These stocks have earnings momentum heading into their reports this week

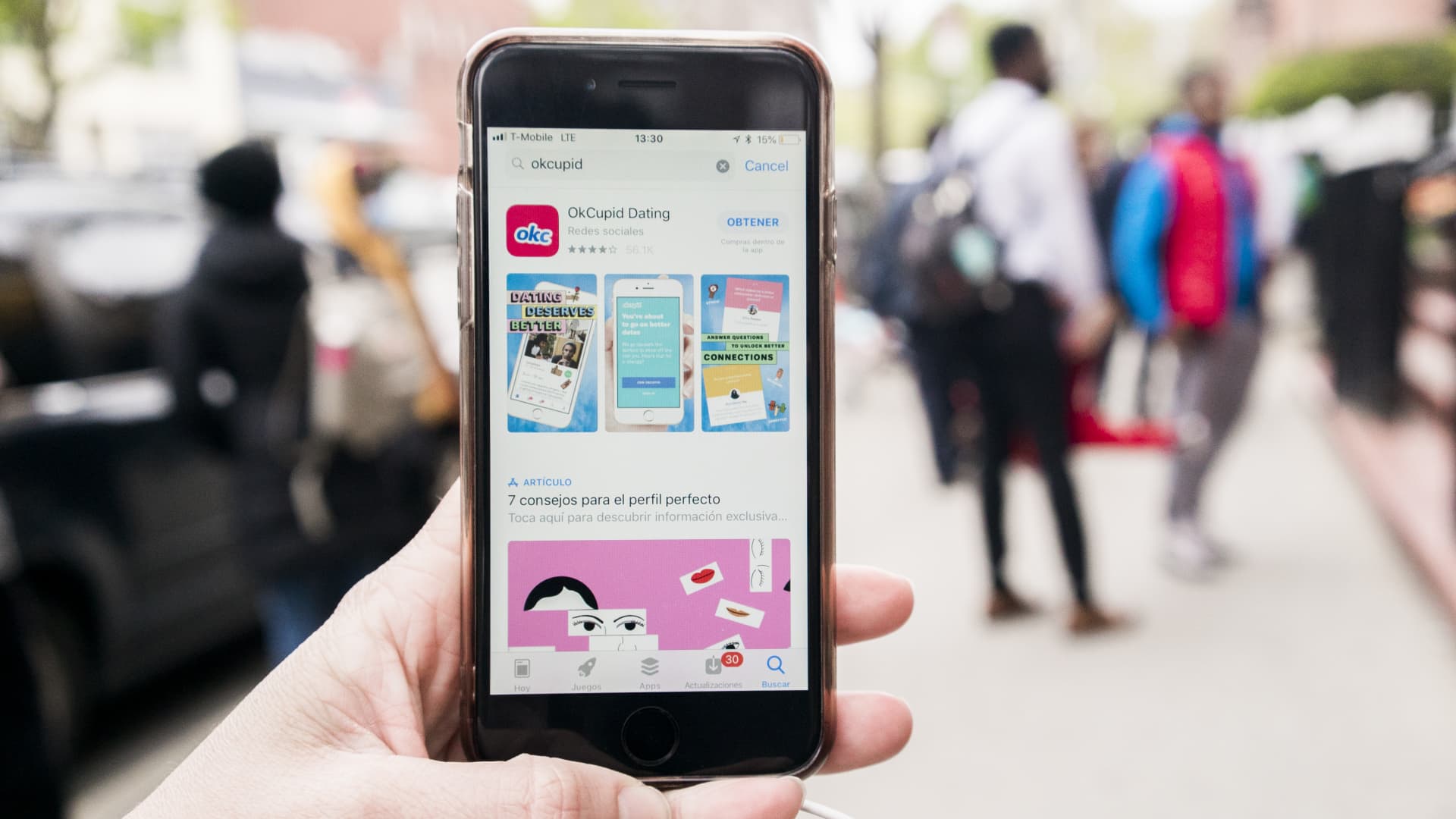

Another chunk of companies are set to report this week, and analysts think earnings are on their side. About 50% of S & P 500 companies have reported earnings for the third quarter. Of those companies, nearly 77% have exceeded expectations, FactSet data shows. Roughly 30% of S & P 500 companies are reporting this week. CNBC Pro screened for the S & P 500 companies reporting this week that analysts are most excited about, leading them to lift their earnings estimates. Here is the criteria we followed for the search: EPS estimates are up 15% or more in past three months. EPS estimates are up 15% or more in past six months. Well-liked by analysts: These stocks have buy ratings from at least 55% of analysts covering them. Match Group has the highest potential upside of the list and more than half of analysts covering the stock rate it a buy, expecting the global dating service company to pop more than 68% in the next 12 months. Earnings per share estimates are also up 18.1% and 29.6% in the past three and six months, respectively. Shares of the company — which owns several popular dating apps such as Tinder, Hinge and Azar — are down 18% for the year. The company is set to report earnings Tuesday after market close. Bank of America maintained its buy rating on Match Group, saying it views the company’s current valuation as “attractive to growth” and expects multiple expansion largely on revenue acceleration, according to an Oct. 23 note. The firm expects Tinder to revive its year-to-year user growth in 2024, following a slowdown in users and share loss to Bumble and Hinge. First Solar has the highest changes in analysts’ earnings per share estimates, up 90% and 115.1% in the past three and six months, respectively. The residential solar company is rated buy by nearly 57% of analysts covering it. JPMorgan upgraded the stock to overweight on Oct. 19, viewing its recent pullback as an attractive entry point for investors. Shares have slid about 9% this year, with losses accelerating this month after peer solar company SolarEdge cut its third-quarter guidance on slowing demand in Europe. First Solar will report Tuesday after the close. Energy names Marathon Petroleum and Entergy also made the list, with analysts expecting more than 15% and 9% upside to the stocks, respectively. Entergy on Monday agreed to sell its gas distribution business to a private equity management firm for about $484 million in cash, sending the stock 3% higher Monday. The company’s shares are down roughly 16% this year. Entergy is slated to post results Wednesday before the bell. Marathon’s stock, on the other hand, is up 26% for the year. The oil and gas giant increased its quarterly dividend 10% last week and announced a $5 billion share repurchase authorization. More than half the analysts covering the stock rate it a buy. Marathon will post earnings Tuesday morning. Other names that analysts are bullish on this earnings season include semiconductor company Advanced Micro Devices , industrial firm Ingersoll Rand and information management services company Iron Mountain . — CNBC’s Michael Bloom contributed reporting.