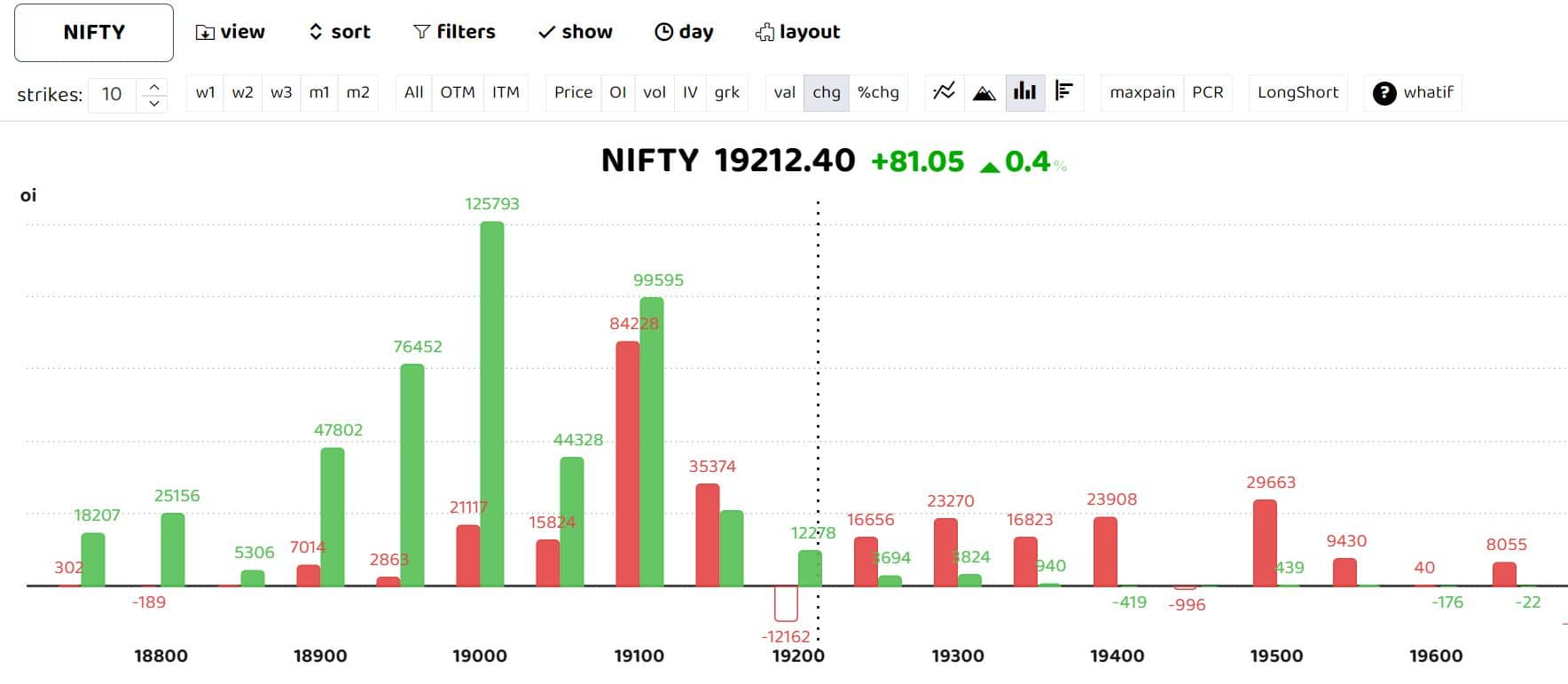

F&O Manual | Nifty data shows key straddle positions at 19,100 strike amid volatility

Analysts expect Bank Nifty to spend some time in consolidation before fresh directional move

The Indian market opened with a gap down but was trading higher mid-day amid volatility.

Reliance Industries, BPCL, Cipla, SBI Life Insurance and Bharti Airtel are among the top gainers on the Nifty, while losers are Maruti Suzuki, Tata Motors, M&M, Axis Bank and NTPC. Among sectors, realty and oil & gas were up 1 percent each, while selling was seen in the auto, bank, capital goods, FMCG, and power counters.

At 1 pm, the Sensex was up 282.10 points or 0.44 percent at 64,064.90, and the Nifty was up 71.70 points or 0.38 percent at 19,119. About 1710 shares advanced, 1495 shares declined, and 149 shares unchanged.

Options data suggests heavy put writing at 19000 and 18950 strikes. Key straddle position can be seen at 19100 levels. As per Axis Securities, “The chart pattern suggests that if Nifty crosses and sustains above the 19200 level, it could witness buying, propelling the index towards 19300-19400 levels. However, if the index breaks below the 18900 level, it could witness selling, pushing it towards 18750-18600. For the week, we expect Nifty to trade in the range of 19400-18600 with a negative bias. The weekly strength indicator RSI is moving downwards and is quoting below its reference line indicating a negative bias.”

Bank Nifty

Raj Deepak Singh, Head of Derivatives at ICICI Securities, said, “A sharp recovery seen in PSU banking stocks helped Bank Nifty to trim the weekly losses to near 1.6 percent. However, Bank Nifty closed the last week in negative territory for the sixth consecutive week as it closed at its lowest levels seen since May 2023. Going ahead, we expect that last week’s low near 42000 should act as immediate support for Bank Nifty and it may spend some time in consolidation before a fresh directional move.”

Weekly technical pick- Axis securities

Canara Bank

A derivatives expert said, “Despite the underperformance last week, none of the PSU bank stocks significantly deteriorated. Their performance, while lacklustre compared to 14 days prior, remained relatively stable, suggesting resilience in contrast to the overall market trend.”

According to Axis Securities, the PSU Canara Bank stock is showing higher highs and lows on the weekly chart, forming an upward-sloping trendline, indicating a strong uptrend. The stock experienced a surge in trading volume during the breakout, indicating a substantial increase in market participation at the breakout level. The weekly strength indicator RSI with a crossover above its reference line generated a ‘buy’ signal. The above analysis indicates an upside of 407-418 levels with a holding period of 3 to 4 weeks.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.