Trade setup for today: 15 things to know before opening bell

The market extended its upward journey for yet another session on October 30, but will that northward move continue in coming sessions? Possibly yes, if the index decisively surpasses its hurdle of 19,250-19,300 area in coming sessions; otherwise the rangebound trade may continue, experts say.

The clearing and holding above this resistance of 19,250-19,300 can open doors for 19,500, the 50-day EMA (exponential moving average) given the Nifty50 made higher tops and higher bottoms for yet another session with bullish candlestick pattern on the daily timeframe. But if it fails to sustain above Friday’s close, i.e. 19,050, then it may take support at the 18,900-18,800 area, experts said.

The BSE Sensex climbed 330 points to 64,113, while the Nifty50 jumped 94 points to 19,141 and formed a bullish candlestick pattern with a long lower shadow on the daily charts.

The index showed a 200-point recovery from the day’s low. “The Nifty index staged a strong recovery with the bulls successfully defending the previous day’s low, ultimately closing at its highest point. Despite a broader negative outlook due to the prevailing downtrend, the possibility of a pullback exists, potentially taking the index to the 19,300 mark,” Kunal Shah, senior technical & derivative analyst at LKP Securities said.

However, it’s crucial to note that the support level at 18,900 is critical, and any closing breach below it would shift control to the bears, potentially leading the index down to the 18,500-18,300 range, he feels.

The broader markets had a flat closing on the first day of the week, while the volatility index, India VIX rose by 5.36 percent to 11.49 levels which remained in the broad range of 9-13 levels for the past several months.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty may take support at 18,996, followed by 18,945 and 18,861. On the higher side, 19,163 can be the immediate resistance followed by 19,215 and 19,298.

On October 30, the Bank Nifty, too, continued its uptrend for the second straight session, rising 257 points to 43,039 and forming a bullish candlestick pattern with a long lower wick on the daily scale, showing a good recovery from the day’s low.

“If the index can maintain levels above 43,000, there is potential for further gains in the range of 43,500-43800. This resurgence signals a positive trend in the trading session,” Kunal Shah of LKP Securities said.

The immediate support for Bank Nifty is 42,800, he feels.

As per the pivot point calculator, the index is expected to take support at 42,572, followed by 42,401 and 42,125. On the upside, the initial resistance is at 43,123 then at 43,294 and 43,569.

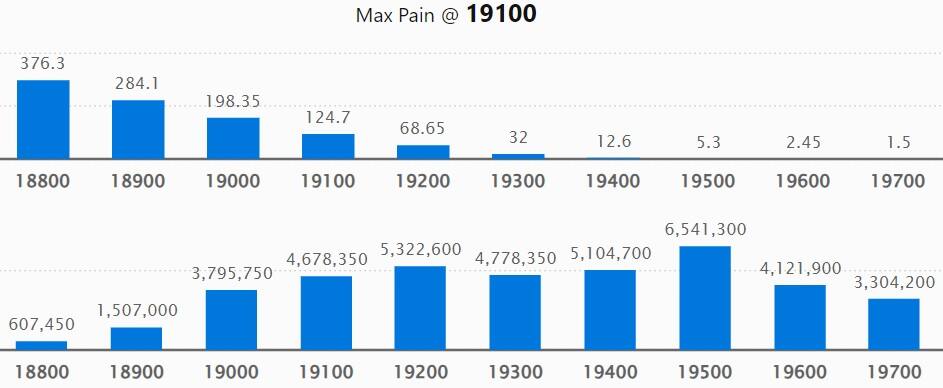

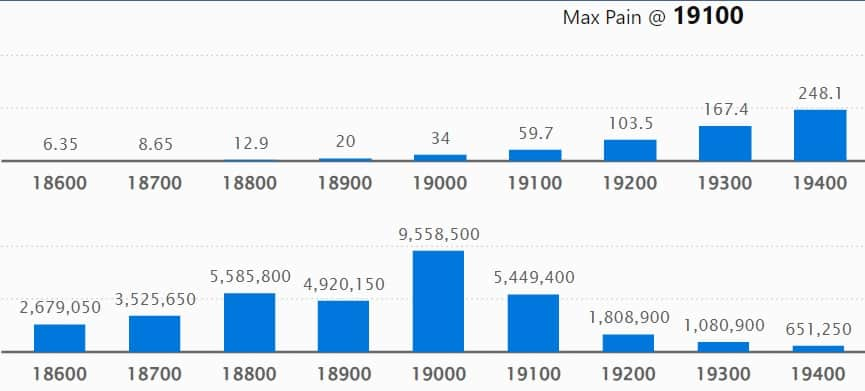

On the weekly options data front, the maximum Call open interest (OI) was visible at 19,500 strike, with 65.41 lakh contracts, which can act as a key resistance for the Nifty. It was followed by the 19,200 strike, which had 53.22 lakh contracts, while the 20,000 strike had 52.62 lakh contracts.

