F&O expiry: Derivative strategy to trade Nifty on today’s expiry

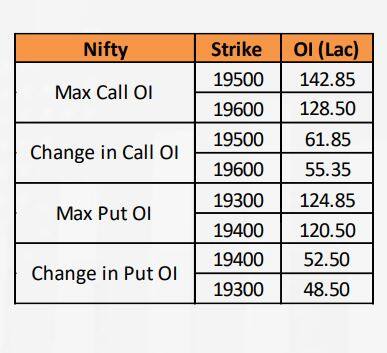

Nifty option max pain is observed around the 19,400 mark.

Nifty opened flat on November 9, following a previous session that witnessed buying interest at the 19,400 support zones, closing with gains of 36 points. It formed a Doji on the daily timeframe and has been consistently forming higher lows over the past five sessions.

Key highlights

The Nifty futures’ Open Interest (OI) decreased by 0.52 percent to 1.09 crore

• The Nifty Put/Call Ratio (OI) declined from 0.95 to 0.88

• India VIX declined by 0.01 percent 11.03, signalling a slight decrease in volatility, which contributes to flattish momentum in the index.

Weekly Expiry Perspective

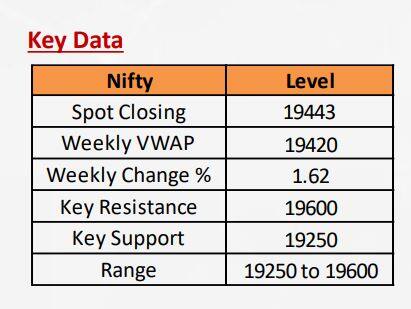

Nifty has risen by 1.62 percent to reach 19,443 on a weekly basis. With the Nifty VWAP of the week situated at the 19,420 zones, trading marginally above the same, indicating to consider a buy-on-dips stance.

The Option Max Pain is observed around the 19,400 mark.

Analysing the Open Interest (OI) data for the weekly series, a substantial Put OI was established at the 19,400 and 19,350 strikes. On the calls front, significant OI additions were noticed from the 19,400-19,450 to 19,500-19,550 strikes.

Therefore, Sudeep Shah, Head of Technicals and Derivatives at SBI Securities, believes that from an intraday expiry trading perspective, the “19,365-19,390 zone could act as an important support zone, while the first resistance on the upside could be at 19,470. A breakthrough of this level may lead to reaching 19,520-19,525.”

“Considering the build-up in the 19,500 calls, the 19,520-19,530 zone could act as a crucial level for the day. The projected overall range for the day might fluctuate between 19,370 on the downside and 19,540 on the upside,” Shah added.

Expiry day point of view

According to Motilal Oswal Financial Services (MOFSL), “The overall trend is expected to be positive. Currently, it needs to maintain levels above 19,400 zones to facilitate an upward movement towards 19,550 and subsequently 19,600 zones. Meanwhile, the supports are gradually moving higher and are positioned at 19,333 and 19,250 zones.”

Trading Range:

Expected broader trading range: 19,250-19,333 to 19,550-19,600 zones.

Option Strategy recommended by MOFSL:

Option traders can initiate Bull Call Ladder Spread

Buy 19,400 CE, Sell 19,500 CE and Sell 19,550 CE to play the up swing

Option Writing: Option writers are suggested to Sell Nifty 19,350 Put and Sell 19,550 Call with strict double stop loss.

Bull Call Ladder Spread involves purchasing a lower strike call option, while simultaneously selling a middle strike call and a higher strike call. It’s structured for a moderately bullish market outlook, with the goal of profiting from a controlled upward move in the underlying asset’s price. This strategy is a net debit trade and offers limited risk, with potential capped gains. Ideal for investors anticipating moderate bullish trends, it manages costs and risk by using multiple strike prices, expecting the asset’s price to rise but with a restricted profit ceiling.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-1383931917-16f7e81b08344140b4041462de226112.jpg)