How to trade Bank Nifty on expiry day today

At 1pm on November 1, Bank Nifty index is trading around 42680 levels down 0.38 percent.

The Bank Nifty index opened positively but immediately drifted down. It formed a bearish candle on the daily scale following October 31 close but has been consistently forming higher highs over the past three sessions.

“It needs to maintain levels above 42,750 for an upward movement towards 43,250 and then 43,500 zones. Conversely, support levels are identified at 42,750, followed by 42,500,” Motilal Oswal Financial Services (MOFSL) said.

Expiry Day View

“The overall trend is expected to be choppy, and it requires stability above 42,750 for a move towards 43,250 and 43,500 zones. The downside support is noted at 42,750, further at 42,500 levels,” MOFSL maintained.

Weekly Change

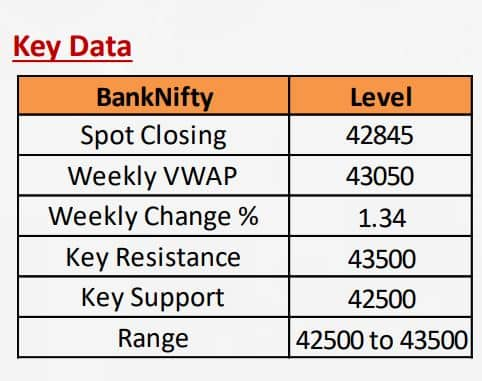

The Bank Nifty shows a 1.34 percent increase, reaching 42,845 on a weekly basis. The Bank Nifty Volume Weighted Average Price (VWAP) for the week stands at 43,050 zones, trading 200 points lower, suggesting a capped upside, as indicated by MOFSL.

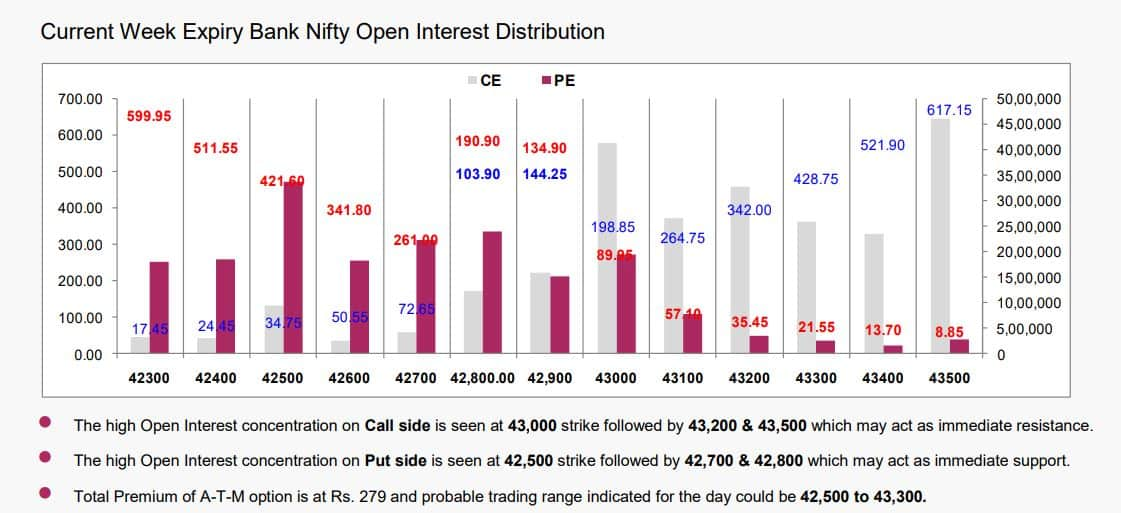

“Bank Nifty exhibits a 5.06 percent rise in Open Interest with a 1.12 percent price increase, signifying a long build-up,” Axis Securities said.

Chart above shows the open interest position built up; Source: Axis Securities

Chart above shows the open interest position built up; Source: Axis Securities

Derivative Strategy recommendation

Strategy for week November 8, 2023 expiry

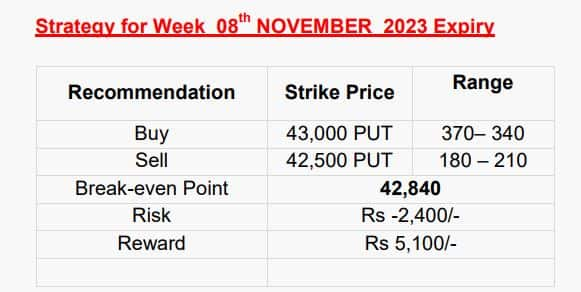

Axis Securities: PUT Spread

Derivative strategy by Axis Securities

Derivative strategy by Axis Securities

Axis Securities suggests a Put Spread strategy, classifying it as moderately bearish view. “Traders might consider this spread strategy to achieve modest returns with limited risk and reward. The suggested spread involves buying one lot of the 43,000 strike Put option while simultaneously selling one lot of the 42,500 strike Put Option,” Axis Securities said.

Motilal Oswal Financial Services

Option Strategy: Option traders are advised to initiate a Bull Call Ladder Spread (Buy 42,800 CE, Sell 43,100 CE, and 43,300 CE) to capture the swing with a capped downside.

Option Writing: Option writers are recommended to Sell Bank Nifty 42,300 Put and Sell 43,200 Call, adhering to a strict double stop-loss.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.