The maximum Call writing was seen at 19,300 strike, which added 8.8 lakh contracts, followed by 20,000 and 19,100 strikes, which added 8.11 lakh and 7.93 lakh contracts.

Maximum Call unwinding was at 19,200 strike, which shed 12.02 lakh contracts, followed by 19,600 and 19,000 strikes, which shed 3.02 lakh and 2.81 lakh contracts.

On the Put side, the maximum open interest remained at 19,000 strike with 95.58 lakh contracts, which can act as key support for the Nifty. It was followed by 18,800 strike comprising 55.85 lakh contracts and 19,100 strike with 54.49 lakh contracts.

Meaningful Put writing was at 19,000 strike, which added 41.45 lakh contracts, followed by 19,100 strike and 18,300 strike, which added 34.85 lakh and 10.69 lakh contracts.

Put unwinding was at 19,400 strike, which shed 72,050 contracts, followed by 19,500 strike and 19,700 strike that which shed 49,350 and 29,500 contracts.

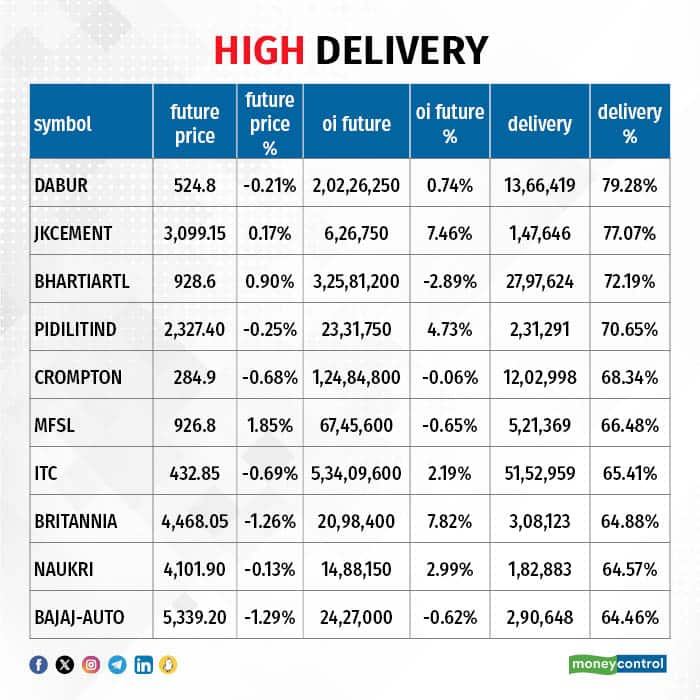

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Dabur India, JK Cement, Bharti Airtel, Pidilite Industries, and Crompton Greaves Consumer Electricals saw the highest delivery among the F&O stocks.

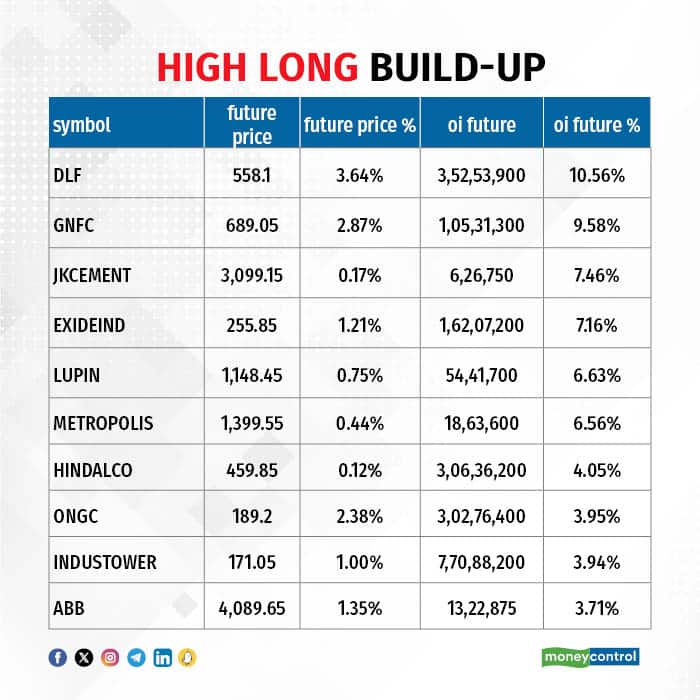

A long build-up was seen in 72 stocks, including DLF, GNFC (Gujarat Narmada Valley Fertilizers and Chemicals), JK Cement, Exide Industries, and Lupin. An increase in open interest (OI) and price indicates a build-up of long positions.

