F&O Manual | Nifty 50 sentiment eases with heavy call writing, Fin Nifty looks bearish

Among individual stocks, SBI Life, MCX, Pidilite India see long build up. While Siemens, Sun Pharma and Ongc witness short built up.

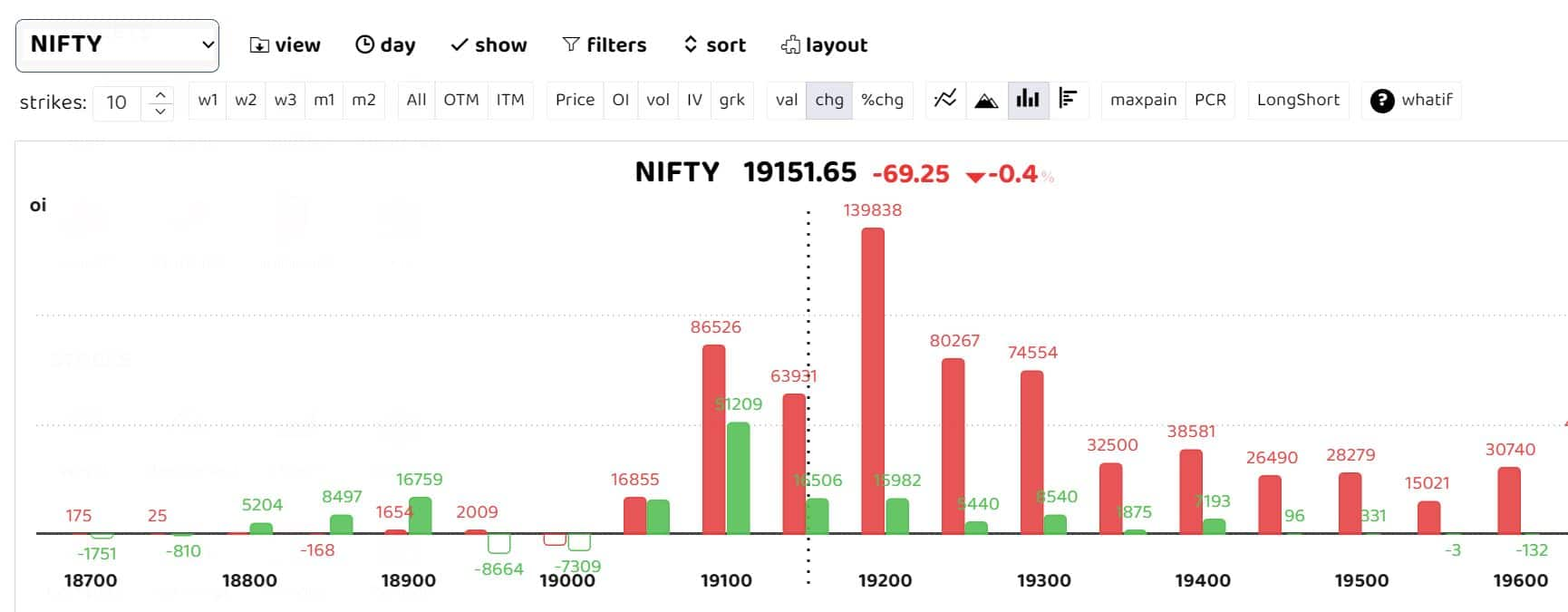

Indian equity markets traded sideways till mid-day on October 31, with call writers dominant at 19,250 and 19,300 strikes on the Nifty 50. Heavy call writing at these strikes shows limited upside expectation for the benchmark index.

“Sentiment has eased somewhat with several major frontline stocks showing improved bias, indicating a potential trend reversal,” Prabhudas Lilladher said in a note.

At 1pm,the Sensex was down 167.97 points or 0.26 percent at 63,944.68, and the Nifty was down 46.90 points or 0.25 percent at 19,094. About 1,717 shares advanced, 1,372 declined, and 98 traded unchanged.

Among the sectors, IT, pharma, oil and gas, metal, and capital goods were down by 0.3-0.8 percent, while the realty and PSU Bank indices were up by 0.5-1 percent each. Top losers on the Nifty include Sun Pharma, ONGC, LTI Mindtree, M&M and Eicher Motors.

The bars in green represent the change in put open interest (OI), while the ones in red depict the change in OI for call options.

The benchmark Nifty 50 needs to break above 19,250 points for turning around the sentiment to positive, said Prabhudas Lilladher. “To establish stronger conviction and improve the bias for anticipating further rise, the index would require a decisive move in the 19,200-19,250 zone. Support for the day is seen at 19,000 levels, while resistance is identified at 19,300 levels,” it said.

