F&O Manual | Indices trade flat; Nifty to hold above 19,350 to reach 19,550 level

The Nifty Put/Call Ratio (OI) declined from 1.07 to 0.95

Indian benchmark indices traded flat in a volatile market around mid-day on November 8. The Nifty found immediate support at 19,333, followed by 19,250, while resistance is seen at 19,550 and then 19,600.

The BSE Midcap and Smallcap indices were up nearly a percent each. Except bank, all other sectoral indices were trading in the green with pharma, oil and gas, and realty up 1 percent each by mid-day on November 8.

At 12 noon, the Sensex was up 24.53 points or 0.04 percent at 64,966.93, and the Nifty was up 28.90 points or 0.15 percent at 19,435.60. About 1,862 shares advanced, 1,241 declined, and 106 traded unchanged.

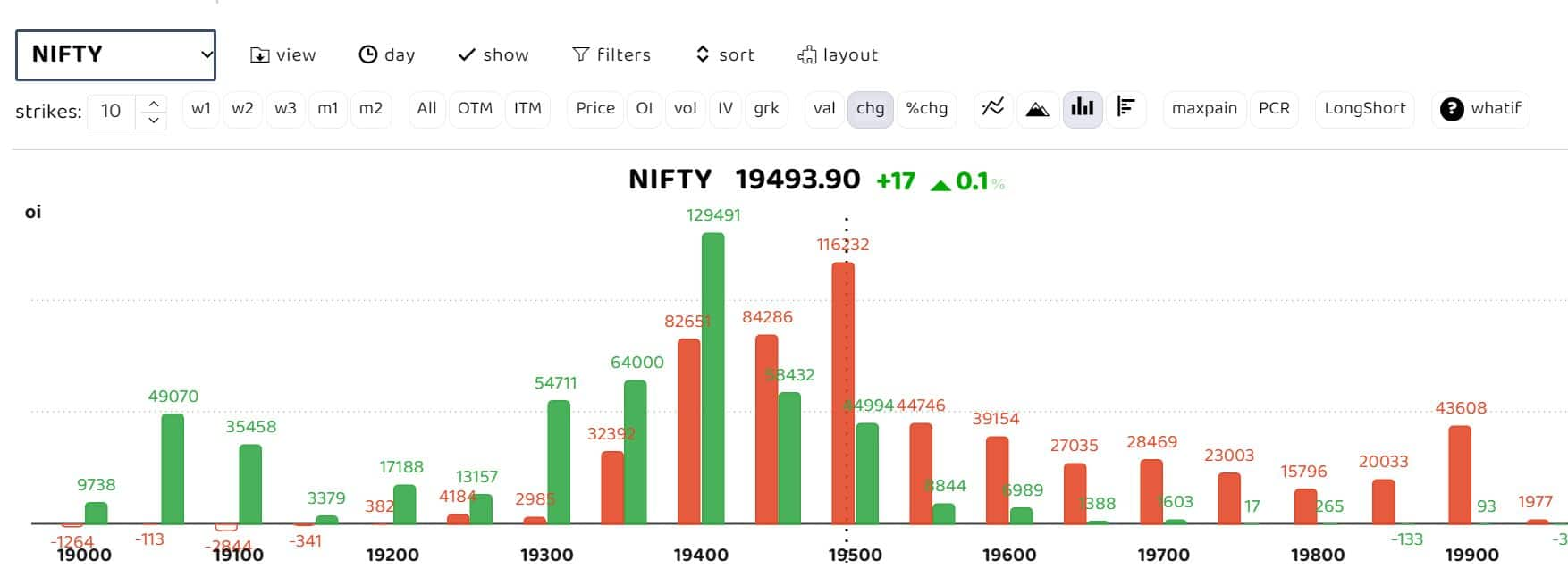

Derivative Outlook: The Nifty November future trades at 19,500, holding a premium of 22 points.

• The Nifty futures’ Open Interest (OI) decreased by 0.94 percent to 1.10 crore

• The Nifty Put/Call Ratio (OI) declined from 1.07 to 0.95

• India VIX declined by 0.01 percent from 11.19 to 11.18, signalling a slight decrease in volatility, which contributes to flattish momentum in the index.

“Now it has to hold above the 19,350 zone, for an up-move towards 19,550 and then 19,600, whereas supports are gradually shifting higher and are placed at 19,333 then 19,250,” Motilal Oswal Financial services (MOFSL) said.

Derivative Strategy recommendation by MOFSL

Option Buying: Purchase the Weekly Nifty 19,350 Call as long as it remains above the 19,350 zones

Option Strategy: Opt for the Weekly Nifty Bull Call Ladder Spread

Buy 19,400 CE

Sell 19,500 CE and 19,600 CE at a net premium cost of 30-35 points.

Option Writing: Sell Weekly Nifty 19200 Put and 19600 Call for an inflow of 16-18 points, maintaining a strict double stop loss.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.