F&O | What does derivatives positioning say about the day’s trading trajectory?

The bulls have confirmed their comeback as Nifty established a higher high and high low sequence on the daily chart

The Nifty, which closed the week nearly a percent higher to recover some of the losses of the previous two weeks, is expected to open on a positive note as indicated by the US market and GIFT NIFTY cues, with resistance expected at 19,500.

Analysts say the previous week’s rally was underpinned by macroeconomic factors such as a drop in bond yields, which sharply dropped from 5 to 4.5 percent. Equity markets have an inverse correlation with bond yields. As yields fall, markets gain but they falter when yields rise.

Another factor was the drop in the dollar index from 107 levels to 105. It could potentially continue its downward trend to 104.5. The dollar index, which measures the greenback’s value against six major currencies, dropped 1.1 percent, marking its largest one-day fall since July.

Crude oil also declined by 5 percent and it may fall further to $78.60 a barrel, benefiting the equity market. India is a net importer of the fuel and a drop in prices is good for forex reserves as well as inflation.

Nifty

On the domestic front, Nifty closed at the immediate resistance of 19,250. However, considering cues from the US market and GIFT NIFTY, the new week is likely to begin on a positive note. The index faces potential resistance at 19,500 followed by 19,770.

According to Kapil Shah, a technical analyst at Emkay Global, the index formed a Bullish Harami pattern on the weekly chart and found support at the 200-day Exponential Moving Average. The momentum oscillator RSI displayed an oversold reading in the previous week and the bulls confirmed their comeback as the Nifty established a higher high and high low sequence on the daily chart.

“The index will remain under bullish control as long as it stays above 18,950, which serves as the immediate low for the index,” Shah said.

From a derivative perspective, Shah added, “The 19,200 strike price holds the highest put base with significant volume and change in open interest. a short build-up was observed at this strike price, indicating that derivative participants do not anticipate the market dropping below 19,200.”

On the call side, a long build-up was observed from 19,200 to 19,500 strike prices. The 19,300 strike price saw the highest call base, volume, and change in open interest. The monthly and weekly Put-Call Ratios (PCR) stand at 1.17 and 0.79, respectively, he said.

Bank Nifty

The Bank Nifty found support at the 42,000, coinciding with the 50-week exponential moving average and formed a piercing line candle, signaling a bullish development, Shah said.

However, Bank Nifty has underperformed the benchmark. It faces resistance in the 43,400-to 43,800 zone. Some stocks with a bullish outlook in include Federal Bank, ICICI Bank and RBL Bank.

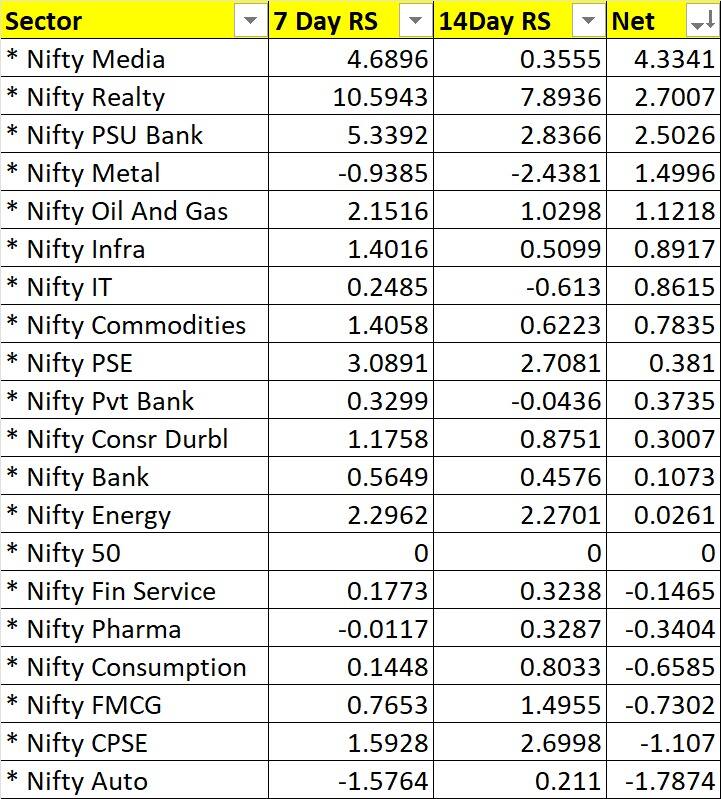

Sectoral Positioning as per derivatives data

Assessing Sectoral strength and weakness for this week by analysing the rate of change (ROC) in price ratios (index vs stock) over the past 7 days in comparison to the previous 14 days | Source: Rajesh Sriwastava

Assessing Sectoral strength and weakness for this week by analysing the rate of change (ROC) in price ratios (index vs stock) over the past 7 days in comparison to the previous 14 days | Source: Rajesh Sriwastava

“To my surprise, Nifty Bank has outperformed the headline index,” Rajesh Sriwastava, a derivatives trader, said.

“The real estate sector performed exceptionally well, surging by more than 10 percent, and it displayed a tall bullish candle. It reached an all-time high after a decade of underperformance,” said Shah.

Other sectors, such as healthcare, FMCG, infra and PSU bank showed bullish signs, while IT and metal sectors continued to underperform.

Stocks with bullish outlook

“Some potential stocks with a bullish view include Bhartiartl, CONCOR, Coromandel, Godrejcp, and Grasim,” Shah said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-611491884-eab74d4b61364ec987b80bff4c516a23.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/INV_IRACustodian_GettyImages-1473133514-5eceea96894947b0a4f2f8e344696dad.jpg)