F&O Manual | Consolidation rules ahead of Fed meet, Nifty faces resistance at 19,200 strike

Among individual stocks, Idea, Birlasoft, and Vedanta Limited show signs of long built-up, while MGL, MFSL, and Jindal Steel are indicating short positions being built up.

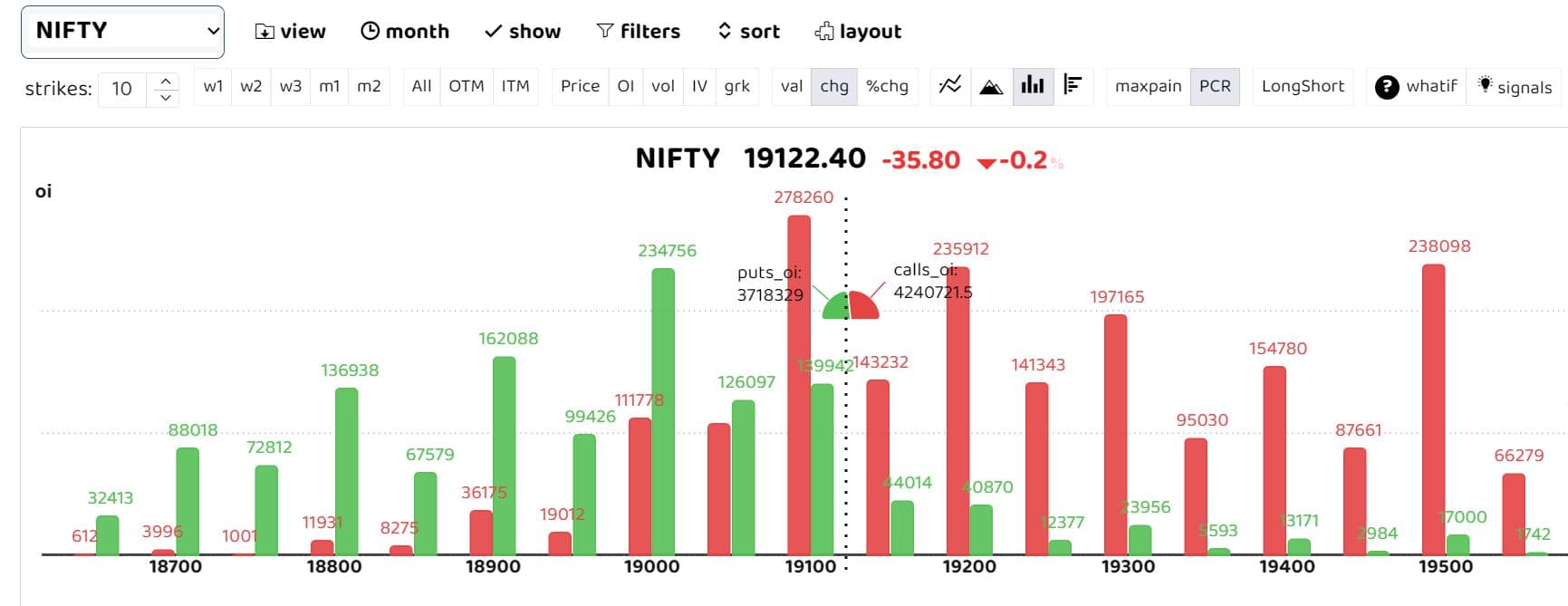

The benchmark Indian indices are in a consolidation phase, with the Nifty 50 trading marginally lower at 19,052. Options data indicates a struggle between call and put option writers, with the 19,050 and 19,100 strikes forming significant straddle positions on the index.

“There is unlikely to be any significant movement today as the markets are consolidating ahead of the US Federal Reserve’s decision on a rate hike,” Sameet Chavan, chief analyst for technical and derivatives at Angel One, said.

Except for the banking and metals, all sectoral indices traded in the green by the mid-day on November 1, with oil and gas and realty gaining 1 percent each. Notable gainers on the Nifty include BPCL, Hero MotoCorp, Bajaj Auto, ONGC, and Adani Enterprises, while Axis Bank, JSW Steel, Kotak Mahindra Bank, Power Grid, and Asian Paints are among the major losers.

At 11am, the Sensex was down 116.91 points or 0.18 percent at 63,758.02, and the Nifty lost 26.60 points or 0.14 percent at 19,053. About 1,710 shares advanced, 1,279 declined, and 106 shares traded unchanged.

The bars in green represent the change in put open interest (OI), while the ones in red depict the change in OI for call options.

Options data suggests a conflict between call and put option writers is evident, particularly with the 19,050 and 19,100 strikes forming key straddle positions. “For the day, 19,200 is likely to act as an immediate hurdle, as the 19,200 Call strike holds substantial Open Interest. On the downside, 19,000 is expected to act as immediate support,” ICICI Securities said.

Looking forward, ICICI Securities expects the index to extend the ongoing pullback towards 19,450 in the coming weeks, as it represents a 61.8 percent retracement of the last decline leg (from 19,850 to 18,838). However, they anticipate this movement to be non-linear due to expected elevated volatility ahead of the US Fed meeting.

“The broader markets have seen a healthy retracement, with over 75 percent of stocks in the Nifty 500 Universe trading above the 200-day EMA in October, compared to a reading of less than 40 percent in March23. This indicates a shallow nature of profit-taking amid a robust price structure. The formation of a lower peak and trough amid global volatility makes us retain the support base for the Nifty at the 18,700 zone, a confluence of the 52-week EMA coinciding with the previous swing high of 18,887, which will now act as a key support as per the change of polarity concept,” ICICI Securities said.

Among individual stocks, Idea, Birlasoft, and Vedanta Limited show signs of long built-up, while MGL, MFSL, and Jindal Steel are indicating short positions being built up.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.