F&O Manual | Indices trade in green; Nifty sees short-covering, aimed at 19,600 levels

As per options data, Bank Nifty index is outperforming headline index

The benchmark Indian indices opened gap-up on the back of positive developments from around the world. Global markets recovered after the Fed meeting last week, while the bond yields and the dollar index plunged on risk-on sentiment. Analysts expect the Nifty to respect the 19,000 levels and a short-covering move towards 19,600 in the coming sessions.

Axis Bank, L&T, UltraTech Cement, Asian Paints, Power Grid are among the top gainers on the Sensex, while losers are SBI, Tata Motors, HUL, ITC and Kotak Mahindra Bank. The BSE Midcap index was up 0.5 percent and the Smallcap index gained 1 percent. Except the PSU Bank index, all sectoral indices are trading in the green with capital goods, oil and gas, and realty climbing 1 percent each.

At 11am, the Sensex was up 312.43 points or 0.49 percent at 64,676.21, and the Nifty was up 98.70 points or 0.51 percent at 19,329.30. About 2,196 shares advanced, 931 declined, and 143 traded unchanged.

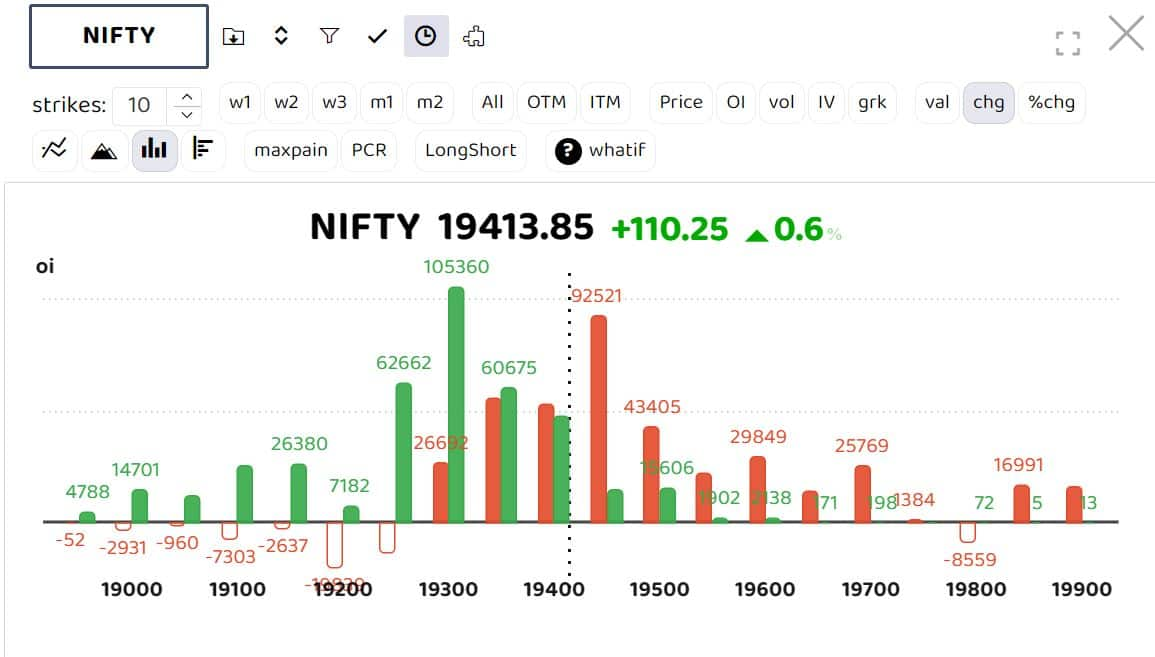

Options data suggests that the Nifty may be taking support at 19,300 with key straddle positions at 19,350 and 19,400 strikes.

“Positive global cues helped markets recover despite continued selling pressure from foreign funds. Heavyweights remained largely laggard and restricted the gains of the headline index. Going ahead, we expect the Nifty to respect the 19,000 levels and expect short-covering move towards 19,600 in the coming sessions,” stated ICICI Securities.

From the data perspective, FIIs have turned aggressive shorts in index futures and, despite some covering on Friday, the net shorts are still highest seen since March at 1.6 lakh contracts. “Historically, we have seen a bout of covering from such aggressive short positions. Moreover, they have been net sellers in the cash segment for some time now. A pause in selling pressure may also trigger fresh recovery. Hence, we believe that the current move may extend towards 19,600. On the other hand, move below 19,000 may trigger fresh round of weakness in markets,” ICICI Securities said.

Bank Nifty

The banking index also closed in a positive note on Friday after remaining under pressure for almost six weeks as both PSU and private sector stocks helped Bank Nifty to outperform Nifty with gains of nearly 1.3 percent. Going ahead, ICICI Securities expect that recovery may extend towards the 44,000 levels with immediate support likely to be seen near 43,000.

“Along with the recovery seen in the last two sessions, closure among Call writing positions was evident. However, aggressive writing is still visible at 43,000 Put and 43,500 Call strikes. Thus recovery may find some steam if Bank Nifty sustains above 43,500 levels, while 43,000 likely to act as immediate support for banking index,” it said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-611491884-eab74d4b61364ec987b80bff4c516a23.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/INV_IRACustodian_GettyImages-1473133514-5eceea96894947b0a4f2f8e344696dad.jpg)