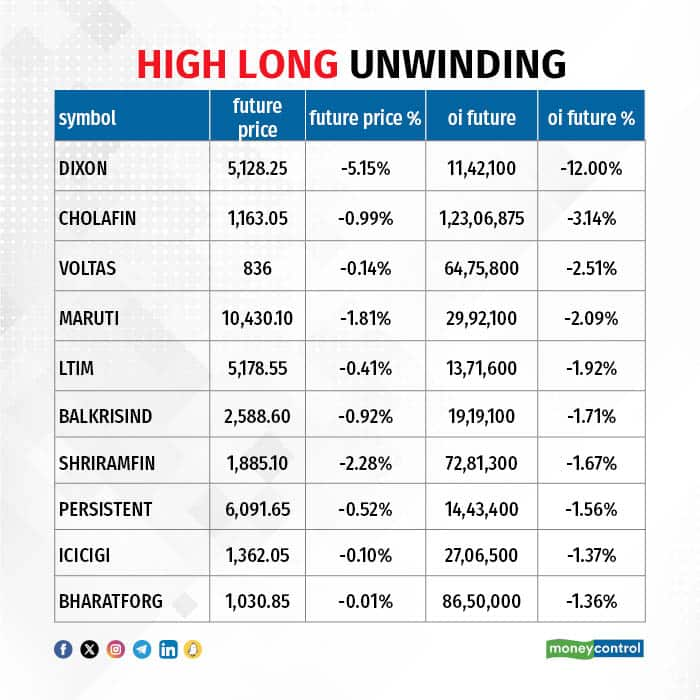

Based on the OI percentage, 28 stocks saw long unwinding including Dixon Technologies, Cholamandalam Investment and Finance, Voltas, Maruti Suzuki India, and LTIMindtree. A decline in OI and price indicates long unwinding.

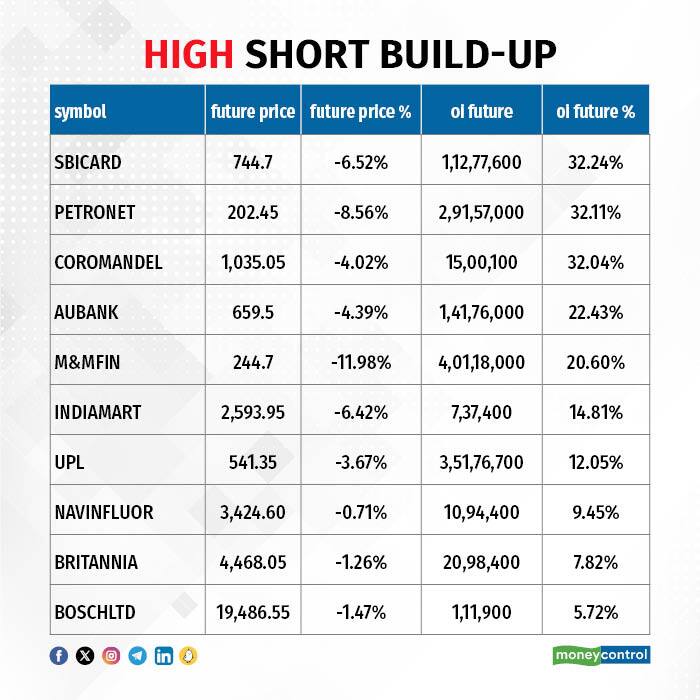

47 stocks see a short build-up

A short build-up was seen in 47 stocks, including SBI Cards and Payment Services, Petronet LNG, Coromandel International, AU Small Finance Bank, and M&M Financial Services. An increase in OI along with a fall in price points to a build-up of short positions.