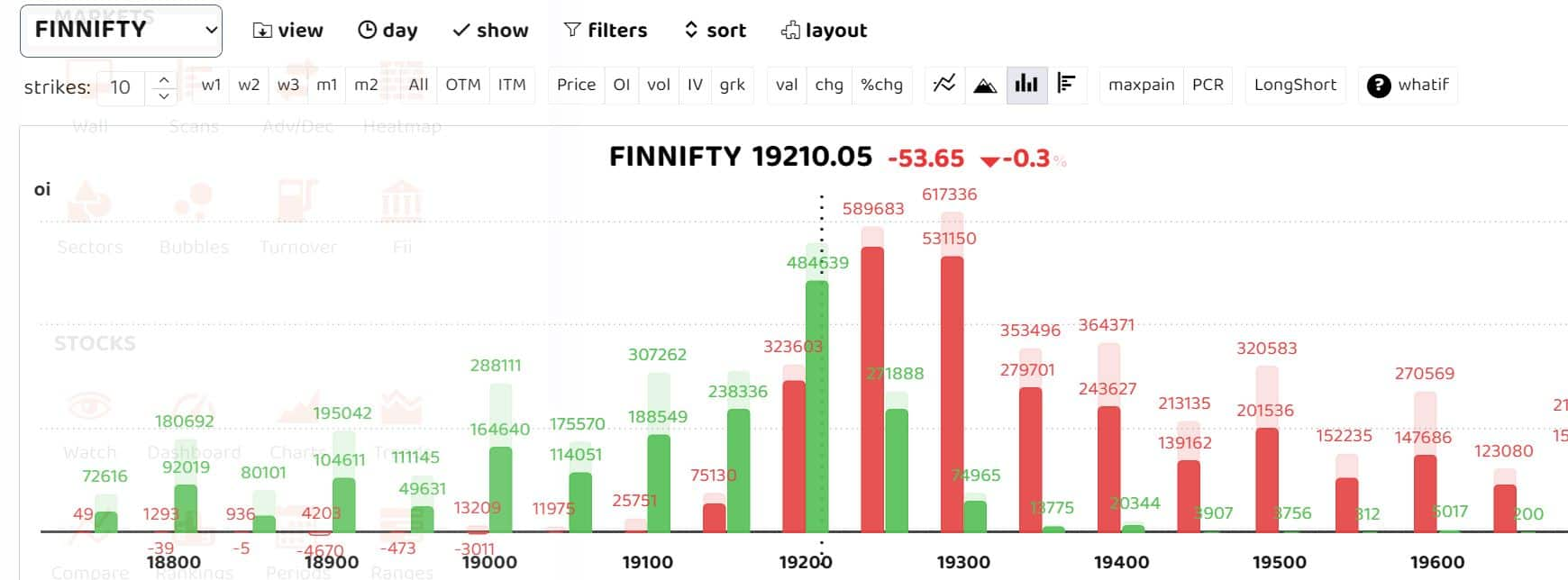

Fin Nifty derivatives outlook

October 31 is also Fin Nifty expiry day. Fin Nifty options data shows sideways to negative momentum with heavy call writing at 19,300 and 19,400 strike forming key resistance.

Change in open interest data shows highest addition at 19,500, followed by 19,400 and 19,200 call strikes. While the highest addition is witnessed at 19,000, followed by 19,200 and 18,800 put strikes.

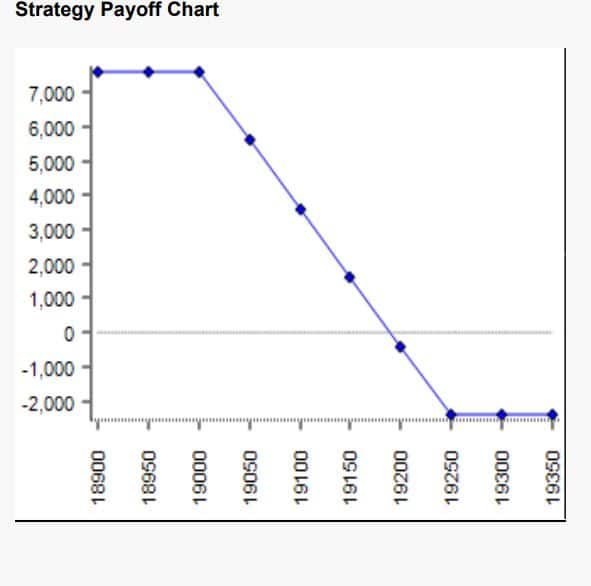

Axis Securities moderately bearish on Fin Nifty; put spread strategy to make modest profit

“Traders could initiate put spread strategy to make modest returns with limited risk and reward. The spread suggested consists of buying one lot of 19,250 strike Put option and simultaneously selling one lot of 19,000 strike Put Option,” said Axis Securities.

Recommendation: Axis Securities

Among individual stocks, SBI Life, MCX, Pidilite India see long build up. While Siemens, Sun Pharma and Ongc witness short built up.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.