Emotions, economics, earnings: When 3 E’s of equity rule the market, embrace volatility, stay invested

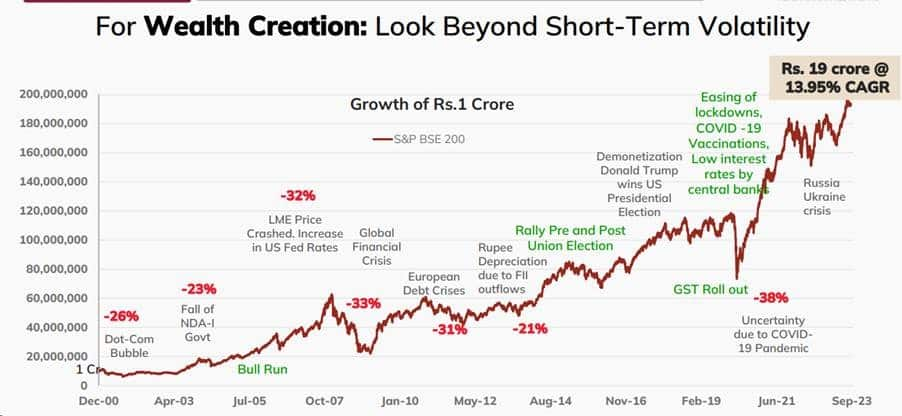

In long run, the time spent in the market is more critical than timing the market itself.

Three E’s come to the fore when the markets turn unpredictable. In the equity space, there is a unique connection between emotions, economics, and earnings, and the relationship between the three E’s of equity tweaks and turns, paving the way for volatility to run high.

Amid geopolitical tensions and interest rate hikes, the market landscape is filled with uncertainty, with a range-bound movement expected in the short term. This is the time for investors to look beyond the short term volatility and keep invested in the market for a long run, said Chockalingam Narayanan, Senior Fund Manager – PMS & AIF at ICICI Prudential AMC.

“Markets are neither very cheap, nor very expensive. Thus, investors must expect a range-bound movement in the near term. In the long run, the market will follow the earnings growth trajectory,” said Narayanan. “In the long run, time in the market is more important than timing the market.”

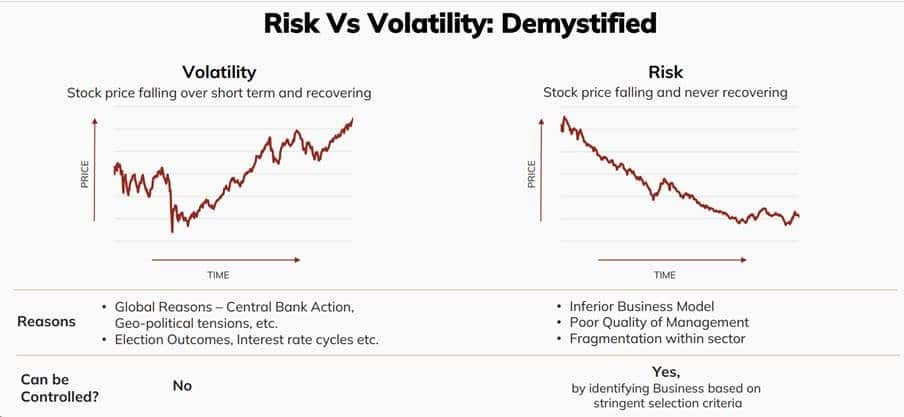

Of the three E’s of equity market, emotions often play crucial in the market’s performance, closely associated with volatility and risks, according to Narayanan. Volatility, again, can be beneficial as it throws up opportunities for participation. The idea is that volatility can be embraced, especially for long-term wealth creation, he said.