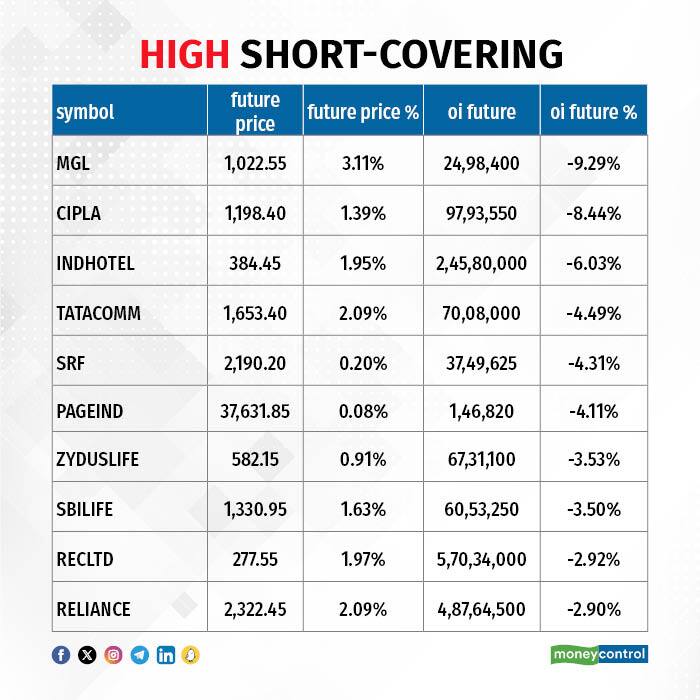

Based on the OI percentage, 40 stocks were on the short-covering list. These include Mahanagar Gas, Cipla, Indian Hotels, Tata Communications, and SRF. A decrease in OI along with a price increase is an indication of short-covering.

For more bulk deals, click here

Stocks in the news

TVS Motor Company: The two-and-three-wheeler company has recorded a standalone profit at Rs 536.55 crore for the quarter ended September FY24, rising 31.7 percent over a year-ago period. Revenue from operations increased by 12.8 percent YoY to Rs 8,145 crore during the quarter, with sales volume rising 5 percent YoY to 10.74 lakh units.

Tata Motors: The Tata Group company has won an arbitral award of Rs 766 crore plus interest to compensate for its investment in the now-scrapped Singur plant.

Bajaj Hindusthan Sugar: The UP-based sugar company has received Rs 1,361 crore in the respective escrow account maintained exclusively for cane price payment for each of its 14 sugar units from Uttar Pradesh Power Corporation. The said amount is paid to the cane growers towards the cane payment arrears for the sugar season 2022-23.

DLF: The real estate major has recorded a 30.6 percent on-year growth in consolidated profit at Rs 622.8 crore for the quarter ended September FY24, despite muted topline, partly supported by EBITDA margin. Consolidated revenue from operations increased by 3.5 percent year-on-year to Rs 1,347.7 crore for the quarter.

Marico: The FMCG major has registered a 17.3 percent on-year increase in consolidated profit at Rs 360 crore for the July-September period of FY24 despite a muted topline, driven by healthy EBITDA performance with lower input cost. Revenue from operations fell by 0.8 percent to Rs 2,476 crore compared to the year-ago period.

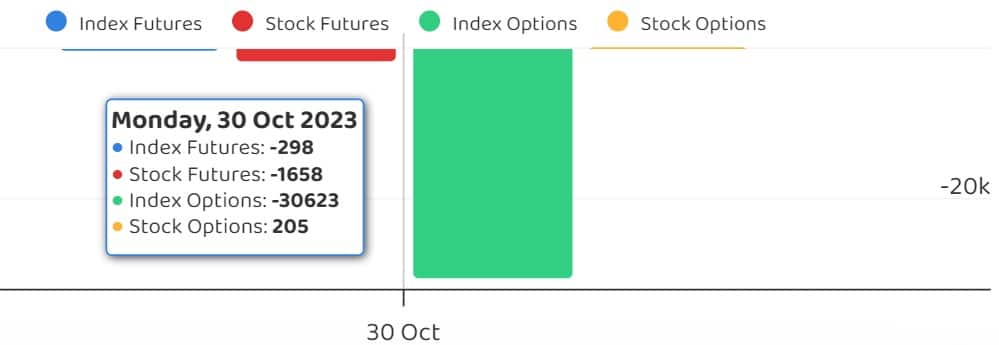

Fund Flow (Rs Crore)

Foreign institutional investors sold shares worth Rs 1,761.86 crore, while domestic institutional investors bought Rs 1,328.47 crore worth of stocks on October 30, provisional data from the National Stock Exchange showed.

Stock under F&O ban on NSE

The NSE has not added any stock to its F&O ban list for October 31.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.