Derivatives data indicates pharma set to rally, analyst suggests buying Cipla

Cipla is currently trading at Rs 1,241

The pharma index is poised for another rally which is expected to take it to new highs in the coming sessions. The immediate support for the index is at 15,140. Technical charts are bullish, with the strength indicator relative strength indicator (RSI) still away from the overbought territory of 70, Avdhut Bagkar, derivatives and technical analyst at StoxBox, said.

Technical chart of Nifty Pharma index showing RSI yet to enter the overbought territory of 70.

Technical chart of Nifty Pharma index showing RSI yet to enter the overbought territory of 70.

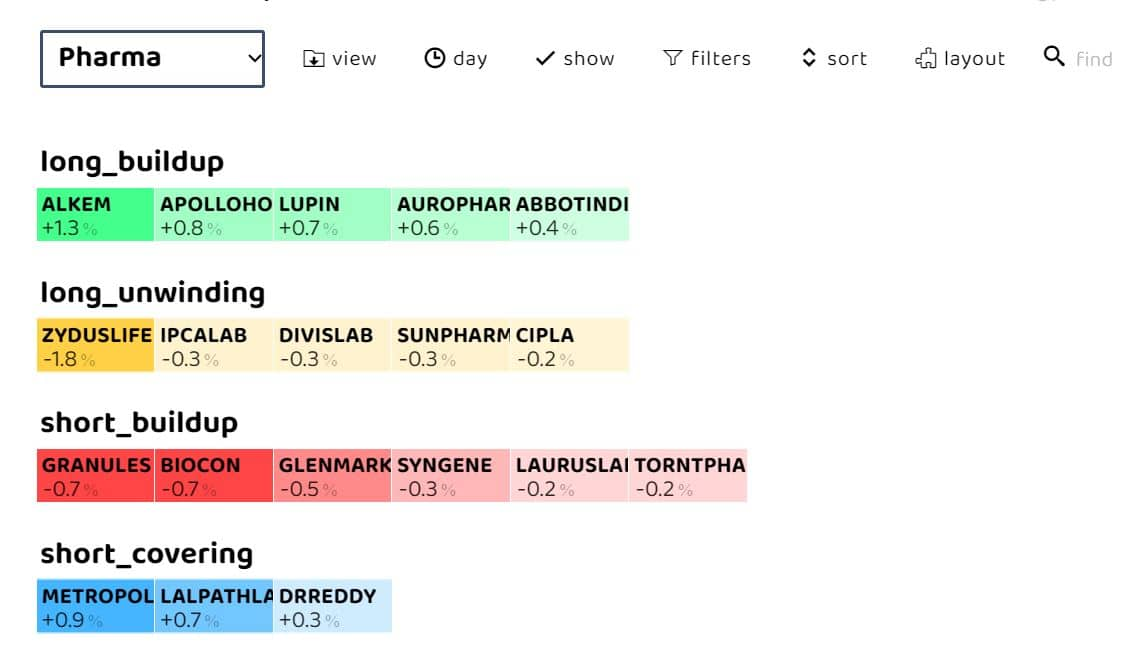

Among individual stocks, a long build-up can be seen in Alkem, Apollo Hospitals and Lupin. While short build-up can be witnessed in Granules, Biocon and Glenmark.

Technical chart of Cipla

Technical chart of Cipla

CIPLA | Bullish

Bagkar said, “Shares of Cipla have given a breakout over the hurdle of 1,230 and is prepared to scale highs of 1,255 and 1,275 levels in the upcoming sessions.”

PCR stands at 0.76, indicating an underlying positive bias. Bagkar suggests traders opt for long position in 1230 CE, holding 20 as the support and targeting 40 and 45 levels.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1383931917-16f7e81b08344140b4041462de226112.jpg)