.1 percent sequentially to Rs 1,912.6 crore. Sonata Software also announced an interim dividend of Rs 7 per share for the current FY and announced a 1:1 bonus issue. CEO Samir Dhir recently in a CNBC interview mentioned they outperformed industry peers with a 5 percent QoQ growth. The company aims to achieve $1.5 billion in revenue by the end of FY2026, expecting high-teen to mid-twenties growth in the coming years, primarily organic. Sonata Software, headquartered in Bangalore and operating globally, offers software solutions across various sectors, including media, healthcare and life sciences.

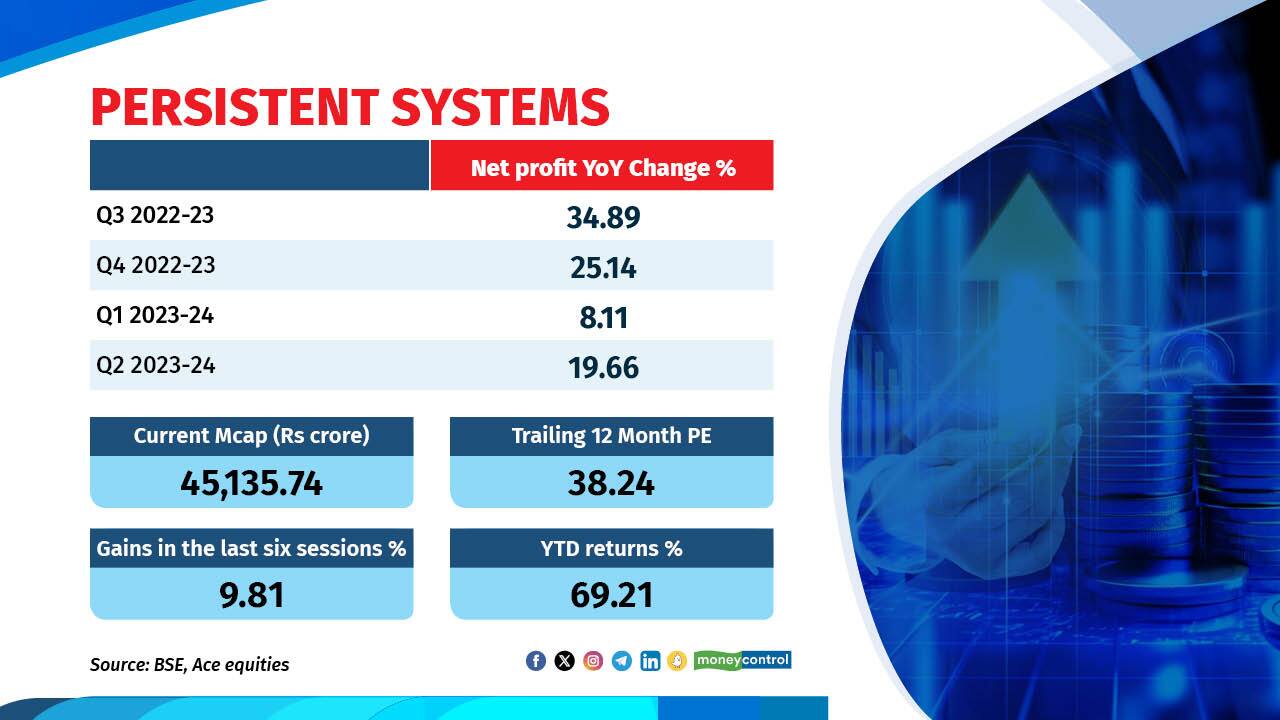

Persistent Systems: The stock has seen a nearly 3 percent gain in the last six sessions and a year-to-date rise of over 51 percent. Since August, the stock has gained 26 percent. For the September quarter, it recorded a 3.2 percent constant currency growth, slightly exceeding analyst estimates. The 13.7 percent margin, while a bit below consensus due to wage hikes, aligned with analysts’ expectations. Growth was driven by Healthcare and Life Sciences (up 7 percent QoQ USD) and Hi-tech (up 3.8 percent), while BFSI remained flat QoQ. Notably, North America and APAC showed strong performance, and the company aims to recover margins in the next two quarters while maintaining its focus on growth. Analysts attribute Persistent Systems’ consistent performance to its strength in Hi-Tech, client focus, wallet share gains through execution and participation in efficiency deals.

Moneycontrol News

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

`);

}

if (res.stay_updated) {

$(“.stay-updated-ajax”).html(res.stay_updated);

}

} catch (error) {

console.log(‘Error in video’, error);

}

}

})

}, 8000);

})

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1180036854-bd92321f0ee641728f625256956e8a54.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-2007594509-ba97533a0736449eb4661aa3324f7d5b.jpg)