Source: ICICI Prudential AMC

Source: ICICI Prudential AMC

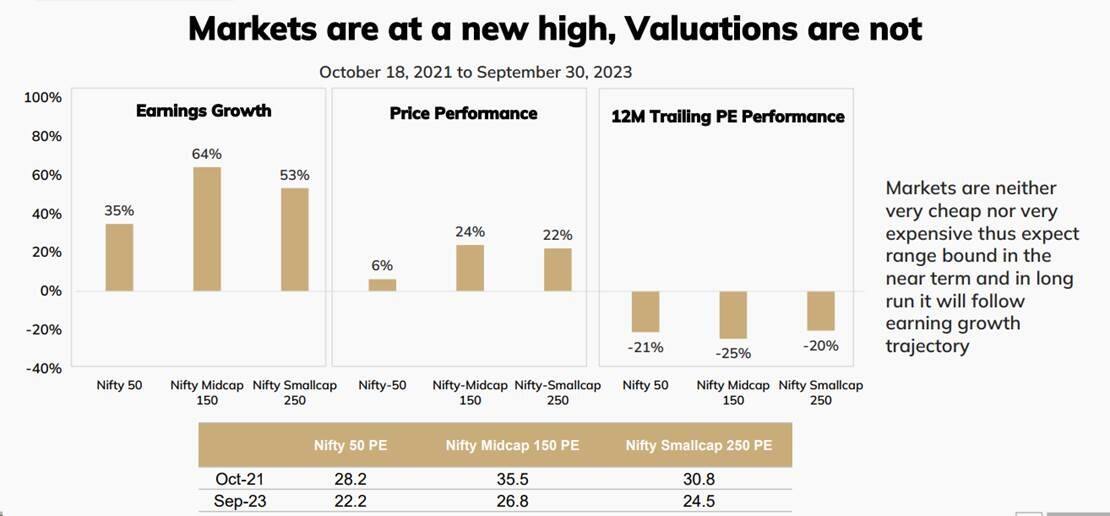

Navigating New Highs in the Market

Narayanan noted the remarkable market run since March, but urges investors to assess the bigger picture. Notably, from the previous peak on September 13, large-cap stocks have fallen by approximately 6 percent; mid-cap stocks by 24 percent; and small-cap stocks by 25 percent. Surprisingly, this decline in the stock values has occurred despite an increase in earnings during the same timeframe.

The price-earnings (PE) ratio has shrunk, indicating a healthier market rally. However, on a trailing PE multiple basis, the valuations of certain stocks may still appear slightly inflated.

Source: ICICI Prudential AMC

Source: ICICI Prudential AMC

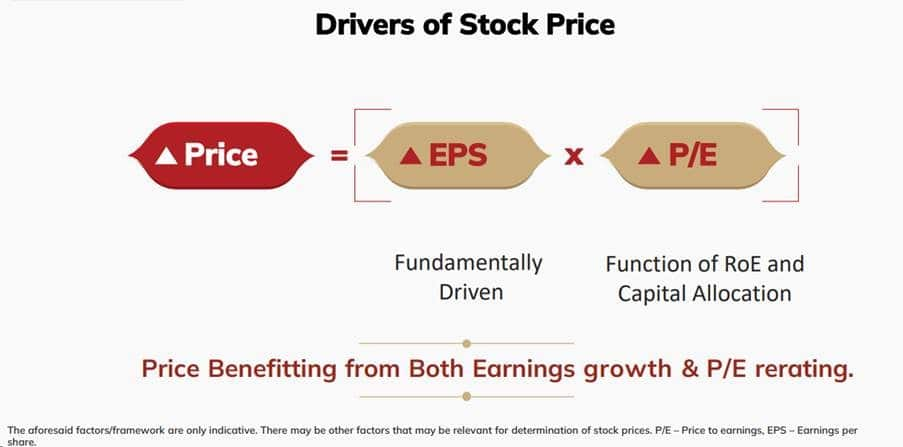

Fundamental Drivers of Stock Prices

Fundamentally, stock prices are driven by a company’s earnings multiplied by PE ratio. However, investors must realise that once asset allocation is determined, then in the long run, the time spent in the market is more critical than timing the market itself.

Narayanan emphasises that even during the most bullish market periods, there have been five to six instances of drawdowns exceeding 10 percent. Therefore, it is essential to manage these occurrences effectively and stay invested to capitalise on investment opportunities.

Investors are encouraged to embrace volatility, focus on long-term wealth creation, and remain invested to navigate market fluctuations effectively.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-611491884-eab74d4b61364ec987b80bff4c516a23.jpg)

:max_bytes(150000):strip_icc():format(jpeg)/INV_IRACustodian_GettyImages-1473133514-5eceea96894947b0a4f2f8e344696dad.jpg)